Canola Market Outlook: October 30, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: Soybean futures were range bound for most of the week; soybean meal broke through its prior highs and traded into the $440’s for the first time since August, while soybean oil fell to the lowest price since June.

The US and China signed a frame agreement for 3-5 million MT of soybean sales.

Longer term, Argentine and Brazilian crop prospects and, Chinese demand levels are key.

Canola: Looking at our year-to-date export performance, we need to improve exports to achieve our export projection of 8 million tonnes, or the carryover will become burdensome.

While the year-to-date domestic usage is excellent, it is not enough to compensate for the shortfall in exports.

We remain 80% sold canola.

Oilseed Market Backdrop

Soybeans

Current market situation

Soybean futures were range bound for most of the week; soybean meal broke through its prior highs and traded into the $440’s for the first time since August, while soybean oil fell to the lowest price since June.

The meal price gains incurred resistance at prior contract highs, but the reversal in meal allowed soybean oil to recover and return to above 52c. The collapse in oil share has returned prices to the long-term average, which the biodiesel bulls might see as good value.

After finding support at last month’s lows, markets in Asia have seen a decent recovery in vegoil prices. In fact, Bursa palm oil futures took back the losses from earlier in the week. Chinese soybean meal was also stronger despite a reported decline in their total pig herd. (The Chinese Ag Ministry reported 0.4% decline in the pig herd, and a 2.8% decline in the sow herd).

In S America, the meal market is concerned about issues with Brazilian logistics and the political/economic and production collapse Argentina has suffered in recent weeks and months.

In the cash markets, the US and China signed a frame agreement for 3-5 million MT of soybean sales. So, it would not be surprising to see strong weekly sales numbers in the coming weeks.

Market outlook

Longer term, Argentine and Brazilian crop prospects and, of course, Chinese demand levels are key.

Canola Market

Canola usage

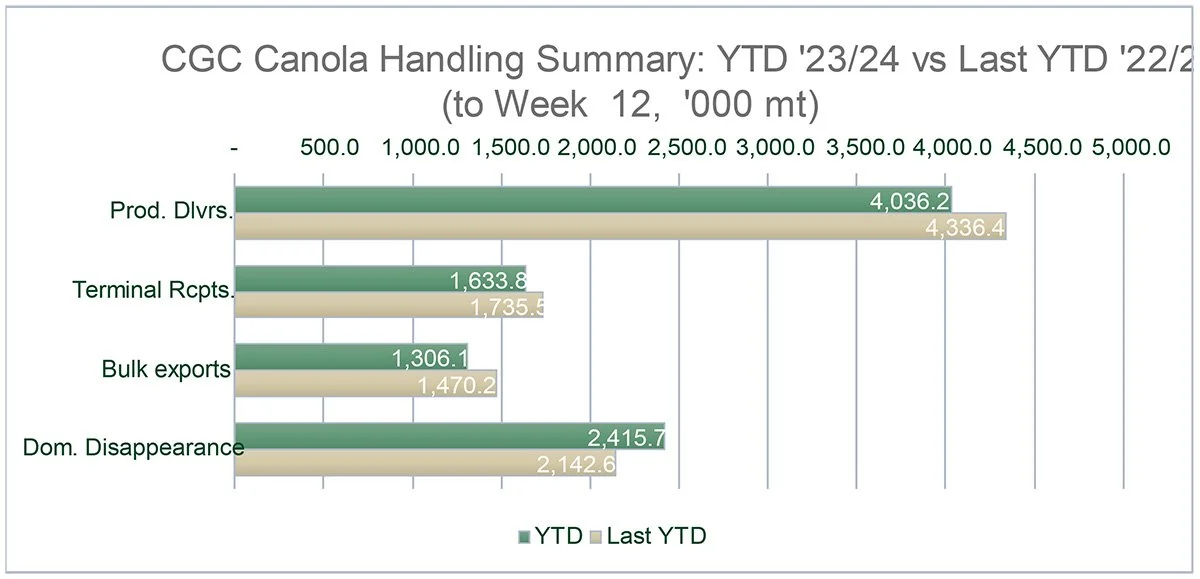

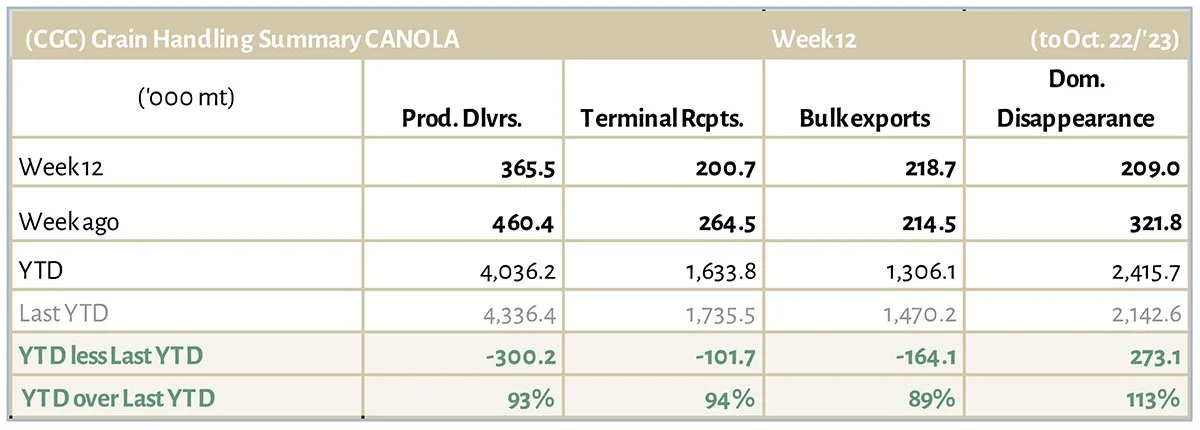

The Canadian Grain Commission reported that during week 12 of the crop year, growers delivered 366 thousand MT of canola into primary elevators, exports were at 219 thousand MT, while the domestic disappearance showed 209 thousand MT.

