Canola Market Outlook: May 8, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans The CBOT soy complex closed last week mixed with soybeans and soybean oil higher, but meal making a 5-month low weekly close.

Friday’s CFTC commitment of trader’s report showed soybean spec Funds were heavy sellers.

South American offers continue to be much cheaper than USA offers and there are few trades reported for the USA.

This week's focus will be on Friday's WASDE report, with most people’s attention on South American production and the USDA’s estimate of Chinese soybean and oil demand.

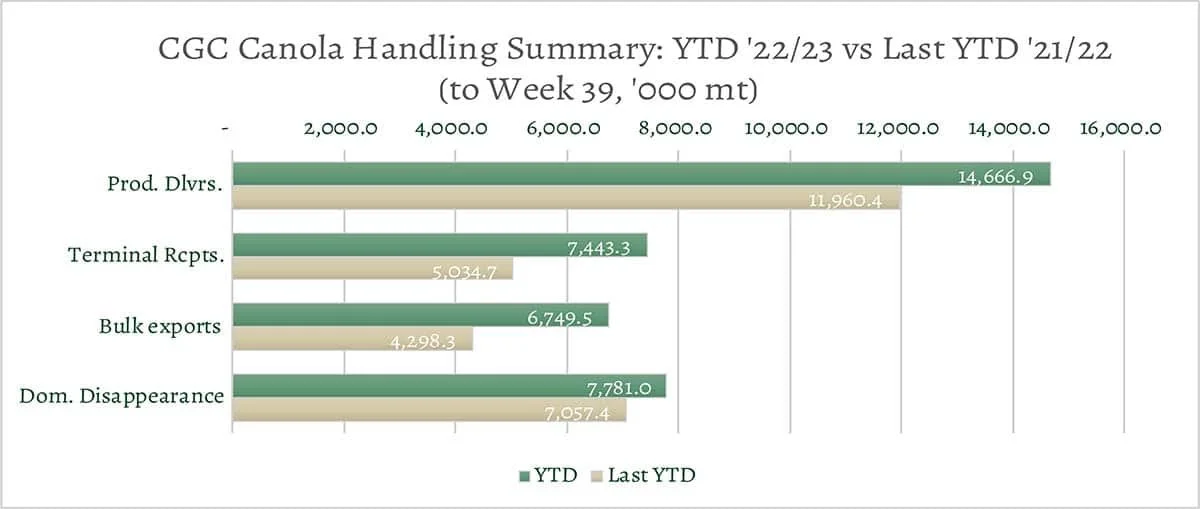

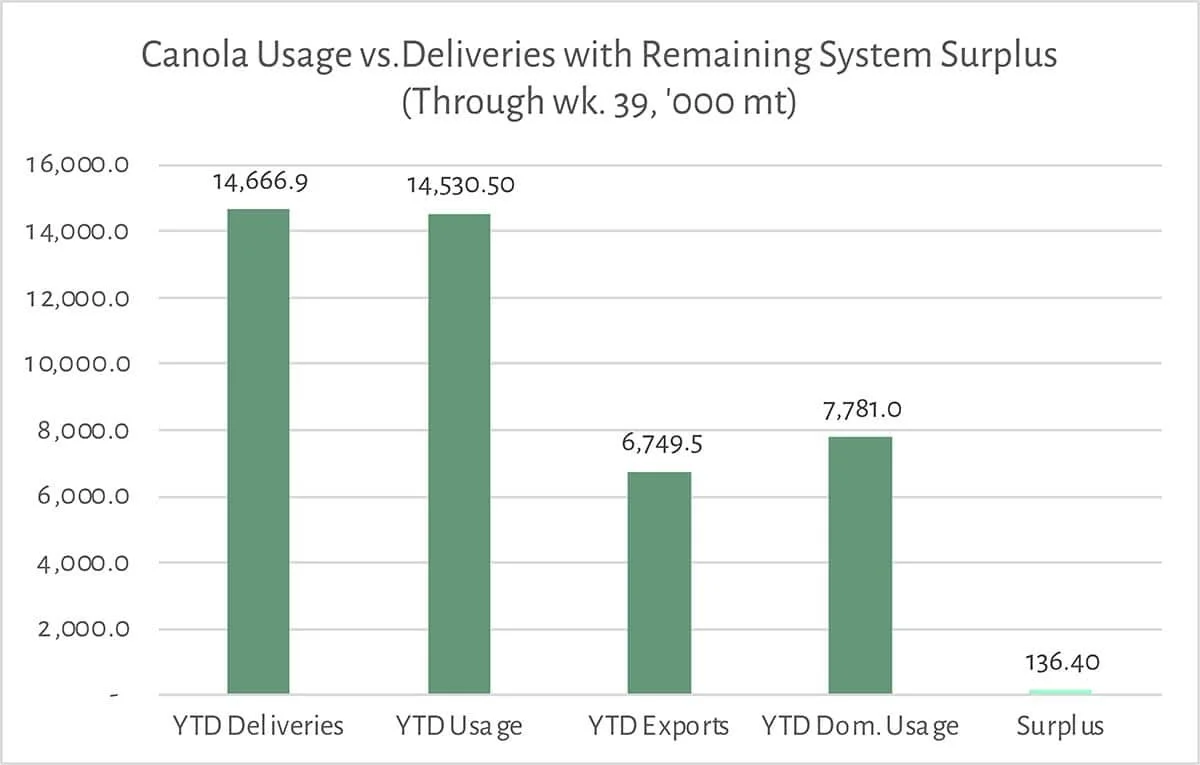

Canola – YTD canola disappearance into week 39 of the crop year is 28% above last year’s (drought-reduced) usage (+3.2 million MT) and amounted to 14.5 million MT compared to 11.4 million MT last year.

