Canola Market Outlook: October 28, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: CBOT soybeans closed higher on fresh Chinese buying. Soaring soybean oil values again lifted crush margins, despite a 9-week low in meal.

World vegetable oils remain strong at or near multi-year highs, China is buying US soybeans, and the charts look supportive alongside big declines in EU/Black Sea oilseed production.

South American weather will increasingly be the focus, while the US election and politics on both China and on domestic biodiesel loom prominently in the 2025 background.

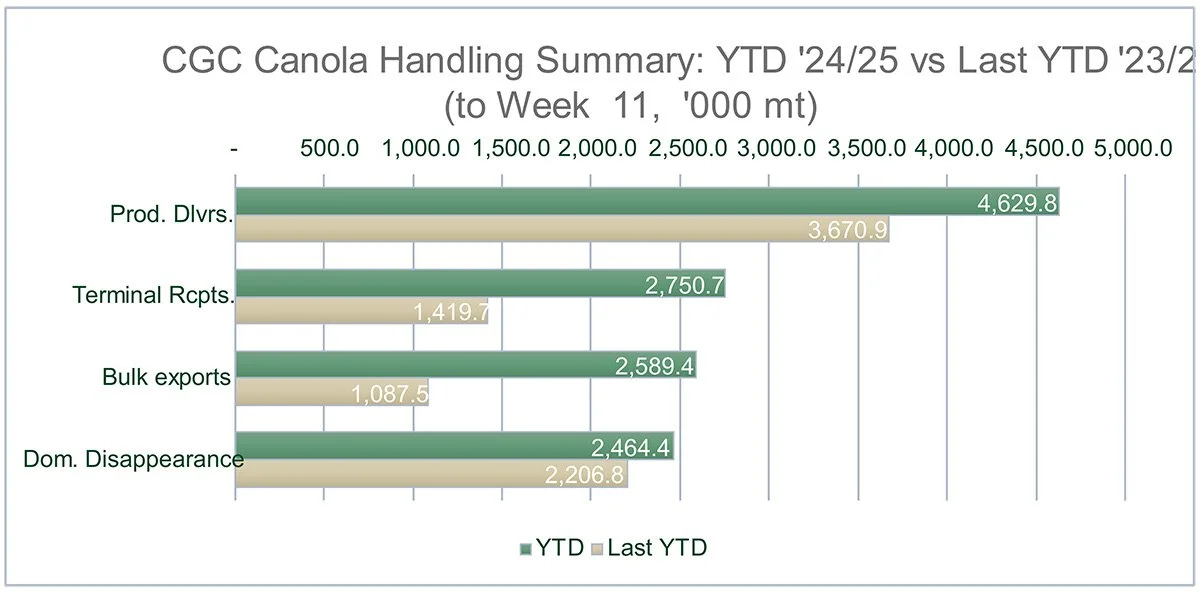

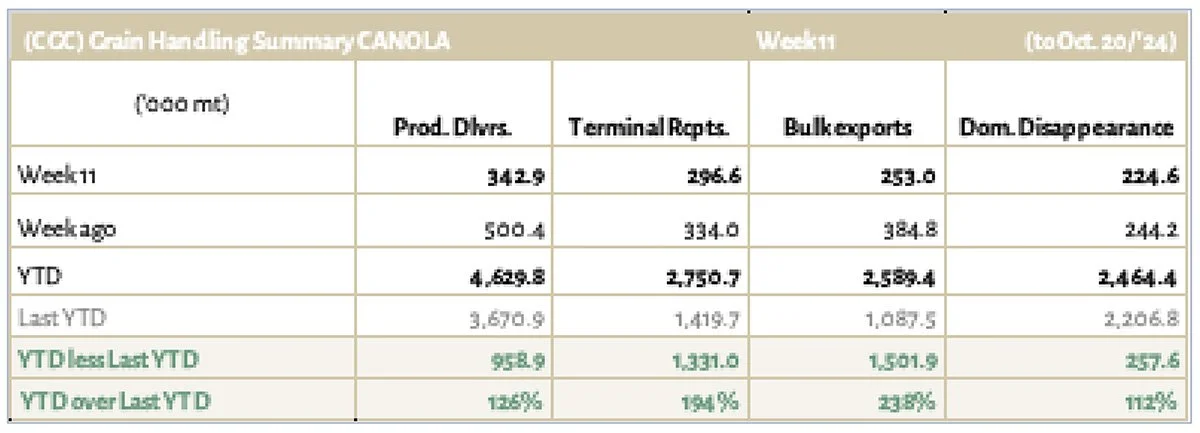

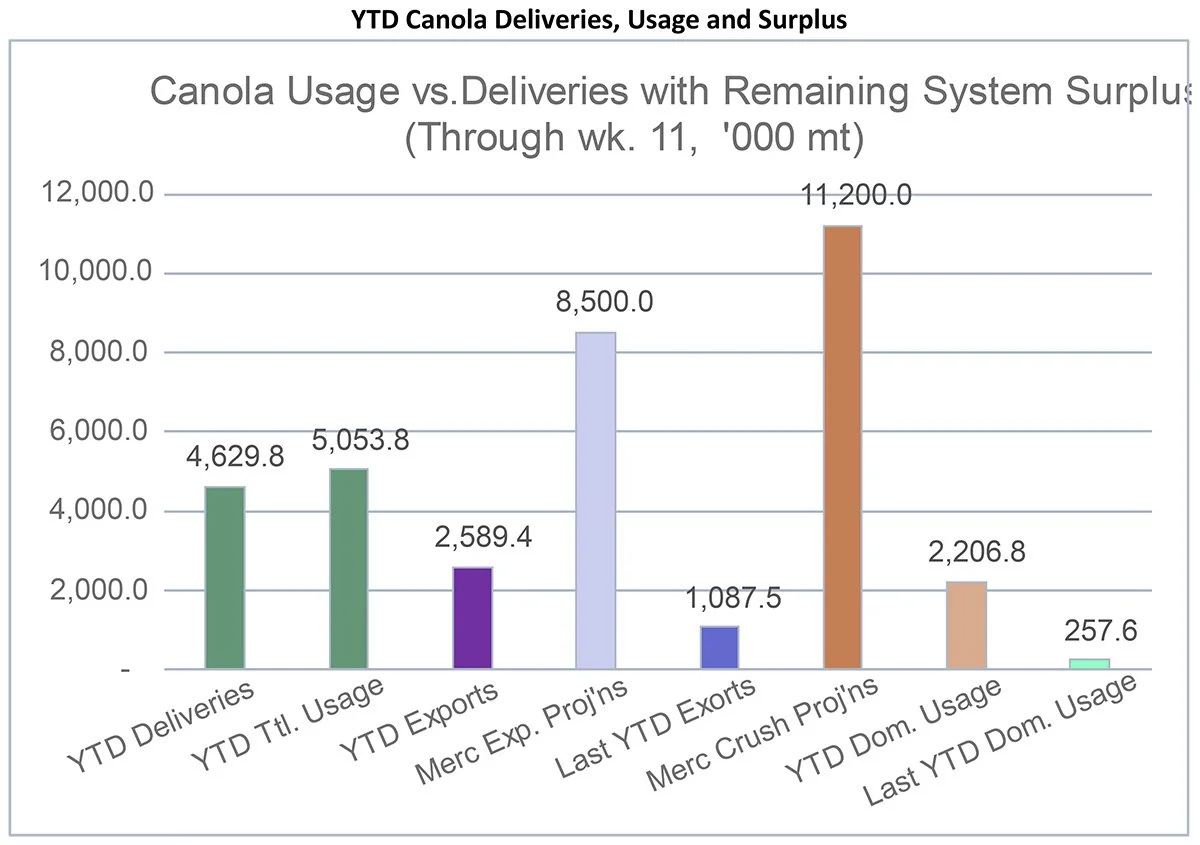

Canola: YTD total canola disappearance into week 11 of the crop year amounts to 5.1million MT compared to 3.3 million MT last year and is up 53% on last year.

We expect export demand to continue as canola seed is well priced to soybeans and canola oil continues to be at a 15 percent premium to soybean oil in China. Good crush margins also recommend a continued record crush.

Global vegetable oil markets have maintained their upward trajectories.

We see no reason to sell additional canola at this time.

Oilseed Market Backdrop

Soybeans

Current market situation

Despite a quickly moving harvest (67% complete against 51% average) and export sales barely in line with USDA projections, CBOT soybeans closed higher on fresh Chinese buying. Soaring soybean oil values again lifted crush margins, despite a 9-week low in meal.

Specifically, CBOT soybeans closed out the week with contracts 3 to 8 ½ cents in the red on Friday, but November managed a weekly gain of 17 ¾ cents.

