Canola Market Outlook: October 15, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: CBOT soybeans closed out Friday’s session with contracts down 9 to 12 cents across the board, and November added to last week’s losses, down another 32 ¼ cents this week.

Ahead of the USDA estimate on harvest, soybeans were down due to hedge pressure (harvest 47% complete vs. 34% average), reports of big yields, exports that are lagging USDA projections, and weak crude oil.

The market reaction to the monthly WASDE report was to maintain the downward trajectory with a post-report 10c/bu drop in soybeans.

Given the 34 million MT world production increase over last year and a 22 million MT hike in stocks, soybeans will go lower unless South American weather does not cooperate.

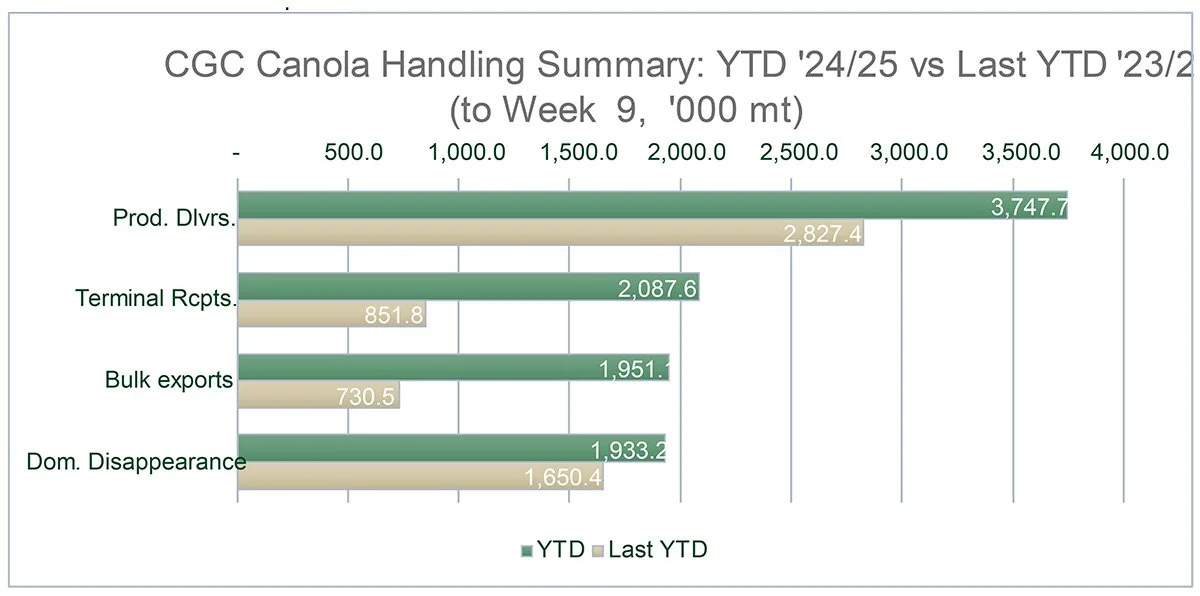

Canola: YTD total canola disappearance into week 9 of the crop year amounts to 3.9 million MT compared to 2.4 million MT last year and is up 63% on last year.

Domestic crush margins remain good, but it is not as easy as last month to generate exports as margins have narrowed to soybeans.

After early weakness, Matif rapeseed closed again above €500/MT as domestic vegetable oil values continue to rise.

However, Canadian canola is down sharply and could be retesting the C$600/MT level with the Matif/ICE Canola spread having widened to a fresh high of €84/tonne.

We would make sure that canola sales are equal to 25 percent sold down to current levels.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans closed out Friday’s session with contracts down 9 to 12 cents across the board, and November added to last week’s losses, down another 32 ¼ cents this week.

Ahead of the USDA estimate on harvest, soybeans were down due to hedge pressure (harvest 47% complete vs. 34% average), reports of big yields, exports that are lagging USDA projections, and weak crude oil.

USDA Crop Production data pegged a slightly lower US soybean yield on Friday at 53.1 bu/ac, down 0.1 from last month. The US production total dropped by 4 million bu to 4.582 billion bushels. 2024/25 US stocks total came to 550 million bu, unchanged from last month.

Regarding global numbers, the monthly WASDE showed no changes to the S American production totals. World ending stocks were up a slight 0.07 million MT to 134.65 million MT. - The market reaction to the report was to maintain the downward trajectory with a post-report 10c/bu drop in soybeans.

Managed money trimmed another 13k contracts from their net short in soybeans futures and options. They held a net short of 22k contracts as of October 8. Commercials added another 10k contracts to their net short, at 40k contracts.

In Brazil, rains should help encourage a brisk planting expansion this week. However, at 8% complete, seeding progress in Mato Grosso remains well behind the 35% of last year. The Brazilian market is becoming increasingly internally focused as biodiesel demand rises.

Market outlook

Given the 34 million MT world production increase over last year and a 22 million MT hike in stocks, soybeans will go lower unless South American weather does not cooperate.

Canola Market

Canola usage

In week 9 of the crop year, growers delivered 474 thousand MT of canola into primary elevators, exports were at 161 thousand MT, while domestic disappearance amounted to 165 thousand MT.

YTD total canola disappearance into week 9 of the crop year amounts to 3.9 million MT compared to 2.4 million MT last year and is up 63% on last year.

