Canola Market Outlook: June 10, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

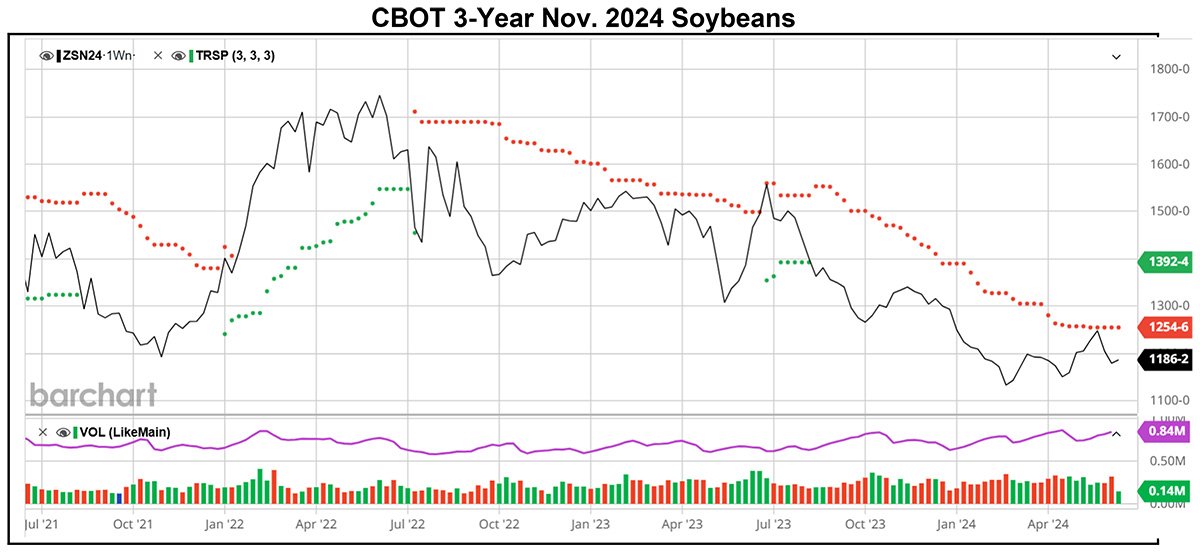

Last week the soya market was down following wheat it is slightly higher at the opening today

The soya premium has narrowed further to corn

USA weather should allow for a normal planting of soybeans

We have a new WASDE report this week where we expect more USA soybean acres

Canola: The YTD canola usage is 15.02 mln tonnes compared to 15.98 mln exports were lower

Growers delivered 439,000 tonnes of canola in week44

Canola exports were a good 238,000 tonnes in week 44

Nov canola is at $652.30 at present

Chinese lower hog numbers suggest lower protein imports

Oilseed Market Backdrop

Soybeans

Current market situation

Commitment of Traders data for the week ending June 4 showed the managed money speculative funds increasing their soybean net short by 45,524 contracts, taking it 59,741 contracts (futures + options). Trade estimates for Wednesday’s USDA reports average 346-350 million bushels for old crop US soybeans and 448-457 million for new crop. Traders expect no change in the 50 mln tonnes soybean number released in May for Argentine soybeans. The average trade guess for Brazilian soybeans is down 2.2 mln to 151.8 myn tonnes. There were no new sales to China and the total weekly sales only reported 78,000 tonnes.

Market outlook

The lack of sales, the favourable early growing conditions and reduced compound production make beans look weighty at the present ratio to feed grains.

Canola Market

Canola usage

In week 44 growers delivered a huge 438,000 tonnes weekly exports were shown to be a good 238,000 tonnes and domestic use 220,000 tonnes. The visible was 1.1 mln tonnes. We heard that one exporter who does not have a crush plant sold $50.00 over to China however his bids to farmers only reflected the low commercial crusher bid. Most large exporters that have crush plants continue basing grower bids that include margins for their plants. Effectively growers are not seeing the best seed values. Crush bids at Yorkton were lower.

Current market situation

We continue to believe that we remain in a weather market and would wait longer before making any new crop commitments. Weather in Europe continues to be poor and planting is delayed which may strengthen the canola market.

Market outlook

Action

We would leave canola alone while there are still problems in the EU.

Canola – Topics of Interest

Global vegetable oil production outlook:

According to USDA, the ‘24/25 global vegetable oil production will amount to 228.3 million mt. If correct, this would be a 4.5 million mt higher than production in ‘23/24. This would more than cover the demand projection of 224.9 million mt.

Within the vegetable oils, palm oil is set to remain the world's most important vegetable oil in terms of manufacture and consumption, with global output estimated at 80 million mt, a 715,000 mt increase over ‘23/24. Palm oil accounts for just over 35 per cent of total global vegetable oil production. Indonesia remains the largest producer with an output of 47.5 million mt, followed by Malaysia with 19 million mt and Thailand with just less than 3.4 million mt.

The production of soybean oil is expected to grow just less than 3 million mt to 65.4 million mt in the coming crop year and could hit a new record. China remains the primary producer with production amounting to 18.5 million mt based on large seed imports. The US ranks second with 12.9 million mt.

The production of rapeseed oil is expected to reach 34 million mt in 2024/25, slightly less than in ‘23/24. By contrast, production of sunflower seed oil is seen to drop around 103,000 tonnes to 21.7 million mt in 2024/25. This estimate reflects production declines in Argentina and Ukraine. The expected increase in sunflower oil production in the EU-27 is unlikely to offset these decreases.