Canola Market Outlook: May 29, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans - CBOT soybean futures were showing double digit gains Friday across the front months after recovering from heavily oversold levels.

The July contract closed the week at a net 30 c/bu gain, but it still is 82 c/bu in the red for the month.

China continued to buy only South American origin product, while and ignoring USA origin oilseeds. Chinese demand is in question, with soymeal sales sharply lower amidst reports of fresh Covid cases.

The November soybean/corn ratio is low, so a long soybeans short corn is viable.

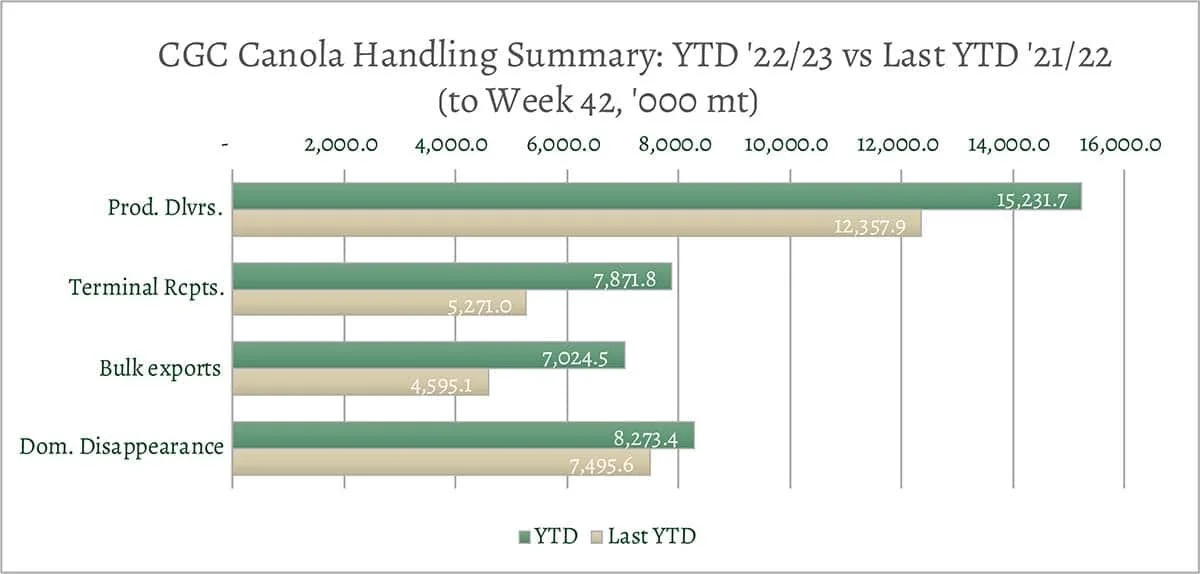

Canola – YTD canola disappearance into week 42 of the crop year is 27% above last year’s (drought-reduced) usage (+3.2 million MT) and amounted to 15.3 million MT compared to 12 million MT last year.

EU rapeseed has been very weak as rapeseed oil is no longer competitive as a fuel oil and the EU expects a much larger rapeseed crop.

Canola oil in China is not a priority, as China anticipates a larger domestic crop and weak soybean oil prices.

We don’t see very much in the market that is bullish, except that soybeans look underpriced to corn. It being a short week, we would leave canola alone.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybean futures were 1% to 1.5% higher on Friday, showing double digit gains across the front months after recovering from heavily oversold levels. The July contract closed the week at a net 30 c/bu gain, but it still is 82 c/bu in the red for the month. CBOT is closed this Monday for Memorial Day but will resume with the Monday night electronic session.

The weekly Commitment of Traders report had soybean specs exiting longs and adding shorts through the week that ended May 23rd. This lowered their net long position by 20k contracts to 4,147 contracts. Commercial soybean hedgers were adding long hedges to reduce their net short to 79k contracts.

The potential for a hot, dry forecast and a debt ceiling resolution were the primary limitations to near-term bearishness. Soybean meal remains the weakest leg despite good sales, while soybean oil moved higher.