YTD canola disappearance into week 12 of the crop year amounts to 3.7 million MT compared to 3.6 million MT last year and is up 3% on last year.

Visible stocks were at 1.3 million MT, with 751 thousand MT in primary elevators, 189 thousand MT in process elevators, 251 thousand MT in Vancouver/ Prince Rupert, and 119 thousand MT in eastern ports.

Current market situation

Looking at our year-to-date export performance, we need to improve exports to achieve our export projection of 8 million tonnes, or the carryover will become burdensome. Extrapolating YTD exports to the whole year, would yield only 5.9 million MT, which would be a 26% shortfall to our target of 8 million MT (-2.1 million MT). And while the year-to-date domestic usage at 2.42 million MT (using weekly CGC numbers into week 12), is excellent, extrapolated to the whole year, it would exceed the 10 million MT target by 870k MT. This is not enough to compensate for the shortfall in exports.

Crush margins remain excellent, so we are not worried about crush, but achieving exports is going to be very difficult with less tonnage going to the EU.

Feb Matif rapeseed recovered from losses earlier in the week amidst slow oilseed imports. Indeed, total EU oilseed imports are down 30%, of which sunflower seeds are down 90% on last year (Jul-Jun).

ICE canola was under pressure for most of the week, following soybean oil and the ongoing debate over the size of the Canadian crop.

Market outlook

For oilseeds, South American weather and crops, and where China sources its soybeans, stand out as the key fundamental drivers. We still expect meal and oil to stay volatile.

We remain bearish on November canola futures.

Action

We remain 80% sold canola.

Canola – Topics of Interest

Statistics Canada: Aug./ Sept. ‘23 Canola Crush Summary

According to StatsCan, Canada crushed an excellent 922k MT of canola during Sept. 2023. This is the highest canola crush achieved in the month of September so far. Given data for just the first two months of the crop year indicates an annual crush of 10.5 million MT if the crush pace remains as high.

AAFC October Balance Sheet for Canola:

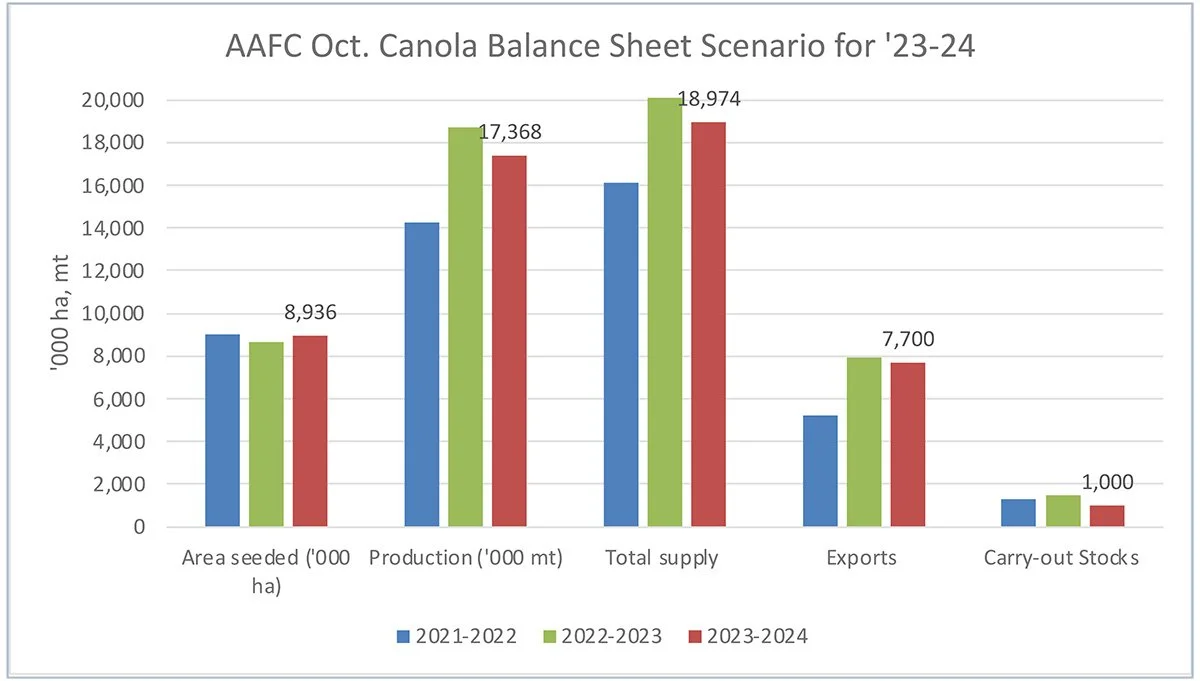

AAFC made no changes to their earlier canola balance sheet in October. AAFC is using a, 17.4 million MT production and 19 million MT supply for ’23. The agency projects exports for this crop year at 7.7 million MT and domestic crush at 10 million MT. 2023/24 ending stocks in this scenario amount to 1 million MT, down from last year’s 1.5 million MT.

As discussed earlier, the Mercantile production and supply are somewhat higher at 17.8 and 19.8 million MT, respectively. Exports are currently projected at 8 million MT (which is ambitious in the current environment), and crush at 10 million MT, resulting in a 1.6 million MT carry-out.