Canola Market Outlook: November 14, 2022

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – Weekly US soybean export sales at 795 thousand MT took the season total to 1,216 million bu, just below last year’s for the first time this year (against the USDA's projected 5% decline).

The corn-soybean ratio has improved and stands now at 2.21. We still think this is too low and 2.30 should be the minimum ratio to consider any sales of oilseeds.

Canola – Year-to-date canola disappearance into week 14 of the crop year is slightly below last year’s usage (-2%) and amounted to 4.37 million MT compared to 4.44 million MT last year.

Crush margins remain very good for soft seed oilseeds. We expect demand for canola for export to be substantial and to continue at a good premium to soybeans.

We see no reason to sell additional canola at current price levels, but we suggest placing pricing orders for the next 15% sales at $21.50 per bushel.

Oilseed Market Backdrop

Soybeans

Current market situation:

Last week’s USDA report did bring much for the bulls, but also did not change much. Global production was down by 550 thousand MT, but US production increased on a slightly higher yield (+0.4 bu/acre), while Argentine production was lowered by 1.5 million MT.

In trade, US exports were unchanged, while Argentine exports increased by 200 thousand MT. Global ending stocks were up by 1.7 million MT, up 250 thousand MT in the USA and up 1 million MT in China. CBOT soybeans fell to sharp losses Thursday, despite the USD having its biggest drop in 7 years, then bounced back overnight. We think the drop was mostly related to rumours that Argentina is contemplating a repeat of the ‘soy peso scheme’ of September (a special FX rate of 200 against the USD resulted in an estimated 7 million MT of farmer soybean sales during Sept. This time the rate might be even higher at around 225 vs. the official rate currently at 160 and the parallel 'blue' rate at around 290). China’s 8-year low in October soybean imports did not help either.

Weekly US soybean export sales at 795 thousand MT took the season total to 1,216 million bu, just below last year’s for the first time this year (against the USDA's projected 5% decline).

Asian markets were mixed during the week.

Market outlook:

The USDA report had nothing for the bulls and resulted in Thursday’s losses but rebounded sharply on the concerns in Brazil and renewed weakness in the US dollar. A move by China (Friday) to start easing its restrictive COVID policy is seen as supportive as well.

China is said to have bought large quantities of South American soybeans and product premiums which will be priced through buying in Chicago’s CBOT.

We also had decent US sales registered with the USDA. If the dollar stays weak, we expect good sales volumes during the coming week. Crush margins are excellent. The product premium basis the futures is showing products at a 25% premium to soybeans which we think is a record.

The corn-soybean ratio has improved and stands now at 2.21. We still think this is too low and 2.30 should be the minimum ratio to consider any sales of oilseeds.

Canola Market

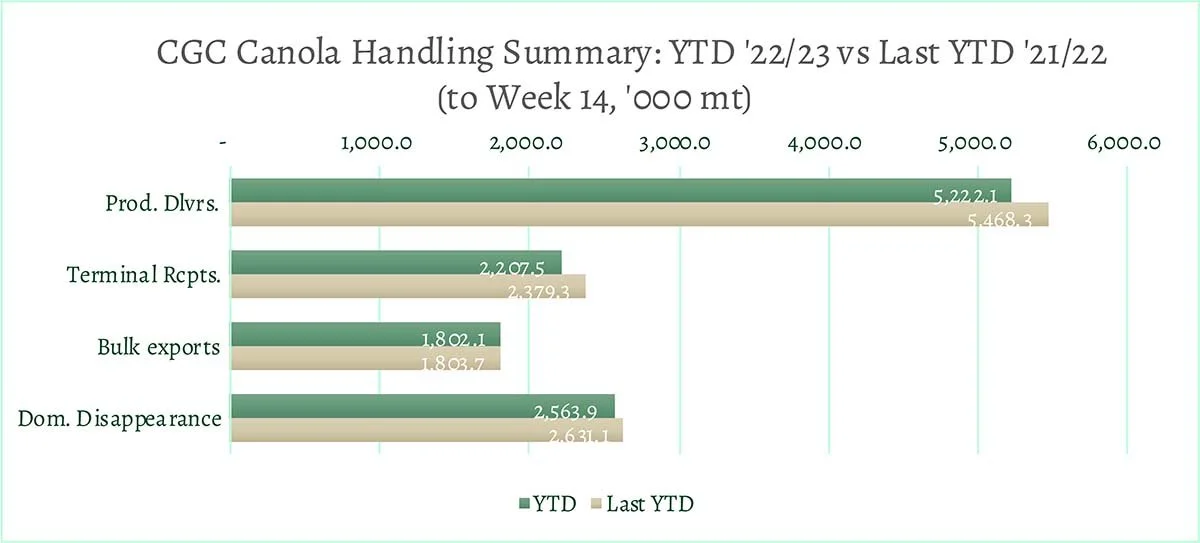

Canola usage: The Canadian Grain Commission reported that during week 14 of the crop year, growers delivered 450 thousand MT of canola into primary elevators, exports were at 202 thousand MT, while the domestic disappearance amounted to a steady 178 thousand MT.

