Canola Market Outlook: January 16, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – CBOT soybeans managed a 7-month high weekly close following the USDA report last week.

The crop estimates for Argentine soybeans by Buenos Aires Grain Exchange (35.5 to 41 million MT) and/or the Rosario Grain Exchange (37 million MT) could be as much as 9 million MT lower than the USDA's number.

World soybean export demand will now start shifting from the US to Brazil, but much focus will remain on the size of the Argentine crop.

Canola – Year-to-date canola disappearance into week 23 of the crop year is 11% above last year’s usage (+811 thousand MT) and amounted to 8.1 million MT compared to 7.3 million MT last year.

While the oil portion in the seed is representing 45% of the crush margin, canola exports will remain strong, particularly to China, Mexico and Japan.

We would sell additional canola given bids given process of ~$20.00 per bushel.

Oilseed Market Backdrop

Soybeans

Current market situation:

CBOT soybeans managed a 7-month high weekly close following a USDA report which put December 1 stocks over 100 million bu, below both last year and below trade guesses. The stock losses were the consequence of a 70 million bu drop in production although this was largely offset by a 55 million bu drop in exports. This left ending stocks down by 10 million bu.

For South America, the USDA increased the Brazilian 2022 and 2023 crops by a combined 3.5 million MT, while lowering the Argentine crop by 4 million MT to 45.5 million MT. Meanwhile, the Buenos Aires Grain Exchange (BAGE) slashed its soybean crop from 48 million MT to 41 million MT and stated that a final soybean crop of only 35.5 million MT was possible if the rains didn't materialize. The Rosario Grain Exchange put the soybean crop at 37 million MT, so both local exchanges are well below the adjusted USDA number.

On the demand side, the USDA lowered China’s imports by 2 million MT to 96 million MT, in line with the government numbers. China's December imports amounted to 10.6 million MT, taking the 12-month total to 91.1 million MT, down 5.6% from last year.

In other oilseed markets, Indonesia – the world’s leading palm oil producer and consumer – expects local consumption to rise to 24.3 million MT in 2023. Indonesia says it plans to increase its biodiesel mandate to 35%, increasing Indonesian palm oil demand and prices. With crude oil prices at the highest level in years, Indonesia is looking beyond palm oil dependence to other oilseeds in the vegetable oil complex, as canola and soybean oil are also inputs in biofuels. Increasing Indonesia’s mandate could direct palm oil away from the export market, causing a tightening supply-demand fundamentals, and pushing prices higher.

Market outlook:

Overall, if BAGE (35.5 to 41 million MT) and/or the Rosario Grain Exchange (37 million MT) are correct on the Argentine crop, then world production could be as much as 9 million MT lower than the USDA's number. If correct, this would be it will be the smallest soybean crop since 2008/2009. Will the USDA then keep lowering demand, or would that mean that global stocks are declining, not building?

The corn-to-soybean ratio has moved to 2.26, and in our view remains too low.

Canola Market

Canola usage:

