Canola Market Outlook: January 15, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

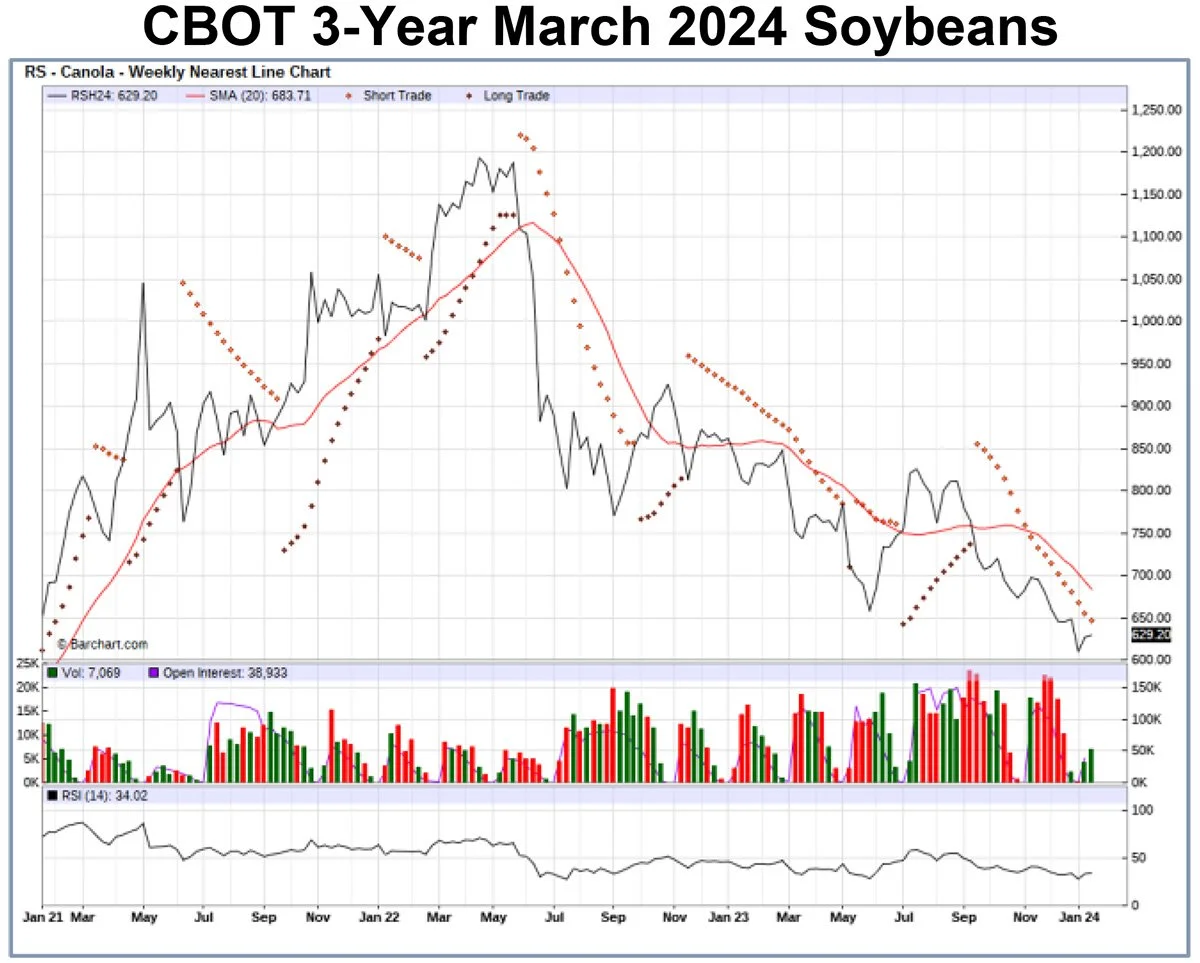

Soybeans: CBOT soybeans and meal were weak even prior to the bearish USDA report last Friday, but the report extended losses further.

