Canola Market Outlook: February 6, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – March CBOT soybeans were up by ~22c for the week, a seven-month high. Not so positive was the 7-8% drop in crude oil, which affected soybean oil negatively and it fell to a six-month low.

US soybean balance sheet does remain tight. South American weather and the USDA report on Wednesday will provide next week's market input.

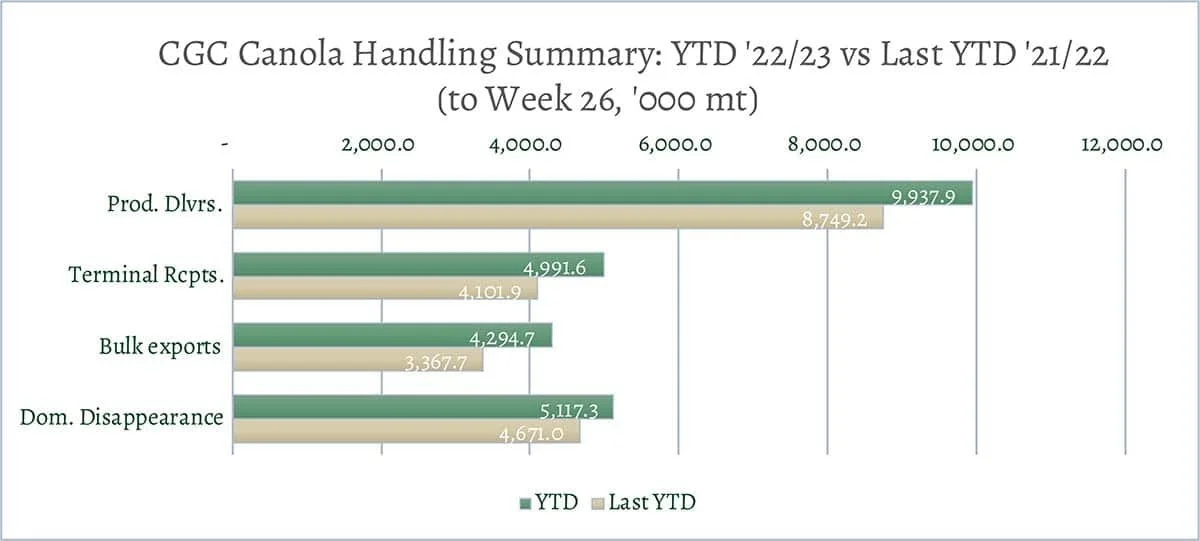

Canola – YTD canola disappearance into week 26 of the crop year is 17% above last year’s usage (+1.4 million MT) and amounted to 9.4 million MT compared to 8 million MT last year.

There is little doubt that the canola balance sheet will remain tight. The one question we have is if demand for US soybeans by China will be enough to fully reflect the tightness in the soybean balance sheet.

Given the relatively flat forward markets, we would look at selling the remainder of old crop canola at $18.75-$19.00/bu. And if you expect a normal crop, we would consider selling 25% of new crop canola at $17.50-18.00/bu (+) SK.

Oilseed Market Backdrop

Soybeans

Current market situation:

March CBOT soybeans were up by ~22c for the week, a seven-month high. Not so positive was the 7-8% drop in crude oil, which affected soybean oil negatively and it fell to a six-month low. US export sales of soybeans were at 736 thousand MT, bringing the season total to 1,738 million bu, up almost 5% on last year against the USDA's projected 8% decline. Soybeans are supported by ongoing concerns over dryness in Argentina, and the slow harvest pace in Brazil’s Mato Grosso region (10% complete versus 20% last year). And while US export sales were at the lower end of expectations, the US needs to sell just 250 million bu to achieve the USDA's annual number. The US soybean balance sheet remains tight.

Market outlook:

South American weather and the USDA report on Wednesday will provide next week's market input. More dry weather is in the forecast for Argentina and estimates ahead of the USDA-WASDE report are for a significant (-3.5 million MT) cut in the Argentine soybean crop.