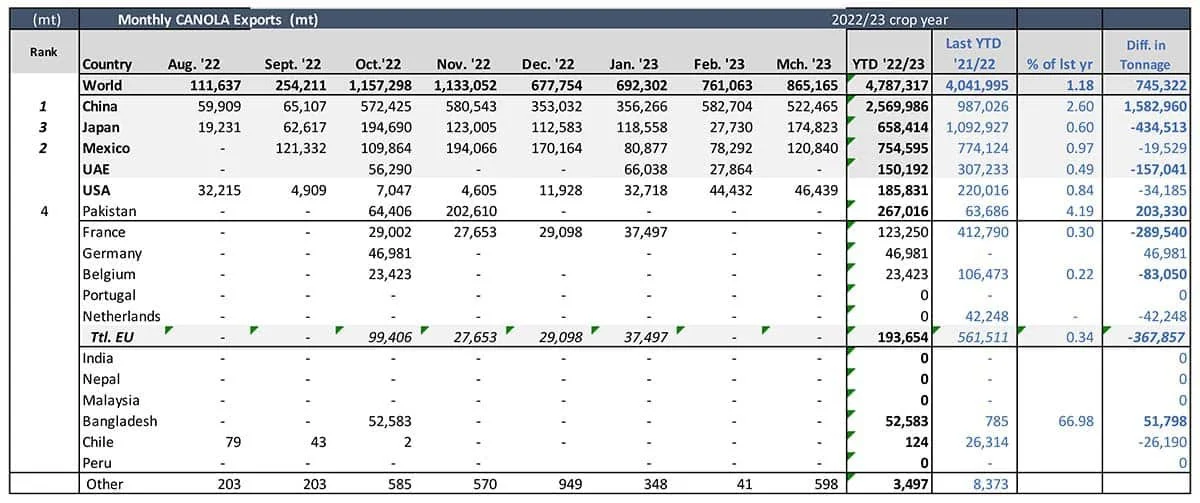

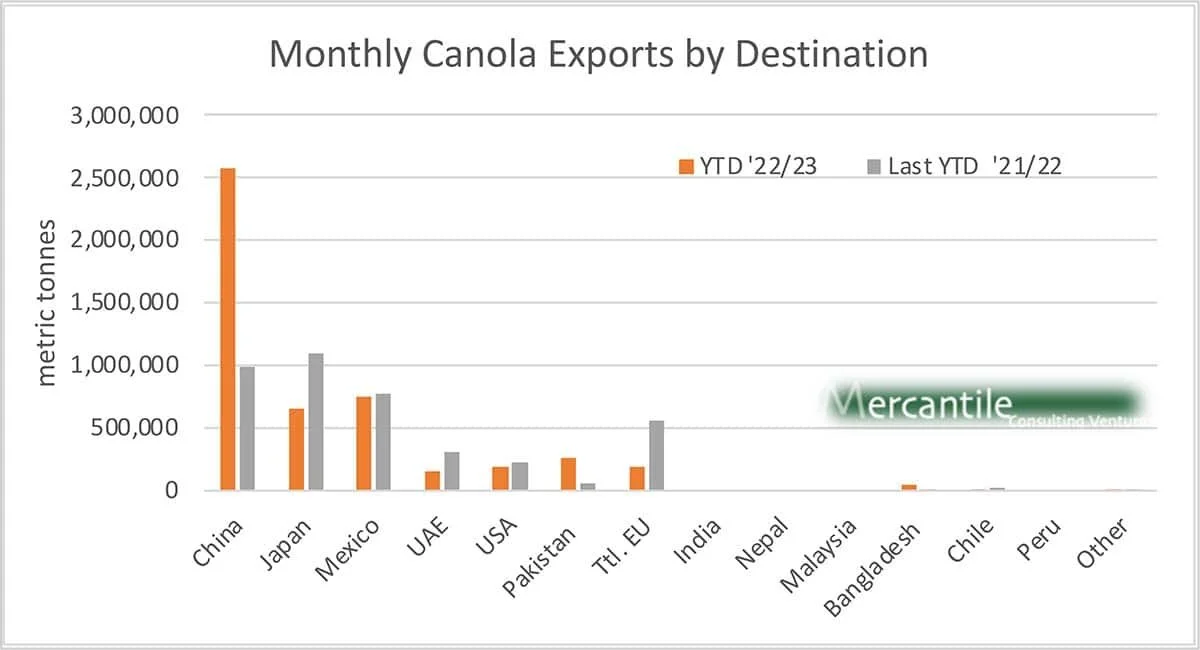

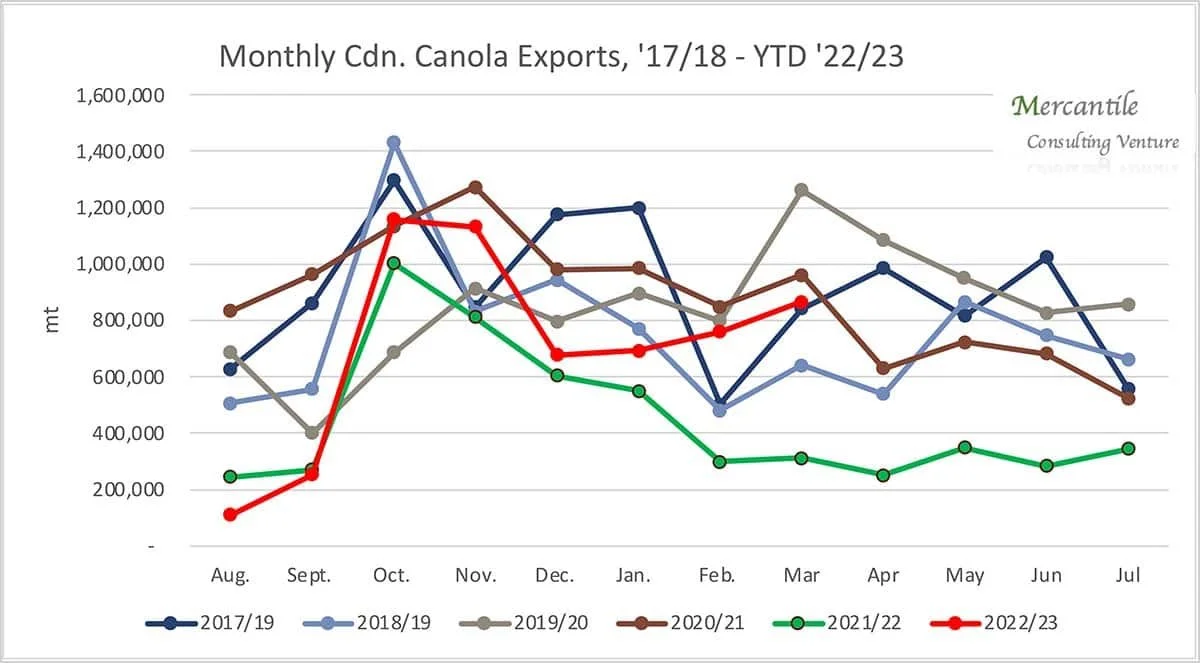

The Statistics Canada exports by destination through March showed China to be by the far largest buyer of canola at 2.57 millionMT. This represents 54% of the March YTD total of 4.79 million MT.

What this week’s USDA-WASDE report (on Friday) will say about China’s rapeseed production and its demand outlook is going to be very important for canola exports.

We are sold out on old crop and We would hold additional canola sales for the present.

Oilseed Market Backdrop

Soybeans

Current market situation

