Canola Market Outlook: August 8, 2022

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – Despite the Chinese military drills around Taiwan, the CBOT soybean complex rallied sharply last Thursday amidst rumours of volume Chinese buying/pricing of US new crop soybeans. However, on Friday, soybeans followed their Thursday rally with 8 to 9 cent pullbacks in the new crop contracts past September.

In our view, soybeans are somewhat bullish, but would not buy them at this point as the chart looks a little “overbought.” We would stay even, not short.

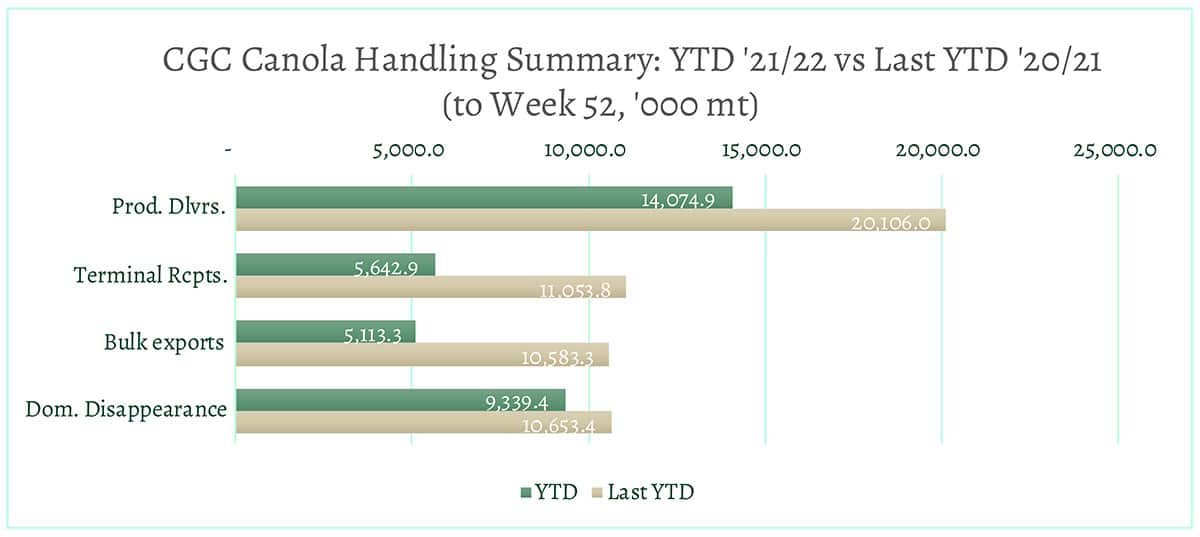

Canola – Total canola disappearance during the 52 weeks of the crop year amounted to 14.5 million MT compared to 21.3 million MT last year-to-date.

Energy is way off from the highs in the European Union, so we don’t see it affecting rapeseed oil prices currently. Canola is uncompetitive to the EU. However, given the tight nearby supply in Canada, we expect growers to get very good prices for early deliveries. We see no reason to sell additional canola at this time.

Oilseed Market Backdrop

Soybeans

Current market situation:

Despite the Chinese military drills around Taiwan, the CBOT soybean complex rallied sharply last Thursday amidst rumours of volume Chinese buying/pricing of US new crop soybeans.

August soybeans saw the biggest gains at 57 cents, but in percentage terms it was August meal which was the real winner rising $32 (6.6%) to new contract highs. On Friday, soybeans followed their +50 cent Thursday rally with 8 to 9 cent pullbacks in the new crop contracts past September. August closed fractionally lower, with September posting a 2-cent gain. Soybean meal prices ended the day double digits weaker with losses of as much as $16/MT. Soybean oil futures rallied 255 points on the day.

The weather update lent support with the models showing somewhat better agreement for prolonged heat and dryness across the Plains and W. Midwest, although most private estimates of the US yield remain around the USDA current 51.5 bu/ac estimate.

In Brazil, there are reports of quality problems in Mato Grosso, although we saw no accounts of this earlier. These reports, along with stories of China buying Brazilian soybeans resulted in Brazilian soybean premiums moving up by 5-10¢/bu. The Brazilian vessel line-up lists 4.8 million MT, with 675 thousand MT loaded so far in August.