A late rally off the lows limited the week’s declines to ‘only’ 32c/bu on soybeans and $7/ton on meal. Soybean oil was range-bound for most of the week with the oil share gaining as a result.

US ending stocks were raised from 245 to 280 mln bu. on a higher yield.

Increasing US stocks and an almost unchanged S American production leave the bulls with few opportunities until the next updates next month.

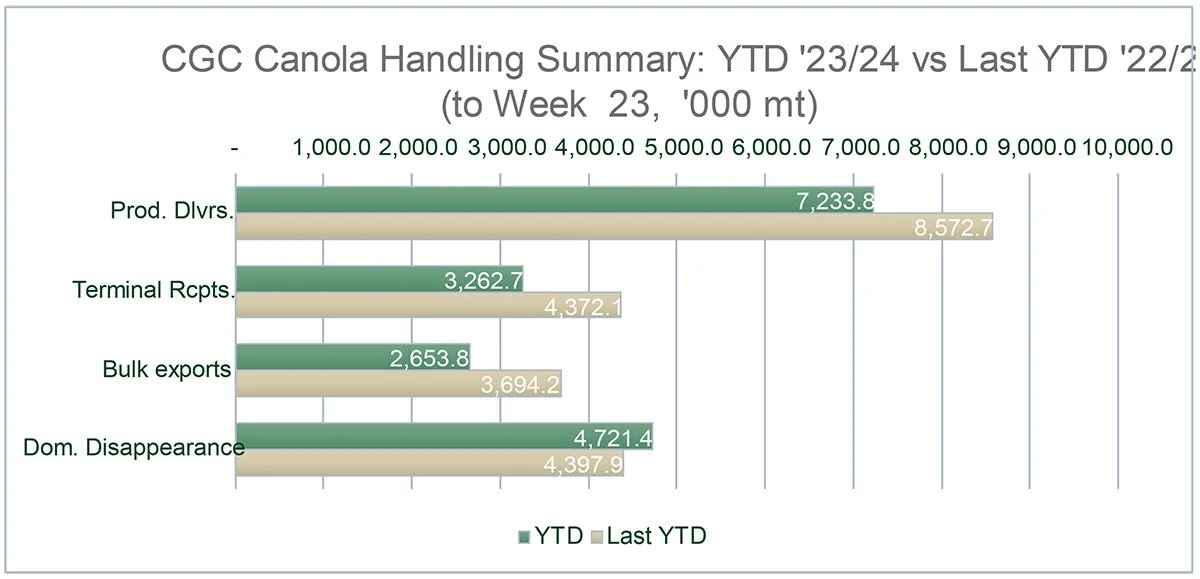

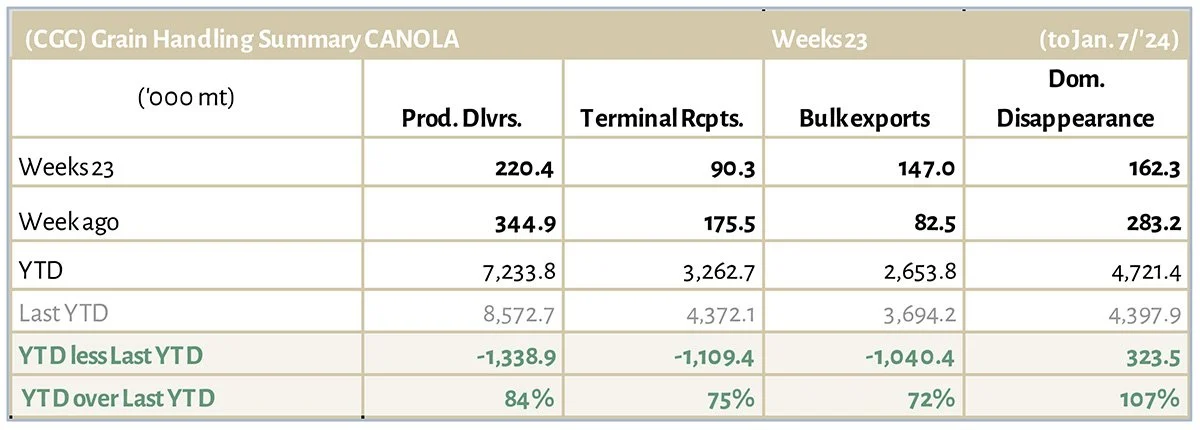

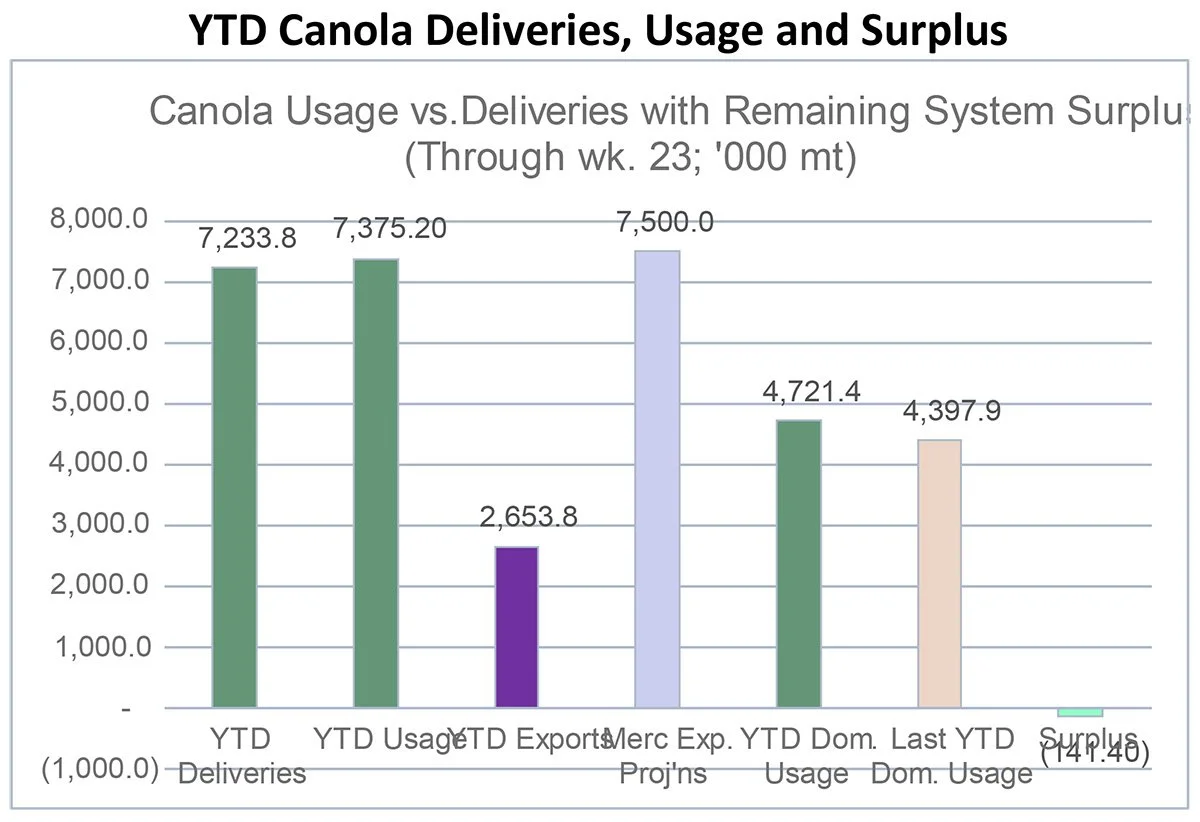

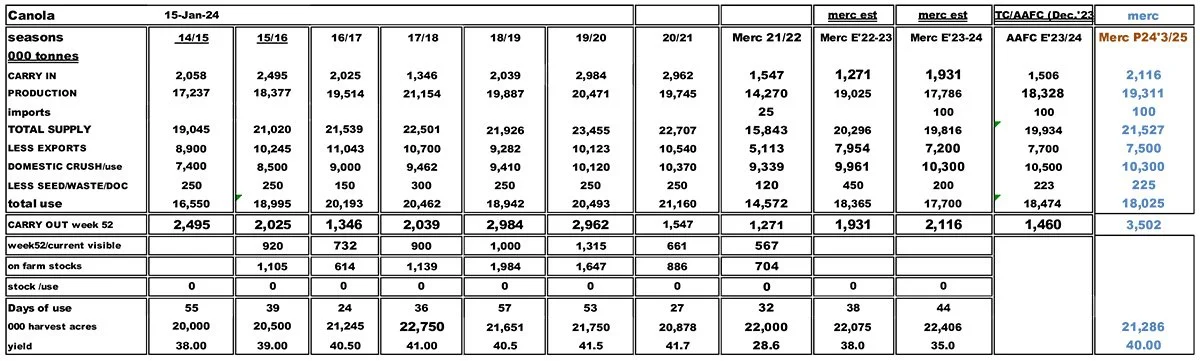

Canola: YTD total canola disappearance into week 23 of the crop year amounts to 7.4 million MT compared to 8.1 million MT last year and is down 9% on last year.

Canada is currently on pace to export only 6 mln mt of canola this crop year. To effectively increase exports, we would need to be very competitive in international markets in 2024.

Meanwhile, low diesel prices have meant that less is being used in biofuels and more canola oil is available for human consumption.

We would consider selling some new crop canola for August.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans and meal were weak even prior to the bearish USDA report last Friday, but the report extended losses further. A late rally off the lows limited