The CBOT soy complex closed last week mixed with soybeans and soybean oil higher, but meal making a 5-month low weekly close. This Monday morning, soybeans are down again 2-8 c/bu. Last Friday’s CFTC commitment of trader’s report showed soybean spec Funds were heavy sellers, selling another 31k contracts to a net long of just 56k contracts as of May 2nd. That is a near 18 months low for their net long position. Commercial soybean hedgers were closing short hedges during the week. That reduced the group’s net position 24k contracts to 140k net short.

Planting progress in the US was the 2nd fastest ever at 19% complete.

South American offers continue to be much cheaper than USA offers and there are few trades reported for the USA.

US export sales were 290k MT net, middle of expectations. China, Germany and Holland were the buyers. Meal sales at 180k MT, again in the middle of expectations and soybean oil sales were a little surprising at 14k MT.

Market outlook

This week's focus will be on Friday's WASDE report, with most people’s attention on South American production and the USDA’s estimate of Chinese soybean and oil demand. - For the present, we see no opportunity in soybeans. Hopefully the WASDE report will provide more info, particularly on China.

Canola Market

Canola usage

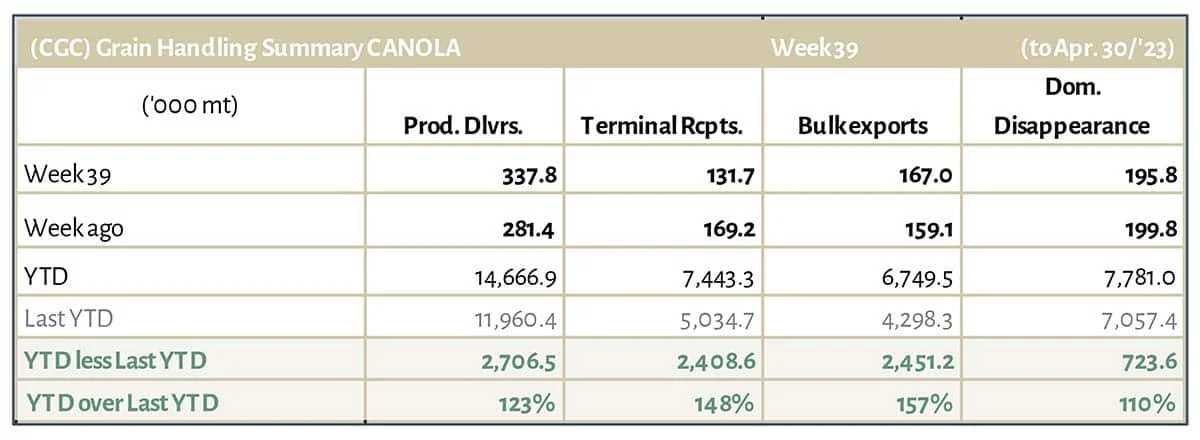

The Canadian Grain Commission reported that during week 39 of the crop year, growers delivered 338 thousand MT of canola into primary elevators, exports were at 167k MT, while the domestic disappearance amounted to 196 thousand MT.

