Canola Market Outlook: October 17, 2022

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – CBOT November soybean futures closed the week at $13.83 ¾ /bu., up 16 ¾ cents from the previous week.

The big surprise in the October WASDE report was that US ending stocks remained unchanged at 200 million bushels, but USDA offset this with a 3 million MT larger Brazilian crop and estimating total world production 35 million MT above last year’s production.

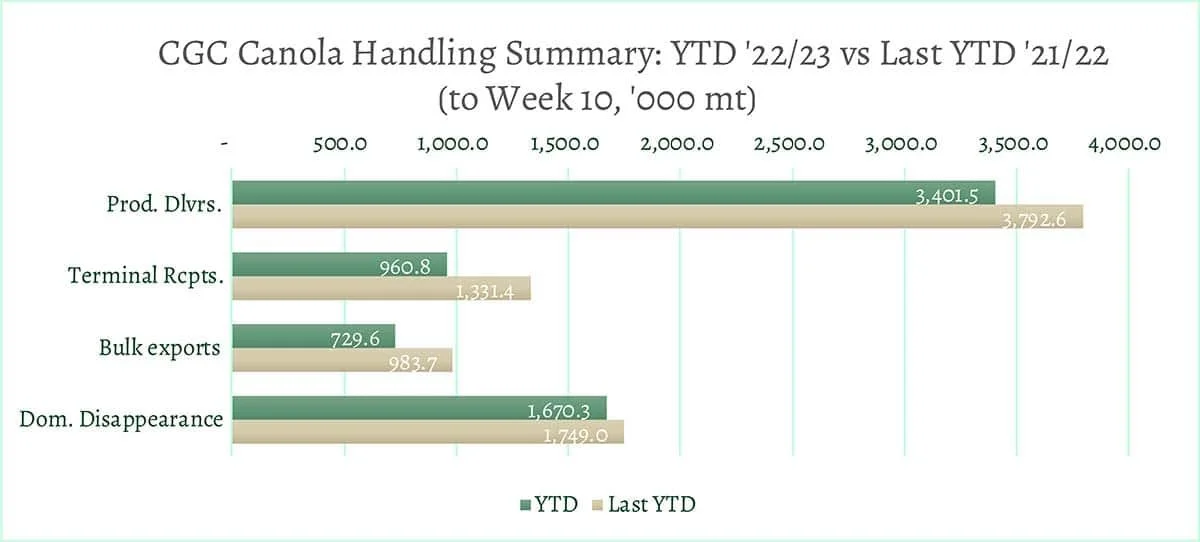

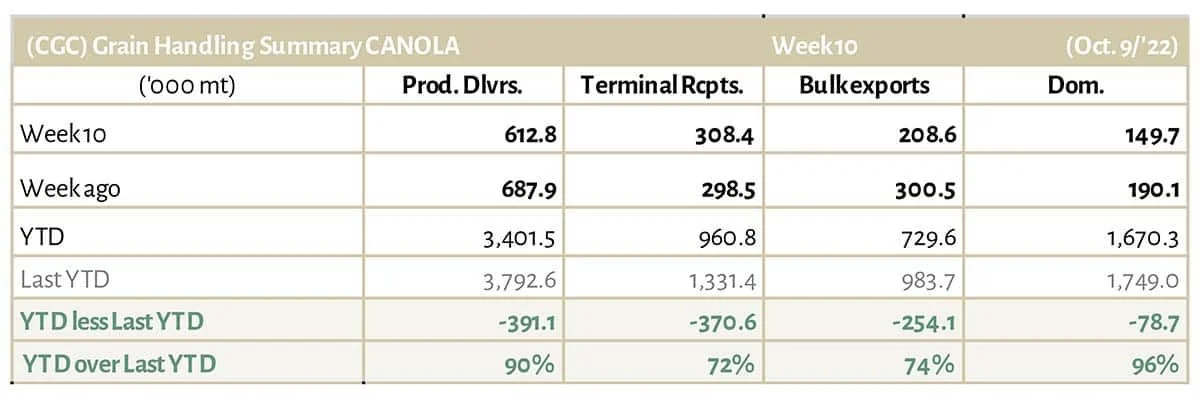

Canola – YTD canola disappearance into week 10 of the crop year amounted to 2.4 million MT compared to 2.7 million MT last year.

Crush margins remain quite good. The soybean-corn ratio at 2.03 is too low and will correct after the crops are harvested.

We see no reason to sell canola right now, especially while the soybean-corn ratio is so low.