the week’s declines to ‘only’ 32c/bu on soybeans and $7/ton on meal. Soybean oil was range-bound for most of the week with the oil share gaining as a result. US ending stocks were raised from 245 to 280 mln bu. on a higher yield (50.6 bu/ac compared to 49.8 bu/ac in the Dec. report).

In international numbers, S American production was reduced only modestly: Argentine production was raised 2 mln mt to 50 mln mt, Paraguay was raised 300k mt to partially offset a 4 mln mt decrease for Brazil to 157 mln mt. Imports by China were left unchanged at 102 mln mt.

This was a bearish report. Every major metric the trade was watching leaned negative: Increasing US stocks, S American production almost unchanged (217.3 mln mt vs. 219 mln mt in Dec.) leaves the bulls with few opportunities until the next updates next month.

Market outlook

Friday’s WASDE report extended losses further, and it was a very late rally off the lows that limited the week’s declines to ‘only’ 32 cents per bushel on soybeans and $7.00 per short ton on meal, with soybean oil range-bound for most of the week and the oil share gaining slightly as a result. - USA stocks are rising, so we leave our long March corn - short soybeans for a while.

Canola Market

Canola usage

During week 23 of the crop year, growers delivered 220 thousand MT of canola into primary elevators, exports were at 147 thousand MT, while the domestic disappearance fell to 162 thousand MT.

YTD total canola disappearance into week 23 of the crop year amounts to 7.4 million MT compared to 8.1 million MT last year and is down 9% on last year.

Visible stocks were shown at 934k MT, with 473 thousand MT in primary elevators, 183 thousand MT in process elevators, 115 thousand MT in Vancouver/ Prince Rupert, and 168 thousand MT in eastern ports.

Current market situation

To effectively increase exports, we will need to be very competitive in international markets in 2024. Canada is currently on pace to export only 6 mln mt of canola this crop year. We are using 7.2 mln mt of exports for ‘23/24 in our balance sheet, and AAFC is still showing 7.7 mln mt of exports, but to achieve either, the pace will have to pick up fairly significantly.

Meanwhile, crush margins in Canada have weakened, but still remain good. Canada is on pace to crush 10.7 mln mt of canola. We are using a 10.3 mln mt crush projection for the crop year, while AAFC is using 10.5 mln mt. However, it should be kept in mind that canola oil is used for diesel, and low diesel prices have meant that less is being used in biofuels and more canola oil is available for human consumption.