Canola Market

Canola usage:

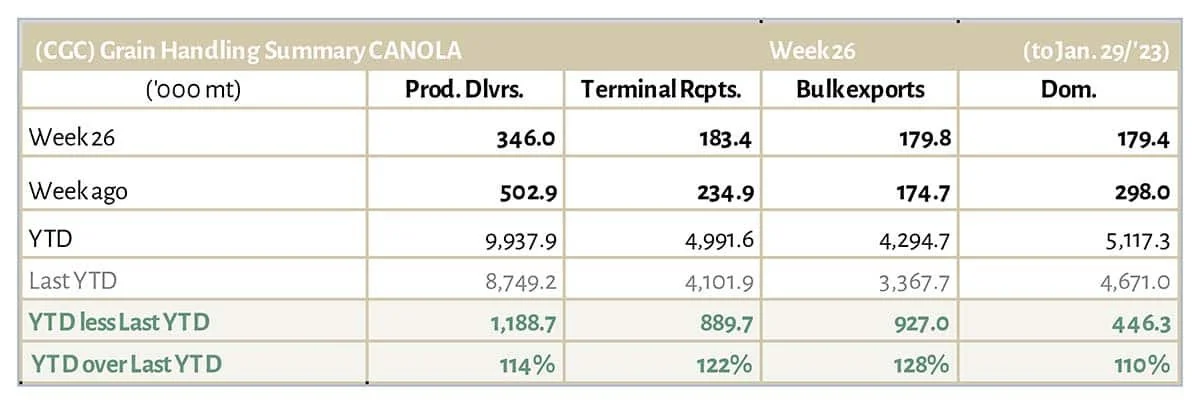

The Canadian Grain Commission reported that during week 26 of the crop year, growers delivered 346 thousand MT of canola into primary elevators, exports were at a 180 thousand MT, while the domestic disappearance amounted to a strong 179 thousand MT.

YTD canola disappearance into week 26 of the crop year is 17% above last year’s usage (+1.4 million MT) and amounted to 9.4 million MT compared to 8 million MT last year.

Visible stocks fell to 1.2 million MT, with 695 thousand MT in primary elevators, 253 thousand MT in process elevators, 117 thousand MT in Vancouver/ Prince Rupert, and 159 thousand MT in eastern ports.

Current market situation:

Year-to-date total deliveries of canola into the handling system over total YTD usage (export and crush) are at 526 thousand MT, so the Canadian pipeline remains tight.

Domestic crush margins are down a little with the recent drop in crude oil and soybean oil, but still remain quite good/ profitable. In Europe, Matif rapeseed followed the CBOT oilseeds higher helped by the reversal in the Euro despite the European Central Bank (ECB) rate hike, and Canadian canola improved over the week by ~$23/MT despite the losses in crude oil, which pressured vegetable oils. Given exports of rapeseed/ canola by Ukraine and Australia, it seems that the European market is not as tight. As a result, the main export demand for Canadian canola will have to come from China.

However, there is little doubt that the canola balance sheet will remain tight. The one question we have is if demand for US soybeans by China will be enough to fully reflect the tightness in the soybean balance sheet. The questions about this year’s demand potential by China have been generating some uncertainly in oilseed markets.

