Canola Market Outlook: September 12, 2022

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – The USDA projected US soybean production at 4.4 billion bushels, down 152 million bu with lower harvested area and yield. The soybean yield forecast of 50.5 bu/acre is down 1.4 bu/acre from last month.

Global soybean ending stocks at 98.9 MMT are down 2.5 MMT, mainly on lower US and China stocks.

The US soybean crop estimate was a significant shock with trade guesses averaging 120 million bu higher. CBOT soybean futures are currently up by 67c/bu following the USDA-WASDE reports.

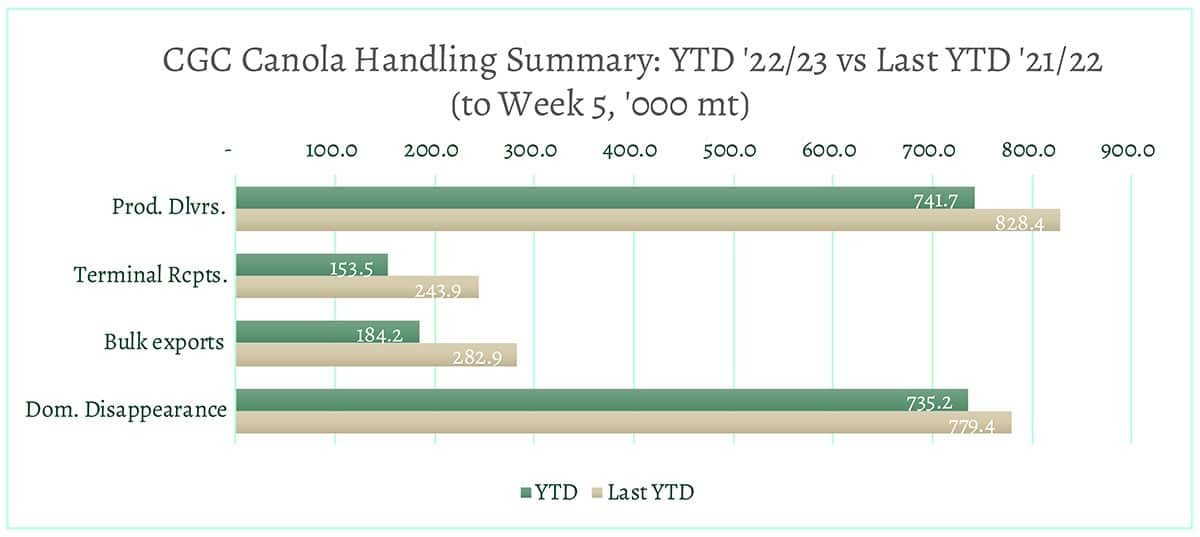

Canola – Year-to-date canola disappearance into week 5 of the crop year amounted to 919 thousand MT compared to 1.1 million MT last year.

The Canadian pipeline is empty and crush margins in Canada are still extremely good and crushers will keep crush volumes high. But we also need more seed export sales to China in particular.

Canola is still undervalued relative to soybeans and – given today’s numbers – we think that soybeans have room to appreciate more. We see no reason to sell additional canola at this time.

Oilseed Market Backdrop

Soybeans

Current market situation:

The USDA numbers on the US soybean crop were a significant shock to the market. Trade guesses ahead of the report had averaged 120 million bu higher. If the USDA had kept their August demand base the same, US end stocks would have dropped to just 92 million bu. This would have been a very low number for September, so USDA lowered demand to compensate. It seems that the world now definitely needs a record South American soybean crop.

Market outlook:

China’s imports of soybeans were lowered by 1 MMT from 98 to 97 MMT. At the same time, 2022/23 vegetable oil imports and consumption in China are expected to recover to close to 15 MMT. Until today, the trade had been working with record US and South American crops, along with doubts over world demand in general and Chinese demand in particular. That was not an overly bullish scenario. Reducing the US crop decreased 2022/23 US ending stocks to 22 million bu (a 5% stock-use ratio) and decreased global ending stocks to 98.8 MMT from 101.4 MMT. This makes especially US soybeans look quite tight.

Canola Market

Canola usage: The Canadian Grain Commission reported that during week 5 of the crop year, growers delivered 212 thousand MT of canola into primary elevators, exports were 88 thousand MT, while the domestic disappearance was at 163 thousand MT.

Year-to-date canola disappearance into week 5 of the crop year amounted to 919 thousand MT compared to 1.1 million MT last year.

Visible stocks fell to increased slightly to 528 thousand MT, with 157 thousand MT in process elevators, 46 thousand MT in Vancouver/ Prince Rupert, and 33 thousand MT in eastern ports.

Current market situation:

Pertaining to Canadian production, Sask Ag reported that 22% of Saskatchewan canola was harvested as of last week and assessed an average yield of 34 bu/acre. This would be significantly lower than the 41 bu/acre we estimated after our crop tour in late July. Alberta Ag showed only 8% of canola harvested and estimated average provincial yields at 41 bu/acre, the same we use. Manitoba canola was only 1% harvested as of September 6, and early yields were reported at 45-55 bu/acre.

Given the relatively low harvest progress, we are still in the interval between old crop and new crop canola. The Canadian crop size is not yet defined, though we are using a decent 20.5 MMT production estimate for now. The USDA today estimated Canadian 2022/23 production at 20.0 MMT, unchanged from last month, but up 45% from last year and 5% above the 5-year average.

The Canadian pipeline is empty and crush margins in Canada are still extremely good and crushers will keep crush volumes high. But we need more seed export sales to China in particular.

Last week, Matif rapeseed in Europe and Canadian canola both fell to their lowest close since January, despite a 9-year low in Canadian stocks [see graph below], but both recovered today following the USDA-WASDE report by €7/mt and $28.50/mt, respectively.

Market outlook:

The markets have tightened up somewhat for oilseeds based on today’s USDA soybean numbers.

Action:

Canola is still undervalued relative to soybeans and – given today’s numbers – we think that soybeans have room to appreciate more. We see no reason to sell additional canola at this time.

Canola – Topics of Interest

USDA – Australian rapeseed outlook:

USDA forecasts Australian 2022/23 rapeseed production at 6.7 MMT, up 600 thousand MT or 10% from last month, but down 62 thousand MT (less than 1%) from last year’s record. Yield is forecast at 1.86 mt/ha, up 4% from last month, but down 12% from last year.

Australian rapeseed is entering the critical flowering crop stage with favourable soil moisture. Harvesting will commence in November and will conclude in December.

USDA – China’s rapeseed outlook:

USDA Foreign Agricultural Service (FAS) staff in Beijing increased their estimate for the 2022/23 Chinese rapeseed production to 15.4 MMT from a previous estimate of 14.9 MMT, and up from an estimated 14.5 MMT in 2021/22.

The increase reflects area expansion and higher yields due to good weather conditions. Rapeseed area has expanded moderately in the Yangtze River region, including Sichuan, Hubei and Hunan, driven by local demand for rapeseed oil and rising rapeseed prices in 2021.

In its August report, the China National Grain & Oils Information Center (CNGOIC) cited increased area and yield in revising its mid-year 2022/23 production forecast upward 0.65 MMT from its July report to a record 15.6 MMT. The rapeseed harvest in major producing provinces concluded in June.

Industry reports indicate both quality and yield moderately improved from 2021/22. Marketing of the mid-year 2022/23 crop peaked in June and has continued through August.

Rapeseed prices also peaked in June with farm-gate prices rising 10% from the previous year before declining slightly in August.