In Europe, Matif rapeseed fell to 9-month lows despite EU oilseed imports falling by 20% compared to last season. In the WSDE report, the Russian rape crush was lowered by 500k mt.

Market outlook

Further on the Cdn. canola balance sheet, we remain of the view that StatsCan has overestimated the ’23 canola crop. It still is early to look at the 2024 crop, but ending stocks could accumulate more next year.

Action

Given our balance sheets, we would consider selling some new crop canola for August.

Canola – Topics of Interest

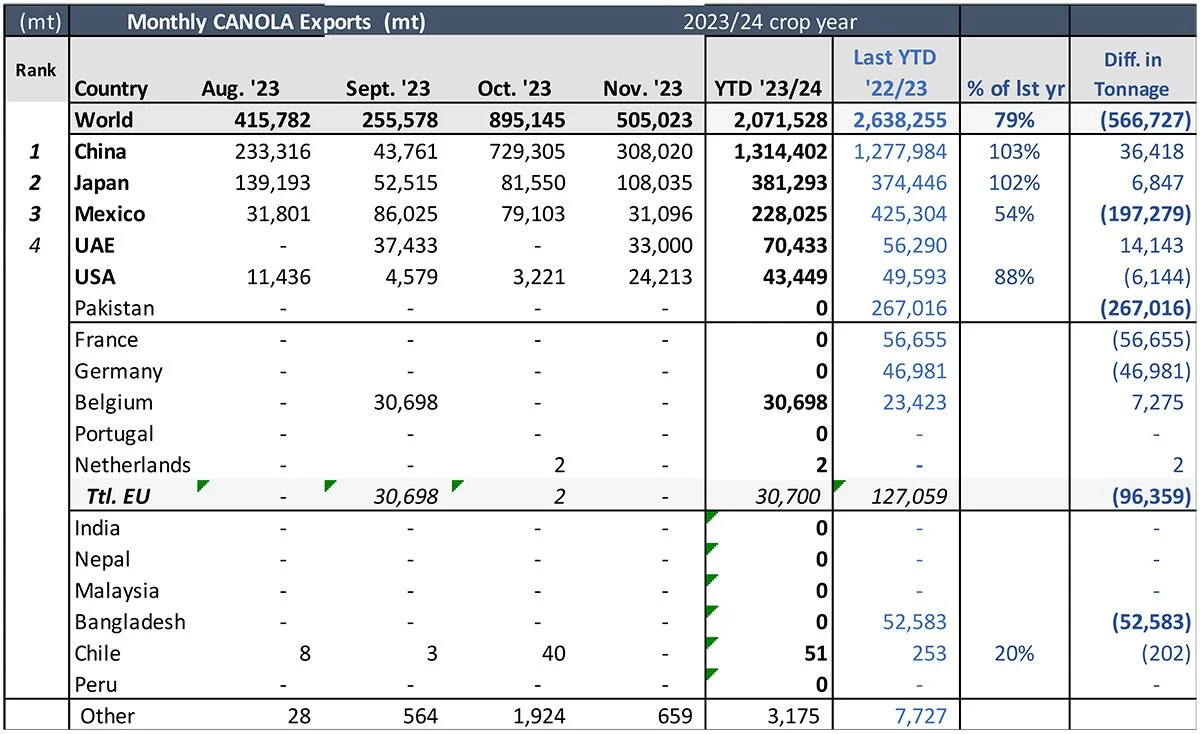

Statistics Canada – November ’23 Exports by Destination

Canada exported just 505k mt of canola in November 2023, the smallest November tonnage shipped over the past seven years. Of this tonnage, 308k mt went to China (61% of total), 108k mt went to Japan (21%), and 33k mt went to the UAE. Additional exports went o Mexico (31k mt) and to the USA (24k mt).

August through November ’23 exports trail last year’s by 567k mt. The biggest reductions are to Pakistan, Mexico, and to the EU.