Canola Market Outlook: September 5, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans - Through the month of August, November futures gained 37 cents, though the contract ended last week with an 18-cent loss.

US crop ratings had only a 1% reduction in crop condition ratings to 58% Gd/Exc (57% last year), despite ongoing US heat and dryness.

On the buying side, the trade continues to debate the implications of weak economic data in China against the short-term stimulus efforts.

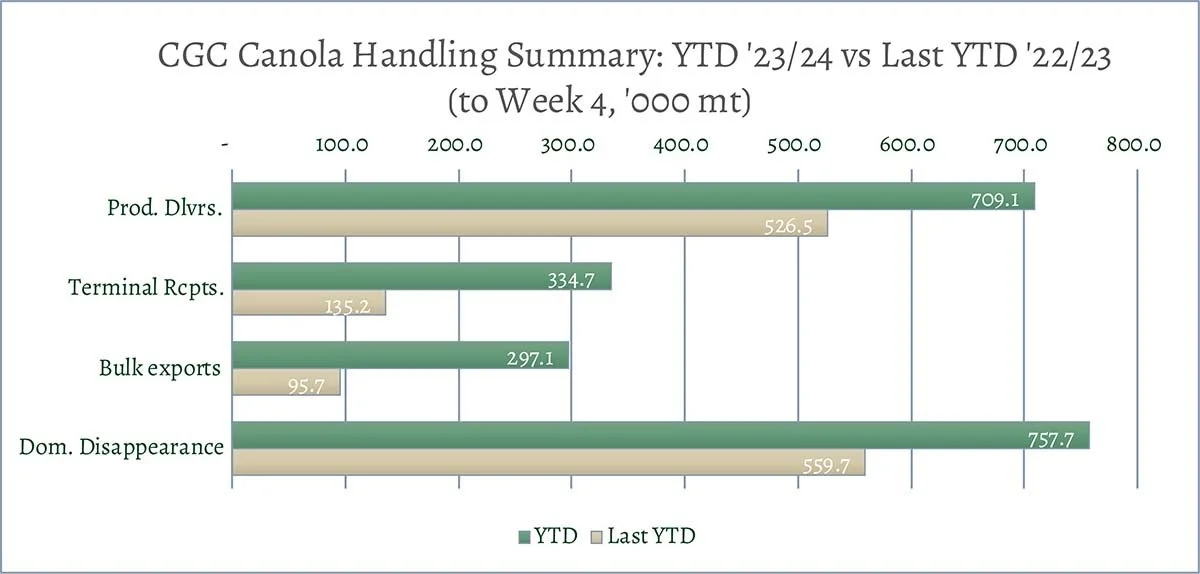

Canola: YTD canola disappearance (exports plus crush) into week 4 of the crop year amounted to 1 million MT compared to 655k MT last year and is up 61% on last year.

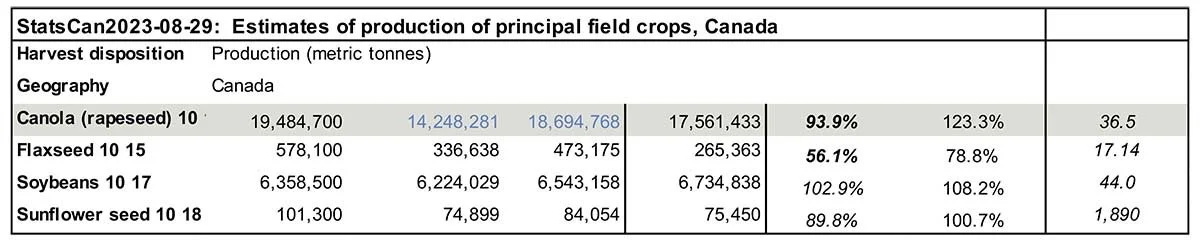

The StatsCan estimate for canola production came in last week at 17.56 mln mt and implies an average yield of 36.5 bu/acre. If correct, this will represent a 6% reduction in canola production (-1.13 million MT).

We think that $18.00/ bu (+) prices by crushers are attractive, especially if you need cash. Otherwise, you might wait with additional sales while yields remain in question.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans closed mixed last week ahead of a long weekend and were down again this Tuesday. Through the month of August, November futures gained 37 cents, though the contract ended last week with an 18-cent loss. Sept soybean oil futures had triple digit gains (+1.03) and Dec was up 81 cents. The Funds are long the entire soy complex: +85k contracts soybeans, +73k contracts meal and +59.5k contracts of oil.

US crop ratings had only a 1% reduction in crop condition ratings to 58% Gd/Exc (57% last year), despite ongoing US heat and dryness. Brazilian weather remains problematic for early soybean planting.

