Canola Market Outlook: July 31, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: The CBOT soybean complex had a mixed week with crush margins higher, but oil share down a full 2%.

US crop ratings dipped 1% to 54% good to excellent, but with Illinois gaining 4%, while Iowa was steady.

In our view, soybeans for new crop are too high compared to competing oilseeds and grains.

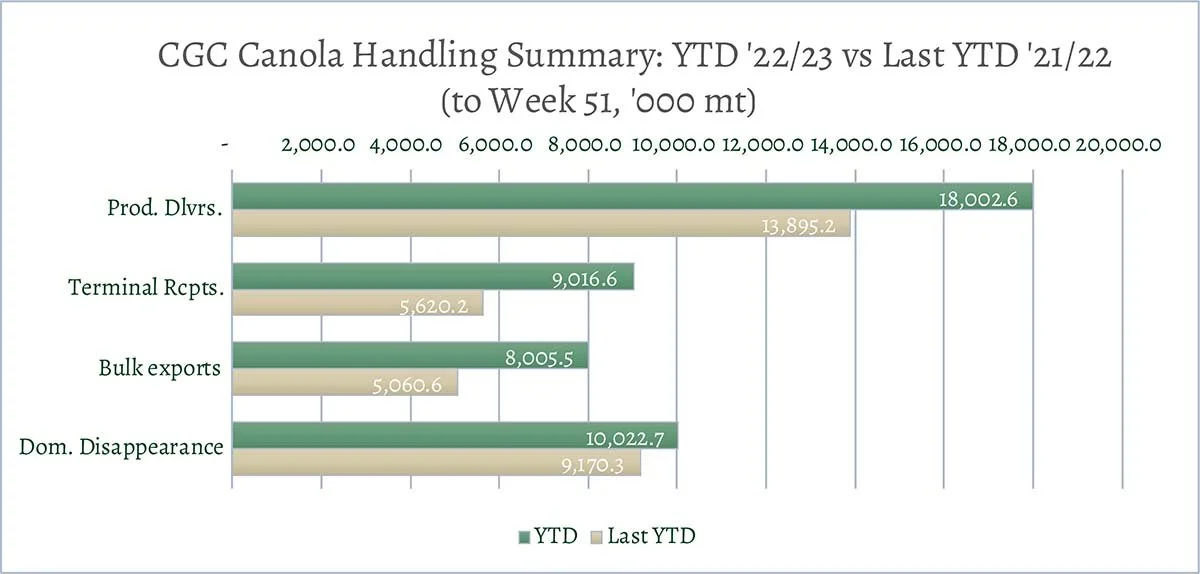

Canola: YTD canola disappearance into week 51 of the crop year is 27% above last year’s (drought-reduced) usage (+3.8 million MT) and amounted to 18 million MT compared to 14.2 million MT last year.

Winnipeg ICE canola futures were steadier, with expanding old crop crush margins and poor growing conditions dominating the market. But markets are very thin with no grower selling, which makes prices vulnerable to go higher when crush margins are good.

We do not recommend additional sales while we do not see precipitation on the prairies.

Oilseed Market Backdrop

Soybeans

Current market situation

The CBOT soybean complex had a mixed week with crush margins higher, but oil share down a full 2%. US crop ratings dipped 1% to 54% good to excellent, but with Illinois gaining 4%, while Iowa was steady.

We think that what appear to be substantial soybean new sales registered this week with the USDA are only premiums; the flat price was covered some weeks ago in Brazil. And it being only a premium registration is why futures were weak. The Brazilian premiums strengthened recently, which is why the sellers now prefer shipping from the USA - hence the USDA registration.

Soybean oil is being supported by biodiesel, and soybean meal by the shift in demand for soybean meal from Argentina to the US: US new crop soymeal sales are up 32% while Argentine exports are down 30%.

Soybean meal in Dalian (China) reached the highest level since 2022, and vegetable oils in China were also testing highs. The strength is being attributed to Chinese GvMT. stimulus to get their economy moving.

Market outlook

In our view soybeans for new crop are too high compared to competing oilseeds and grains. We retain our soybean/corn spreads (long Dec corn-short Nov soybeans) thinking new crop soybeans are too expensive relative to corn.