Argentina was again quiet. There still is no clarity about the exact nature of the government economic package.

Market outlook:

China purchased some US soybeans and Poland bought some US soybean meal, which traders thought to be constructive. The corn to soybean ratio weakened a little. In our view, soybeans are somewhat bullish, but would not buy them at this point as the chart looks a little “overbought.” We would stay even, not short.

Canola Market

Canola usage: The Canadian Grain Commission reported that during week 52 of the crop year, growers delivered 180 thousand MT of canola into primary elevators, exports were 52 thousand MT, while the domestic disappearance was at 169 thousand MT. Crush volume still averages at 180 thousand MT per week. Exports are running at 98 thousand MT per week (5.1 million MT annualized).

Total canola disappearance during the 52 weeks of the crop year amounted to 14.5 million MT compared to 21.3 million MT last YTD.

Visible stocks fell to 567 thousand MT, with 175 thousand MT in process elevators, 61 thousand MT in Vancouver/ Prince Rupert, and 40 thousand MT in eastern ports.

Year-to-date usage (export and crush) at 14.5 million MT is 32% smaller than last YTD.

Current market situation:

We note that deliveries of canola were good for week 52, confirming beyond doubt that the crop (and the 2021/22 carry-in) had been understated. We can see that by the time we close the crop year statistics, there will be well over 1 million MT of canola delivered over and above the StatsCan numbers. (The discrepancy currently is at 842,528 MT). Exports for the year are at 5.1 million MT, and there are still 100 thousand MT in export position. Total domestic use for the year is at 9.3 million MT with crush at 8.5 million MT, which represents 86% of Western crush capacity.

General harvest of canola in Canada is still some time away, and while generally good, there are varying crop conditions across the Prairies. While eastern Saskatchewan look quite good, the west central and western Saskatchewan are distinctly drier. Much of Alberta looks promising, and Alberta Agriculture estimated average yields there at 40.6 bu/acre on July 26. We expect average Prairie yields to be slightly above the 5-year average yield for canola (excluding 2021).

In Europe, Stratégie Grains recently increased their EU rapeseed estimate by ~1% to 18.5 million MT. This would increase the 2022 EU production by almost 9% over last year’s thanks to a higher acreage and better than expected yields. However, it seems that producers are only delivering contracted rapeseed while putting uncontracted seed into storage in the hope of increasing prices.

It is getting difficult to analyze the international markets as we also need to consider energy, as well as vegetable oil consumption, particularly in the EU where canola oil is used in diesel. Energy is way off from the highs in the EU, so we don’t see it supporting rapeseed oil prices currently. With rapeseed oil currently priced at €1,650/MT FOB oil mills, canola currently is uncompetitive to the EU.

