Canola Market Outlook: September 25, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans - The US soybean complex was down sharply across the board.

US export sales at 434k MT were well below trade estimates, leaving the early season pace well behind last year’s.

Acc. to Chinese customs data, soybeans sourced from Brazil increased by 45% this August over Aug. ‘22, while US sourced soybeans showed a 58% drop from Aug ’22.

In our view, soybeans look vulnerable to a sell off.

Canola: YTD canola disappearance into week 7 of the crop year amounted to 1.8 million MT compared to 1.3 million MT last year and is up 39% on last year.

The oil share has become less in the crush, other countries’ rapeseed is cheaper, and China is buying less canola this year for now. All of these factors weaken canola prices.

We would be happy to close out the season selling cash at $16.00/bu. - There is no hurry to do so.

Oilseed Market Backdrop

Soybeans

Current market situation

The US soybean complex was down sharply across the board. CBOT Nov. soybeans fell 44c/bu over the week soybean meal was down 5.40 for the week, and soybean oil showed a net 253-point loss for the October contract. US soybean crop ratings stabilized at 52% Good to Excellent against 55% last year. 54% of the crop is dropping leaves ahead of a 5-year average 43%, with the harvest 5% complete.

The CFTC weekly Commitment of Traders update showed managed money 46k contracts net long in soybeans Sept.19. That was a 28k contract weaker net long through the week given major long liquidation.

US export sales at 434k MT were well below trade estimates, leaving the early season pace well behind last year’s. The combination of a strong program from Brazil, a strong US dollar and the low Mississippi water levels have all impacted early season export demand.

Chinese import data showed that 9.09 million MT of soybeans were imported in August. That was down 3% from 9.36 million MT during Aug ’22. But importantly, soybeans sourced from Brazil increased by 45%, reflecting their record crop and record export program. China Customs data showed the US as the origin for just 120k MT of the total for the month, a 58% drop from Aug ’22.

The International Grains Council (IGC) released their updated 2023/24 soybean outlook. Production fell 2 million MT to 396 million MT but is still up 29 million MT from 367 million MT last season. Carryout got 2 million MT tighter as well, now to 62 million MT.

In Brazil, CONAB put the new crop Brazilian soybean area at 45.3 million hectares, up from 44.1 million hectares last harvest. This compares to the USDA’s 45.6 million hectares, up from 43.9 million hectares. CONAB estimated the crop at 162.4 million MT (154.6 million MT this year) against the USDA’s 163 million MT and 156 million MT, respectively.

Market outlook

In our opinion, soybeans look vulnerable to a sell off.

