Canola Market Outlook: February 27, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – Last week CBOT soybeans tested the $15.50/bu futures price level again but did not break through. Old crop soybeans just stayed green for the week, but new soybeans crop fell to a three-week low.

The USDA Outlook Forum projected unchanged soybean acres for 2023 (87.5 million acres) but showed a record yield (52 bu/ac), which resulted in higher ending stocks.

Net sales of 545 thousand MT for 2022/23 were up 20% from the previous week, but down 18% from the prior four-week average. They were within trade expectations of 300 thousand – 800 thousand MT.

Low US soybean exports will pressure US soybean futures.

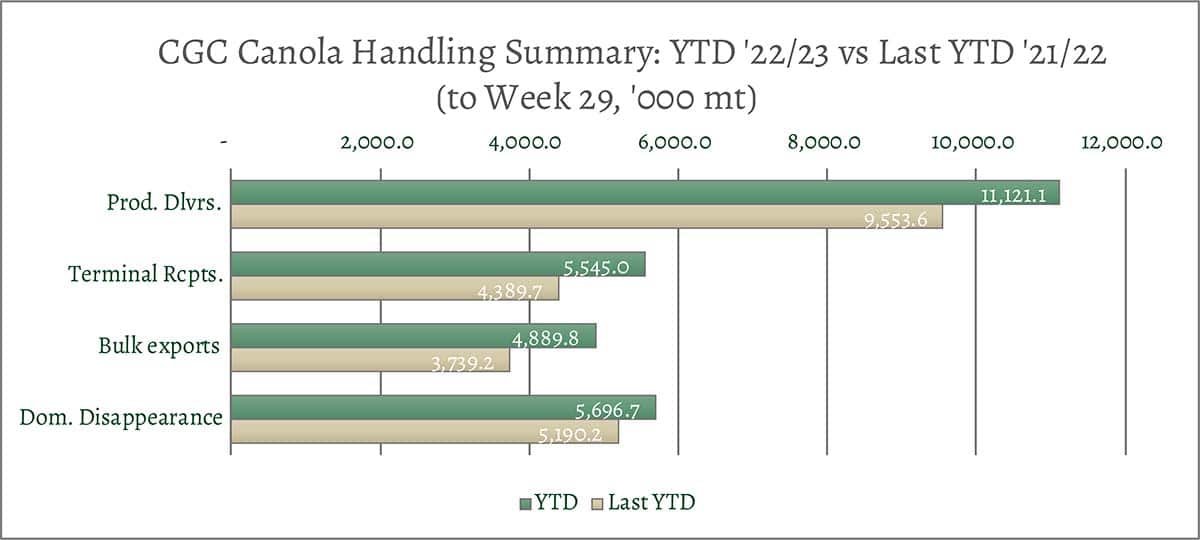

Canola – YTD canola disappearance into week 29 of the crop year is 19% above last year’s usage (+1.7 million MT) and amounted to 10.6 million MT compared to 8.9 million MT last year.

Year-to-date total deliveries of canola into the handling system over total YTD usage (export and crush) are at 535 thousand MT, so the pipeline remains tight.

We could well see weather markets over the summer, but some of the acreage forecasts tell us to sell 30% of new crop acres down to $17.75/bu as a precaution (if not done earlier).

Oilseed Market Backdrop

Soybeans

Current market situation:

The USDA Outlook Forum projected unchanged soybean acres for 2023 (87.5 million acres) but showed a record yield (52 bu/ac), which resulted in higher ending stocks. Meanwhile, current season US export sales fell below last year’s. So, last week CBOT soybeans tested the $15.50/bu futures price level again but did not break through. Old crop soybeans just stayed green for the week, but new soybeans crop fell to a three-week low.

In Argentina, BAGE revised their Argentine crop production estimate to just 33.5 million MT (USDA is using 41 million MT). Argentine Good/Excellent ratings fell to a new all-time low of 3%. However, while reviewing the USDA Outlook numbers, the market paid little attention to South American figures. It is also widely expected that the Brazilian crop size will largely compensate for shortfalls in Argentina while meal premiums at $45 below the Gulf suggested that Brazil, not the US, will pick up the slack in world meal demand left by Argentina.

Market outlook:

Although there are ongoing logistic problems in Brazil (interior freight rates continued to rise due to the lack of trucks and storage space), it will be increasingly difficult for the US to increase soybean and meal exports March forward. Low exports will pressure US soybean futures.

Canola Market

Canola usage:

The Canadian Grain Commission reported that during week 29 of the crop year, growers delivered 418 thousand MT of canola into primary elevators, exports were at 191 thousand MT, while the domestic disappearance amounted to 180 thousand MT.

YTD canola disappearance into week 29 of the crop year is 19% above last year’s usage (+1.7 million MT) and amounted to 10.6 million MT compared to 8.9 million MT last year.

Visible stocks were shown at 1.3 million MT, with 726 thousand MT in primary elevators, 224 thousand MT in process elevators, 222 thousand MT in Vancouver/ Prince Rupert, and 138 thousand MT in eastern ports.

Current market situation:

Year-to-date total deliveries of canola into the handling system over total YTD usage (export and crush) are at 535 thousand MT, so the pipeline remains tight.

China remains the major export buyer of seed and this will continue while rapeseed oil commands a premium in China. (China bought 58% of all Canadian canola exports into the end of December, the latest official export statistics by destination.) Rapeseed oil currently fetches an 8.8% premium over soybean oil.

In Europe, Matif rapeseed fell to sharp losses for two straight days last week and gave back all the previous two week’s gains. However, it is trading in the green this Monday morning. ICE canola remained up on the week and had the highest weekly close in six weeks. ICE canola is up $3-7.60/MT this Monday morning.

Market outlook:

The US Outlook Conference suggested that US soybean growers would plant unchanged soybean acres and more canola in 2023, which we saw as a little bearish. We also expect more rapeseed acres in China and in the European Union in the coming crop year. EU rapeseed acres could reach 6 million ha (14.8 million acres), and rapeseed acreage in China could reach 7.1-7.15 million ha (17.5-17.7 million acres). The sunflower seed area in the EU/Black Sea could also be big.

Action:

We could well see weather markets over the summer, but some of the acreage forecasts tell us to sell 30% of new crop acres down to $17.75/bu as a precaution (if not done earlier).

Canola – Topics of Interest

Statistics Canada – Monthly Canadian Crush:

Statistics Canada reported the January 2023 crush at 875 thousand MT, the second highest January crush over the past six years. The YTD crush (Aug. 2022 – Jan. 2023) amounts to 4.9 million MT, compared to 4.5 million MT last year and 5.3 million MT the year prior. Annualizing the YTD crush would result in 9.8 million MT for year. We expect domestic crush to reach 10 million MT this year.