Canola Market Outlook: June 12, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans - CBOT soybeans were up 36c/bu on the week. Reports were circulating of US soybeans being sold to Europe with the intention of taking the crushed oil back to the US to satisfy increasing bio-diesel demand, which US crush capacity is struggling to fill.

Soybean oil was the biggest mover last week, rising 5c/lb ($110/tonne) on the back of a re-energised US biodiesel demand focus.

The corn-soybean ratio has improved, so owning it at 2.18 has been profitable.

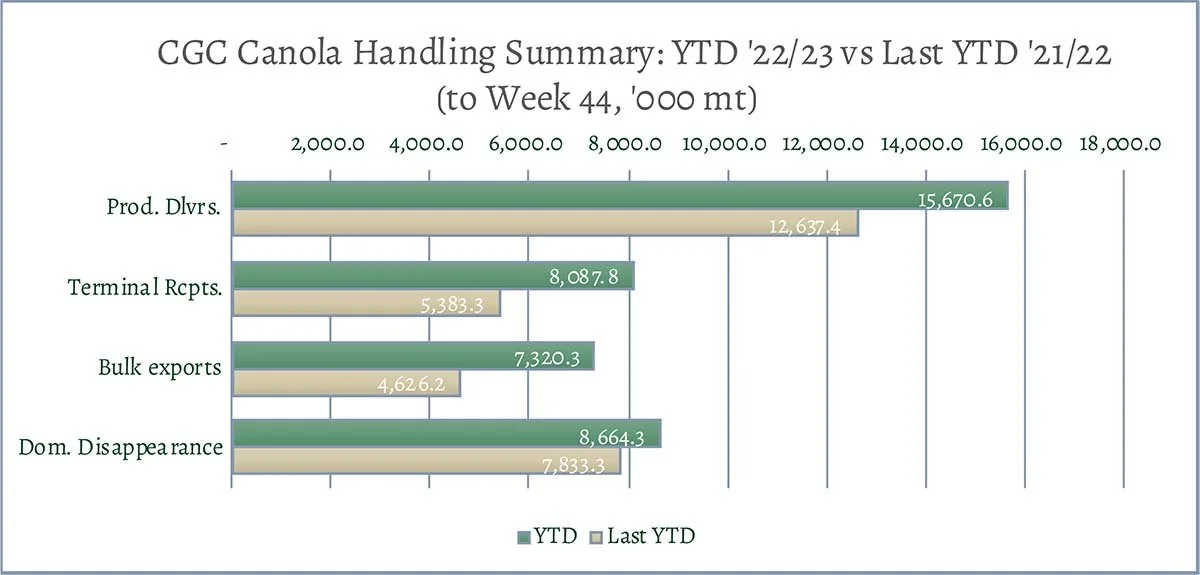

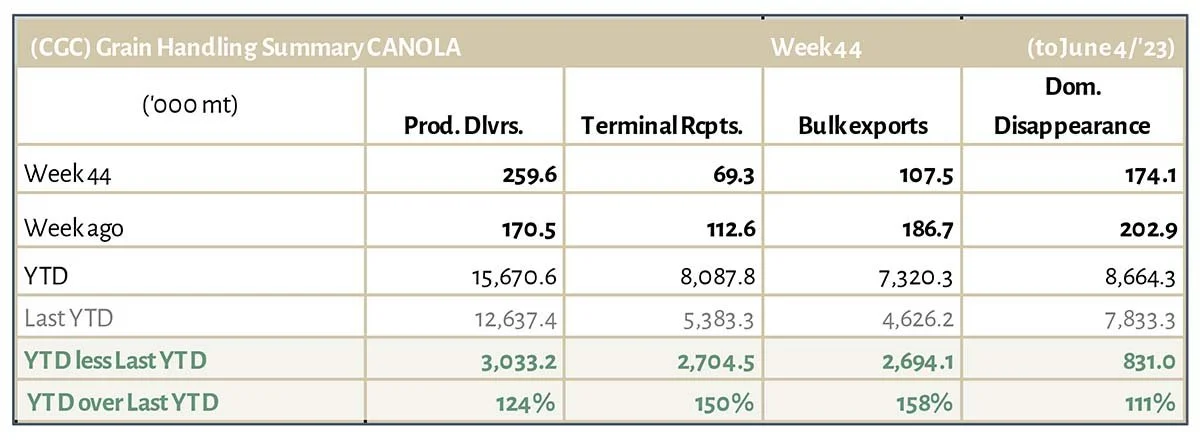

Canola - YTD canola disappearance into week 44 of the crop year is 28% above last year’s (drought-reduced) usage (+3.5 million MT) and amounted to 16 million MT compared to 12.5 million MT last year.

Re. futures, there are still 72,778 contracts open in July Winnipeg canola, so we might see the July get stronger, which should pull the November along. Importantly, soybean oil is stronger, which should help canola prices as the crush will improve.