YTD canola disappearance into week 39 of the crop year is 28% above last year’s (drought-reduced) usage (+3.2 million MT) and amounted to 14.5 million MT compared to 11.4 million MT last year.

Visible stocks were at 1.1 million MT, with 564 thousand MT in primary elevators, 213 thousand MT in process elevators, 192 thousand MT in Vancouver/ Prince Rupert, and 128 thousand MT in eastern ports.

Current market situation

The Statistics Canada exports by destination through March showed China to be by the far largest buyer of canola at 2.57 million MT. This represents 54% of the March YTD total of 4.79 million MT. Without Chinese buying, canola prices would be much lower. Clearly, how much oil China produces and how much seed it buys from Canada matters a lot to canola values. We also note that that Japan bought 500,000 MT of Australian canola, which we believe is a first.

What this week’s USDA-WASDE report (on Friday) will say about China’s rapeseed production and its demand outlook is going to be very important for canola exports.

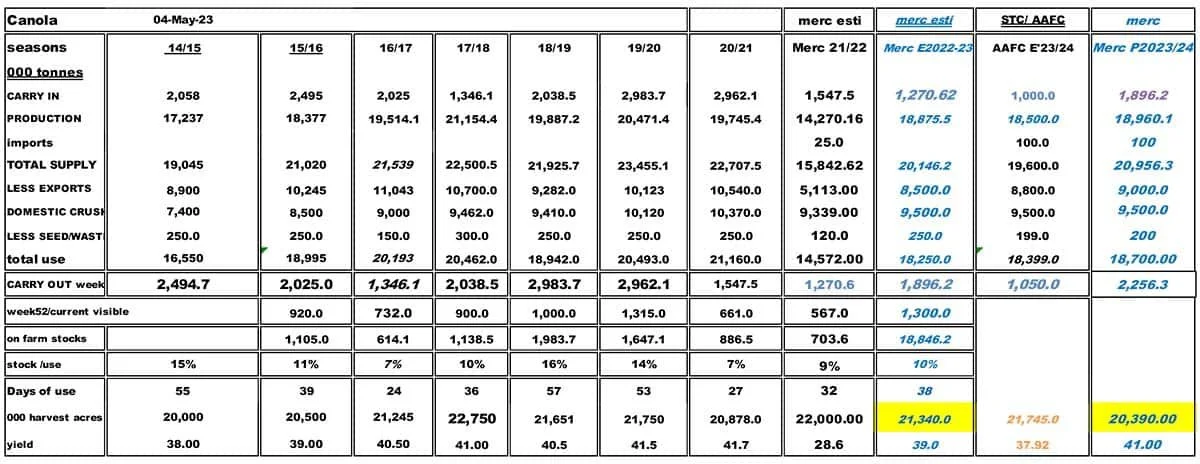

We adjusted our canola balance sheet last week: We lowered ‘22/23 exports to 8.5 million MT but left domestic crush at 9.5 million MT for the crop year. We also adjusted the ‘22/23 production to 18.7 million MT by lowering yields to 39 bu/acre. Ending stocks for ‘22/23 and for ‘23/24 adjusted to 1.9 million MT for ‘22/23 and to 2.3 million MT for ‘23/24.

In Europe, Matif rapeseed was in something of a holding pattern last week with support at €430/MT, but broke through the support this morning to close at €429/MT. The underlying theme there has not changed: There are no supply issues on either old or new crop rapeseed/ canola, although imports have slowed which is taking some of the pressure off of the market. There is also some discussion/ concern about growing conditions in Canada as memories about the disastrous 2021 crop are still intact. But this will have to become more tangible to provide support to the market.

