Canola Market Outlook: June 19, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans - July CBOT soybeans rose 80 cents per bushel this week, but new crop jumped 138 cents per bushel. But soybean oil was the market leader with a 5.1¢ ($112/tonne) gain ahead of this week’s EPA biofuel announcement.

It is going to be a short week in the USA, so how we open on Tuesday and the weather outlook will be key.

Canola - YTD canola disappearance into week 45 of the crop year is 27% above last year’s (drought-reduced) usage (+3.5 million MT) and amounted to 16.2 million MT compared to 12.8 million MT last year.

The crush margins have improved considerably with the strong revival in soybean oil values. But how the US will manage to supply the food-, industrial- and biofuel markets with enough vegetable oils without creating a domestic oil tightness remains to be seen.

Cdn. and US weather and the EPA announcement on biofuel markets will be the main oilseed market elements for this week.

We would hold sales of canola as we think soybean oil could strengthen further.

Oilseed Market Backdrop

Soybeans

Current market situation

July CBOT soybeans rose 80 cents per bushel this week, but new crop jumped 138 cents per bushel. But soybean oil was the market leader with a 5.1¢ ($112/tonne) gain ahead of this week’s EPA biofuel announcement. The combination of solid export sales, a bullish NOPA report and expanding US drought conditions sent soybeans, soybean oil and soybean meal up significantly last week. The market was also ostensibly pricing in a bullish EPA announcement next week.

Weather: It is very early to call soybean yields, but too many regions are getting too little precipitation: 51% of the US soybean area is now classified as experiencing drought. Much of the drought is moderate so far, but the trend is in the wrong direction.

Oil demand: The NOPA crush at 178 mln bu was at the top end of guesses, and a record for the month of May, which provided further support to soybeans. Soybean oil stocks were below expectations at 1,872 mln lbs, although still higher than this time last year.

EPA announcement next week: Oil traders now seem focused on next Thursdays EPA mandate update and clearly do not want to be short heading into the announcement; funds were covering shorts into the long weekend.

Brazilian soybean premiums weakened further. BAGE kept the Argentine crop at 21 mln mt, with harvest 98% complete.

Market outlook

It is going to be a short week in the USA, so how we open on Tuesday and the weather outlook will be key. We think this market is overdone and will close lower on soybeans, but stronger on soybean oil.

Canola Market

Canola usage

The Canadian Grain Commission reported that during week 45 of the crop year, growers delivered 258 thousand MT of canola into primary elevators, exports were a small 39k MT, while the domestic disappearance amounted to 163 thousand MT.

YTD canola disappearance into week 45 of the crop year is 27% above last year’s (drought-reduced) usage (+3.5 million MT) and amounted to 16.2 million MT compared to 12.8 million MT last year.

Visible stocks were at 791k MT, with 421 thousand MT in primary elevators, 162 thousand MT in process elevators, 134 thousand MT in Vancouver/ Prince Rupert, and 74 thousand MT in eastern ports.

Current market situation

We still have low stocks in Vancouver of 118,000 MT, so exports for week 46 will likely again be low.