In the markets, China continued to buy only South American origin product, while and ignoring USA origin oilseeds. Chinese demand is in question, with soymeal sales sharply lower amidst reports of fresh Covid cases. The November soybean/corn ratio is low, so a long soybeans short corn is viable.

US soybean plantings are 66% complete, with 36% emerged. The focus now shifts to germination, with 20% of the soybean area shown to be in drought areas (compared to 12% this time last year).

Market outlook

Malaysian palm oil is ending the week strongly and pulling further away from recent support lines.

The next few days are about the US weather and demand by China. Longer term over the coming weeks, the biofuels markets are likely to be very topical.

Canola Market

Canola usage

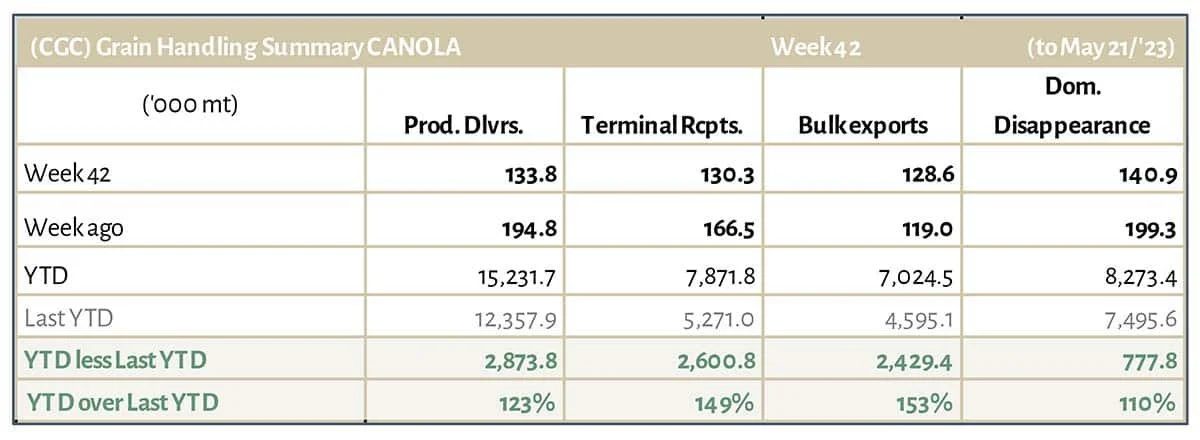

The Canadian Grain Commission reported that during week 42 of the crop year, growers delivered 134 thousand MT of canola into primary elevators, exports were better at 129k MT, while the domestic disappearance amounted to 141 thousand MT.

YTD canola disappearance into week 42 of the crop year is 27% above last year’s (drought-reduced) usage (+3.2 million MT) and amounted to 15.3 million MT compared to 12 million MT last year.

Visible stocks were at 965k MT, with 386 thousand MT in primary elevators, 178 thousand MT in process elevators, 203 thousand MT in Vancouver/ Prince Rupert, and 139 thousand MT in eastern ports.

Current market situation

Markets: EU rapeseed has been very weak as rapeseed oil is no longer competitive as a fuel oil and the EU expects a much larger rapeseed crop.

Canola oil in China is not a priority, as China anticipates a larger domestic crop and weak soybean oil prices.

Canadian production outlook: SK Ag assessed seeding progress for SK canola at 60% as of May 22nd, compared to the average 5-year progress at that date of 76%. AB Ag. reported seeding progress at 79% as of May 22nd. MB Ag put canola planting across the province at 40% complete, though that seems low.

Topsoil moisture ratings in SK have continued to drop in many regions. Province wide, crop land topsoil moisture is rated as 35% short to very short. The driest regions are the northwest, west-central and southwest. There was widespread thunderstorm activity across SK over the weekend.

AB soil moisture conditions are rated as 16% poor, 32% fair, 45% good, 7% excellent. Soil moisture conditions in MB are shown as optimal to wet.

AAFC issued their May balance sheets last week. For the ‘22/23 crop year, total domestic canola usage (industrial use plus feed, waste, dockage) was raised by 338k MT to 10.09 million MT. This lowered projected ‘22/23 ending stocks to 650k MT.

