Canola Market Outlook: May 15, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

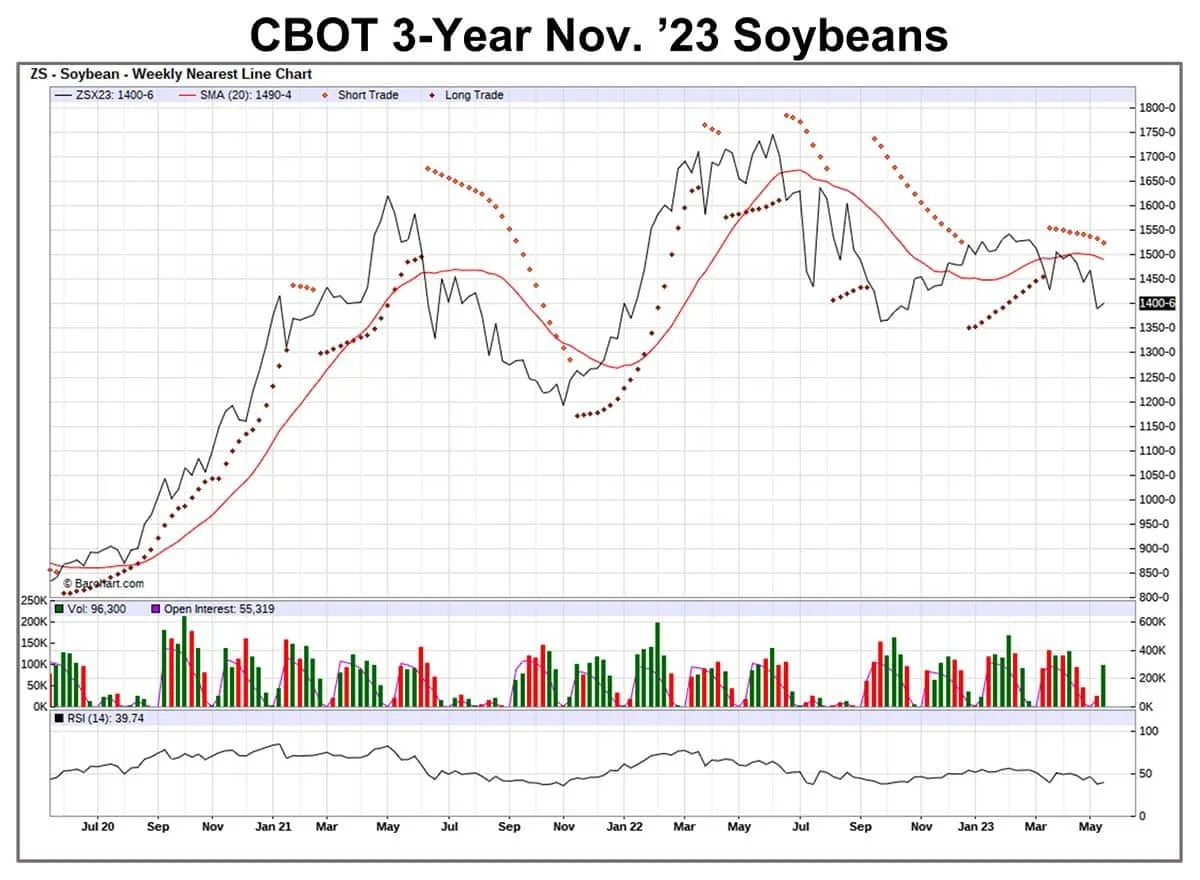

Soybeans - Last week, CBOT soybeans ended sharply lower, re-testing support. Meal values were mixed, but soybean oil closed at more than 2-year lows.

The higher-than-expected soybean stocks for ‘23/24 in the May USDA report pushed July soybeans to a 10-month low weekly close, while Nov. dropped to a 16- month low.

‘23/24 US ending stocks bounced to 335 mln bu, while global stocks increased by over 21 million MT to 122.5 million MT, despite a 22 million MT increase in demand.

We prefer to leave additional trade alone for the present.

