Canola Market Outlook: September 23, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: CBOT soybeans were higher despite a sharp drop in the US August crush and exports still running behind the USDA forecast, as weekly sales hit a 10-month high.

Soybean oil was also higher, with NOPA August stocks at 20-year low and export sales near a 3-year high.

Chinese demand, US yields, South American weather and poor oilseed crops in Europe remain the cornerstones of the world oilseed complex.

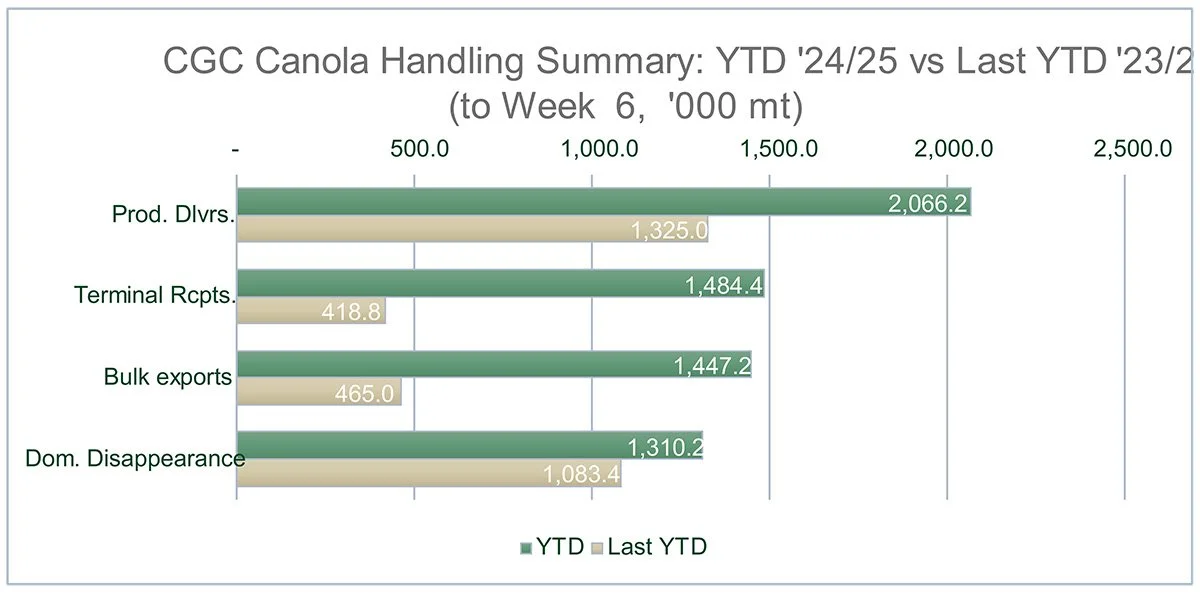

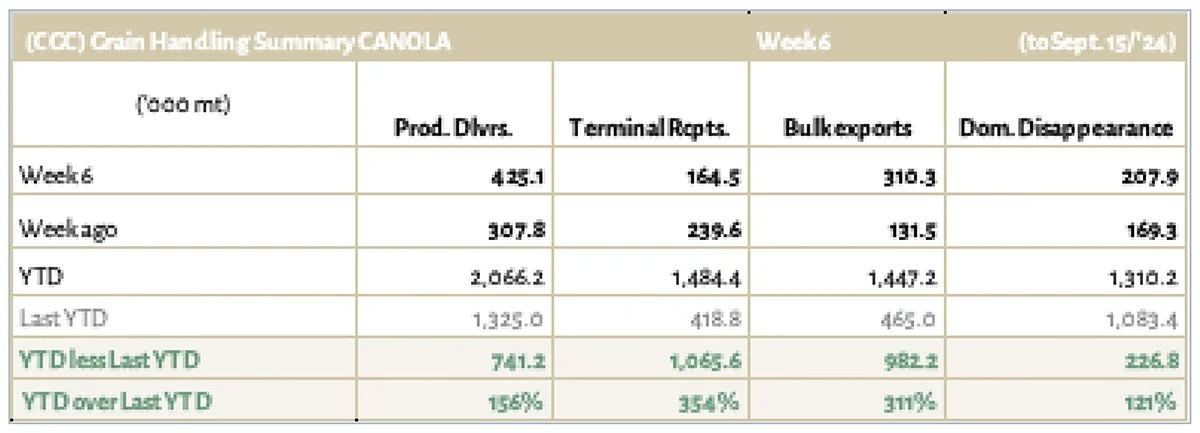

Canola: YTD total canola disappearance into week 6 of the crop year amounts to 2.8 million MT compared to 1.6 million MT last year and is up 78% on last year.

