Canola Market Outlook: June 26, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans - CBOT July soybeans ended the week up 30c/bu, but below $15/bu, while November ended down 32c/bu, but above $13/bu.

the trade is still weighing the opposite forces of falling crop ratings against the disappointing EPA report.

Canola - YTD canola disappearance into week 46 of the crop year is 26% above last year’s (drought-reduced) usage (+3.4 million MT) and amounted to 16.4 million MT compared to 13 million MT last year.

We have reduced exports in our balance sheet. With the reduced usage rates and still good deliveries by growers, we do not see too much tightness in our supplies.

Weather and the resulting production conditions will be watched in the US for soybeans and in Canada for canola.

We see no reason to chase more sales; we would just watch weather this week.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT July soybeans ended the week up 30c/bu, but below $15/bu, while November ended down 32c/bu, but above $13/bu. Soybean oil was hugely volatile, trading limit down on Wednesday as the market reacted to the disappointing EPA biodiesel blending targets, but with a strong recovery Friday. Basically, the trade is still weighing the opposite forces of falling crop ratings against the disappointing EPA report.

Crop ratings had soybeans at 54% Gd./Exc. nationally, down from 59% last week and below the trade guess of 57%. The trend in crop ratings remains worrying with some comparing it to the 2012 developments. However, in 2012, Funds were already holding a significant long. Meanwhile, the EPA report had the traditional soybean oil focused biomass-based diesel portion at improved blending above the proposed levels, but the annualised 6% per year increase in demand fell short compared to the rate of increase in capacity expansion and investment. Combined with advanced biofuels, the annualised rate of growth is around 7% per year through 2025. While this certainly represents solid growth, it is not the double-digit growth that investors had lobbied for.

Market outlook

The decrease in US crop ratings is causing production uncertainty, and Jul-Aug precipitation will be critical. However, the trade took a negative view of the EPA blending mandates, which showed that while there is growth in biodiesel demand, it is not the rate of increase the trade and investors had lobbied for.

Canola Market

Canola usage

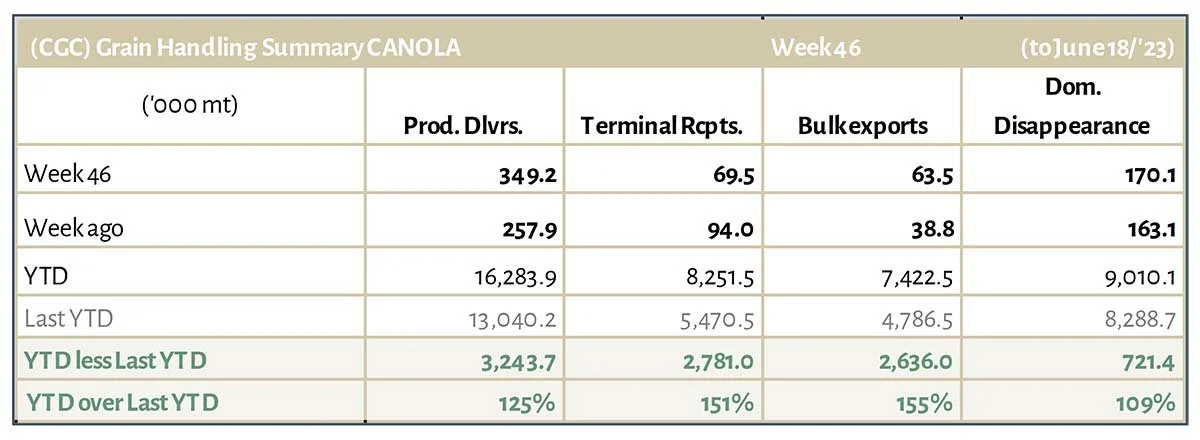

The Canadian Grain Commission reported that during week 46 of the crop year, growers delivered 349 thousand MT of canola into primary elevators, exports were a small 64k MT, while the domestic disappearance amounted to 170 thousand MT.

YTD canola disappearance into week 46 of the crop year is 26% above last year’s (drought-reduced) usage (+3.4 million MT) and amounted to 16.4 million MT compared to 13 million MT last year.

Visible stocks increased to 925k MT, with 507 thousand MT in primary elevators, 161 thousand MT in process elevators, 190 thousand MT in Vancouver/ Prince Rupert, and 67 thousand MT in eastern ports.

Current market situation

Cdn. canola exports have slowed considerably. Domestic crush has also slowed, but not as much as the export movement. We have reduced exports in our balance sheet. With the reduced usage rates and still good deliveries by growers, we do not see too much tightness in our supplies.

There are some concerns about production conditions on the Canadian Prairies. Canola in Alberta has improved by 9 points over the past week but is still showing only 49% of canola in Gd./ Exc. condition as of June 20th. S MB has turned dry, with growers remaining concerned about canola emergence and thin, uneven stands, particularly for later seeded crop. SK did not update their crop condition report from the previous week, which showed 77% of SK canola in Gd./Exc. condition. – For reference, SK has roughly 55% of canola acres, AB 30%, and MB 15%.

In other news, three Chinese companies were suspended from selling biodiesel into the EU because they were not able to verify the sources of their feedstocks. The ISCC (Int’l Sustainability & Carbon Certification) revealed in audit reports that the inaccuracy of records, the lack of traceability of sustainable materials and the mislabelling of raw materials were the reasons for the suspensions. The audit documents for the three suspended companies showed their raw materials coming in part from palm oil from Indonesia or Malaysia.

Matif rapeseed in Europe fell by €16/MT as harvest looms nearby and following the CBOT oilseed losses. Nevertheless, the suspension of some Chinese companies from selling biodiesel to the EU should help domestic producers and domestic demand. But with the Black Sea grain corridor unlikely to be renewed in mid-July, Ukrainian oilseeds will again be generously offered to EU crushers, although probably not to the same extent as last season.

Market outlook

This has become a complicated market. Soybean oil seems to have stabilized while the trade debates the highly complex range of combinations for the US biodiesel market. Meanwhile weather and the resulting production conditions will be watched in the US for soybeans and in Canada for canola.

Action

We see no reason to chase more sales; we would just watch weather this week.

Canola – Topics of Interest

Statistics Canada – May Canola Crush

Statistics Canada reported the domestic May canola crush at 770k MT, down from 886k MT in April, but above last year’s May crush of 592k MT. However, this is the second lowest monthly crush this crop year and seems to indicate a general slowdown in crush pace.

USDA – Global Vegetable Oil Production

According to USDA, the global output of vegetable oils is set to increase to new record highs in the 2023/24 crop year. Production of both rapeseed and soybean oil as well as palm oil will rise, while production of sunflower oil will probably decline.

USDA projects ‘23/24 global vegoil production to rise by 6.1 million MT to 222.8 million MT. Production of soybean oil is expected to grow 3.7 per cent to 62.4 million MT in the coming crop year and could hit a new record. Rapeseed oil production is also expected to increase compared to 2022/23, by 200,000 million MT to 32.9 million MT. Sunflower oil will probably decline around 10,000 MT to 20.8 million MT in 2023/24, although global supply of sunflower seed is expected to exceed the previous year's figure due to expansions in area planted.