Visible stocks settled at an increased 1.63 million MT, with 1.05 million MT in primary elevators, 204 thousand MT in process elevators, 176 thousand MT in Vancouver/ Prince Rupert, and 199 thousand MT in eastern ports.

Current market situation

SK Ag said that 94% of SK canola was combined as of Oct. 7, with another 5% ready to combine. AB Ag showed 83% of canola harvested. AB Ag increased their yield estimate last week by 0.3 bu/acre to 32.2 bu/acre. MB Ag showed canola 94% harvested, with “average yields ranging from 30 to 45 bu/acre”. – FWIW, the latest provincial yields only add to a 16.8 million MT canola production. StatsCan is using 19 million MT, and Mercantile 19.5 million MT.

According to the latest USDA data, US canola production is expected to reach a record 2.2 million MT in the United States, up 18% from the 2023 revised production.

On the usage side in Canada, domestic crush margins remain good, but it is not as easy as last month to generate exports, as margins have narrowed to soybeans. Crushers are storing grain in third party storage as margins remain good at the large daily capacity plants. Exports remain well above last year, but they will need to stay in the 170k MT plus weekly average to lower the carry-in.

We do note that 64,200 MT of the week 9 exports were lifted in the port of Thunder Bay and may be moving towards Europe.

In Europe, Matif rapeseed traded over €500/MT last week for the first time since July, and vegetable oils hit new highs in Europe due to disappointing sunflower seed crops. This Tuesday after early weakness, Matif rapeseed closed again above €500/MT as domestic vegetable oil values continue to rise, especially for sunflower oil, which reached 2-year highs at around US$1,240 for nearby positions. Poor sunflower seed harvests in central/E EU and delays to French field work due to rains are providing support following a poor rapeseed harvest. However, Canadian canola is down sharply and could be retesting the C$600/MT level with the Matif/ICE Canola spread having widened to a fresh high of €84/tonne.

Market outlook

Given the 22 million MT hike in global soybean stocks over last year’s, soybeans are now leading oilseeds lower. Canola is having to fight harder for exports, and they will need to stay in the 170k MT plus weekly average to lower the carry-in.

Action

We would make sure that canola sales are equal to 25 percent sold down to current levels.

Canola – Topics of Interest

Statistics Canada – August ‘24 canola export numbers by destination:

Canada exported a very good 979k MT of canola during August ’24 compared to 416k MT in August ’23. These were the highest August canola exports recorded to date.

China was by far the biggest destination, taking 738k MT during August. The UAE (84k MT), Mexico (71k MT), Japan (61k MT), and the USA (19k MT) were the other destinations.

USDA – EU Rapeseed production

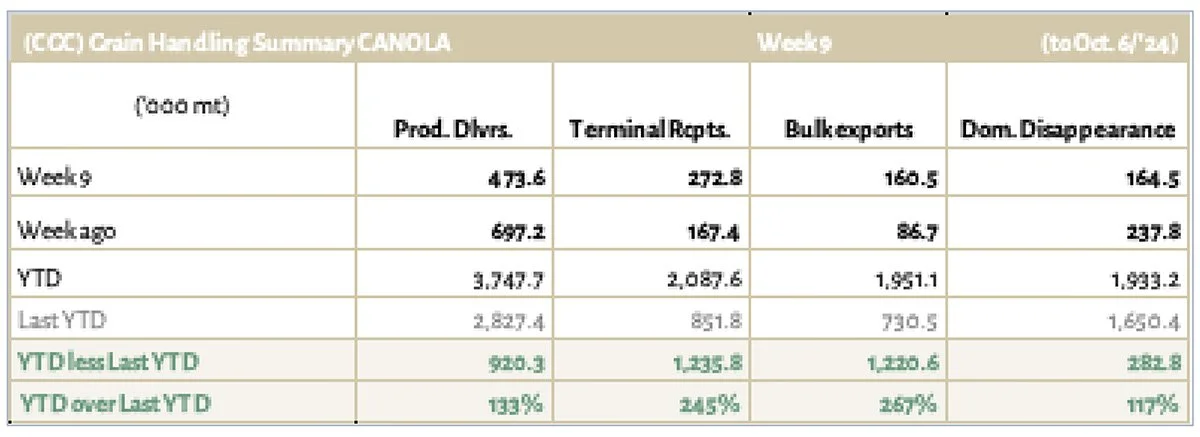

According to the latest USDA numbers, the EU rapeseed production for 2024/25 is estimated at 17.5 million MT, down 200k MT from last month, and down 2.5 million MT (13%) from last year. Yield was estimated at 3.06 MT/ha, compared 3.21 MT/ha last year.

Excessive rainfall early in the season was particularly concentrated in the EU’s rapeseed belt in the northwest, including the largest producers France and Germany.

The battle with pests, without the use of effective yet banned neonicotinoid products, also continues to be an obstacle for achieving higher yields along with farmers’ desire to plant rapeseed. It remains, however, one of the best complementary crops for crop rotation with wheat in the region.

USDA – China Rapeseed production

Rapeseed production in China for marketing year 2024/25 was estimated at 15.8 million MT, up 200k MT (1%) from last month, but down 3 percent from last year.

Harvested area was estimated at 7.4 million hectares. Yield was estimated at 2.14 MT/ha up 1% from last month, up 2% from last year.