Canola Market Outlook: November 4, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: CBOT soybeans settled the Friday afternoon steady to 1 ½ cents down, despite early strength and good export business. Soybean meal futures were down $3.50 to $4.30/tonne across the board, but soybean oil futures were up another 87 to 116 points on Friday.

However, soybean oil hit 4-month highs as strong world vegoil’s offset US domestic uncertainty over biofuel demand.

World vegoil’s remain on fire and should keep soybeans strong.

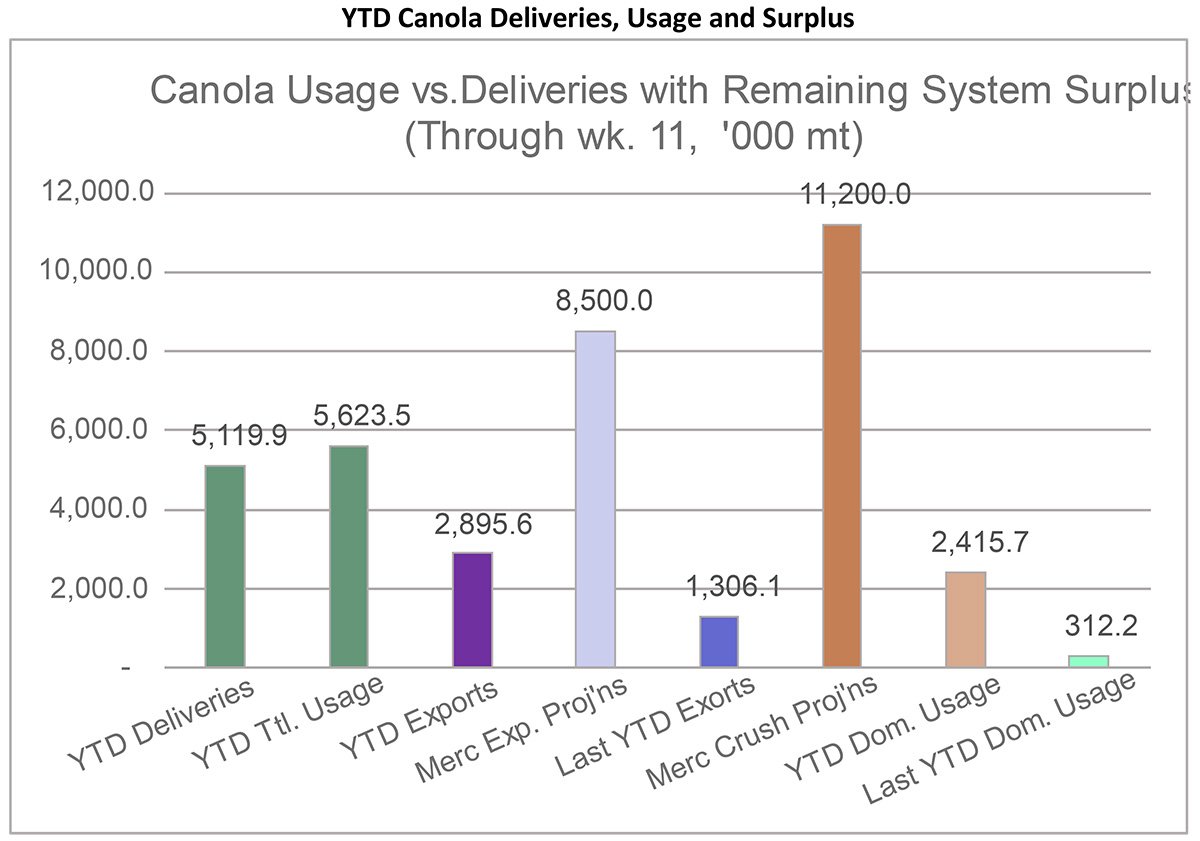

Canola: YTD total canola disappearance into week 12 of the crop year amounts to 5.6 million MT compared to 3.7 million MT last year and is up 51% on last year.

