Canola Market Outlook: January 23, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – Soybean closed down by 12 cents/bu on the week. Weekly US export sales were decent at 986 thousand MT of soybeans, against pre-report estimates at 600 thousand and 1.2 million MT.

The market is waiting to get a handle on South American production numbers to reconcile the gap between USDA and BAGE/ Rosario Grain Exchange crop estimates.

Markets will also likely be thin and choppy for the next 10 days while China celebrates its Lunar New Year holiday.

Canola – Year-to-date canola disappearance into week 24 of the crop year is 15% above last year’s usage (+1.1 million MT) and amounted to 8.6 million MT compared to 7.5 million MT last year.

Soybean oil has dropped slightly, and oil is now representing 44% of the crush margin. Still, canola exports should remain strong, especially to China, Mexico and Japan.

We would sell additional canola given bids given prices of ~$19.00 per bushel.

Oilseed Market Backdrop

Soybeans

Current market situation:

Soybean closed down by 12 cents/bu on the week. Weekly US export sales were at 986 thousand MT of soybeans, against pre-report estimates at 600 thousand and 1.2 million MT. Sales were primarily for China (507 thousand MT) and Mexico (262 thousand MT).

According to customs data, China’s soybean imports from the US dropped 10% in 2022, lowering the US share of the world's top soybean market to less than a third. Total soybean imports by China last year dropped 5.6% to 91.08 million MT due to high global prices and weaker demand earlier in the year.

Further regarding China, China's December hog slaughter was reported at 18% above November and 7% above December 2021. China’s Ag Ministry is openly encouraging farmers to curb excess pork production by reducing sow herds. China’s pork production for 2022 was an 8-year high, and prices have reportedly fallen by almost 50% since October. Meal sales were zero ahead of the holiday in China.

Last week’s NOPA crush report was not friendly as it posted lower volume of soybeans crushed in December and soybean oil stocks increased higher than anticipated. Otherwise, fresh news was limited to the desired improvement in Argentine weather, while the lack of activity in China suggested that the market was already easing into the holiday week. China's absence will make for a quiet week next week. However, the U.S. EIA's monthly energy review should provide a focal point as the bio/renewable fuel markets gain ever greater attention.

Market outlook:

The latest update on Argentine weather calls for 1-2" of rain over the weekend, followed by a dry week. The market is waiting to get a handle on South American production numbers to reconcile the gap between USDA and BAGE/ Rosario Grain Exchange crop estimates. Markets will also likely be thin and choppy for the next 10 days while China celebrates its Lunar New Year holiday.

Canola Market

Canola usage:

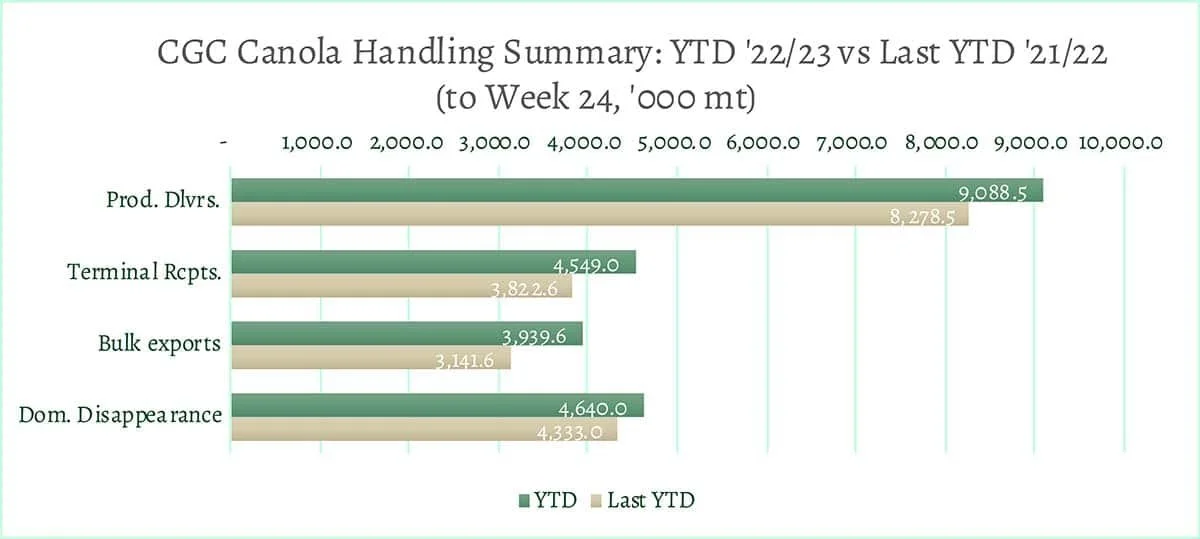

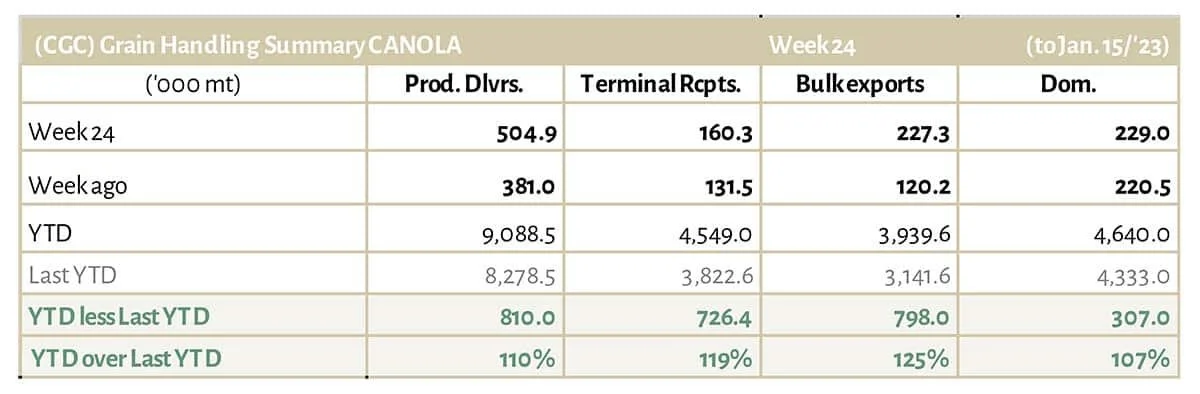

The Canadian Grain Commission reported that during week 24 of the crop year, growers delivered a big 505 thousand MT of canola into primary elevators, exports were at an improved 227 thousand MT, while the domestic disappearance amounted to a strong 229 thousand MT.

YTD canola disappearance into week 24 of the crop year is 15% above last year’s usage (+1.1 million MT) and amounted to 8.6 million MT compared to 7.5 million MT last year.

Visible stocks increased slightly to 1.3 million MT, with 741 thousand MT in primary elevators, 216 thousand MT in process elevators, 260 thousand MT in Vancouver/ Prince Rupert, and 109 thousand MT in eastern ports.

Current market situation:

Crush margins have dropped somewhat, but still are highly profitable. Soybean oil has dropped slightly, and oil is now representing 44% of the crush margin. Canola exports should remain strong, especially to China, Mexico and Japan. However, expect markets to be thin and choppy for the next 10 days while China celebrates its Lunar New Year holiday.

In Europe, March Matif rapeseed fell for five consecutive days to a 13-month low, and to the lowest in 18 months for a nearby contract. Cheap imports and the German bio-fuel proposals continue to weigh. Canadian canola was also down, dropping to a 2-month low.

Germany: regarding biofuels, Germany’s Environment Minister Steffi Lemke said last Tuesday that she will soon introduce proposals to curb the use of crop-based biofuels in the country. Germany is the EU’s biggest member state in terms of fuel consumption and a major producer of ethanol and biodiesel from edible crops such as sugar beet, wheat and rapeseed. In this context, the statement of the Minister was taken as negative for the rapeseed market, although the German Ag Minister is still expected to weigh in.

Regarding the size of this market sector, the German biodiesel lobby VDB said last month that for biofuels included in the GHG quota, 2.29 million tons are from biodiesel, 1.15 million tons from bioethanol and 450,000 tons from hydrogenated vegetable oil. Of the biodiesel volume, just over 70% was crop-based, the VDB said. Currently, some 50% of a total 1 million hectares of German rapeseed acreage go to biofuel.