Oilseed Market Backdrop

Soybeans

Current market situation:

CBOT November soybean futures closed the week at $13.83 ¾ /bu., up 16 ¾ cents from the previous week. The big surprise in the October WASDE report was that US ending stocks remained unchanged at 200 million bushels, while the average trade estimate expected an increase in carry out. However, the USDA offset the 45 million bu smaller US crop with a 3 million MT larger Brazilian crop and total world production 35 million MT above last year’s production. Still, despite the increase, global (non-China) stocks are forecast to rise just 8.5 million MT, showing the absolute importance of South American weather. Current soil moisture profiles differ greatly in Brazil and Argentina. Overall, we consider the USDA -WASDE report as negative.

Estimates for the Brazilian production are very high and it will take time to see if they can reach the forecasted 152 million MT.

US export sales at 724 thousand MT were within a wide range of expectations of 600 thousand to 1.4 million MT of soybeans, importantly with 392 thousand MT sales to China and 198 thousand MT to unknown destinations.

According to an estimate ahead of the NOPA report due today, the US soybean crush in September likely reached an all-time high for the ninth month of the year as processors ramped up operations with the arrival new crop soybeans. NOPA members handle about 95% of all soybeans processed in the US and are estimated to have crushed 161.6 million bushels (4.4 million MT) of soybeans last month.

Market outlook:

We expect the corn-soybean ratio to improve from the current 2.03 after the harvest is complete. Asian markets ended the week higher, the USDA raised China's soybean imports 1 million tonnes to 98 million tonnes (90 million MT in 2021/22); we expect 100 million MT. Crush rose by a similar amount leaving stocks unchanged.

Canola Market

Canola usage: The Canadian Grain Commission reported that during week 10 of the crop year, growers delivered 613 thousand MT of canola into primary elevators, exports were 209 thousand MT, while the domestic disappearance was at 150 thousand MT.

YTD canola disappearance into week 10 of the crop year amounted to 2.4 million MT compared to 2.7 million MT last year.

Visible stocks increased to 1.4 million MT, with a big 986 thousand MT in primary elevators, 194 thousand MT in process elevators, 141 thousand MT in Vancouver/ Prince Rupert, and 107 thousand MT in eastern ports.

Current market situation:

There is nothing new regarding this year’s production estimates. Manitoba was 79% harvested canola as of October 11, with only 63% completed in the southwest. Manitoba yields seem to vary from 20 to 60 bu/acre, with many recently harvested crops rated tough (11-13% moisture). Overall, Prairie production estimates still vary from around 17.5 million MT according to provincial estimates, to StatsCan’s 19.2 million MT and the USDA’s 19.5 million MT. We are expecting production to end up around 20 million MT.

Export movement has improved over the past two weeks; the railways are still not fulfilling the full railcar demand.

Forward bids have moved up, and we are hearing from a number of larger producers that at current futures levels, they would prefer to plant wheat over canola next spring. The high price of planting canola, disappointing yields, and the opportunity to extend crop rotations with improved wheat prices are the underlying reason. We recall similar events in 1983/84, when the Canadian canola crush industry was in dire financial trouble and was taken over by Americans. However, at the present, crush margins are very good.

In Europe, Matif rapeseed headed for its highest weekly close in nine weeks, while Canadian canola saw better gains on the back of the soybean oil rally.

With the exception of Dalian* soybeans, Asian markets were all trading higher.

*The Dalian Commodities Exchange is located in China and trades futures contracts on a wide variety of commodities.

Market outlook:

Crush margins remain quite good and the soybean-corn ratio at 2.03 is too low and will correct after the crops are harvested.

Action:

We see no reason to sell canola, especially when the soybean-corn ratio is so low.

Canola – Topics of Interest

USDA on Canadian Rapeseed:

The USDA estimates 2022/23 Canadian rapeseed production at 19.5 million MT, down 3% from last month, but up 42% from last year and 2% above the five-year average. In comparison. StatsCan/ AAFC are assuming a 19.1 million MT production for this year. USDA estimates yield is estimated at 2.27 MT/ha (40.56 bu/acre), down 3% from last month, but up 47% from last year’s crop which struggled under historic drought. StatsCan/ AAFC show a 39.7 bu/acre yield.

The lower yield expectation stems primarily from Saskatchewan, which typically accounts for 55% of the total Canadian rapeseed production. Statistics Canada expects rapeseed yield in Saskatchewan to be 9% below its 2016-2020 five-year average.

Global Rapeseed Outlook (USDA):

In their October report, the USDA projects 2022/23 global rapeseed production at 83.8 million MT, 660 thousand MT lower than in their September report, but up almost 10 million MT (+13.5%) from last year’s 83.1 million MT.

The single biggest production increase over last year is in Canada, with a 5.7 million MT (+42%) gain over last year to 19.5 million MT. Canada restored its position as the largest rapeseed producer (19.5 million MT), just ahead of the European Union (19.15 million MT). China is the third largest producer with 14.7 million MT. India is fourth with an estimated 11 million MT.