SK Ag put the percentage of canola combined in SK at 47% as of Sept. 16th, with another 18% sitting in swaths. AB Ag showed 31% of canola harvested (Sept. 17th); there was no update on yields.

Statistics Canada lowered their ’24/25 production canola numbers to 18.9 million MT (19.5 million MT earlier), slightly below last year’s 19.2 million MT.

We remain negative on China banning canola imports (i.e., we do not expect China to target canola directly), and canola is now competitive into the EU.

Lots of crosswinds in this oilseed market, but we expect prices to improve when canola starts moving into the EU.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans were higher, with Nov. soybeans managing to close 5 ¾ cents higher for the week despite a sharp drop in the August NOPA crush and exports still running behind the USDA forecast. Weekly sales hit a 10-month high fueled by renewed Chinese demand. And soybean oil was also higher, with NOPA August stocks at 20-year low and export sales near a 3-year high.

Pertaining to the US crop, Gd/Exc ratings fell 1 point to 64%, and harvest was 6% complete against 3% average. In Brazil, CONAB estimated Brazil's ‘24/25 crop at 166.3 million MT, a new record, up 13% on last year, but below the USDA's 169 million MT. Dryness continued across Brazil.

Regarding products, soybean oil premiums were choppy as India greatly increased import tariffs on edible oils (to support their farmers), creating uncertainty for world vegoil demand. [The Indian import tax on edible oils was raised by 20%; crude edible oils went to a 27.5% tax vs 5.5.% earlier; refined oils went to 35.75% vs 13.75% earlier.] Still, Asian markets were all higher with Chinese palm oil the best performer at 5-month highs.

Market outlook

Chinese demand, US yields, South American weather and poor oilseed crops in Europe remain the cornerstones of the world oilseed complex.

Canola Market

Canola usage

In week 6 of the crop year, growers delivered a big 425 thousand MT of canola into primary elevators, exports were at a good 310 thousand MT, while domestic disappearance amounted to 208 thousand MT.