Year-to-date canola disappearance into week 14 of the crop year is slightly below last year’s usage (-2%) and amounted to 4.37 million MT compared to 4.44 million MT last year.

Visible stocks rose to 1.5 million MT, with a big 879 thousand MT in primary elevators, 168 thousand MT in process elevators, 274 thousand MT in Vancouver/ Prince Rupert, and 171 thousand MT in eastern ports.

Current market situation:

Crush margins remain very good for soft seed oilseeds. We expect demand for canola for export to be substantial and to continue at a good premium to soybeans. The premium for vegetable oil is a big benefit for canola and the underlying reason for the excellent crush margins in Canada. In our view, current grower bids are undervalued relative to export markets, but growers are perceiving these returns as excellent and are selling. Grain companies are making very good profits both in the crush and in exports of canola seed.

We note that Matif rapeseed fell to a 4-week low close helped by the bounce in the Euro last week and dropped another €10/MT today.

Market outlook:

Canola remains attractive in export markets based on its relatively high oil content. Crush margins remain high, and we expect this to support Chinese buying, especially for soft oilseeds.

Action:

We see no reason to sell additional canola at current price levels. We suggest placing pricing orders for the next 15% sales at $21.50 per bushel.

Canola – Topics of Interest

Update on China’s rapeseed production and crush:

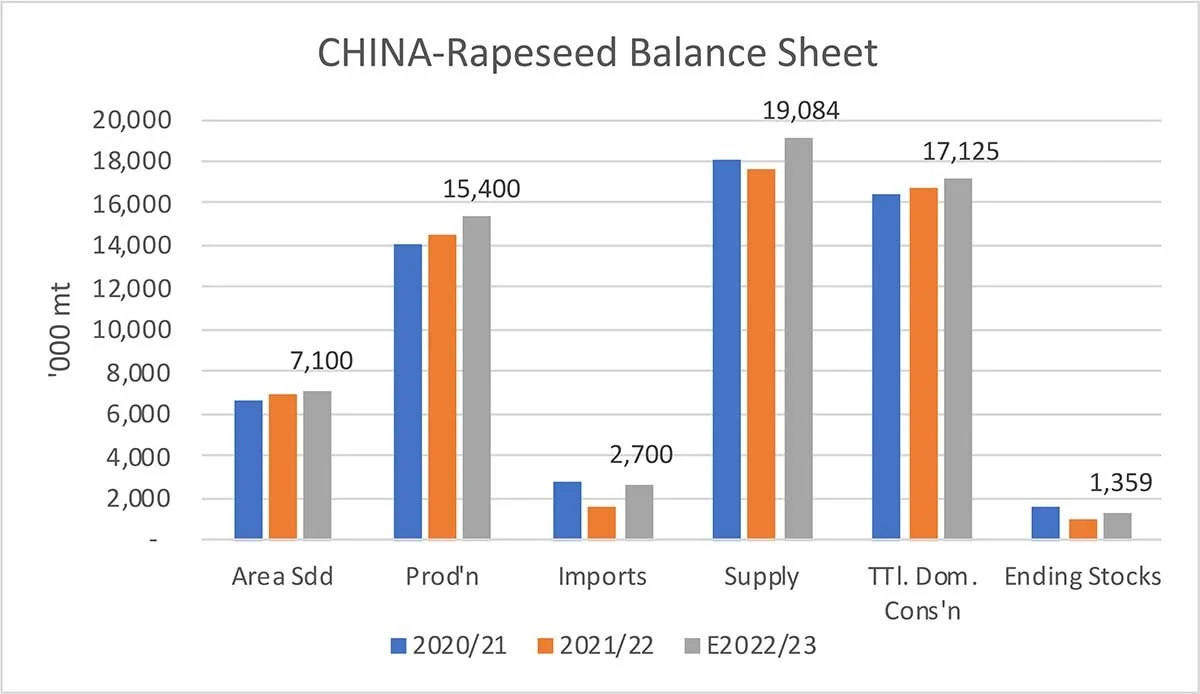

Based on the assessment and data of the USDA attaché in Beijing, China, rapeseed production in that country will increase by 7% and supply by 8% this crop year to 15.4 million MT and 19.1 million MT, respectively.

Importantly for Canada, consumption and crush are also expected to rise, leading to a resurgence in imports of both rapeseed (canola) seed and oil to 2.7 million MT and 1.9 million MT, respectively, despite the increase in domestic production.