Canola Market Outlook: November 25, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: Extreme volatility continues. CBOT soybean futures recovered from early losses to post small gains on Friday and again this Monday.

US export sales of 1.9 million MT were above the trade guesses of 1 - 1.6 million MT, with the season total of 31.6 million MT being 9% above last year’s.

However, the mood in the vegoils market has shifted and funds have cut their long nearly in half (they are still long around 38k lots).

Politics still is the biggest uncertainty facing the oilseed complex, and the trade is grappling to understand what direction the politics of biofuels will take.

Canola: YTD total canola disappearance into week 15 of the crop year amounts to 7 million MT compared to 4.9 million MT last year and is up 45% on last year.

ICE canola dropped on four successive days last week, with Jan. ’25 futures closing down $54/MT at $592.40/MT. This is the weakest level in ~ 2 months. Canola followed CBOT soybean oil, Matif rapeseed and Malaysian pam oil lower.

The Trump election has added uncertainty to the oilseed markets about trade relations with China, and the correction in the vegoil market in Asia also is negative to canola demand.

This is a short week with US Thanksgiving looming on Thursday. We hope you took advantage of 25% March sales last week and would wait out his week.

Oilseed Market Backdrop

Soybeans

Current market situation

Extreme volatility continues. CBOT soybean futures recovered from early losses to post small gains on Friday, as recent weakness in the market was thought to generate some end user buying interest. US export sales of 1.9 million MT were above the trade guesses of 1 - 1.6 million MT, with the season total of 31.6 million MT being 9% above last year’s, vs. the USDA's projected 8% increase.

South American markets returned from their holiday, and BAGE reported plantings 36% complete, up 16% from last week thanks to good planting conditions. Seeding now is in line with last year and their production forecast remained 50.8 million MT (vs. 50.2million MT last year).

Moreover, the mood in the vegoils market has shifted and while funds have cut their long nearly in half, funds are still long around 38k lots. The declines in palm oil exports from Indonesia is the most tangible contraction in demand but the trade is grappling to understand what direction the politics of biofuels will take. Palm had the biggest drop and has given back all the gains of the past 2 1/2 months. (Re. palm oil, one notion is that a large share of palm oil demand is via palm oil pretending to be used cooking oil (UCO). If correct, and if the US restricts (UCO) imports, then that would reduce demand for Chinese vegoils as they no longer pass through their customs channels from SEA origins.)

Considering the market from a different angle, soybean meal has become a progressively cheaper source of protein (on a per-unit-of-protein basis). Comparing the relative value per unit of protein, the price of wheat in an EU ration is historically high. This could result in EU feed compounders preferring to switch out of wheat in favour of meal and to compensate by replacing wheat with corn. However, other cash markets are just a few Euro from parity with corn.

Market Outlook:

Politics still is the biggest uncertainty facing the oilseed complex, and the trade is grappling to understand what direction the politics of biofuels will take.

Canola Market

Canola usage

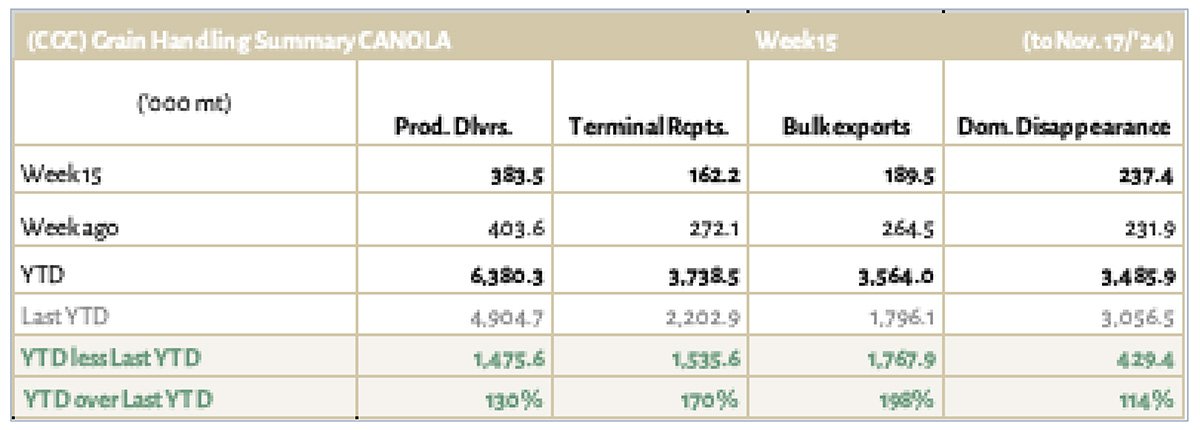

In week 15 of the crop year, growers delivered 384 thousand MT of canola into primary elevators, exports dropped to a 190 thousand MT, while domestic disappearance amounted to 237 thousand MT, still near full capacity.

YTD total canola disappearance into week 15 of the crop year amounts to 7 million MT compared to 4.9 million MT last year and is up 45% on last year.

Visible stocks settled at 1.45 million MT, with 839 thousand MT in primary elevators, 184 thousand MT in process elevators, 239 thousand MT in Vancouver/ Prince Rupert, and 186 thousand MT in eastern ports.

