Canola Market Outlook: May 1, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – Despite Friday's move up (+8 - 17.5 cents), CBOT soybeans ended the week down 40c, meal was off $10, and soybean oil fell 1.80.

Weakness in competing vegetable oils took soybean oil to its lowest level since November 2021, while Indonesia lowered its domestic sales requirements.

Funds seem to be in a long liquidation phase across the soybean complex ahead of the new US crop cycle while large Brazilian supplies are outweighing Argentine losses, and for now, bearish world vegetable oils outweigh the growth in US biodiesel demand.

Canola – YTD canola disappearance into week 38 of the crop year is 27% above last year’s (drought-reduced) usage (+3 million MT) and amounted to 14.2 million MT compared to 11.1 million MT last year. Visible stocks dropped to a small 1.04 million MT.

Statistics Canada pegged the 20123 Can canola acreage 21.6 million acres, up modestly by 0.9% from last year.

In China, the canola oil premium over soybean oil has now again declined to 4 percent. We still think this is enough of a premium for China to buy canola seed, if it is offered.

We are sold out on old crop and would leave new crop sales at current levels.

Oilseed Market Backdrop

Soybeans

Current market situation

Despite Friday's move up (+8 - 17.5 cents), CBOT soybeans ended the week down 40c, meal was off $10, and soybean oil fell 1.80. Weakness in competing vegetable oils took soybean oil to its lowest level since November 2021, while Indonesia lowered its domestic sales requirements from 450k MT/month to 300k MT ahead of the seasonal increase in production. There were also again robust sales of Brazilian soybeans to China, as premiums looked to have found a base, rising 20¢-30c on the week.

Weekly US soybean export sales came in at 311k MT for old crop and at 328k MT for new crop. That was up from 100k MT last week but was lower than the 481k MT sold during the same week last year. Analysts had been expecting between 75k to 500k MT of sales going into the report.

Soybeans are starting the new month and new week with small gains today (0.6 – 4.2 c). There were zero deliveries against May soybeans. CoT data had managed money firms at 87,208 contracts net long as of April 25th. Commercial soybean hedgers closed 57k shorts through the week, leaving the group 164,627 contracts net short.

Market outlook

Funds seem to be in a long liquidation phase across the soybean complex ahead of the new US crop cycle while large Brazilian supplies are outweighing Argentine losses, and for now, bearish world vegetable oils outweigh the growth in US biodiesel demand. - We expect further pressure on deferred USA futures.

Canola Market

Canola usage

The Canadian Grain Commission reported that during week 38 of the crop year, growers delivered 281 thousand MT of canola into primary elevators, exports were at 159k MT, while the domestic disappearance amounted to 200 thousand MT.

YTD canola disappearance into week 38 of the crop year is 27% above last year’s (drought-reduced) usage (+3 million MT) and amounted to 14.2 million MT compared to 11.1 million MT last year.

Visible stocks dropped to 1.04 million MT, with 533 thousand MT in primary elevators, 184 thousand MT in process elevators, 202 thousand MT in Vancouver/ Prince Rupert, and 124 thousand MT in eastern ports.