For the ‘23/24 crop year, AAFC reduced seeded acres by 148k acres to 21,597k acres (from 21,745k ac in April), 1% lower than last year’s canola acres. This reduced production by 100k MT to 18.4 million MT (18.5 million MT previously). AAFC left exports at 8.8 million MT and industrial use at 9.5 million MT. Combined with the lower carry-in, 2023/24 ending stocks fell to 600k MT (1.05 million MT previously). – Mercantile expects this year’s ending stocks at ~1.5 million MT, and projects ‘23/24 ending stocks at ~2 million MT.

EU biofuels: Last week, the EU Vegetable Oil and Protein Meal Industry Association (FEDIOL) posted a letter stating concerns regarding declining rapeseed and rapeseed oil values, which they linked to ‘abnormal market behaviour’. [See complete letter below.] FEDIOL highlighted the ‘magnitude of biodiesel import growth’ and questioned the ‘Authenticity of their classification as originating from waste streams’. Specifically, in April ‘23, 139k MT of Used Cooking Oil (UCO) was shipped from China to the EU (an annualised 1.7 million MT), and FEDIOL is conveying that some UCO/FAME (fatty acid methyl esters) entering the EU’s premium waste-based biofuel markets from abroad, is actually not waste. The question now is if and how the EU will act to prevent palm oil camouflaged as UCO from entering the EU. - How member states react to this could be either bullish rapeseed (i.e., if they choose to support domestic biodiesel and stop mis-represented imports), or disastrous (if they cannot see a way to regulate fat/oil supply chains and choose to wind down the industry).

Market outlook

The coming days will be about finishing seeding and early development of the Canadian and US crops. Medium term, the biofuels markets are likely to remain very topical.

Action

We don’t see very much in the market that is bullish, except that soybeans look underpriced to corn. It being a short week, we would leave canola alone.

Canola – Topics of Interest

StatsCan – April crush data

StatsCan reported the April canola crush at 886k MT, 4% lower than the March ’23 crush, but still 180k MT bigger than the crush last April. The YTD crush amounts to 7.5 million MT, with three months of the crop year remaining. Annualizing the Aug. ’22 to April ’23 crush results in a 10 million MT crush. – Mercantile is expecting the ‘22/23 crush to come in at 9.5 million MT.

FEDIOL letter on rapeseed markets: (Ref. 23PRESS233)

Rapeseed markets under abnormal pressure from waste biodiesel

Brussels, 25 May 2023 – FEDIOL, the vegetable oil and protein meal industry, draws attention to acute market developments due to massive increases of imported biodiesel which lead to devastating consequences for the Europe based feedstock up to EU farm level.

Imports of biofuels, classified as waste based, for example identified as HVO (hydro-treated vegetable oil) or FAME (fatty acid methyl esters) are taking place at such scale, that it has led to important disturbances in the EU markets for rapeseed methyl ester, and as a consequence also in the rapeseed and rapeseed oil markets.

Over the last 5 months, prices for rapeseed oil have dropped significantly by over 30 % to 800 €/ton, driving down physical rapeseed prices for spot delivery from 625 €/ton to 410 €/ton over the same period. Also, futures prices for new rapeseed crop, providing rapeseed farmers with a price indicator, have declined from about 600 € per ton early January 2023 to levels of about 400 € per ton by mid-May 2023. This will not only impact rapeseed farmers’ revenue, but also future planting decisions.

These trends cannot be explained by other market developments and are a signal that there is abnormal market behaviour. The magnitude of biodiesel imports’ growth is such that it raises question as to the authenticity of their classification as originating from waste streams. There is urgent need to investigate the legitimacy of these imports.

FEDIOL represents the interests of the European vegetable oil and protein meal industry. With over 180 facilities in Europe, the sector provides over 20.000 direct employments. Our members process approximately 55 million tonnes of basic products a year for the food and non-food markets. Oilseed crushing produces vegetable oils and protein meals as co-products. While vegetable oils are used for food and technical uses (pharmaceuticals, paints, detergents, biodiesel, etc.), protein meals are used to meet the increasing global demand for meat and protein. For further information, please contact Nathalie Lecocq, FEDIOL Director General, fediol@fediol.eu