Canola Market

Canola usage

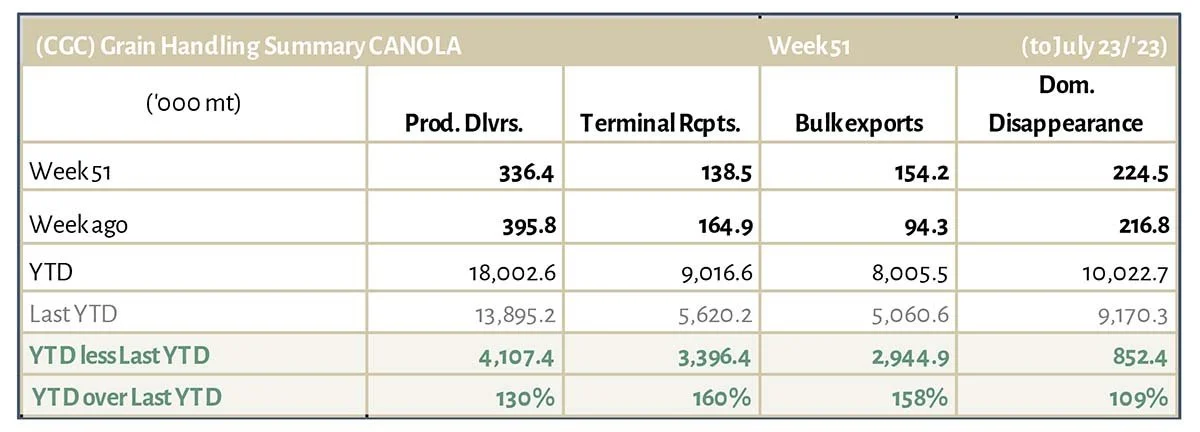

The Canadian Grain Commission reported that during week 51 of the crop year, growers delivered a strong 336 thousand MT of canola into primary elevators, exports were 154 thiusand MT, while the domestic disappearance amounted to 225 thousand MT.

YTD canola disappearance into week 51 of the crop year is 27% above last year’s (drought-reduced) usage (+3.8 million MT) and amounted to 18 million MT compared to 14.2 million MT last year.

Visible stocks were at 991 thousand MT, with 538 thousand MT in primary elevators, 210 thousand MT in process elevators, 179 thousand MT in Vancouver/ Prince Rupert, and 62 thousand MT in eastern ports.

Current market situation

Meanwhile, Winnipeg ICE canola futures were steadier, with expanding old crop crush margins and poor growing conditions dominating the market. But markets are very thin with no grower selling, which makes prices vulnerable to go higher when crush margins are good.

We have made some changes to our balance sheet recognizing handling numbers and the dry conditions. Given continued good producer deliveries, we have increased the acres for ‘22/23 and we have decreased the yields for ‘23/24. Nevertheless, we still need Chinese new crop buying to increase, but that will depend on oil values. Given today’s production forecast, we expect ‘23/24 canola exports at 8.5 million MT, and crush at 10 million MT. This would leave ‘23/24 ending stocks at 1.1 million MT.

Crop Condition: The Gd./Exc. canola crop condition rating in SK by SK Ag fell by 13 points from July 10th to July 24th to 35% Gd./Exc., 42% Fair, and 23% Poor to very Poor. In AB, the rating fell by 2 points to 41.6% Gd./Exc. IN MB, the overall canola crop condition ranged from fair to mostly good.

SK canola condition ratings: Current conditions and rating progress since May 29th

In Europe, Nov. Matif rapeseed futures came under harvest pressure amidst limited buying interest from crushers. Over the course of the past 2 weeks. Nov. Matif rapeseed futures have traded in a €56/MT range with a €30/MT range over the past week. Rapeseed did not garner the same positive momentum as other vegetable oils/ oilseeds, as crushers are covered, and harvest pressure is being exerted. Sunflower seed production prospects are still good for both the EU and Ukraine.

Market outlook

The economic stimulus program in China gives hope for improved demand for soybean exporters, and record Indian vegoil imports should be supportive for the vegoil complex. However, rapeseed failed to muster much of rally and came under pressure despite the attacks on the Danube ports which shows that there are not many concerns about the overall supply situation.

Action

For SK farmers, we do not recommend additional sales while we do not see precipitation on the prairies.

Canola – Topics of Interest

StatsCan: June Canola Crush

Total Cdn. canola crush for June was reported by Statistics Canada at 772k MT, slightly above the May crush and 112k MT higher than in June ’22. The YTD total adds to 9.06 million MT. Annualizing the YTD crush to the full crop year would result in 9.9 million MT crushed, the third biggest annual crush to date.

Both Mercantile and AAFC had been using a 9.5 million MT crush number for ‘22/23 in their balance sheets, which AAFC upgraded to 9.7 million MT last week. According to the CGC handling numbers, the domestic disappearance for the first two weeks of July was 411k MT.

AAFC July Canola Balance Sheet

In their July balance sheet, AAFC increased the canola acreage by 484k acres from their June estimate to 22.1 million acres. This boosted production to 18.8 million MT. AAFC left exports at 9.5 million MT, but increased crush by 200k MT to 9.7 million MT. ‘23/24 canola ending stocks were left at a low 600k MT.

Given that in the new crop year export volumes will be heavily dependent on China (the EU has been buying Ukrainian and Australian rapeseed/ canola), we think that the export number is too aggressive. Mercantile is currently using a much more cautious 8.5 million MT of canola exports for ‘23/24, leaving ending stocks at 1.1 million MT.