Canola Market Outlook: January 9, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – Soybeans fell by 30 cents per bushel over the past week but bounced 20 cents per bushel last Friday.

Argentine weather will provide the early input ahead of Thursday's USDA report, where the focus will be on US December 1 stocks, and the changes to South American production.

Canola – YTD canola disappearance into week 21 of the crop year is 11% above last year’s usage (+770 thousand MT) and amounted to 7.7 million MT compared to 7 million MT last year.

As long as the oil portion in the seed is representing 48% of the crush margin, canola exports will remain strong, particularly to China, Mexico and Japan.

We see no reason to sell additional canola unless bids can be achieved at $20.00 per bushel.

Oilseed Market Backdrop

Soybeans

Current market situation:

Soybeans fell by 30 cents per bushel over the past week but bounced 20 cents per bushel last Friday after more fears of drought in Argentina and decent US export sales. Soybean meal closed higher on crushing difficulties caused by the storms in the US.

Argentina (BAGE) lowered the good to excellent ratings 2% to 8% (compared to 50% last year) with plantings 82% complete against 93% on average. The crop production estimate was left unchanged at 48 million MT, compared to the USDA estimate of 49.5 million MT.

Argentine weather will provide the early input ahead of Thursday's USDA report, where the focus will be on US December 1 stocks, and the changes to South American production.

Market outlook:

We expect a bullish report based on South American weather. However, the three-year chart does look overbought. The record fund long in soybean meal could result in down pressure. The corn-to-soybean ratio has moved to 2.29, but in our view remains too low.

Canola Market

Canola usage:

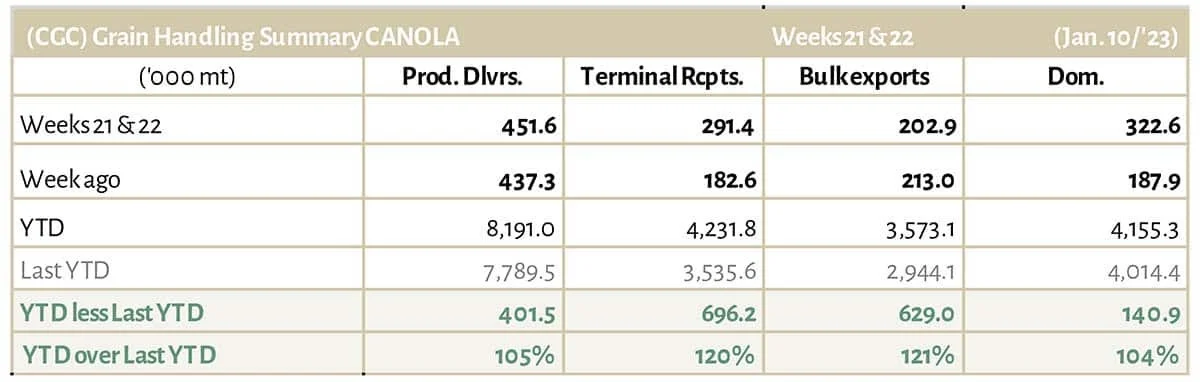

The Canadian Grain Commission reported that during weeks 20 and 21 of the crop year, growers delivered 452 thousand MT of canola into primary elevators. Exports were at 203 thousand MT, while the domestic disappearance amounted to a strong 323 thousand MT.

YTD canola disappearance into week 21 of the crop year is 11% above last year’s usage (+770 thousand MT) and amounted to 7.7 million MT compared to 7 million MT last year.

Visible stocks remained at 1.2 million MT, with 608 thousand MT in primary elevators, 216 thousand MT in process elevators, 231 thousand MT in Vancouver/ Prince Rupert, and 190 thousand MT in eastern ports.

Current market situation:

