Canola Market Outlook: October 24, 2022

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – The CBOT soy closed the week higher as US weekly export sales of soybeans of 2.33 million MT lifted the season total to 1.12 billion bu. China took 81% of the weekly total, and the renewed Chinese buying took cumulative sales up 5% on last year.

In our view, soybeans remain well below value relative to corn. The corn-soybean ratio at 2.05 is very low and a reason for the Chinese to buy.

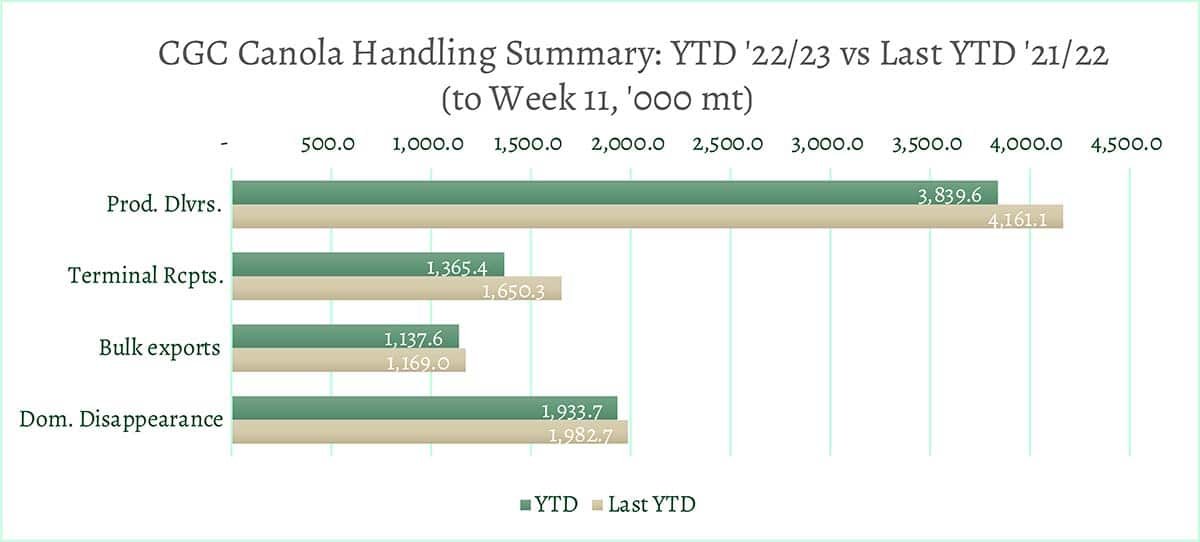

Canola – Year-to-date canola disappearance into week 11 of the crop year amounted to 3.1 million MT compared to 3.2 million MT last year.

Canadian canola was supported by gains in CBOT soybeans, which pulled nearby canola futures to their highest intra-day close since the end of July (an 18-week high).

Canola usage is very good; Canadian crush margins are exceptional due to the high values of the oil.

We see no reason to sell additional canola at this time. If you need to for cash flow, we suggest a pricing order at $950.00/ MT.

Oilseed Market Backdrop

Soybeans

Current market situation:

US weekly export sales of soybeans of 2.33 million MT lifted the season total to 1.12 billion bu, up 50 million bu on last year's 1.07 billion bu. China took 81% of the weekly total, and the renewed Chinese buying took cumulative sales up 5% on last year. Gulf premiums continued to rise with the Mississippi River reported to be at record lows causing transportation problems. Soybean oil rallied following reports of a 2-year low in NOPA stocks, while meal rose despite the record high US cull of poultry due to bird flu.

South America – In Brazil, farmer selling was reportedly light because the strength in the Real largely offset the higher futures. Rains in the south of Brazil have been heavy (too heavy in places), while improved rain is expected next week in the centre-north regions.

Farmer selling in Argentina remains minimal. The September crush at 2.9 million MT was almost 1 million MT below last year’s, and the 6-month total is already running 2 million MT behind versus the USDA-predicted 2 million MT decline for the whole season.

Market outlook:

We note that (according to customs data this Monday morning) China's soybean imports in September rose 12% from a year earlier to 7.72 million MT, reversing a months-long trend of low arrivals.

In our view, soybeans remain well below value relative to corn. We saw good buying by China this week, and we expect that to continue. The corn-soybean ratio at 2.05 is very low and a reason for China to buy.

Canola Market

Canola usage: The Canadian Grain Commission (CGC) reported that during week 11 of the crop year, growers delivered a reduced 431 thousand MT of canola into primary elevators, exports were an impressive 407 thousand MT, while the domestic disappearance was also impressive at 247 thousand MT.

Year-to-date canola disappearance into week 11 of the crop year amounted to 3.1 million MT compared to 3.2 million MT last year.

Visible stocks remained at 1.4 million MT, with a big 913 thousand MT in primary elevators, 181 thousand MT in process elevators, 203 thousand MT in Vancouver/ Prince Rupert, and 118 thousand MT in eastern ports.

Current market situation:

It seems that the CGC numbers do not add properly, as the exports do not match with last week’s visible at all and we do not see how the export number could be achieved given the numbers. We wonder if the elevators are reporting figures that are up-to-date with deliveries. In any case, growers should take note that usage is very good.

Canadian canola was supported by gains in CBOT soybeans, which pulled nearby canola futures to their highest intra-day close since the end of July (18-week high).

Rapeseed in the European Union is presently at a discount to canola. However, we expect prices there to improve later. Canadian crush margins are exceptional due to the high values of the oil.

Values for Matif rapeseed in Europe increased for three days last week, but closed down on Friday by €3.75/MT, and by €5.50/MT for the week. Some support came from the very unusual news of a vessel arriving in the French port of Rouen to load 40 thousand MT of rapeseed for America, though the logistics to deliver into North American crush are hard to understand.

Asian markets on Monday morning are mixed with meal and palm oil just slightly higher, while soybeans and the other vegetable oils were lower. Palm oil saw the biggest weekly gains (at around 7%), on fresh production concerns linked to the monsoon season (October-January).

Market outlook:

Canola usage is very good; Canadian crush margins are exceptional due to the high values of the oil.

Action:

We see no reason to sell additional canola at this time. If you need to for cash flow, we suggest a pricing order at $950.00/ MT.

Canola – Topics of Interest

US Canola production (USDA's National Agricultural Statistics Service data):

US canola production is expected to reach 1.9 million MT this year, up from 1.2 million MT last year. Acreage went up just by 2.8% over last year’s, but average yields improved from 21.7 bu/acre in 2021 to 30.4 bu/acre in 2022. At the same time, we estimate US crush capacity dedicated to canola to have increased to about 2.5 million MT annually, with roughly half committed to biodiesel production, and the remainder to fully refined canola oil.