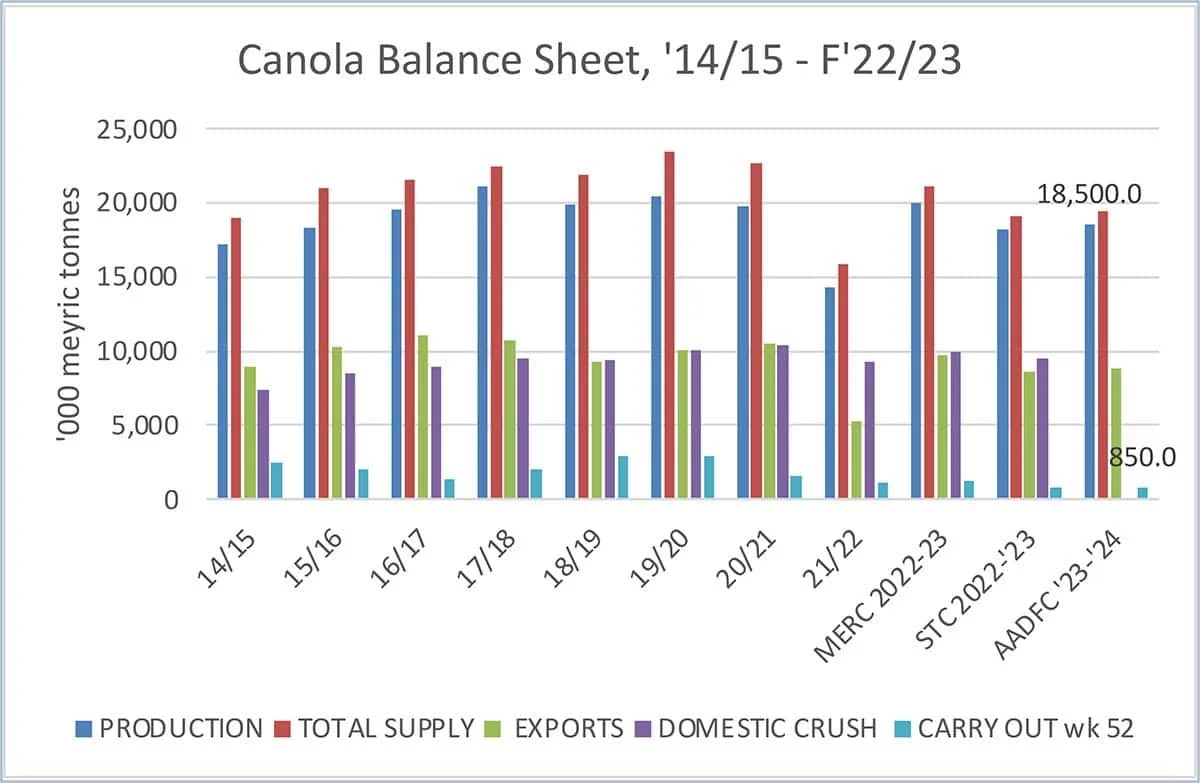

Re: new crop canola, AAFC projected a slight increase in acres for next year (+1.2%) to 21.75 million acres. The AAFC scenario shows 2023 Canadian canola production at 18.5 million MT (up just 1.8%). AAFC sees exports and crush close to this year’s, resulting in another small carry-out for 2023/24 at just 850 thousand MT [see graph].

The industry seems to expect an increase in canola acres, but we think it will be difficult to increase canola acres materially. We expect acres to increase only slightly, while yields remain to be seen given current dry conditions in significant swaths of Saskatchewan and central Alberta [see map last page]. As discussed, we think last year’s canola crop was clearly bigger than StatsCan/AAFC have been saying, but it is hard to see big acreage increases in canola for 2023 over 2022. But if you expect a normal crop, we would consider selling 25% of new crop canola at $17.50-18.00/bu (+) SK.

Market outlook:

South American weather and the USDA report on Wednesday will provide next week's main market input on oilseeds. Estimates ahead of the WASDE report are expecting USDA to cut the Argentine soybean crop by 3.5 million MT to 42 million MT, with some at 38 million MT. (The estimate by the US Agriculture Attaché was at only 36 million MT.)

Action:

Given the relatively flat forward markets, we would look at selling the remainder of old crop canola at $18.75-$19.00/bu. And if you expect a normal crop, we would consider selling 25% of new crop canola at $17.50-18.00/bu (+) SK.

Canola – Topics of Interest

International Grains Council (IGC): Global rapeseed acreage for 2023

The IGC expects the global rapeseed acreage for the 2023 crop to be marginally lower (-600 thousand ha) than last year’s. The rapeseed acreages in India, China and Australia are expected to decline, while those in the EU-27 and Ukraine are seen to increase.

The IGC projects the 2023/24 global acreage to drop to 40.2 million ha from 40.8 million ha in 2022/23. This would represent a small 1.5% reduction. It will be important to watch yield developments.