Canola Market

Canola usage

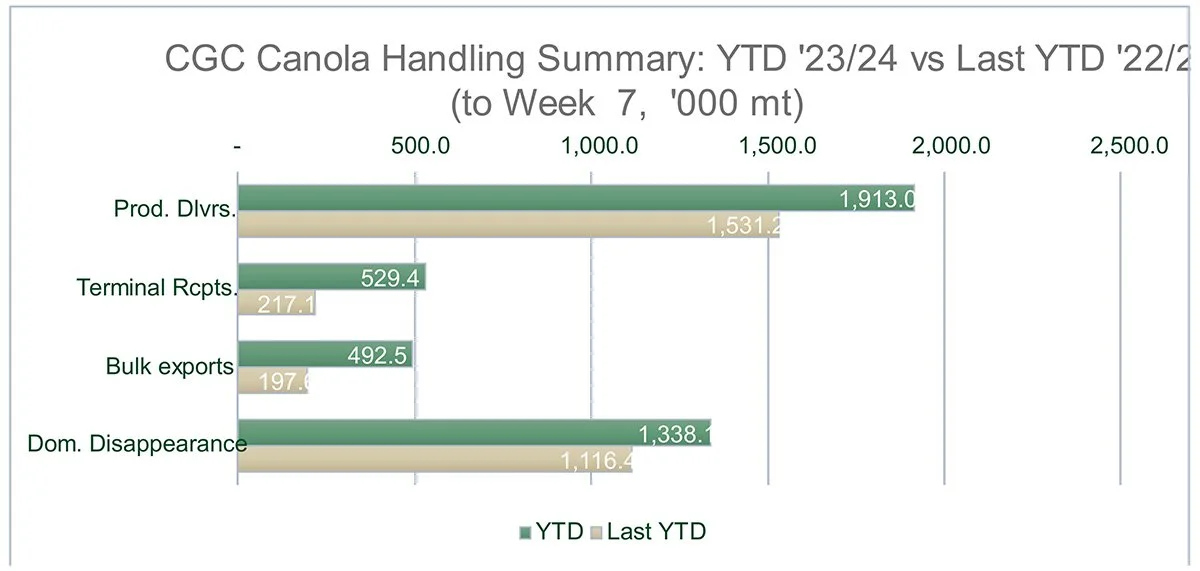

The Canadian Grain Commission reported that during week 7 of the new crop year, growers delivered a big 554 thousand MT of canola into primary elevators, exports were very small again at 27 thousand MT, while the domestic disappearance amounted to 194 thousand MT.

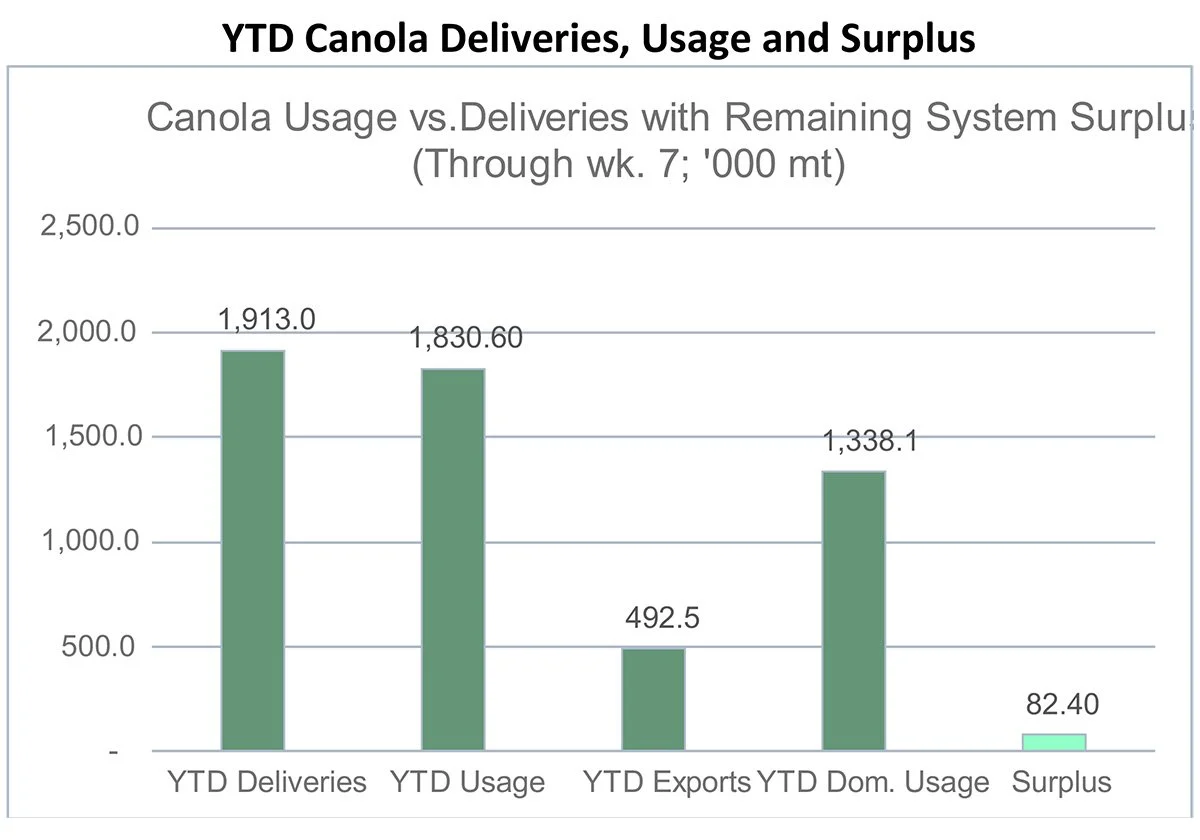

YTD canola disappearance into week 7 of the crop year amounted to 1.8 million MT compared to 1.3 million MT last year and is up 39% on last year.