In international business, Brazilian sales to China remain strong and premiums firm. Dalian soybean meal values continued the positive trajectory and traded to fresh highs for the quarter. Matif in Europe was mixed all week, ending little changed as strong vegoil competition in the export market capped gains, while the low relative value limits weakness.

Market outlook

Following an erratic growing season, there still seems to be a wide range of production estimates for the US and the market has little choice but to wait until actual yield results emerge. There also already is discussion about next season’s acreage in the US and what, if any, recovery will be seen in Argentina. On the buying side, the trade continues to debate the implications of weak economic data in China against the short-term stimulus efforts and the long-term aging demographics. Bursa palm oil is starting the week on a negative footing and is retesting last week’s lows with Malaysian palm oil exports expected to decline nearly 2% for August.

The next USDA-WASDE report is due on Sept. 12th.

Canola Market

Canola usage

The Canadian Grain Commission reported that during week 4 of the new crop year, growers delivered 184 thousand MT of canola into primary elevators, exports were at a tiny 1,200 MT, while the domestic disappearance amounted to 173 thousand MT.

YTD canola disappearance into week 4 of the crop year amounted to 1 million MT compared to 655k MT last year and is up 61% on last year.

Visible stocks were at 689 thousand MT, with 266 thousand MT in primary elevators, 184 thousand MT in process elevators, 170 thousand MT in Vancouver/ Prince Rupert, and 69 thousand MT in eastern ports.

Current market situation

Only 10% of canola in SK had been combined by late last week, which reflects roughly average progress for this date. 3.5% of the AB canola crop were in. AB soil moisture ratings have decreased last week due to ongoing dryness in the South and Central regions, while there is a growing percentage of the northern regions with excessive moisture ratings. The percentage of the province with surface moisture (sub-surface in brackets) rated good to excellent is 37% (38%).

The StatsCan estimate for canola production came in last week at 17.56 mln mt, close to our number and just slightly higher than the pre-report trade estimate at 17.4 mln mt. The StatsCan production number implies an average yield of 36.5 bu/acre. If correct, this will represent a 6% reduction in canola production (-1.13 million MT). The StatsCan Canadian canola crop estimate is 1.4 million mt below the current USDA estimate.

Also of note is the fact that StatsCan retroactively increased the previous canola production numbers for both 2021 and 2022 by 1.012 mln mt! StatsCan had materially underestimated the production for both years, and a correction was necessary to make the canola balance sheets balance! Both numbers are now close to our earlier numbers for those years.

Week 4 exports of canola were virtually nonexistent, for a YTD total of 297k mt, compared to 96k mt last year. We discussed previously that we are concerned about export demand for canola by China this year, and the numbers seem to bear out that there are few forward sales to that destination for the fall.

Market outlook

Nov. ICE canola futures closed at $811.40 on Friday, up 10c/mt on the week. The strong soybean oil performance on Friday was supportive as the rally crude oil prices spilled over into vegetable oils. Matif rapeseed has been choppy all week and is falling into a €460-480 range, but it closed up €4.75/mt on Friday at €473.50/mt. The main issues facing the EU crusher is vegoil competition by the Ukraine and Russia, offsetting the lower supplies of Ukrainian oilseeds. ICE canola is also caught in a range ($800-820) with the pending harvest pressure capping gains, while the strong domestic crush is limiting weakness.

Action

Crushers remain the best buyers at this time. We think that $18.00/ bu (+) prices by crushers are attractive, especially if you need cash. Otherwise, you might wait with additional sales while yields remain in question.

Canola – Topics of Interest

Snapshot: German Rapeseed Imports in 2022/23

In 2022/23, Germany imported around 5.74 million tonnes of rapeseed, 2% more than in the previous marketing season, despite the bigger 2022 rapeseed crop.

Australia remained the number one supplier, shipping 1.4 million tonnes. Still, at 3.4 million tonnes, the majority of imports came from EU countries. However, this figure could be misleading, because according to official statistics, Belgium delivered about 323,000 tonnes to German oil mills and traders despite a national harvest of only 32,000 tonnes. As in previous years, the largest share of these shipments was probably Ukrainian commodity since Ghent is a delivery location for contract commodity at the Paris stock exchange. From there, the deliveries are directly transported on to the Rhine River. (Canada also shipped a small tonnage (23.4k MT) to Belgium in Oct. 22, so a small portion of the Belgium exports might have come from Canada.) Unlike in previous marketing years, imports from the Netherlands to Germany did not play any significant role in 2022/23.

France supplied around 1.1 million tonnes of rapeseed to Germany, and this tonnage was likely produced in France. Pertaining to rapeseed imported from Poland, the Baltic countries, Bulgaria and Romania, the origins are not always evident from the foreign trade figures. Most of the rapeseed from Poland was likely rapeseed from the Ukraine. The same applies to the Baltic rim. About 705,000 tonnes came from Ukraine itself, which translates to an increase of about 90,000 tonnes.