Canola Market Outlook: October 3, 2022

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – The USDA stock report on soybeans came in right at the top end of trade guesses thanks to the revised 2021 crop, sending soybeans down 30¢ to 4-week lows.

However, the soybean/corn ratio is down to 2.00, which in our opinion is far too low. Soybeans are oversold in the 2-year charts.

Canola – Year-to-date canola disappearance into week 8 of the crop year amounted to 1.55 million MT compared to 1.8 million MT last year.

Provincial canola yield estimates have been coming in lower than expected and lower than the AAFC number.

We see no reason to sell canola right now, especially when the soybean/corn ratio is so low.

Oilseed Market Backdrop

Soybeans

Current market situation:

The US harvest pace continues to be slow (8% complete versus 15% complete last year), but the USDA stock report on soybeans came in right at the top end of trade guesses thanks to the revised 2021 crop, sending soybeans down 30¢ to 4-week lows. The revised US soybean production came in higher than trade estimates and higher than last year’s. The USDA numbers were considered bullish for wheat and corn, but bearish for soybeans.

Weekly US soybean export sales came in above expectations at 1 million MT, lifting the season total to 981 million bu., up 10% from last year. China took 55% of total sales, which was better than recent data suggested. However, product sales were poor with just 86 thousand MT of meal and a net negative 5 thousand MT of oil. September 30 was the final day of the 2021/22 product season. Low water levels in rivers could also affect US exports, with spot barge bids reportedly jumping 30¢ on Friday.

South America – Argentina reported additional heavy farmer selling ahead of Friday's end to the 'Soy Peso.' Although, there is a wide difference between official sales (5.7 million MT) and the trade's numbers (12-13 million MT). This discrepancy is supposedly due to simply being behind with the paperwork. BAGE's (Buenos Aires Grain Exchange) first 2023 Argentine crop number of 48 million MT is up from 43.3 million MT last year, but below the USDA number of 51 million MT. New crop seeding in Brazil is coming along as well, though we have no concrete numbers.

Market outlook:

China has purchased large volumes of Argentine soybeans in the ‘normal’ US Oct-Nov harvest slots, and Brazilian new crop is available in February, so the US export window is narrowing. On the other hand, we still are of the view that China is buying Argentine soybeans because they are better value than corn (note that China has also not bought Argentine corn).

The soybean/corn ratio is down to 2.00, which in our opinion is far too low. Soybeans are oversold in the 2-year charts.

Canola Market

Canola usage: The Canadian Grain Commission reported that during week 8 of the crop year, growers delivered 570 thousand MT of canola into primary elevators, exports were again a very small 22,400 MT, while the domestic disappearance was at 214 thousand MT.

Year-to-date canola disappearance into week 8 of the crop year amounted to 1.55 million MT compared to 1.8 million MT last year.

Visible stocks increased to 1.04 million MT, with a very big 791 thousand MT in primary elevators, 120 thousand MT in process elevators, 87 thousand MT in Vancouver/Prince Rupert, and 45 thousand MT in eastern ports.

Current market situation:

Saskatchewan Agriculture reports that 66% of SK canola was harvested as of September 26, Alberta Agriculture shows 75% harvested, while Manitoba Agriculture indicates that only 30% of MB canola has been harvested. Yield assessments remained mostly unchanged, with the average SK yield shown at 34 bu/acre, AB yields at 38.8 bu/acre and MB yields at 35-45 bu/acre (slightly lower than previously). These provincial numbers – if correct – would imply a small crop of ~17.4 million MT compared to 19.1 million MT in the latest AAFC report.

Grower deliveries at 570 thousand MT last week were quite good, but it seems that the railroads are doing a poor job of getting canola into export positions. Primary elevator stocks have grown to 791 thousand MT, while Vancouver stocks are at 62,000 tonnes. Canola values have been moving up as companies are forced to buy futures to price grain, while growers are stubborn flat price sellers.

Both EU and Canadian rapeseed/canola made multi-week highs but, with the exception of rapeseed oil, all Asian markets ended the week lower, with palm oil making contract lows. The Chinese Yuan fell to 14-year lows mid-week and China now is on a weeklong holiday.

Market outlook:

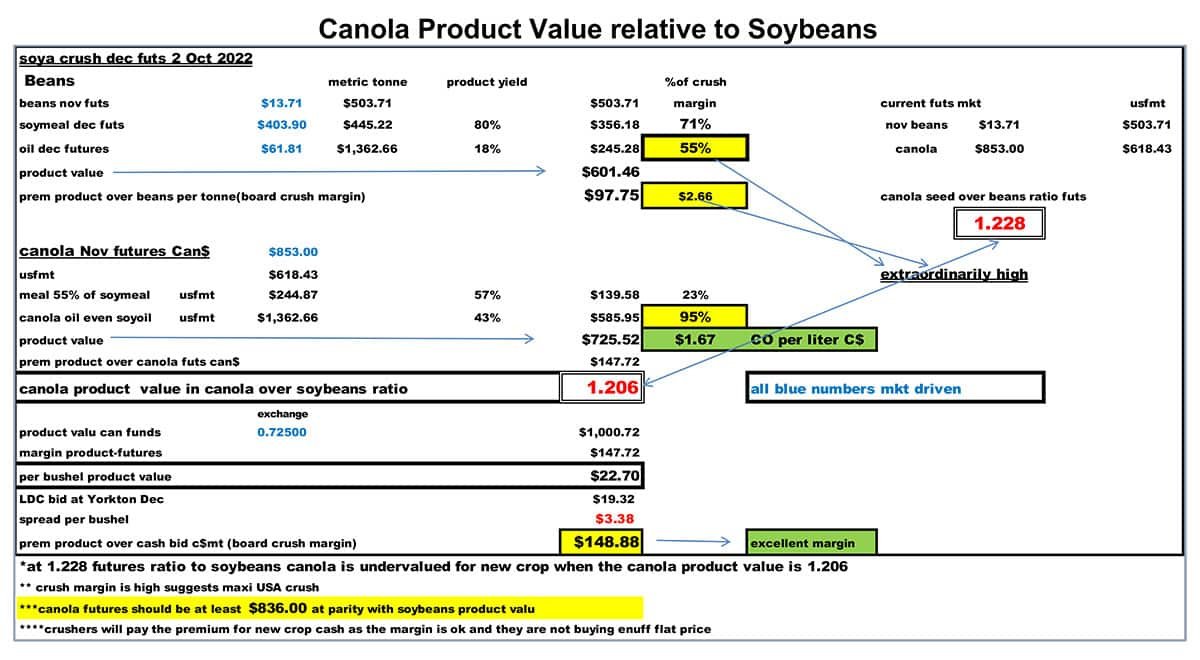

Canola is still well priced against soybeans to destinations like Japan, Mexico, the US and China that primarily crush for oil. There appears to be plenty of seed in primary elevators (676 thousand MT) to provide seed for exports, but we need to get more into export position at the ports.

Action:

We see no reason to sell canola, especially when the soybean/corn ratio is so low.

Canola – Topics of Interest

StatsCan – Monthly Canola Crush:

The August 2022 canola crush came in at 633 thousand MT, 29 thousand MT smaller than the crush in August 2021. However, this is far bigger than the canola exports during that period. StatsCan export numbers for August are not out yet, but weekly Canadian Grain Commission numbers indicate that canola exports during the first four weeks of the crop year amounted to only around 96 thousand MT, compared to 205 thousand MT the year prior.