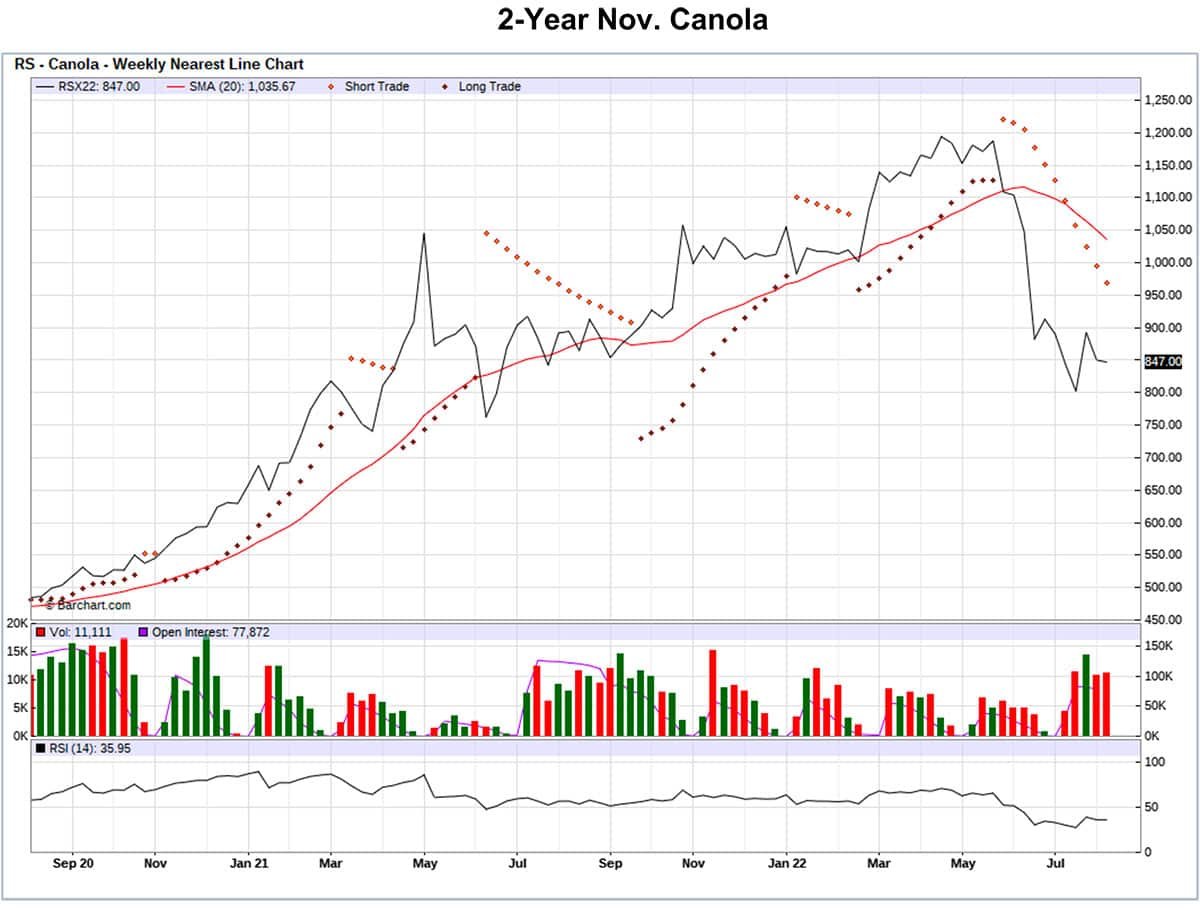

Matif rapeseed followed the CBOT to gains of €15/MT but remains down €40/MT on the week. Canadian canola also saw sharp gains, but still ended down on the week. Asian markets remained mixed, with soybeans, soybean meal and palm oil higher while soybean oil and rapeseed oil are down. Only soybeans and meal ended the week higher, while all vegetable oils were lower.

Additional news is limited but the major input this week has been the 9% drop in crude oil, which headed for its lowest weekly close since before the Russian-Ukraine war.

Market outlook:

Energy is way off from the highs in the European Union, so we don’t see it affecting rapeseed oil prices currently. Canola is uncompetitive to the EU.

The August USDA report is now just a few days away, but we do not expect any major changes. Weather and demand by China remain the key elements into harvest.

Action:

We expect growers to get very good prices for early deliveries. We see no reason to sell additional canola at this time.

Canola – Topics of Interest

Latest Statistics Canada (STC) Export Statistics:

Statistics Canada reported June canola exports at 284 thousand MT. The biggest volume was shipped to the US (93 thousand MT), followed by Mexico (92 thousand MT), Japan (55 thousand MT) and France (44 thousand MT).

YTD (Aug. 2021-June 2022) exports add to 5 million MT, compared to 10.1 million MT the year prior.

European Union Rapeseed Prices:

Rapeseed prices in the EU seem to have come under harvest pressure. In some regions, yields for wheat and rapeseed were surprisingly good, steadying the downward slide of producer prices.

In addition, uncertainties about Ukraine's shipping potential, the weather in North America and the ongoing harvests in Europe led to strong fluctuations at the futures exchanges.

Meanwhile, processors were stocked up well via forward contracts, so that the prices shown do not reflect producers' actual selling or contract prices. We think some effort will be necessary to avoid supply gaps caused by limited freight options. Low water levels have made river transport to the inland ports much more difficult. Cargo space has been scarce and expensive, especially as high energy prices are driving transport costs anyway.