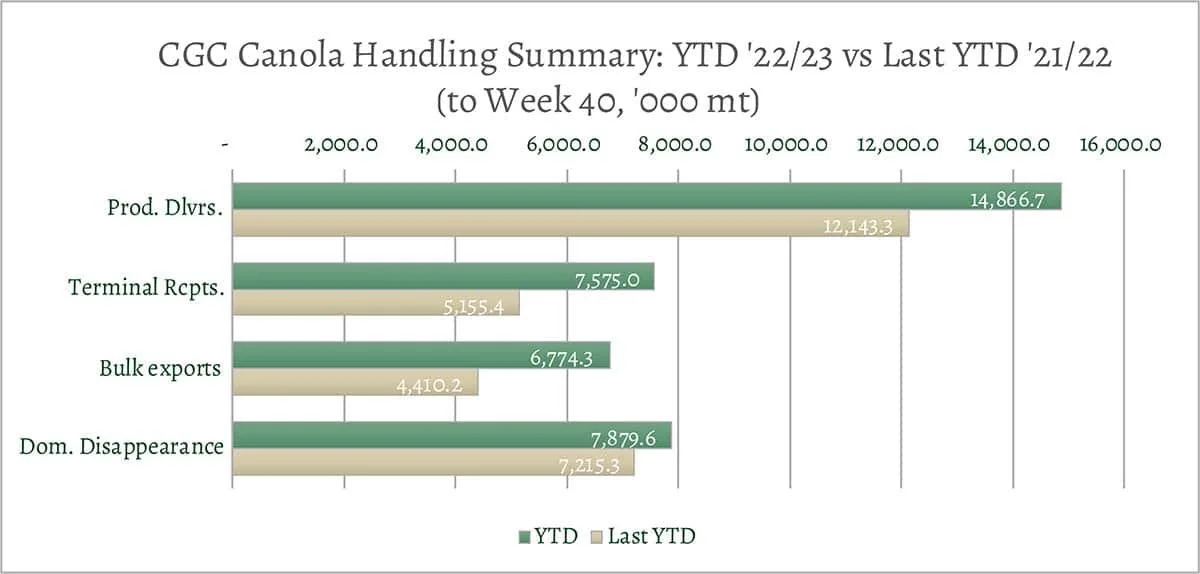

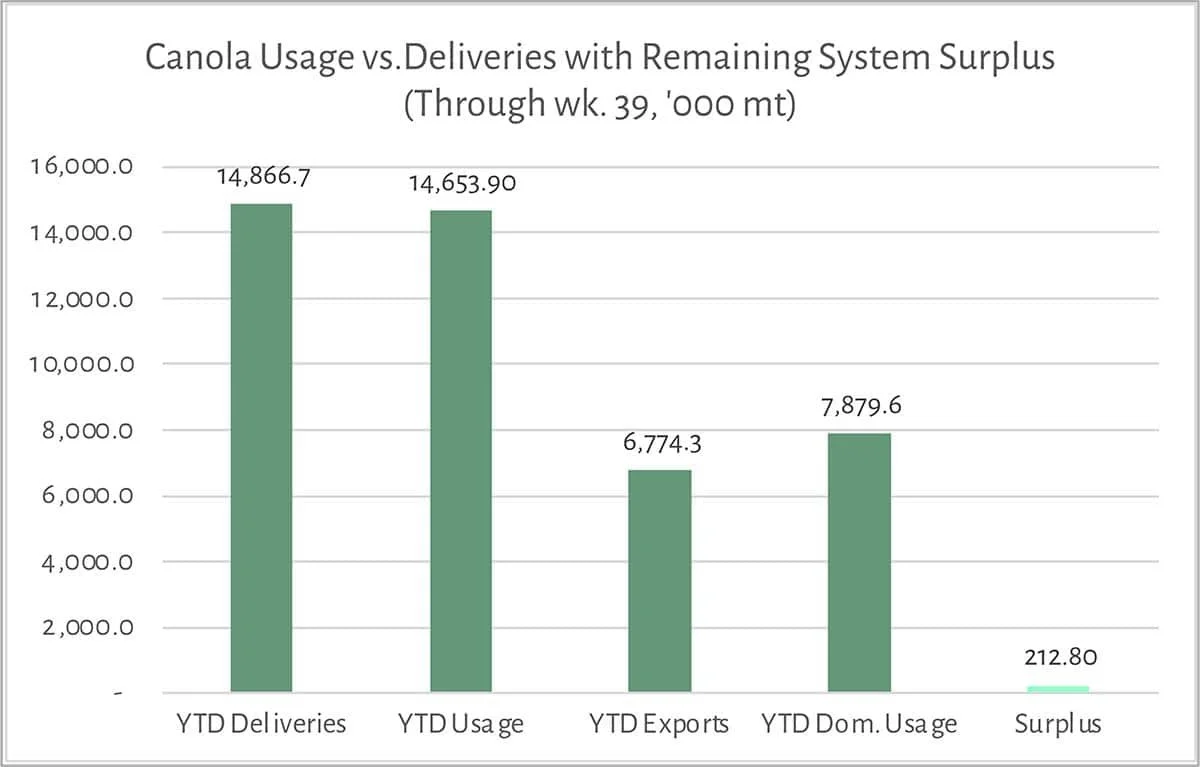

Canola – YTD canola disappearance into week 40 of the crop year is 26% above last year’s (drought-reduced) usage (+3 million MT) and amounted to 14.7 million MT compared to 11.6 million MT last year.

For Canada specifically, USDA projects rapeseed production 7% higher in ‘23/24 at 20.3 million MT. Both crush and exports are forecast to rise from the previous year’s levels.

Statistics Canada estimated Cdn. canola stocks as of March 31/’23 at 5.9 million MT, up 15% from last year at that time. This year’s March stocks are significantly higher than last year’s stocks by 789k MT but are still well below the 7.8 million MT in March ’21.

The next 4-6 months of weather conditions will be critical for both northern and southern Hemisphere crops, both for grains and oilseeds. Weather remains volatile; for the present, we would leave markets alone.

Oilseed Market Backdrop

Soybeans

Current market situation

Last week, CBOT soybeans ended sharply lower, re-testing support. Meal values were mixed, but soybean oil closed at more than 2-year lows. The higher-than-expected soybean stocks for ‘23/24 in the MAY USDA Report pushed July soybeans to a 10-month low weekly close, while Nov. dropped to a 16- month low. We can add that this Monday, markets closed up 10 cents for soybeans, down 2 cents for meal, and up 0.17-0.25 cents.

In the USDA report last Friday, USDA raised the ’22/23 Brazilian crop by 1 million MT, offset by Paraguay. But the shock was Argentina with the USDA 5-7 million MT higher than the rest of the world! For ’23/24, the US remained unchanged from the Outlook Forum, Brazil was raised to another record !63 million MT), and Argentina was showing a sharp recovery (48 million MT). Regarding ‘23/24 consumption, USDA projects a 22 million MT (6%) increase in domestic offtake, following its unchanged 22/23 level from 21/22. ‘22/23 Chinese imports were raised 2 million MT to 98 million MT, with ‘23/24 new crop imports set at 100 million MT. ‘23/24 US ending stocks bounce to 335 mln bu, while global stocks increase by over 21 million MT to 122.5 million MT, despite a 22 million MT increase in demand.

Market outlook

The increased soybean production indicated in the WASDE report and the next 4-6 months of weather will be critical for both Northern and Southern Hemisphere oilseed crops.

We prefer to leave additional trade alone for the present.

