Canola Market Outlook: September 19, 2022

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – The USDA's 4-week update of export sales showed a season total of 929 million bu, up 13% from last year.

The NOPA August crush at 165.5 million bu was marginally below the average trade guess of 166.1 million bu, but it was still a record for the month. Oil stocks came in at a 13-month low of 1,565 million pounds.

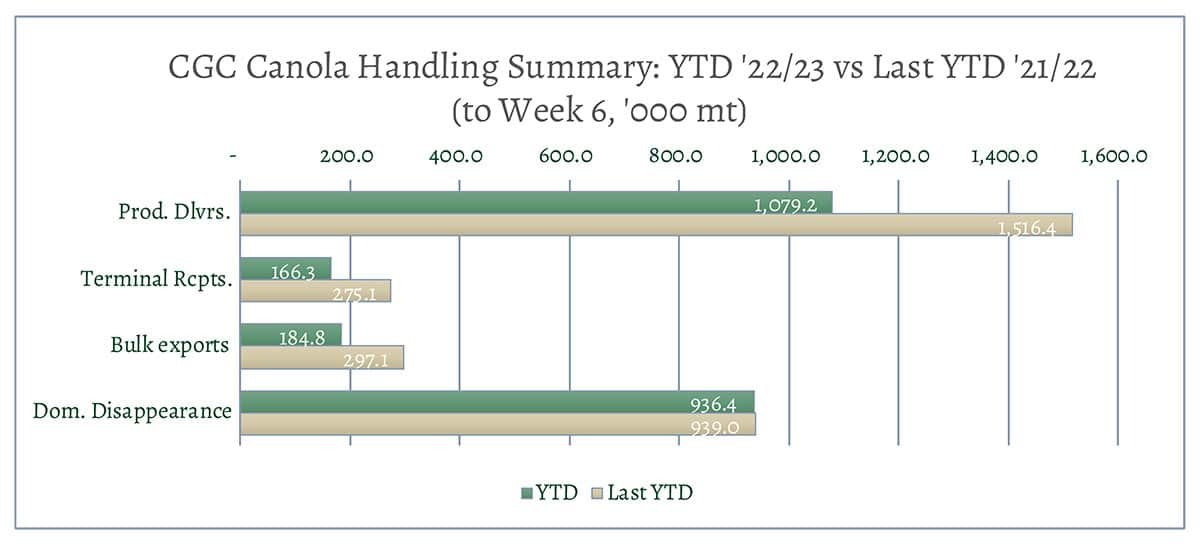

Canola – Year-to-date canola disappearance into week 6 of the crop year amounted to 1.1 million MT compared to 1.2 million MT last year.

Canola exports are taking place but are quite small. We need sellers to be more aggressive, rather than just protecting their crush margin.

Exports should improve the further we get into harvest. We would not sell additional canola at this time, as canola clearly is undervalued to soybeans.

Oilseed Market Backdrop

Soybeans

Current market situation:

The USDA surprised the trade in their estimate of soybeans in the September WASDE report. The USDA reduced the crop by 153 million bushels and the US carryover was estimated to be 200 million bushels, a 45 million bushel drop. The soybean/ corn ratio improved a little to 2.14, but we think that after harvest we should see a return to a ratio of 2.30 plus.

The USDA's 4-week update of export sales showed a season total of 929 million bu, up 13% from last year. China represents 52% of the total and is up 27% (103 million bu) from last year. Still, the trade is well aware of the recent volume buying by China of South American soybeans, notably from Argentina.

The NOPA August crush at 165.5 million bu was marginally below the average trade guess of 166.1 million bu, but it was still a record for the month. Oil stocks came in at a 13-month low of 1,565 million pounds, well below the average guess of 1,650 million pounds.

Market outlook:

Due to the US-China disputes over Taiwan, some suggest that China will concentrate on buying South American soybeans and only the minimum of US soybeans. We don’t agree; China will continue to buy the cheapest product. We expect prices to lower on harvest pressure but to recover when soybeans are in the bin.

Export sales (particularly to China) and South American weather will be the market’s focus over the next period, while waiting for the September stocks report and October US yield update.

Canola Market

Canola usage: The Canadian Grain Commission reported that during week 6 of the crop year, growers delivered 336 thousand MT of canola into primary elevators, exports were a tiny 300 MT, while the domestic disappearance was at 197 thousand MT.

Year-to-date canola disappearance into week 6 of the crop year amounted to 1.1 million MT compared to 1.2 million MT last year.

Visible stocks fell to increased slightly to 646 thousand MT, with 117 thousand MT in process elevators, 51 thousand MT in Vancouver/ Prince Rupert, and 21 thousand MT in eastern ports.

Current market situation:

Statistics Canada (STC) published their August ‘Model-based field crop estimates’ last Wednesday. STC used a 39.7 bu/acre average yield, which is 1.5 bu/acre lower than the 5-year average yield (excluding the unusually low 2021 year). We are still using a 41 bu/acre yield but may adjust this later.

STC is projecting a 19.1 million MT canola crop for 2022/23 and a 20.2 million MT supply scenario. The Mercantile balance sheet has a somewhat higher production and supply, but we also expect exports and crush to reach ~10 million MT, leaving next year’s ending stocks at ~1.4 million MT.

Canola exports are taking place but are still quite small. We need sellers to be more aggressive, rather than just protecting their crush margin. Crush margins in Canada remain extremely high, some say at record high, so either vegetable oil prices must fall, or canola prices increase. [See graph below.] We think that canola is undervalued.

Exports should improve the further we get into harvest. The oil is carrying the crush, which will make canola particularly interesting to Mexican and Chinese crushers.

Canadian canola futures remained up on the week, but Matif rapeseed in Europe extended its losses and headed for its third straight weekly decline and the lowest close since the final week of 2021.

As a matter of interest, the EU Parliament has approved a bill blocking the import of “dirty commodities” in an effort to combat global deforestation. Under the new bill passed last week, importing companies will be required to verify if their products were produced in deforested areas, including the Amazon rain forest. The initial six commodities (soybeans, beef, palm oil, timber, cocoa and coffee) have been expanded to include pork, lamb, poultry and corn. Any commodity found to be linked to land deforested after Dec. 31, 2019, is to be banned from import into the EU.

Market outlook:

The oil is carrying the crush, which should make canola particularly interesting to Mexican and Chinese crushers. We expect the export side to pick up.

Action:

We do not see a need to sell additional canola at this time. Canola clearly is undervalued to soybeans.

Canola – Topics of Interest

Summary of 2021/22 canola usage numbers:

Monthly Canola Crush: