Canola Market Outlook: May 21, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: Soybean futures were stronger, but in our view, soybean value is too high relative to corn.

Strikes and weather in Argentina are currently supporting futures.

Canola: YTD total canola disappearance into week 41 of the crop year amounts to 13.9 million MT compared to 15 million MT last year and is down 7% on last year.

Seeding in Canada has been progressing slowly due to varied shower activity, but soil moisture has improved significantly over the past month.

The big export number last week (333k mt) reduced the export shortfall compared to last crop year to 26%.

ICE canola remained firm, supported by soybean oil, Matif rapeseed, and in response to the potential US tariffs on UCO (uncooked oil).

We suggest holding canola sales for now.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans held on Friday for steady to 11 ¾ cent higher trade across the front months at the close, with back month 2025 contracts lower. July soybeans were up 9 cents last week. Soybean meal futures were up 30 cent to $1.10/ton in the front months but weaker in the deferred’s. Soybean oil had gains of 44 to 75 points.

The Commitment of Traders data from CFTC showed specs in soybean futures and options adding 1,212 contracts to their net short last week, as open interest was dropping. Specs held a net short of 42,665 contracts on Tuesday. Commercials showed a reduction to their net short of 1,472 contracts to -45,417 contracts as of Tuesday.

In the US, soybean planting pace advanced 10 points to 35% planted, but remains 10 points behind last year’s pace as wet weather slowed seeding. Soybean oil is volatile because of to rumours of US UCO (uncooked oil) import tariffs against China and because of the surprisingly small NOPA crush data for April (166mln bu.).

In Brazil, Rio Grande do Sul (RGDS) flood damage is being assessed with loss assessments still ranging between 1 and 3 mln mt. BAGE put the Argentine harvest at 64% complete, although some areas are progressing very slowly due to the same rain system affecting S Brazil.

Market outlook

Soybean futures were stronger, but in our view, soybean value is too high relative to corn. However, it will take time to adjust. Strikes and weather in Argentina are currently supporting futures.

Canola Market

Canola usage

During week 41 of the crop year, growers delivered 291 thousand MT of canola into primary elevators, exports were 333 thousand MT, while domestic disappearance amounted to 229 thousand MT.

YTD total canola disappearance into week 41 of the crop year amounts to 13.9 million MT compared to 15 million MT last year and is down 7% on last year.

Visible stocks dropped to 1.09 million MT, with 630 thousand MT in primary elevators, 190 thousand MT in process elevators, 143 thousand MT in Vancouver/ Prince Rupert, and 122 thousand MT in eastern ports.

Current market situation

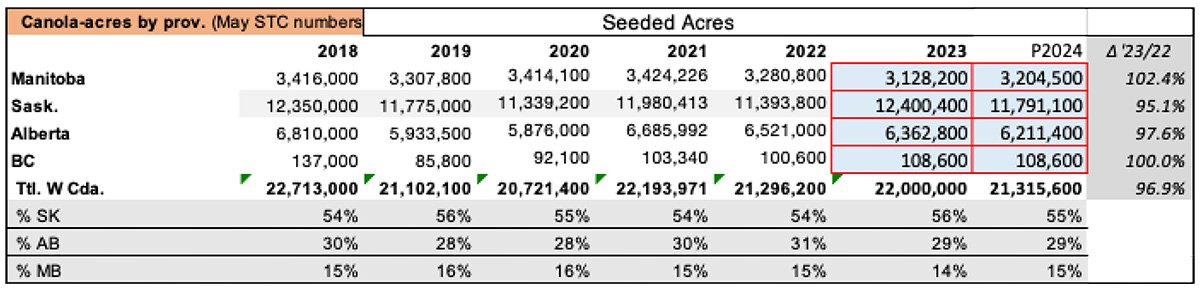

Seeding in Canada is progressing slowly due to varied shower activity, with 20% planted in MB (as of May 21), 19% in SK (as of May 13) vs the 5-year average of 43%, and 15% in AB (as of May 14). On the other hand, soil moisture has improved significantly over the past month. Here is a breakdown of canola acres by province:

We were surprised by the high export number, although last week’s terminal receipts gave a clue. This week’s big exports reduce the export shortfall compared to last crop year to 26% (-1.8 mln mt) from 29% last week (-2 mln mt). We note that export number included loadings in Thunder Bay (20k mt), which looks to sail to the EU. There were also another 37k mt of canola in transit to the Great Lakes in week 41!

We still have farm bids at levels where the commercials maintain margins in their crush plants. Because the same companies own the crush plants and export elevators, they have a virtual monopoly on buying canola for both markets. It will get worse if the Bunge-Viterra merger is allowed to proceed without some adjustment.

The strikes and weather concerns in Argentina and the EU are currently supportive to canola.

In Europe, Matif rapeseed retreated again and November retested support at €480, to close at €487.27 today. Farmers in Europe are reluctant to sell new crop product despite the good margins because of yield uncertainty. The German Stats Office pegged the German winter rapeseed area at 1.1 mln ha, down 6% on last crop year, but total the EU rapeseed area may hold up because there is a larger than normal proportion replanted with spring crops. Nevertheless, spring yields are lower than winter rapeseed yields.

ICE canola also remained firm, supported by soybean oil, Matif rapeseed, and in response to the potential US tariffs on UCO (uncooked oil).

Market outlook

S America continues to capture the Chinese demand for oilseeds even as CFR prices push to new seasonal highs. As US soybean oil closes the gap to world values, it should see better domestic demand. However, the US premium widens back out for deferred positions, suggesting the market anticipates less competition (due to tariffs) and/or a tightening domestic S&D.

ICE canola remained firm supported by Matif rapeseed, and in response to the potential US tariffs on UCO (uncooked oil).

Action

We suggest holding canola sales for now.

Canola – Topics of Interest

AAFC May Canola Balance Sheet

AAFC issued their May balance sheets this afternoon. For canola, they made several changes to their April balance sheet on the usage side of the equation. For the ‘23/24 crop year, AAFC decreased exports from 7 mln mt to 6 mln mt. At the same time, they increased crush/ industrial use from 10.5 mln mt to 10.7 mln mt. Feed/ Waste/ Dockage was increased from 533k mt to 783k mt. The resulting ‘23/24 crop carry-out increased from 2 mln mt to 2.55 mln mt.

The increase in ‘23/24 ending stocks goes directly into the ‘24/25 supply figure, which increased to 20.75 mln mt. Usage was also changed for the ‘24/25 crop year: Exports were lowered from 7.7 mln mt to 6.9 mln mt. Crush/ industrial use uncreased from 10.5 mln mt to 11 mln mt. Feed/ Waste/ Dockage was left at a small 299k mt. The resulting ‘24/25 crop carry-out increased from 1.65 mln mt last month to 2.5 mln mt in the May report.

The AAFC ‘amended’ May version gets closer to the Mercantile balance sheet. We would say that the adjustment in the ‘22/24 exports were long overdue, but we are actually using 6.5 mln mt for exports this year, and a more optimistic 7.5 mln mt for next crop year. For crush/ industrial use, we use 11 mln mt for both the ongoing crop year and for ‘24/25. We show 2.3 mln mt of carry-out for ‘23/24 and 3.2 mln mt for ‘24/25.