Canola Market

Canola usage

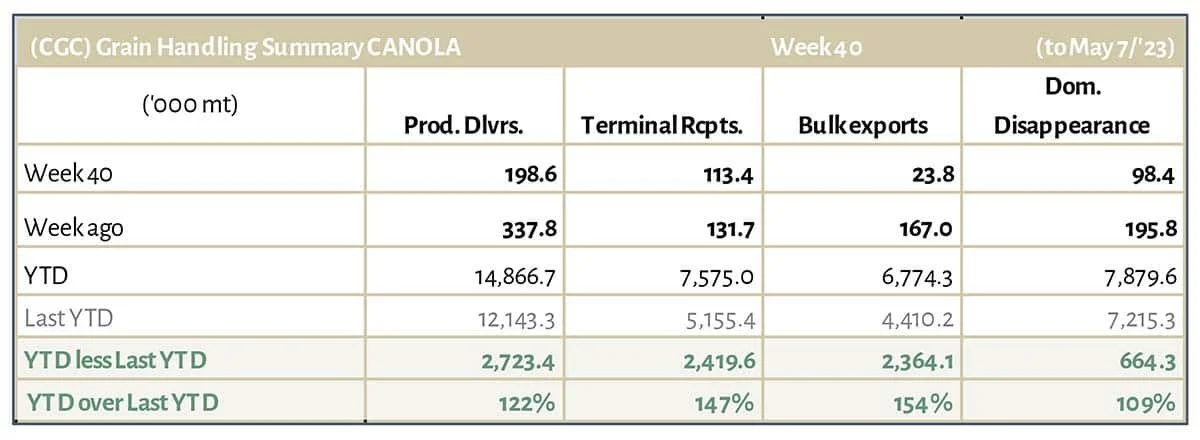

The Canadian Grain Commission reported that during week 40 of the crop year, growers delivered 199 thousand MT of canola into primary elevators, exports were at a very small 24k MT, while the domestic disappearance amounted to 98 thousand MT.

YTD canola disappearance into week 40 of the crop year is 26% above last year’s (drought-reduced) usage (+3 million MT) and amounted to 14.7 million MT compared to 11.6 million MT last year.

Visible stocks were at 1.13 million MT, with 564 thousand MT in primary elevators, 224 thousand MT in process elevators, 250 thousand MT in Vancouver/ Prince Rupert, and 117 thousand MT in eastern ports.