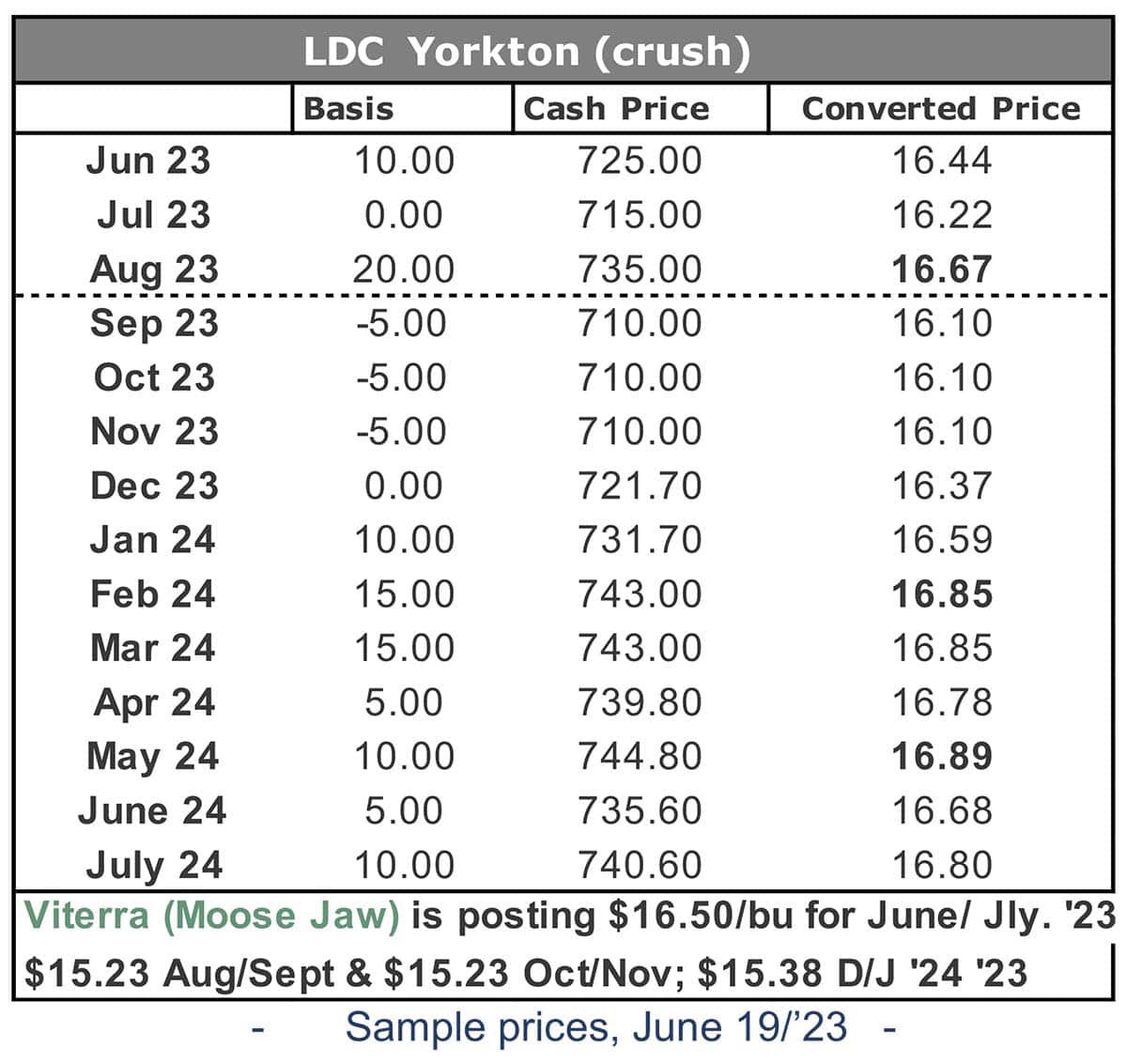

However, the crush margins have improved considerably with the strong revival in soybean oil values. How the US will manage to supply the food-, industrial- and biofuel markets with enough vegetable oils without creating a domestic oil tightness remains to be seen.

Palm oil futures had one of the strongest days last week in months, with markets going through the 50-day moving average and testing the May highs. Dalian markets in China were similarly strong with soybean oil and palm oil gaining 5-6%. This was partly due to lower import duties in India, but predominantly responding to the soybean oil rally, and next week’s expected EPA announcement.

November Matif rapeseed in Europe increased by €30/mt over the past five business days. But with ample European old crop stocks and harvest just around the corner, the next few days will be interesting. At the same time, rapeseed is at deep discounts, and will not be able to resist the gains across the Atlantic forever. ICE Canola is currently up $2-9/mt today.

We don’t think that the Bunge-Viterra merger is good for Canadian growers, as less competition is the last thing Canadian growers want to see.

Deliveries from growers remain quite good, which to us suggests the AAFC crop estimate is understated.

Market outlook

Cdn. and US weather and the EPA announcement on biofuel markets will be the main oilseed market elements for this week.

Action

We would hold sales of canola as we think soybean oil could strengthen further.

Canola – Topics of Interest

Update on Australia

According to ABARES, Australia exported 355k mt of canola in April, down 46 percent from the 661k mt shipped in May. At 167k mt, Germany on was the largest-volume destination for April shipments, followed by Japan 70k mt and the UAE with 55k mt. – These are all Canadian export destinations as well.

According to the June 6 Australian Export Vessel Lineups report, 400k mt is scheduled for export this month.

ABARES also recently released their initial estimate for the 2023 Australian canola crop. They expect 4.9 mln mt of canola this year, down 41 percent from the record ‘22/23 crop of 8.3 mln mt.