Canola Market Outlook: April 24, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – CBOT soybeans closed down 17c/bu (May contract) last week and are back below the $15/bu gauge. Soybean oil futures also went into the weekend on triple digit losses, with May down 103 points.

The weekly US export sales report for soybeans posted old crop sales of 100 thousand MT and 2,900 MT of new crop, which was well below trade expectations.

The market sentiment for now is dominated more by the large soybean crop in Brazil, than the low stocks in the US or the small crop in Argentina. We will be watching to see if Brazilian logistics are capable of keeping up with their sales pace.

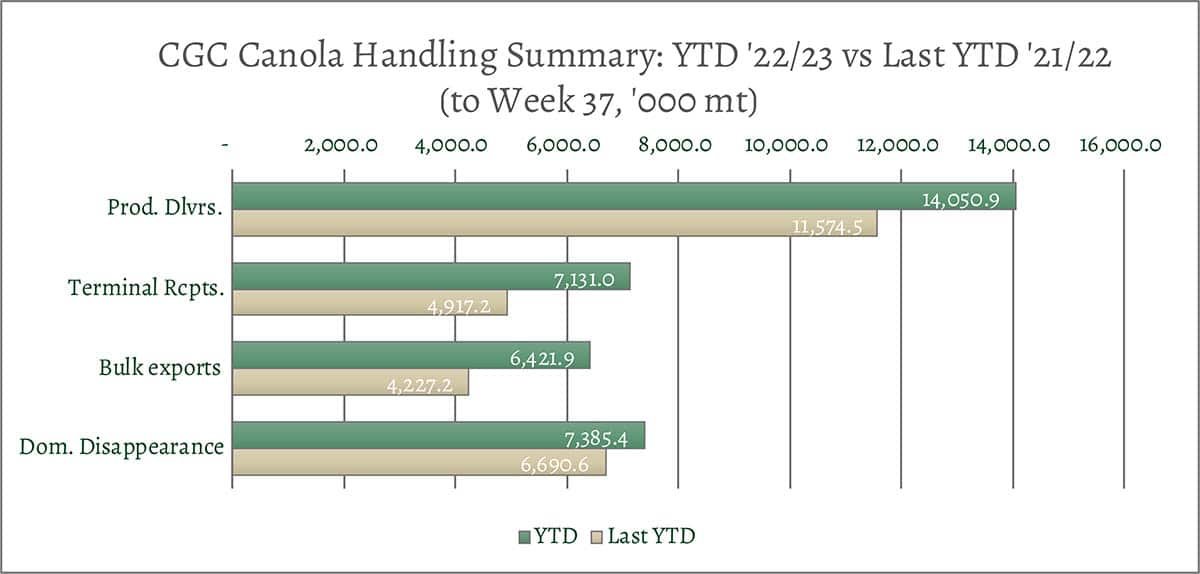

Canola – YTD canola disappearance into week 37 of the crop year is 26% above last year’s (drought-reduced) usage (+2.9 million MT) and amounted to 13.8 million MT compared to 10.9 million MT last year.

Visible stocks dropped to a small 1.09 million MT.

In China, the canola oil premium actually has slightly improved to 8% over soybean oil, so we still think China will buy canola seed if it is offered.

We should see some premiums for nearby canola.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans closed down 17c/bu (May contract) last week and are back below the $15/bu gauge. Soybean oil futures also went into the weekend on triple digit losses, with May down 103 points. The weekly Commitment of Traders report showed net new buying from spec traders during the week (+11.3 thousand Ct’s), expanding the group’s net long to 135 thousand contracts. However, commercial soybean hedgers liquidated 50 thousand contracts during the week, taking their net short hedge to 214,706 contracts.

Industry sources had China buying about 40 cargoes (~2.4 million MT) of soybeans from Brazil over the course of the week, because premiums are very cheap in Brazil at present. Both state-owned companies and commercial crushers were said to have been active in the market covering near-term positions. This event has been taken as a negative signal for CBOT soybeans, as is did not involve US beans. We note, however, that this is also an impressive indication of ongoing Chinese demand. Chinese March soybean imports from the US were 4.83 million MT compared to 3.37 million MT last year (+43%). Imports from Brazil were 1.67 million MT in March, which was a 42% lower than last year. Total March imports were 6.85 million MT, 8% above March 2022.

Still, the weekly US export sales report for soybeans posted old crop sales of 100 thousand MT and 2,900 MT of new crop, which was well below trade expectations.

BAGE reported Argentina’s soybean harvest as 16.7% complete. BAGE reduced their production forecast by 2.5 million MT to 22.5 million MT due to lower-than-expected yields, compared to the USDA estimate at 27 million MT (33 million MT last year) and the Rosario Grain Exchange estimate at 23 million MT. The Brazilian soybean crop is estimated at an unprecedented 154 million MT this year (130.5 million MT last year). Brazil’s Ag Rural reported the soybean harvest at 92% complete, almost equal to last year’s 91% pace.

Market outlook

Chinese demand is worthy of continued close attention over the coming weeks. In China, soybean meal and oil ended the week on a weak tone and trading at or near the week’s lows with the market sentiment there dominated more (for now) by the large soybean crop in Brazil, than the low stocks in the US or Argentina’s small crop. We will be watching to see if Brazilian logistics are capable of keeping up with their sales pace.

Canola Market

Canola usage

The Canadian Grain Commission reported that during week 37 of the crop year, growers delivered 311 thousand MT of canola into primary elevators, exports were at 168 thousand MT, while the domestic disappearance amounted to 273 thousand MT.

YTD canola disappearance into week 37 of the crop year is 26% above last year’s (drought-reduced) usage (+2.9 million MT) and amounted to 13.8 million MT compared to 10.9 million MT last year.

Visible stocks dropped to 1.09 million MT, with 572 thousand MT in primary elevators, 203 thousand MT in process elevators, 219 thousand MT in Vancouver/ Prince Rupert, and 96 thousand MT in eastern ports.

Current market situation

Canadian canola supplies are tightening and the visible declined to just over 1 million tonnes. Stocks at the West Coast have improved somewhat, and exports for week 38 should be good.

In China, the canola oil premium actually has slightly improved to 8% over soybean oil, so we still think China will buy canola seed if it is offered. To reach our export estimate we need average weekly exports to reach 172,000 MT, which is just below the year-to-date average exports of 174 thousand MT. We may need to take our supply for 2022/23 lower.

AAFC published their monthly commodity balance sheets. There was one significant change in the 2022/23 canola numbers: AAFC lowered their export number by 200 thousand MT to 8.4 million MT, but left the crush number unchanged at 9.5 million MT. The lower export number carries into the ending stocks, which were adjusted up by 200 thousand MT to 1 million MT. 2023/24 ending stocks increased accordingly to 1.05 million MT.

Market outlook

The general oilseed market sentiment is currently dominated by the effects of the big Brazilian crop as described above. However, the rapeseed oil premium combined with the higher oil yield on canola should keep canola a product of first choice for crushers, as long as there are adequate offers. We anticipate exports to stay strong as long as there is product to be offered to China.

Action

We should see some premiums for nearby canola.

Canola – Topics of Interest

Vegetable Oil Values in Dalian, China

USDA on Global Rapeseed Supply and Demand

Further to previous our comments on global USDA rapeseed numbers, the graph below summarizes the conclusions reached on 2022/23. Global production was up at 87.2 million MT, 14.5% higher than in the previous year. Global rapeseed consumption is expected to reach 84 million MT, up 11% over the previous year. Ending stocks are expected to reach 6.2 million MT, up 51% over the previous year.