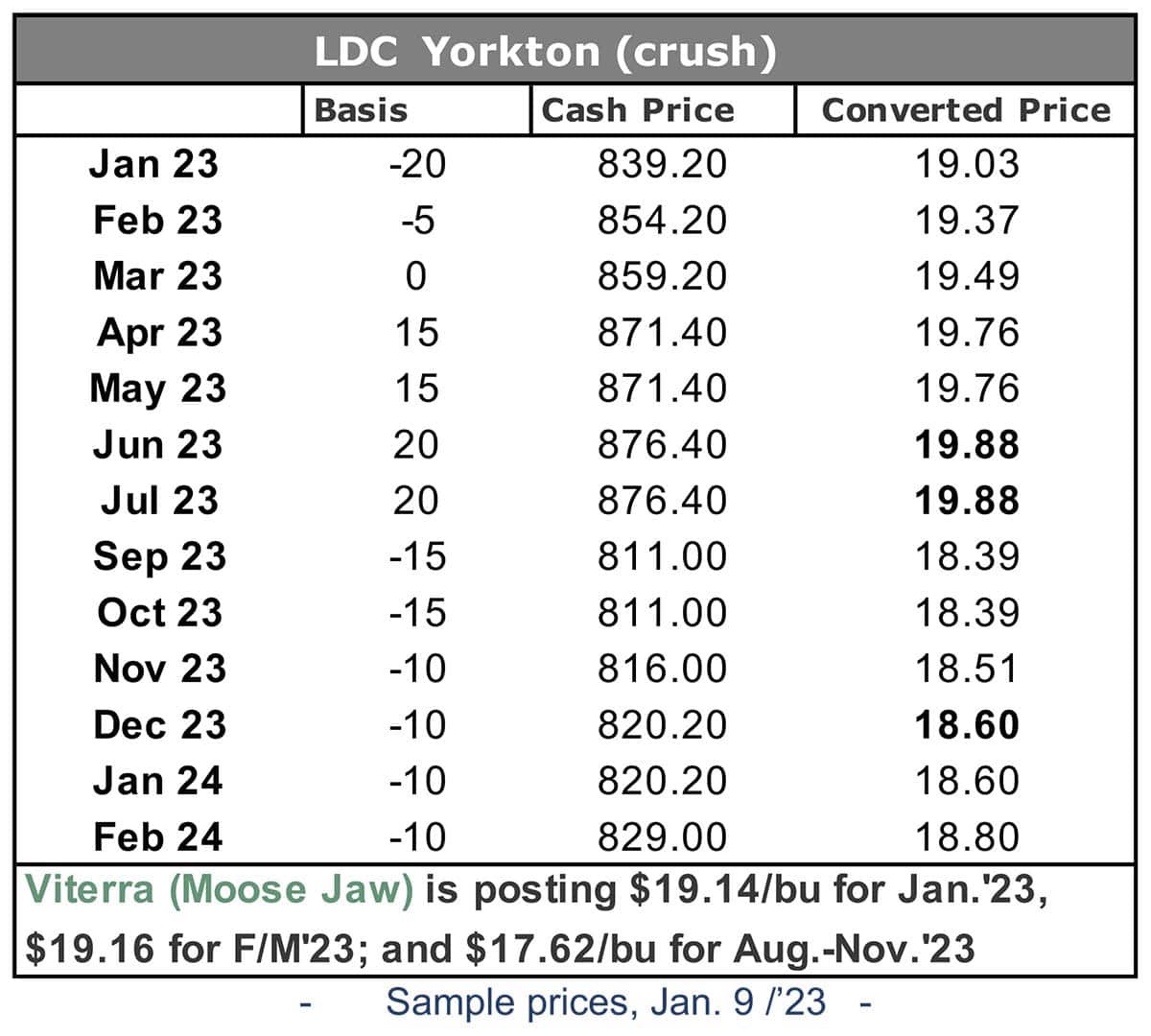

Canola exports maintained a decent pace over the holidays, and domestic usage of canola barely slowed down. As long as the oil portion in the seed is representing 48% of the crush margin, canola exports will remain strong, particularly to China, Mexico and Japan. Crushers there will try to capture the good margins as well. With imports attractive to foreign crushers, we expect the best bids should be at G3 and P&H, as these companies are export-focused and are not affected by domestic crush sensitivities.

We note that Asian markets were lower over the weekend, with rapeseed oil showing the biggest losses.

Market outlook:

Crush margins have remained strong, and we expect good import demand by our major canola destinations. We will watch the WASDE report on Thursday. We expect a bullish report based on South American weather, but the three-year soybean chart does look overbought.

Action:

We see no reason to sell additional canola unless bids can be achieved at $20.00 per bushel.

Canola – Topics of Interest

Canadian Canola Exports:

Statistics Canada published their November 2022 exports by destination last week. November canola exports amounted to 1.13 million MT, for a year-to-date total of 2.7 million MT for August through November 2022 (compared to 2.35 million MT last crop year).

China was the biggest importer in November with 581 thousand MT, followed by Pakistan (203 thousand MT), Mexico (194 thousand MT) and Japan (123 thousand MT). The only shipment to the European Union was to France with 28 thousand MT.