Exports and crush continue at a very good pace. We have changed our Supply-Demand estimate accordingly, increasing exports and domestic usage. The balance sheet looks more accommodating to farmers, and we clearly cannot continue exports at the current pace.

Strong vegoil markets should support demand for canola.

We see no reason to chase sales until we know the USA election results and see the next USDA-WASDE report.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans settled the Friday afternoon steady to 1 ½ cents down, despite early strength and good export business. January was down 3 ¾ cents for the week. Soybean meal futures were down $3.50 to $4.30/tonne across the board, while soybean oil futures were up another 87 to 116 points on Friday, as December managed a 215-point gain for the week.

The US September crush data had actual soybean crush coming in at 186.4 million bu, which was below estimates, but 11.3% higher than August and 6.7% above last year’s September record.

Managed money added 13k contracts to their net short position, which took the position to -72k contracts. Commercials increased their net short position by 5k contracts to 23k contracts.

So, despite additional sales to China, CBOT soybeans closed lower due to the fast harvest (89% complete vs. a 78% average), and following threats of Chinese port closures. However, soybean oil hit 4-month highs as strong world vegoil’s offset US domestic uncertainty over biofuel demand.

Market outlook

World vegoil’s remain on fire and should keep soybeans strong.

Canola Market

Canola usage

In week 12 of the crop year, growers delivered 491 thousand MT of canola into primary elevators, exports were a big 306 thousand MT, while domestic disappearance amounted to 264 thousand MT.

YTD total canola disappearance into week 12 of the crop year amounts to 5.6 million MT compared to 3.7 million MT last year and is up 51% on last year.

Visible stocks settled at 1.5 million MT, with 876 thousand MT in primary elevators, 204 thousand MT in process elevators, 298 thousand MT in Vancouver/ Prince Rupert, and 161 thousand MT in eastern ports.

Current market situation

Week 12 Cdn. canola exports were again good 306,000 MT. If we were to continue exports at the YTD pace, we would reach crop year exports of 12.5 million MT. Exports are good because Cdn. canola remains very competitive to soybeans. We note that 22k MT of canola were loaded in Thunder Bay, which may be headed to Europe.

Domestic crush margins also remain good, and if we were to maintain the current pace, then YTD crush would reach 11.8 million MT.

In Europe, Matif rapeseed hit new highs, driven by vegoil’s with 6-port sunflower oil and lower Rhine rapeseed oil at multi-year highs. Strong oil markets should support demand for canola.

We have changed our Supply-Demand estimate accordingly, increasing exports and domestic usage. The balance sheet looks more accommodating to farmers, and we clearly cannot continue exports at the current pace.

Market outlook

Global vegetable oils remain fired up and look poised to bring in fresh buying interest, which will be the driving force behind a likely new record global crush.

Action

We see no reason to chase sales until we know the USA election results and see the next USDA-WASDE report.

Canola – Topics of Interest

The International Grains Council (IGC) Projects Increased Cdn. Canola Exports:

The IGC estimates Canada's 2024 canola harvest amounts at 19.0 million MT.

Canada and the EU-27 are the world's biggest producers of canola and rapeseed, each producing approximately 20 million tonnes per year. This crop year, the EU relies more than usual on imports to supply its oil mills, including from Canada, due to a smaller harvest.

The IGC expects this year’s Cdn. domestic consumption to rise to 11.9 million MT, resulting in a surplus of 7.1 million tonnes. Nevertheless, stocks are projected to drop to 1.7 MT, to an expected increase in exports, and well below the 3.0 million MT recorded last year. According to the IGC, Canada is set to ship 8.7 million MT of canola overseas, almost 30% more than in ‘23/’24.

The main reason for this increase is fairly tight global supply, as availability of rapeseed from Ukraine and Australia, the other major rapeseed exporting countries, is reduced.