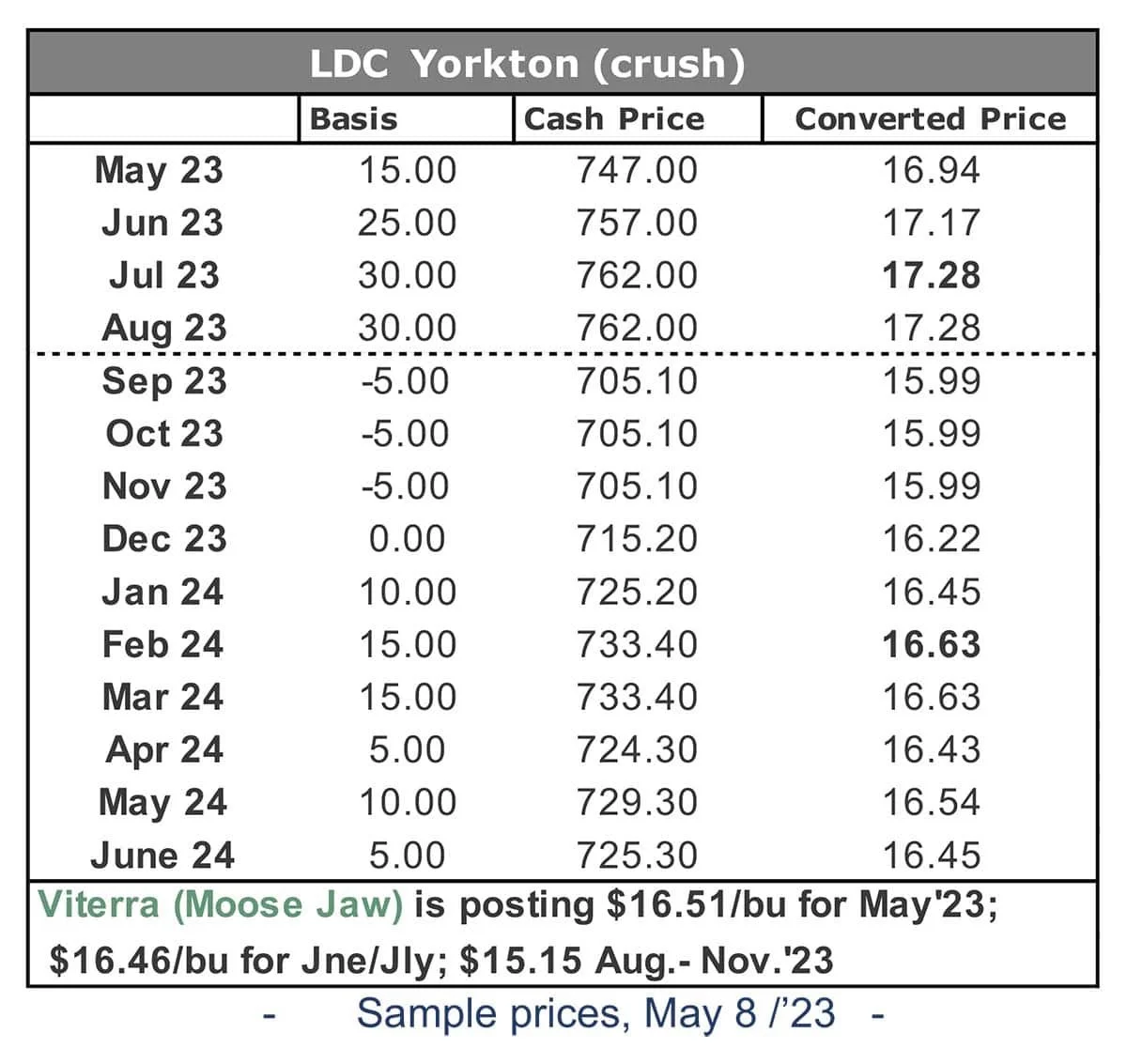

Meanwhile, Canadian canola continues to maintain a premium over European rapeseed values as it expands its domestic crush and tries to keep canola out of export channels. With further expansion of their crush looming, this is unlikely to change over the near term.

Market outlook

What the USDA WASDE report will say on China’s rapeseed production this week is very important for canola exports.

Action

We would hold additional canola sales for the present.

Canola – Topics of Interest

Statistics Canada: Monthly Canola Exports by Destination

According to StatsCan, Canada exported 865k MT of canola during March ’23, with 522k MT of those being shipped to China (60% of total). The next largest buyers were Japan (175k MT), Mexico (121k MT) and the USA (46k MT).