Visible stocks increased to 1.1 million MT, with 700 thousand MT in primary elevators, 172 thousand MT in process elevators, 158 thousand MT in Vancouver/ Prince Rupert, and 71 thousand MT in eastern ports.

Current market situation

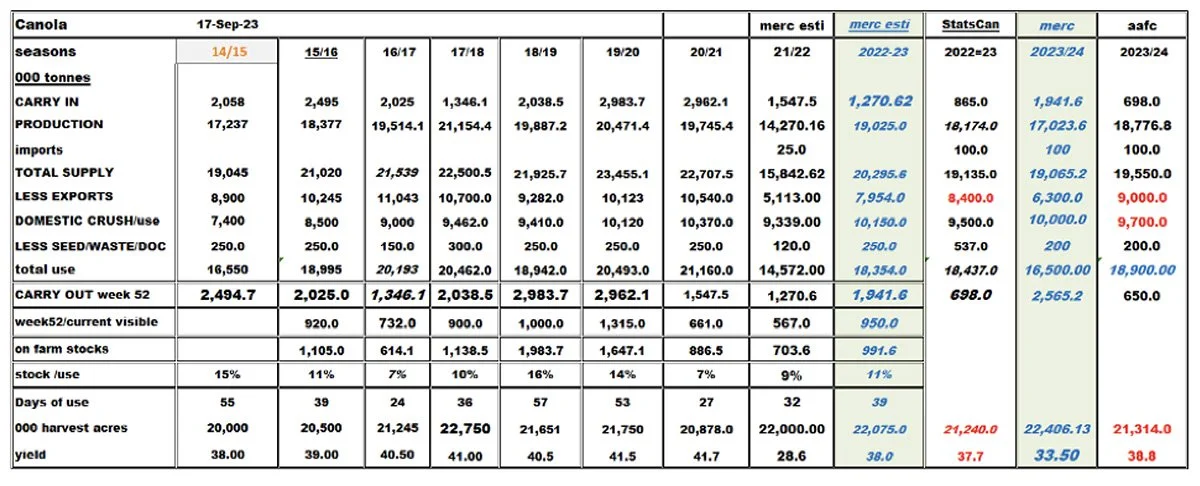

The oil share has become less in the crush, other countries’ rapeseed is cheaper, and China is buying less canola this year for now. All of these factors weaken canola prices.

Vegetable oils in Dalian, China, are lower with soybean oil making a 6-week low close, and rapeseed oil heading for a 12-week low. Bursa Malaysian palm oil was caught in the same negative undercurrent and ended the week lingering around recent support levels.

In Europe, Matif rapeseed had an exceptionally choppy week with crush largely covered for the fall months. With Ukrainian rapeseed offered at negative basis delivered to German crushers, the prospects for November futures do not look great either. The one positive is that crush margins are good, which in time should draw crushers back into the market for Q1-Q2.