World vegetable oils remain strong at or near multi-year highs, China is buying US soybeans, and the charts look supportive alongside big declines in EU/Black Sea oilseed production.

Weekly US Export Sales showed 2.15 mln mt of 2024/25 bookings, which brought the marketing year total to 24 mln mt, which represents 48% of the USDA export forecast. The 5-year average pace is to be 56% sold by this time.

Market outlook

South American weather will increasingly be the focus, while the US election and politics on both China and on domestic biodiesel loom prominently in the 2025 background. - We would recommend an even position on soybeans at the present time.

Canola Market

Canola usage

In week 11 of the crop year, growers delivered 343 thousand MT of canola into primary elevators, exports were a decent 253 thousand MT, while domestic disappearance amounted to 225 thousand MT, near full capacity.

YTD total canola disappearance into week 11 of the crop year amounts to 5.1million MT compared to 3.3 million MT last year and is up 53% on last year.

Visible stocks settled at 1.4 million MT, with 836 thousand MT in primary elevators, 184 thousand MT in process elevators, 218 thousand MT in Vancouver/ Prince Rupert, and 186 thousand MT in eastern ports.

Current market situation

YTD Cdn. canola exports at 2.6 mln mt exceed last year’s by 1.5 mln mt. We expect export demand to continue as canola seed is well priced to soybeans and canola oil continues to be at a 15 percent premium to soybean oil in China. We doubt Chinese crushers would support any reduction in canola imports.