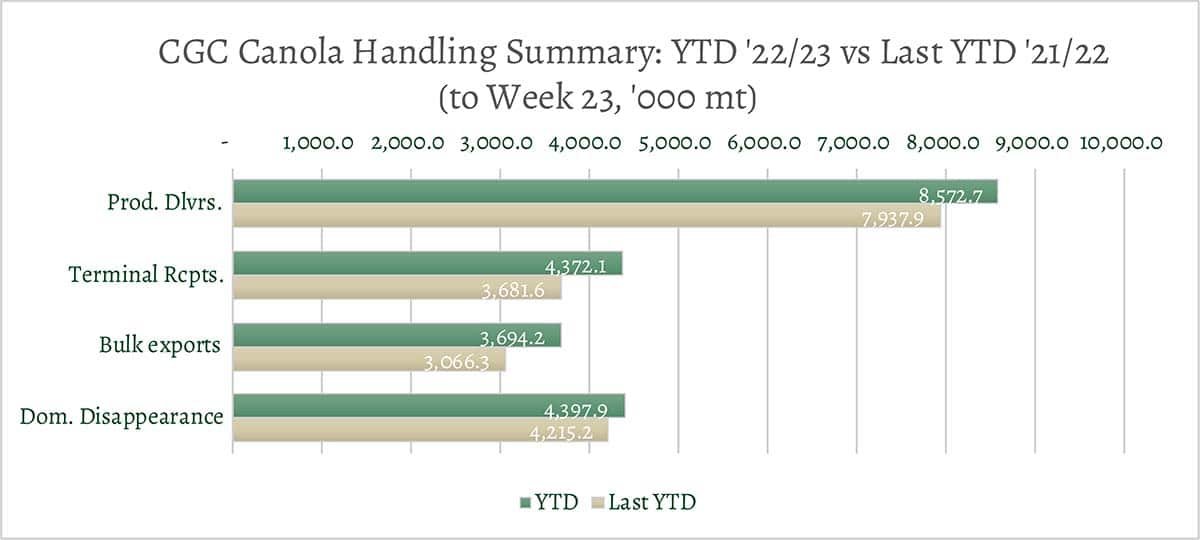

The Canadian Grain Commission reported that during week 23 of the crop year, growers delivered 381 thousand MT of canola into primary elevators, exports were at a smallish 120 thousand MT, while the domestic disappearance amounted to a strong 221 thousand MT.

YTD canola disappearance into week 23 of the crop year is 11% above last year’s usage (+811 thousand MT) and amounted to 8.1 million MT compared to 7.3 million MT last year.

Visible stocks remained at 1.2 million MT, with 634 thousand MT in primary elevators, 183 thousand MT in process elevators, 263 thousand MT in Vancouver/ Prince Rupert, and 160 thousand MT in eastern ports.

Current market situation:

Producer deliveries, terminal receipts and exports all eased last week from the recent pace, while commercial stocks remained roughly the same.

However, with oil still representing 45% of the crush margin, canola exports should remain strong, particularly to China, Mexico and Japan. In fact, we were told that China came into the market in January to buy at least three cargoes of canola, and perhaps up to five cargoes. That makes sense to us and confirms our theory about oil value.

We also hear that Australia is having logistic problems due to the size of their wheat and oilseed crops. The Australian Bureau of Agricultural & Resource Economics & Sciences (ABARES) put their canola crop at 7.3 million MT, 4% above last year’s record crop, while some traders put the crop as high as 7.8 million MT. The logistic problems will push China back to the Canadian market. We expect bids should still be aggressive at G3 and P & H, as they do not crush canola and depend on exports.

Market outlook:

As mentioned, there are still questions about the supply-side of soybeans, and if South American production is as low as BAGE/ the Rosario Grain Exchange fear, then supplies will fall well below last week’s USDA scenario. On the other hand, we will watch how severely Chinese demand will switch towards Brazil over the next while.

Meanwhile, canola crush margins have remained strong, and we expect good import demand by our major canola destinations.

Action:

We would sell additional canola given bids at $20.00 per bushel.

Canola – Topics of Interest

US Canola Production:

The USDA last week pegged US canola production at 173,000 MT, up 41% from the 2021 crop, and up 11% from the 2020 crop. Seeded acreage was at a record of 2.21 million acres, harvested acres were at 2.17 million acres, and yields at 1,762 lbs/acre were up by 460 lbs from last year. North Dakota produces 85% of US canola, followed by Washington (6%), Montana (5%) and Minnesota (4.4%).

We note that the USDA-WASDE calculated that a total of 1.3 billion pounds of canola oil were used to produce biofuels in 2021/2022, contributing 6% to total feedstocks used in biofuel production.

Australian Canola Production:

In their December report, ABARES pegged the Australian canola production at 7.3 million MT, which is 8% above last year’s record crop. As mentioned above, private estimates are as high as 7.8 million MT. A full 55% of the Australian canola is produced in Western Australia, 19% and 18%, respectively, in Victoria and New South Wales, and 8% in South Australia.

The volume of canola exports is forecast to increase to a record of 5.8 million MT in the 2022/2023 financial year. This is double the 10-year average to 2021/2022 of 2.9 million MT. Major markets for Australian canola are Japan, the EU, the UAE, and potentially China.