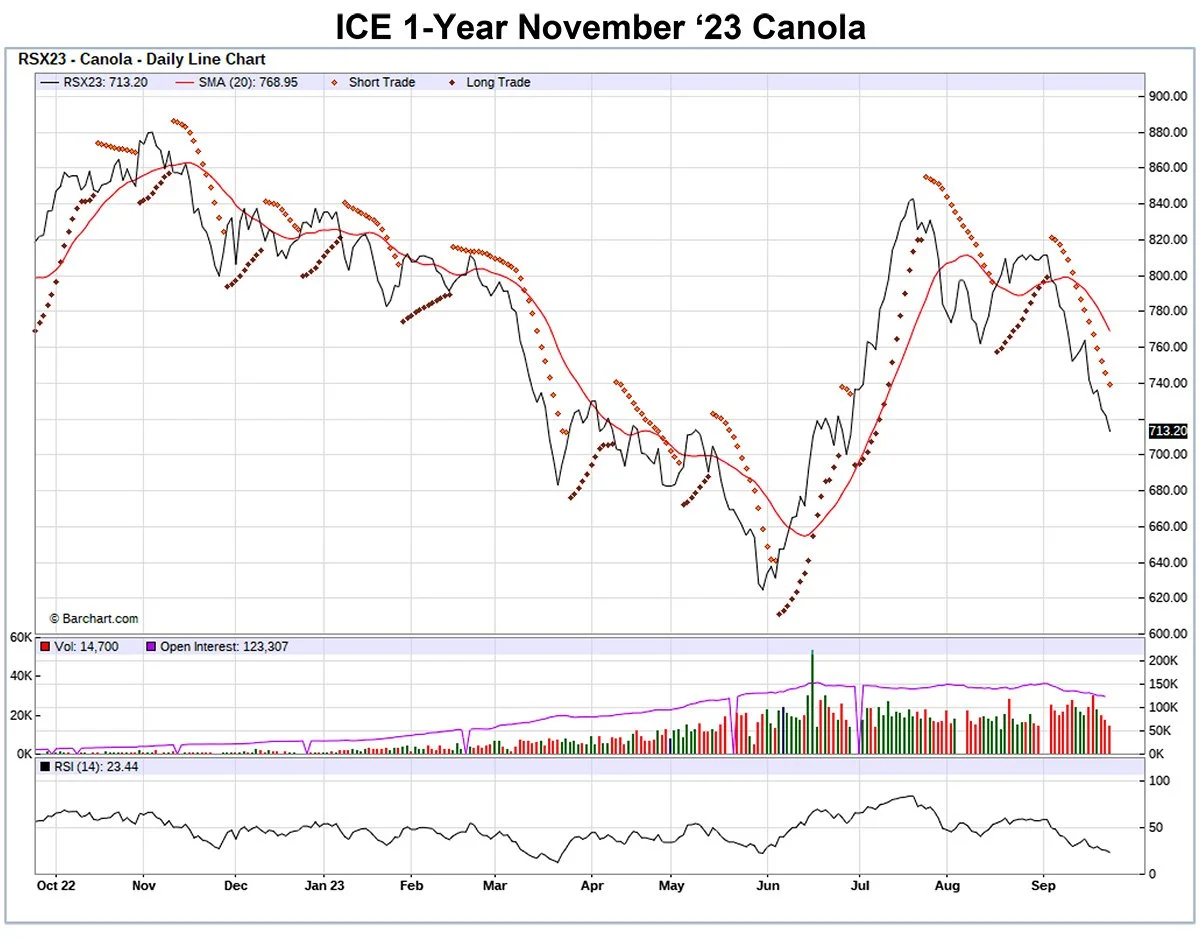

Canola followed the market lower and is trading at 3-months lows with the harvest generally perceived as ‘better than expected’. However, we expect our final yield to be lower than other estimates. But exports need to increase considerably to support this market.

Market outlook

With soybeans facing a potential sell-off and canola export sales very slow, we do not see sustained strength develop for canola.

Action

We would be happy to close out the season selling cash at $16.00/bu. - There is no hurry to do so as the market will remain choppy.

Canola – Topics of Interest

International Grains Council (IGC) on Global Soybeans, Sept. 21, 2023

In their September report, the IGC lowered global soybean production by 2 million MT to 396 million MT, while leaving total consumption unchanged from last month at 1388 million MT.

Total ending stocks also dropped by 2 million MT from last month’s estimate to 62 million MT, which still is 8 million MT (15%) bigger than thew estimated ‘22/23 ending stocks of 54 million MT.

Trade of soybeans was lowered by 2 million MT from August to 169 million MT.