On a year-to-date basis, China bought 2.6 million MT of the total 4.9 million MT exported (54%), followed by Mexico with 755k MT (16%), Japan with 658k MT (14%), Pakistan with 267k MT (6%), the USA with 186k MT (4%), and the UAE with 150k MT (3%).

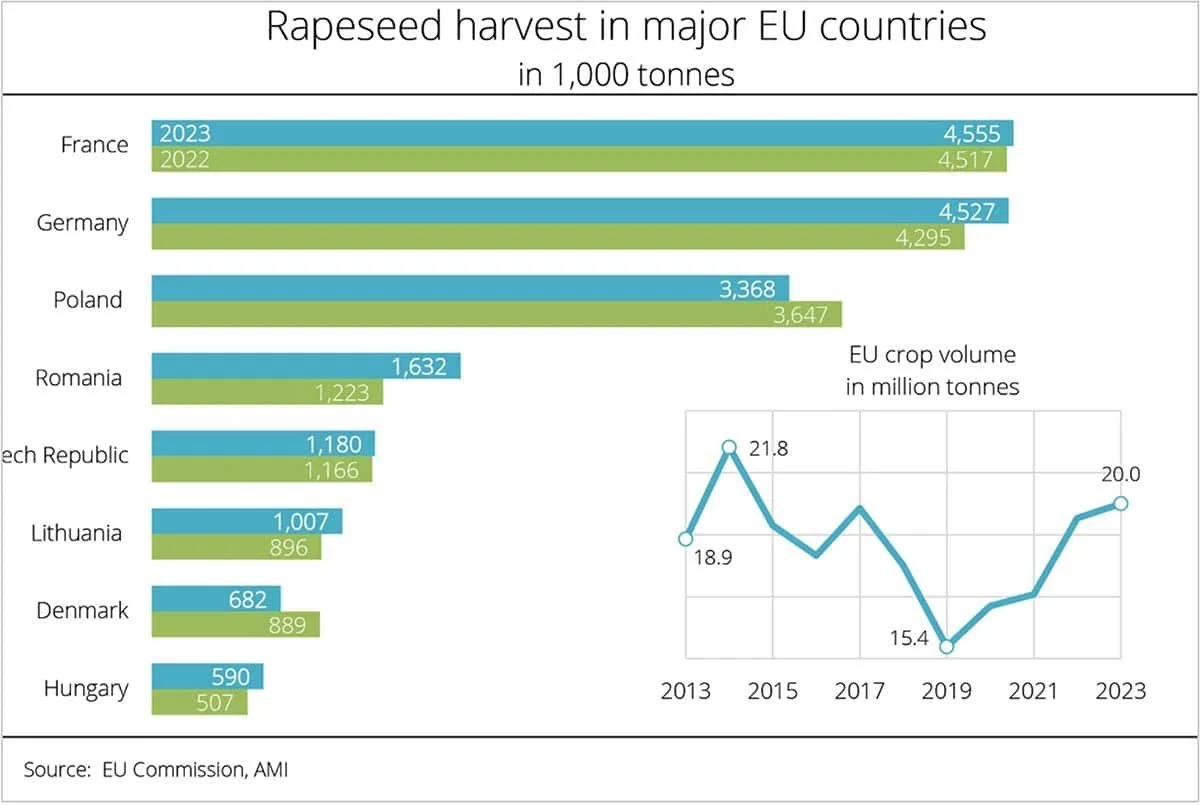

EU Rapeseed Production in 2023

According to the EU Commission, EU rapeseed production in 2023 will increase to 20 million MT from 19.536 million MT last year. France and Germany are forecast to remain the biggest producers in 2023, with 4.55 and 4.53 million MT, respectively. Poland, the EU's third most important rapeseed producer, is expected to see a decline of 8 per cent to 3.4 million tonnes on the previous year. The biggest increase is expected in Romania. The Czech Republic, Lithuania and Hungary are also forecast to bring in larger rapeseed crops.