Market outlook:

Markets will likely be thin and choppy for the next 10 days as China enters its Lunar New Year holiday, but there will still be focus on Argentina's weather and whether the wetter forecast proves correct.

Action:

We would sell additional canola given bids at ~$19.00 per bushel.

Canola – Topics of Interest

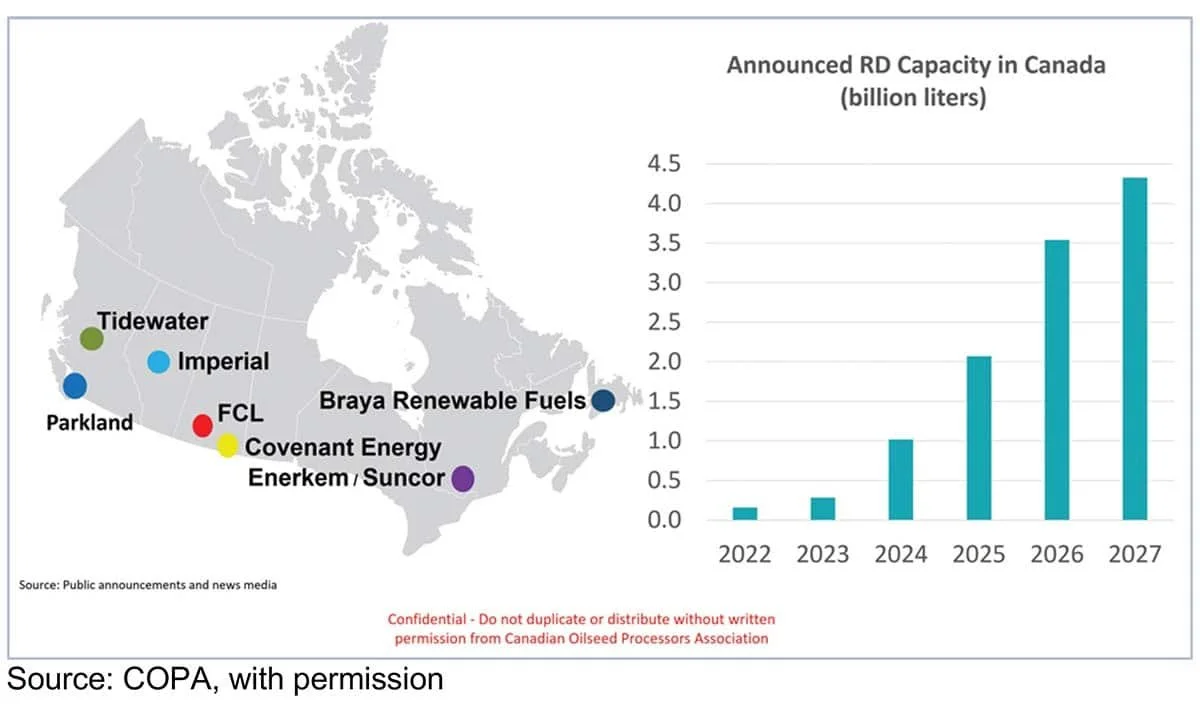

Canada renewable diesel demand projections:

According to the Canadian Oilseeds Processors Association (COPA), renewable diesel production is going to increase significantly over the next five years. In fact, the association is projecting at 50% increase in the current renewable diesel capacity. COPA stated that renewable diesel production should reach 1 billion litres by 2024, 2 billion litres by 2025, and close to 4.5 billion litres by 2027. This is good news for canola growers, as it increases domestic demand accordingly.

Specifically, Parkland Corporation is expanding its renewable diesel production at its refinery in Burnaby, B.C.; Imperial Oil is proceeding with a renewable diesel complex at its refinery near Edmonton to produce more than one billion litres annually; Federated Co-operatives Ltd. (FCL) expects its similar-sized facility in Regina to be in operation by 2027; Tidewater Renewables is building a facility in Prince George, B.C. to produce 150,000 litres annually; and a Saskatchewan company called Covenant Energy announced last year that it plans to build a 300-million-litre facility in that province.