Canola deliveries by farmers are reducing while crush margins recommend a continued record crush. The YTD Cdn. crush exceeds last year’s by 258k mt, and the YTD pace would annualize at 11.65 mln mt. - We expect continued good demand for canola, both for export and for crush.

As discussed previously, while there is very good demand for canola, there are still questions about the final size of the 2024 Cdn. canola crop, with provincial yield estimates significantly lower than StatsCan/ AAFC estimates, which indicate an 18.98 mln mt crop. Adding to the confusion, USDA is still using 20 mln mt for the Cdn. crop, which is higher than any other number published.

Meanwhile in global markets, vegetable oils have maintained their upward trajectories and are trading at or near the week’s highs. Bursa palm oil is still above the important MYR4,500 level and at multi-year highs. Private surveys put October palm oil exports so far up over 10% on September, which is helping maintain the bullish theme. - Vegoils are in a bull market, which has been most supportive to rapeseed and sunflower seeds.

Feb Matif rapeseed traded back up to €515 last week, close to its yearly highs, but we note it is back to €502.50 today. Lower Rhine rapeseed oil was very strong at €1,120 for nearby positions, and this helps support both crush margins and oilseed demand. Canadian canola benefited from the gains in soybean oil and rapeseed, settling at 3-month highs for the weekend.

Market outlook

We expect continued good demand for canola, both for export and for crush.

Action

We see no reason to sell additional canola at this time.

Canola – Topics of Interest

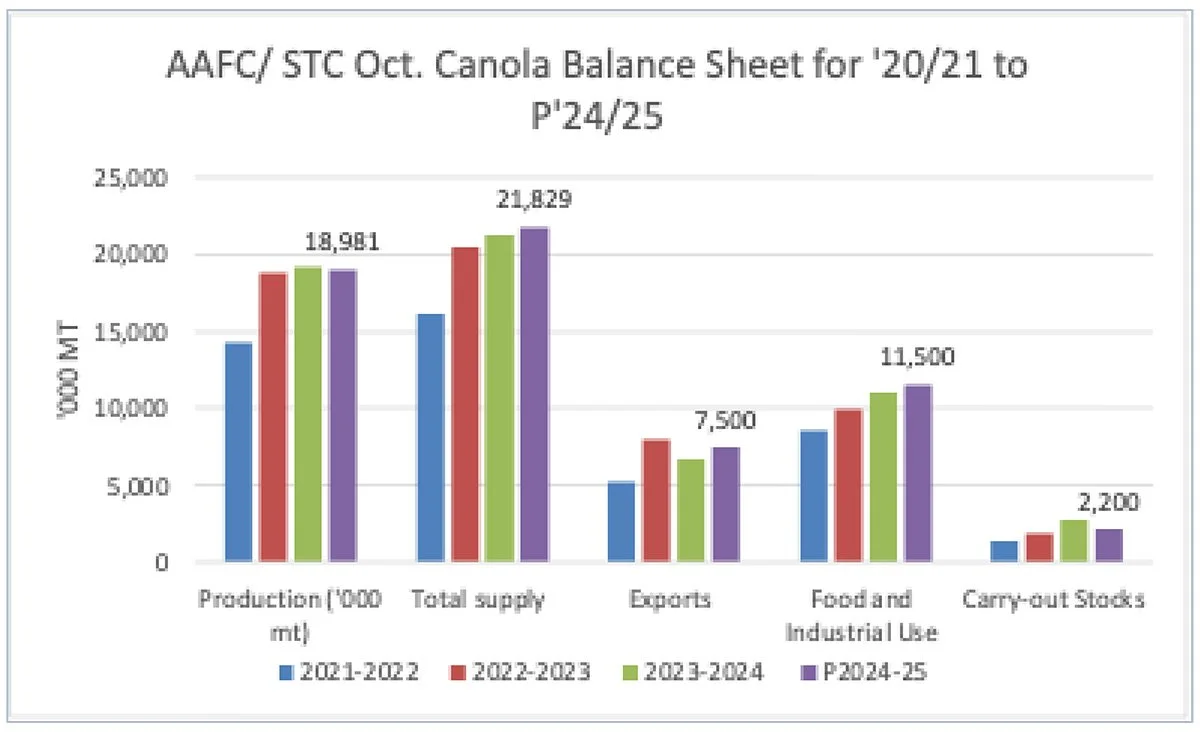

AAFC October Canola Balance Sheet:

AAFC made some changes to the ‘23/24 canola balance sheet, the biggest of which was an increase to Feed/ Waste/ Dockage from 443k mt in September to 797k mt in October (+354k mt). This lowered this year’s carry-in by 344k mt to 2.75 mln mt.

Accordingly, supply for the ‘24/25 crop year also dropped by 344k mt. Feed/ Waste/ Dockage was lowered by 45k mt, and ending stocks dropped from 2.5 mln mt to 2.2 mln mt, an 11% stock-use ratio.

The Mercantile ‘24/25 ending stock projection is higher (3.27 mln mt), because we are using a higher production number.