Soybean oil has been the driver, but there are other vegetable oils that are far cheaper, though not always acceptable. It remains to be seen if soybean oil, can pull up the others.

We would leave canola alone for the time being.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans were up 36c/bu on the week although huge Brazilian exports continue to weigh on US demand. Reports were circulating of US soybeans being sold to Europe with the intention of taking the crushed oil back to the US to satisfy increasing bio-diesel demand, which US crush capacity is struggling to fill. Regarding new crop US soybeans, the weekly drought monitor said 39% of US soybeans were experiencing drought, up 10% on the week before.

In Argentina, BAGE put the harvest at 94% complete with a yield to date of 1.51 mt/ha (22.5 bu/ ac). BAGE left their overall production estimate at 21 mln mt compared to the USDA at 27 mln mt.

In Asia, Dalian markets were well supported for meal and mixed for vegetable oils. Matif rapeseed and ICE canola also both saw welcome gains ahead of harvest. We expect buyers to continue buying South American soybeans, which are cheaper.

US old crop soybean sales of 207k mt left the season total of 1,880 mln bu down 15% on last year compared to the USDA’s projected 7% decline. New crop sales were 265 k mt.

Last Friday’s USDA-WASDE report had U.S. soybean supply and use projections for 2023/24 show higher beginning and ending stocks due to reduced exports for ‘22/23 exports (-15 mln bu to 2.0 bln bu) because of competition from S America. With increased supplies for ‘23/24 and no use changes, soybean ending stocks were projected at 350 mln bu, up 15 mln bu.

The ‘23/24 global soybean outlook includes higher beginning stocks, lower crush, and higher ending stocks. Global ‘23/24 ending stocks are increased 800k mt to 123.3 mln mt with higher stocks for the United States, Brazil, and the EU, which are partly offset by lower stocks for Argentina and Vietnam.

Other notable 2023/24 oilseed changes include higher rapeseed production for the EU that is partly offset by lower production for Australia. Malaysian palm oil production is reduced for 2022/23 based on lower-than-expected monthly production estimates for March and April.

Market outlook

Soybean oil was the biggest mover last week, rising 5c/lb ($110/tonne) on the back of a re-energised US biodiesel demand focus initiated by reports that there were US soybeans being shipped to the EU for crushing, with the intent of oil being brought back to US biodiesel plants.

The US biodiesel story is complicated in that is not simply a soybean oil crush question, but also a holistic issue of fats, oil and waste oil origination, and the regulation and politics of these supply chains.

Canola Market

Canola usage

The Canadian Grain Commission reported that during week 44 of the crop year, growers delivered 260 thousand MT of canola into primary elevators, exports were at 108k MT, while the domestic disappearance amounted to 174 thousand MT.

YTD canola disappearance into week 44 of the crop year is 28% above last year’s (drought-reduced) usage (+3.5 million MT) and amounted to 16 million MT compared to 12.5 million MT last year.

Visible stocks were at 750k MT, with 401 thousand MT in primary elevators, 158 thousand MT in process elevators, 130 thousand MT in Vancouver/ Prince Rupert, and 65 thousand MT in eastern ports.

Current market situation

We have low stocks in Vancouver of 112,000 MT, so exports for week 45 will be low.

Regarding futures, there are still 72,778 contracts open in July Winnipeg canola, so we might see the July get stronger, which should pull the November along. Importantly, soybean oil is stronger, which should help canola prices as the crush will improve.

We will need to adjust our balance sheet to either lower crush or exports.

In Europe, Matif rapeseed ended higher, following the recovery in soybean oil prices. On the one hand, the EU looks likely to produce a solid crop of around 20.5mln mt of rapeseed, on the other there will be regional differences and the Baltic producers are pessimistic after a growing season dominated by drought and late frosts during flowering. ICE canola also settled at the day’s and week’s highs.

Market outlook

Matif rapeseed and ICE canola both saw welcome gains ahead of harvest. As discussed last week, ABARES early new crop forecast of 4.9 mln mt Australian canola is well down on last season’s 8.3 mln mt.

Soybean oil has been the driver in this market, but there are other vegetable oils that are far cheaper, though not always acceptable. It remains to be seen if soybean oil can pull up the others.

Action

We would leave canola alone for the time being.

Canola – Topics of Interest

USDA-FAS on European Union (EU) Rapeseed: Favorable Weather Raises Crop Expectations

USDA estimates that EU rapeseed production for marketing year 2023/2024 reaches 21.0 million MT up 500k mt or 2% from last month, and 1.5 mln MT or 7% higher than last year. Total EU rapeseed production is forecast up 21% from the 5-year average.

Yield is estimated at 3.46 mt/ha, up 2% from last month, 5% above last year, and 12% above the 5-year average.

Harvest of rapeseed in the EU occurs in late June and July.