Canola Market Outlook: March 6, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – CBOT soybeans had a weak start to the week, but a strong second half brought the market back to roughly unchanged prices.

USDA’s weekly Export Inspections at 542 thousand MT were down from 765 thousand MT last week.

We expect the next USDA report on Wednesday, and the trade expects USDA to lower the Argentine crop number by 4.4 million MT to 36.7 million MT. Estimates for the change in the Argentine crop range from -1 million MT to -9 million MT, but this will likely be offset by a record Brazilian crop.

Canola – YTD canola disappearance into week 30 of the crop year is 20% above last year’s usage (+1.8 million MT) and amounted to 11 million MT compared to 9.2 million MT last year.

Year-to-date total deliveries of canola still slightly exceed the total usage of canola.

We still like selling 30% of new crop canola down to $17.75 per bushel, but below that level we would pass for now.

Oilseed Market Backdrop

Soybeans

Current market situation:

CBOT soybeans had a weak start to the week, but a strong second half brought the market back to roughly unchanged prices. BAGE in Argentina dropped their Good/Excellent crop ratings to a new low of just 2%. BAGE also indicated their current crop number of 38.5 million MT could fall further. Strikes in Argentina are adding to the woes of their crushers, which helped support the meal market. However, USDA’s weekly Export Inspections at 542 thousand MT were down from 765 thousand MT last week and from 772 thousand MT during the same week last year. Accumulated shipments total 42.7 million MT as of March 2, compared to 41.5 million MT last year.

Market outlook:

We expect the next USDA report on Wednesday, and the trade expects USDA to lower the Argentine crop number by 4.4 million MT to 36.7 million MT. Estimates for the change in the Argentine crop range from -1 million MT to -9 million MT, but this will likely be offset by a record Brazilian crop. (The Brazilian harvest is about 40% complete compared to 50% last year). We could also see the USDA lower the US soybean export number.

Beyond that, the March 31st stock and planting numbers will become significant, along with the longer-term demand for US soybean oil for renewable diesel. This could progressively become the soybean market bullish leading indicator.

We took a 10-contract spread off at 2.385, which we had on short corn, long soybeans at ratio of 2.27. This gave us a 55 cent per bushel gain. Charts on the new crop looks overbought, but we will leave soybeans alone for the present.

Canola Market

Canola usage:

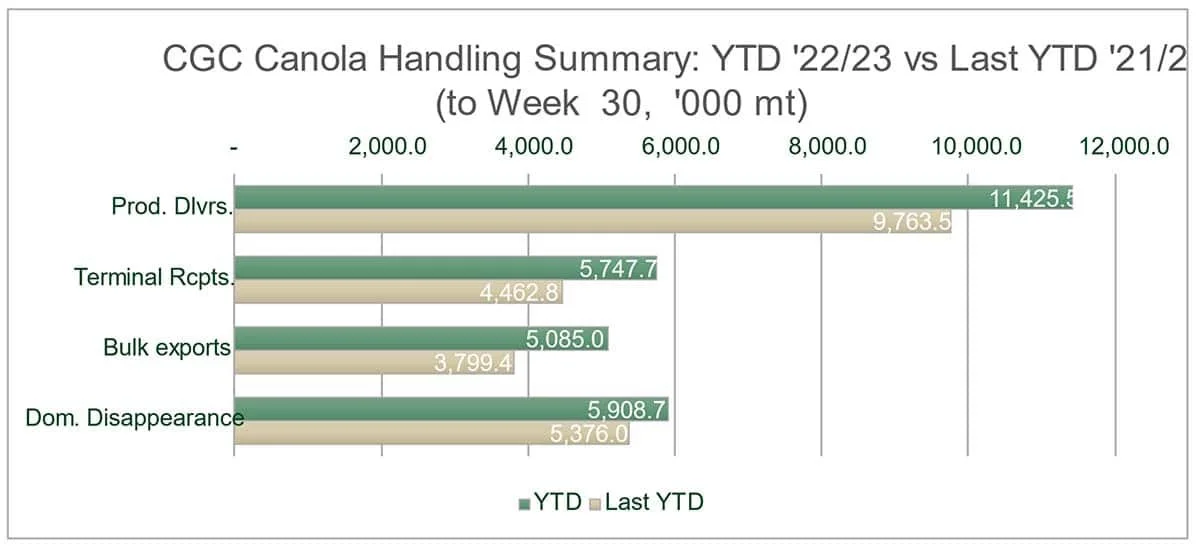

The Canadian Grain Commission reported that during week 30 of the crop year, growers delivered 294 thousand MT of canola into primary elevators, exports were at 195 thousand MT, while the domestic disappearance amounted to 198 thousand MT.

YTD canola disappearance into week 30 of the crop year is 20% above last year’s usage (+1.8 million MT) and amounted to 11 million MT compared to 9.2 million MT last year.

Visible stocks were shown at 1.18 million MT, with 630 thousand MT in primary elevators, 202 thousand MT in process elevators, 216 thousand MT in Vancouver/ Prince Rupert, and 129 thousand MT in eastern ports.

Current market situation:

Year-to-date total deliveries of canola into the handling system over total YTD usage (export and crush) are at 432 thousand MT, so the pipeline remains tight. We can see in the second chart showing deliveries against usage for all grains, oilseeds and pulses that we have have actually reduced the carryover by exporting/using more than was delivered, for wheat in particular. Deliveries of canola still exceed the usage.

However, if we use StatsCan’s estimate of production, we do not have enough canola to meet 2023/2024 demand at the current spread to soybeans.

In Europe, Matif rapeseed tested recent lows last week, which is mostly a reflection of the volumes of Ukrainian oilseeds and vegetable oils arriving in the European market. In contrast, exports of Canadian canola to the EU have fallen to 156 thousand MT (latest STC export numbers are August-December 2022) compared to 471 thousand MT for the same period last season. However, at the same time, exports of Canadian canola to Asia have increased by 51% compared to last season from 1.45 million MT to 2.2 million MT. Europe is well supplied by bigger Ukrainian and Australian canola/ rapeseed exports, which both nearly doubled to the European Union. This reflects the structural change the war in Ukraine has brought to the crush market in the EU, as well as a third record Australian crop. It has meant that Matif has been more consistently at a discount to ICE canola this year.

Market outlook:

We still expect good current crop buying from China, so we anticipate a tight carry-in. We think oilseeds will fall versus the other grains ratio, so we still like selling 30% of new crop canola down to $17.75 per bushel, but below that level we would pass for now.

Action:

We still like being sold 30% of new crop canola acres.

Canola – Topics of Interest

Focus on Australian Canola:

In 2022/2023, Australia produced a third record canola crop with close to 7.8 million MT on an area of 3.8 million ha (6.8 million MT last year). This was achieved despite very wet conditions in the states of New South Wales and Victoria, with heavy rain and floods affecting crops towards the end of the season. Resilient crops, with maturing seeds pods, were able to withstand these conditions in most cases. In the other canola producing states of South Australia and Western Australia, conditions were ideal with record crops recorded in both states.

For the 2023/2024 season, the canola crop in Australia is expected to return towards lower, longer-term yields due to the return of El Niño conditions, which would tend to result in below-average rainfall. The forecast is for only a 20-35% chance of exceeding median rainfall during the seeding and crop establishment phase (April-June), which will mean that the crops will rely on accessing deeper soil moisture reserves during the critical biomass production stage leading up to flowering. If El Niño conditions continue through to pod and seed development, yields and oil content will be impacted.

Early indications are for seeded area to be down by ~10% on last year with yields closer to the national long-term average of around 1.6 MT/ha. This would result in a production of 5.5 million MT, with as much as 2 million MTs carryover from 2022/2023.