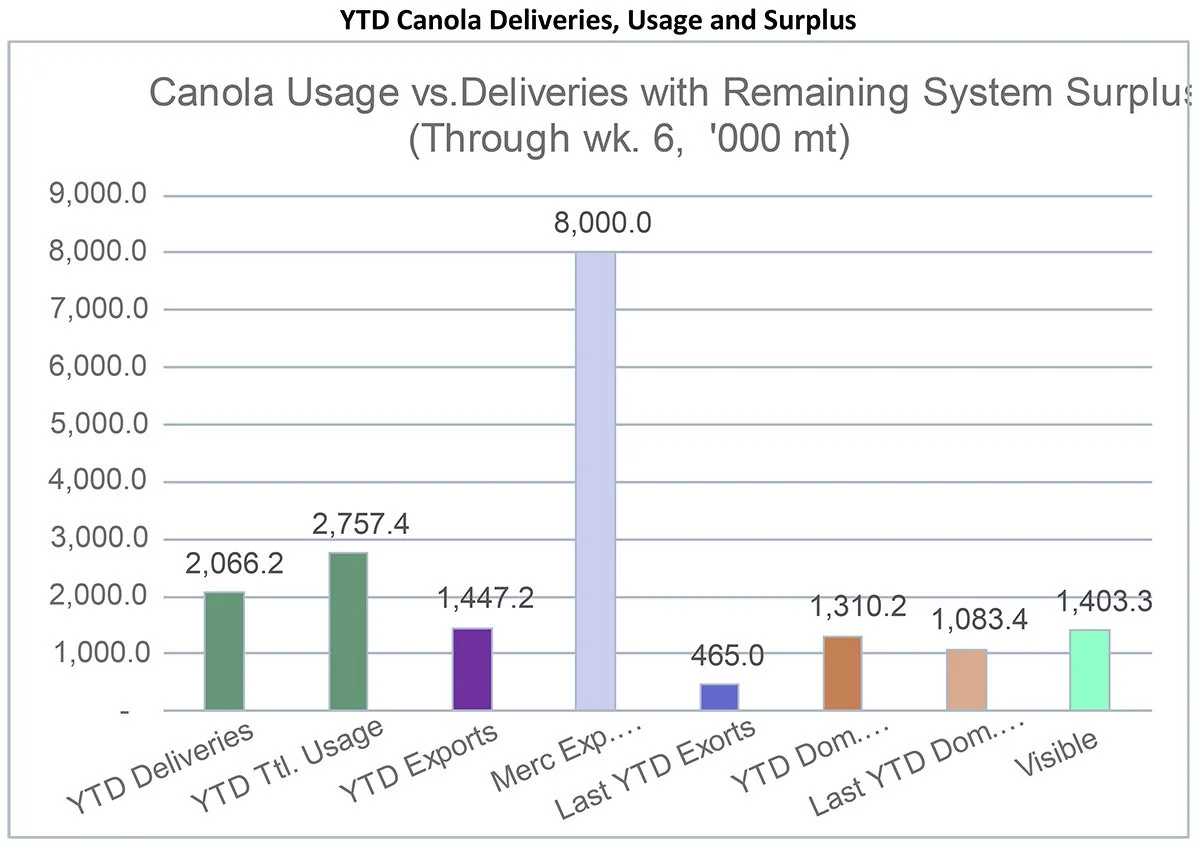

YTD total canola disappearance into week 6 of the crop year amounts to 2.8 million MT compared to 1.6 million MT last year and is up 78% on last year.

Visible stocks settled at 1.4 million MT, with 768k MT in primary elevators, 171 thousand MT in process elevators, 246 thousand MT in Vancouver/ Prince Rupert, and 219 thousand MT in eastern ports.

Current market situation

SK Ag put the percentage of canola combined in SK at 47% as of Sept. 16th, with another 18% sitting in swaths. AB Ag showed 31% of canola harvested (Sept. 17th); there was no update on yields.

Again, in their model-based report, Statistics Canada (STC) lowered their production canola numbers to 18.9 million MT (19.5 million MT earlier), and flaxseed production to 265k MT (300k MT earlier). The canola number is slightly below last year’s 19.2 million MT.

We note that stocks in Thunder Bay are growing this is because canola is now competitive into the EU. Matif rapeseed in Europe went up by €6/MT, with increasing pressure from member states to get Brussels to delay the implementation of EUDR (European Union Deforestation Regulation), as 2025 meal positions still hold a €50 premium over 2024.

We remain negative on China banning canola imports (i.e., we do not expect China to target canola directly). Australia has now begun an anti-dumping investigation into Chinese glass, which could put them on a path towards reciprocal trade investigations/ restrictions (but Black Sea crushers are said to have eyes on Australian rapeseed imports because of the low sunflower seed production). China has also announced sanctions and asset seizures against nine US companies that are selling arms to Taiwan.

Market outlook

Lots of crosswinds in this oilseed market as well. The threat of lost business to China still looms over the market, but we feel that canola is well priced against soybeans, and will buy business, and and crushers are still making good margins.

Action

We expect prices to improve when canola moves to the EU.

Canola – Topics of Interest

USDA estimates on sunflower seed production:

USDA currently forecasts the ‘24/25 global production of sunflower seeds at 50.6 million MT, significantly lower than the August forecast of 52.5 million MT. This would represent the smallest crop in four years. Supply is seen to drop 5.3 million MT compared to the previous year.

The revision is mainly due to anticipated smaller crops in the EU-27 and the Ukraine. For the EU, the USDA projects production at 9.5 million MT, around 650k MT lower than the previous estimate and 500k MT less than the 2023 crop due to lower yields. Ukrainian production is expected to reach 12.5 million MT, one million MT less than in the previous month due to persistent drought and heat waves over the past few months.

The forecast for Russian production remained unchanged from August at 16 million MT, only around 1.1 million MT less than in 2023/24. This means that the country is set to remain the world's biggest supplier of sunflower seeds.