Current market situation

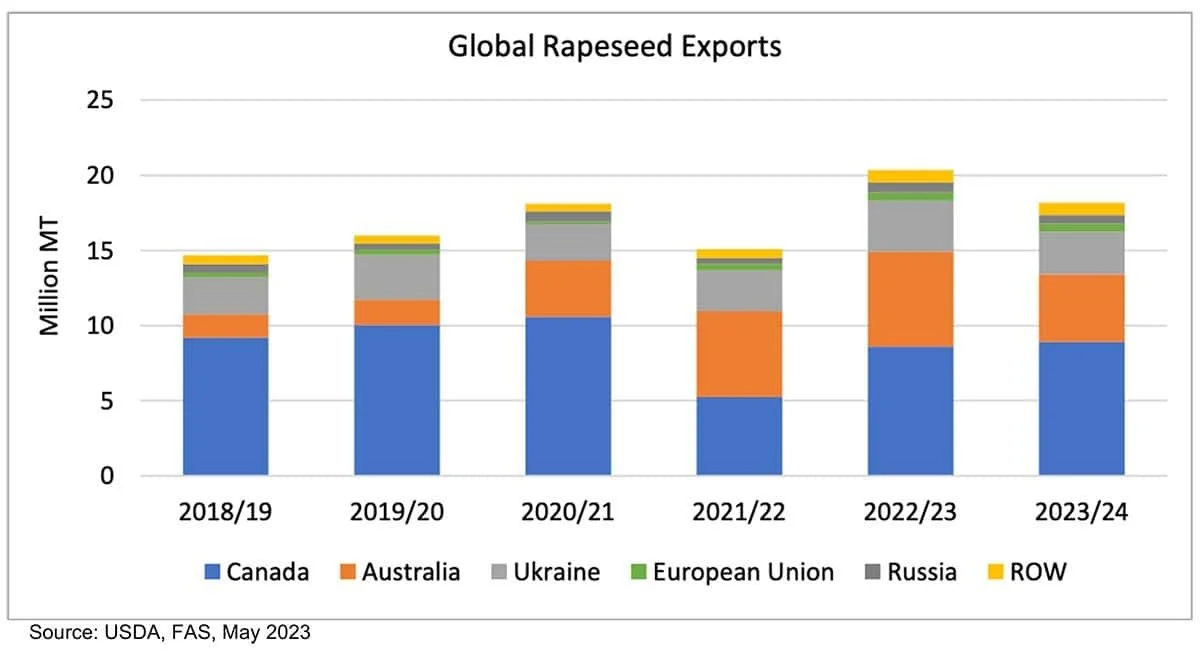

USDA report and global framework: The USDA last Friday put ‘23/24 global rapeseed production at an almost unchanged at 87 million MT. According to USDA, the EU is expected to remain the world’s largest producer, exceeding Canada for the third year in a row. China and India are expected to increase production and will offset losses in Australia, where area harvested is forecast to decline by 10% compared to the previous marketing year. Global carryover is expected to recover slightly year over year, especially in Canada and the EU, and should reach 5-year-average levels. Global exports are projected to decline with lower production in Australia. Exports from Canada are projected to increase modestly as China import demand declines on larger domestic rapeseed production as well as growing demand for other oilseeds and products. Global rapeseed crush is forecast to reach a record 81.0 million MT with growth in the European Union, Canada, and China.

For Canada specifically, USDA projects rapeseed production 7% higher in ‘23/24 at 20.3 million MT. Both crush and exports are forecast to rise from the previous year’s levels. Stocks are projected to recover from the historical lows of the past 2 years but are expected to remain below the 5-year average. Exports of meal and oil will remain strong with growing U.S. demand and robust China purchases. However, oil exports are projected slightly lower than in the previous marketing year, allowing stocks to recover moderately.

Looking at the current Canadian setting, the export number for week 40 needs some more investigation. The stocks on the West Coast are a relatively big 240,000 tonnes, so the explanation of the low export number suggests we either did not have the buyers or that week 41 will be a big export number. It could be that canola is losing sales to Australian rapeseed.

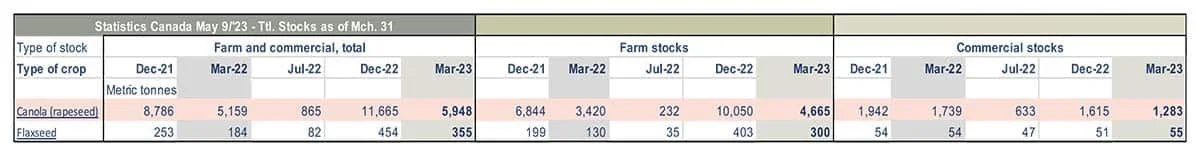

Last week, Statistics Canada estimated Cdn. canola stocks as of March 31/’23 at 5.9 million MT, up 15% from last year at that time. This year’s March stocks are significantly higher than last year’s stocks by 789k MT but are still well below the 7.8 million MT in March ’21.

Of the total March 31 stocks, 78% (4.7 million MT) are still on farm, and 22% (1.3 million MT) are in commercial hands. The trade had expected canola stocks to come in at around 6.9 million MT.

In Europe, there were suggestions that some crushers were not bidding new crop rapeseed at all as Aug. Matif fell €10.75/MT to €425/MT, its lowest intra-day close since July 2021. New crop expectations remain plentiful in the EU, which seems to be keeping crushers relaxed. European river water levels also again adequate to keep barge traffic moving without problems.

Market outlook

The next 4-6 months of weather conditions will be critical for both northern and southern Hemisphere crops, both for grains and oilseeds.

Action

Weather remains volatile. For the present, we would leave markets alone.

Canola – Topics of Interest

Global Rapeseed Production Update

As mentioned above, USDA expects ‘23/24 global rapeseed production to remain almost unchanged from last year at 87 million. The graph below details production by the major players, with the EU the largest producer at 20.5 million MT, followed by Canada (20.3 million MT), China (15.4 million MT), and India (11.7 million MT).

The biggest importers in ‘23/24 are projected to be the EU (5.8 million MT), China (3 million MT, down from 3.8 million MT in ‘22/23), and Japan (2.45 million MT).

FAO Global Vegetable Oil & Cereal Price Indices

In April 2023, the FAO vegetable oil index declined for the fifth time running, falling 122 points since April 2022 to a level of 130 points. This was down 1.8 points, or 1.3%, on the previous month.

Only prices for palm oil remained unchanged from the previous month, whereas sunflower oil, soybean oil and rapeseed oil traded lower.