Current market situation

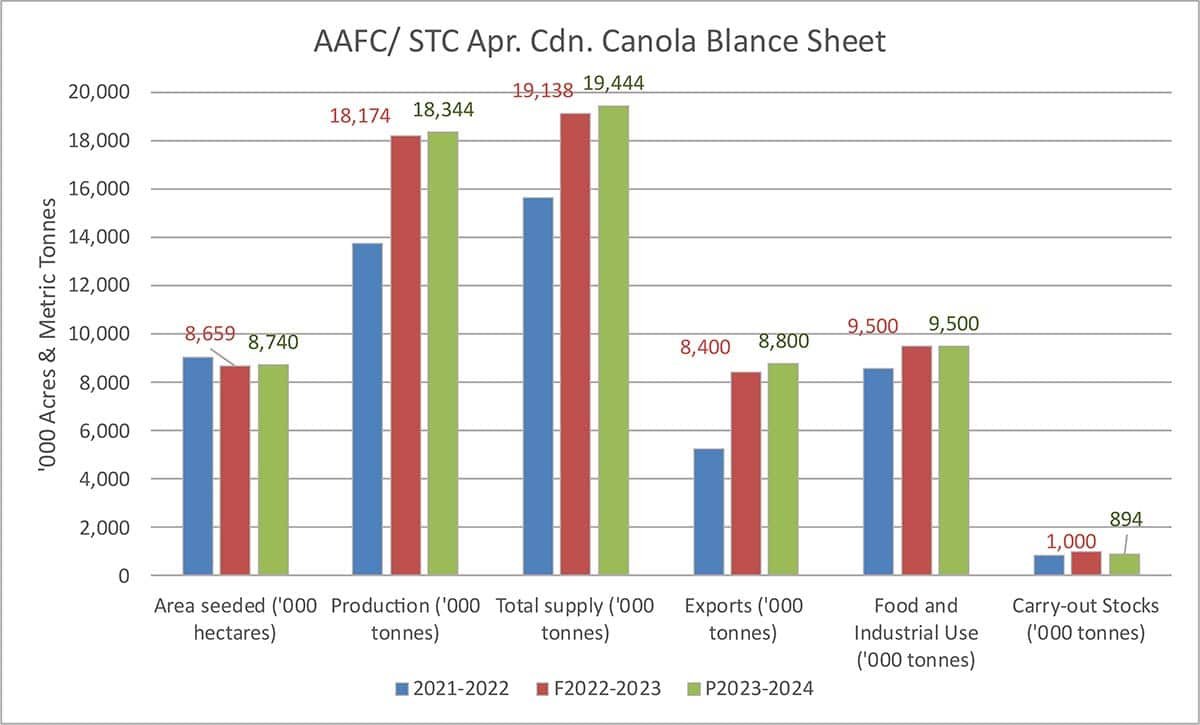

Last Wednesday, Statistics Canada pegged the 20123 Can canola acreage 21.6 million acres, up modestly by 0.9% from last year. That’s roughly in line with the 5-year average acreage, but the trade had expected 21.8 million acres on average, with a big range of estimates of 20.5 to 22.5 million acres. Mercantile still thinks that acres will be down somewhat from last year.

We note that the disclosure (just in a footnote to the report) that this year’s StatsCan Acreage Report based is based on a survey conducted during Dec. 12/'22 to Jan. 14/'23 instead of the previous practice of conducting it during March 1-29 of the ongoing year caused some consternation in the trade. The general thinking is that this change will make the data less reliable/ useful. [StatsCan told us that it is working on a project (dubbed ‘AgZero’) that is using alternative data sources and advanced technologies, such as Earth Observation data (in December?) and machine learning, to reduce the use of surveys. We wonder if the quality aspect of the report is being properly considered.] - Yields will certainly be important to determine the balance sheet this year.

In China, the canola oil premium over soybean oil has now again declined to 4 percent. We still think this is enough of a premium for China to buy canola seed, if it is offered. However, exports are starting to fall behind the pace needed to reach our export target. Domestic crush, on the other hand, is keeping slightly ahead of target. Exports would need to reach 172k MT per week to reach 9 million MT, while crush would only need 137k MT per week to reach 9.5 million MT. Combined projected usage should still be within reach.

Matif rapeseed futures fell €14/MT while maintaining the downward trajectory and retesting recent lows. Rapeseed in Europe is flowering and is in quite good condition, and EU import data showed that border flows from Ukraine are falling dramatically. ICE canola also closed the week lower with the trade debating StatsCan new crop acres and improving new crop planting conditions, against increasing Canadian crush capacity.

Market outlook

Nearby canola will remain tight, and markets are oversold and are looking for support lines. But the Funds’ long liquidation phase across the soybean complex ahead of the new US crop cycle has also weighed on rapeseed/ canola. The May-day holidays in Europe and will leave Monday quiet and China is closed Monday - Wednesday. This week will be quiet, with markets looking for new input from the May 12 USDA/ WASDE reports.

Action

We are sold out on old crop and would leave new crop sales at current level.

Canola – Topics of Interest

Statistics Canada: Monthly Canola Crush

Canola crush in Canada for the month of March ’23 was pegged at 923k MT by Statistics Canada. This is the second highest recorded crush number for the month of March. The crop year to-date crush increased to 6.6 million MT, 14% higher than last year’s YTD crush but still 6% behind the big ‘20/21 YTD crush. Extrapolating the YTD crush to the full year, would bring the total ‘22/23 crop year crush to 9.94 million MT.