Current market situation

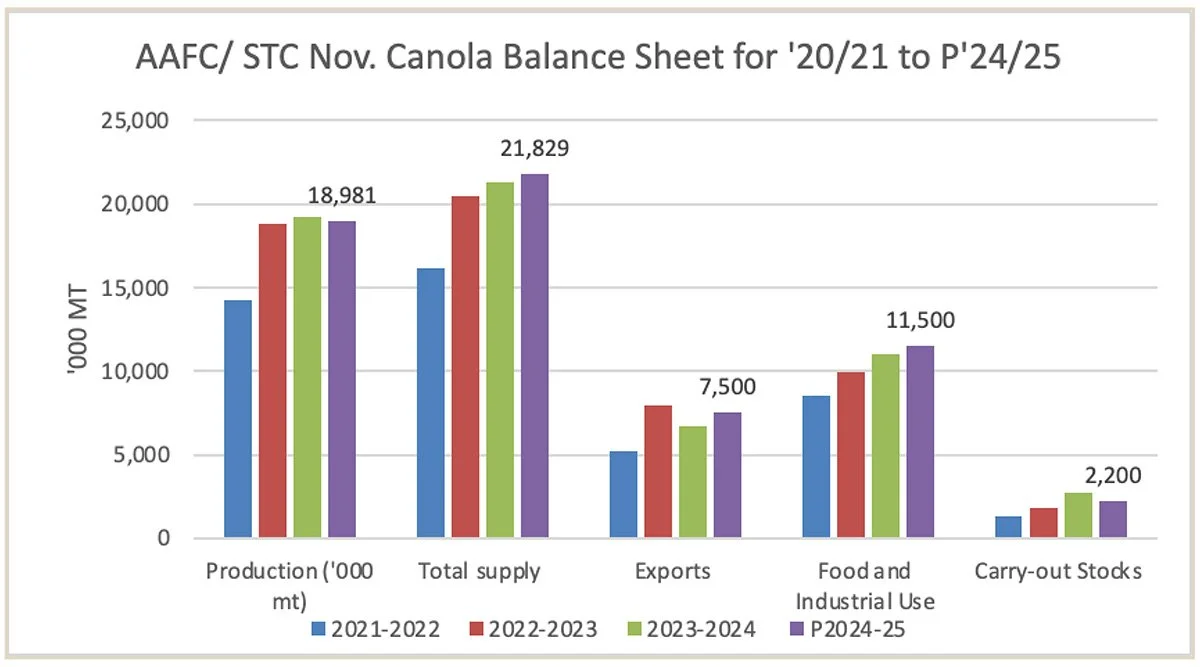

Total YTD canola usage adds to 7 million MT, compared to 4.9 million MT last crop year to date. However, ICE canola dropped on four successive days last week, with Jan. ’25 futures closing down $54/MT at $592.40/MT. This is the weakest level in ~ 2 months. Canola followed CBOT soybean oil, Matif rapeseed and Malaysian pam oil lower. Week 15 canola exports at 190k MT were well below last week’s (265k MT), although we note that YTD exports represent 48% of exports projected by AAFC for the ongoing crop year (7.5 million MT), and their target would only requite weekly exports of 104k MT for the remainder of the crop year. Our export target of 9 million MT would require weekly exports of 143k MT.

YTD crush of 3.5 million MT represents 30% of the AAFC crush projection of 11.5 million MT, and 30% of our projection as well. This means that fundamentals remain supportive. However, going forward, we will have to monitor export sales closely because the Trump election has added uncertainty to the oilseed markets about trade relations with China, and the correction in the vegoil market in Asia also is negative to canola demand. High prices started to ration demand and added uncertainty w.r.t the politics behind biodiesel blending.

While both soybean oil and rapeseed oil values in China have dropped significantly from last week, rapeseed oil still is valued 13% higher than soybean oil.

Meanwhile, AAFC published their November canola balance sheet but made no changes to their October numbers. Total supply remained at 21.8 million MT, with exports at 7.5 million MT and crush at 11.5 million MT, leaving ’24/25 ending stocks at 2.2 million MT (vs. 2.75 million MT last year).

Market outlook

The Trump election has added uncertainty about trade relations with China to oilseed markets, and the correction in the vegoil market in Asia also is negative to canola demand. Politics still is the biggest uncertainty facing the oilseed complex, and the trade is grappling to understand what direction the politics of biofuels will take.

Action

This is a short week with US Thanksgiving looming on Thursday. We hope you took advantage of 25% March sales last week and would wait out his week.

Canola – Topics of Interest

International Grains Council (IGC) on Soybeans:

Boosted by expectations for sizeable harvests in major growers and exporters, world soybean output is seen 6% higher y/y, at a record of 419 million MT.

With gains anticipated to be broad-based, spanning multiple regions and market segments, total utilisation is seen expanding to a new peak, while heavy stock accumulation in the three majors is anticipated.

Tied to above-average shipments to Asia, Europe and Africa, trade is projected to edge up to 180 million MT (+1%).

USDA on Global Oilseed Production:

Global oilseeds: According to the latest USDA estimates, global oilseed output in the 2024/25 crop year is set to hit a peak of around 682.2 million MT, which would be up just under 4 per cent year-on-year.

The USDA has also forecast global oilseed processing to climb to a new record of 556.9 million MT, reflecting a 10.8 million tonne rise from the 2023/24 crop year. Global ending stocks will presumably amount to 147.7 million MT, exceeding the previous year's level by 16.0 MT. and considerably surpassing the previous all-time high of 134.0 million MT recorded in the 2018/19 season. World trade in oilseeds will presumably grow 3.1 million MT, reaching 207.4 million MT.

Soybeans: The current crop year's soybean harvest is expected to break records, with an estimated 425.4 million MT.

Palm kernels: Similarly, global output of palm kernels is seen to increase nearly 4 per cent to 20.9 million MT on the year.

Rapeseed: In contrast, world rapeseed production is projected to decline 3 per cent to 87.2 million MT. This outlook is based on declines in key rapeseed-producing countries, especially the EU.