Canola Market Outlook: February 5, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: CBOT March soybeans futures ended closed Friday with a net 20 ¾ cent loss for the week. New crop Nov remained at a 17 ½ cent discount to the March contract.

US soybean export sales were awful at a meagre 165 million bushels and were way below the lowest trade. But the US December crush was over 200 million bu and a new record to maintain the strong domestic crush demand picture.

We expect soybeans to be around their lows.

Canola: YTD total canola disappearance into week 25 of the crop year amounts to 8.2 million MT compared to 9.4 million MT last year and is down 13% on last year.

We again expect poor exports for week 27 and start to doubt if we will even achieve our revised export estimate of 7 million MT.

On the domestic crush side, the margins of the large crush plants are not too bad, but they are getting tight for the smaller plants.

We would like to be 100% sold old crop seed and would sell ~15% October at around $13.75/bu.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT March soybeans futures ended closed Friday with a net 20 ¾ cent loss for the week. And new crop Nov remained at a 17 ½ cent discount to the March contract. March soybean meal futures held onto a net $7.80 gain for the week. Soybean oil futures were a net 220 points lower for the week.

US soybean export sales were awful at a meagre 165 million bushels and were way below the lowest trade guesses as the discount for Brazilian soybeans comes to bear on the USA demand. But the US December crush was over 200 million bu and a new record to maintain the strong domestic crush demand picture.

In Argentina, BAGE lowered soybean crop ratings to 36% Gd/Exc against 44% a week earlier and 14% this time last year.

China brought most protein and veg oil markets lower and Bursa Malaysia palm oil gave back just over half of the January gains this week. In Europe, oilseed crushing is running at strong levels, but oilseed imports are lagging last year by 18%. Veg oil imports, however, are down 3% and are keeping a lid on region rapeseed oil and sunflower oil values. The Argentine rain forecasts should renew complex weakness.

In their February report, the AMIS Market Monitor showed ’23/24 soybean production virtually stable, as upward revisions in Argentina and the US compensated a lower forecast for Brazil amid unfavourable weather conditions. However, globally, a big 13% y/y recovery in carry-over inventories is expected.

Market outlook

We took in our corn - soybean spread for a nice profit. We think there is more in the corn-soybean spread and will think again on the May. We expect soybeans to be at their lows.

Canola Market

Canola usage

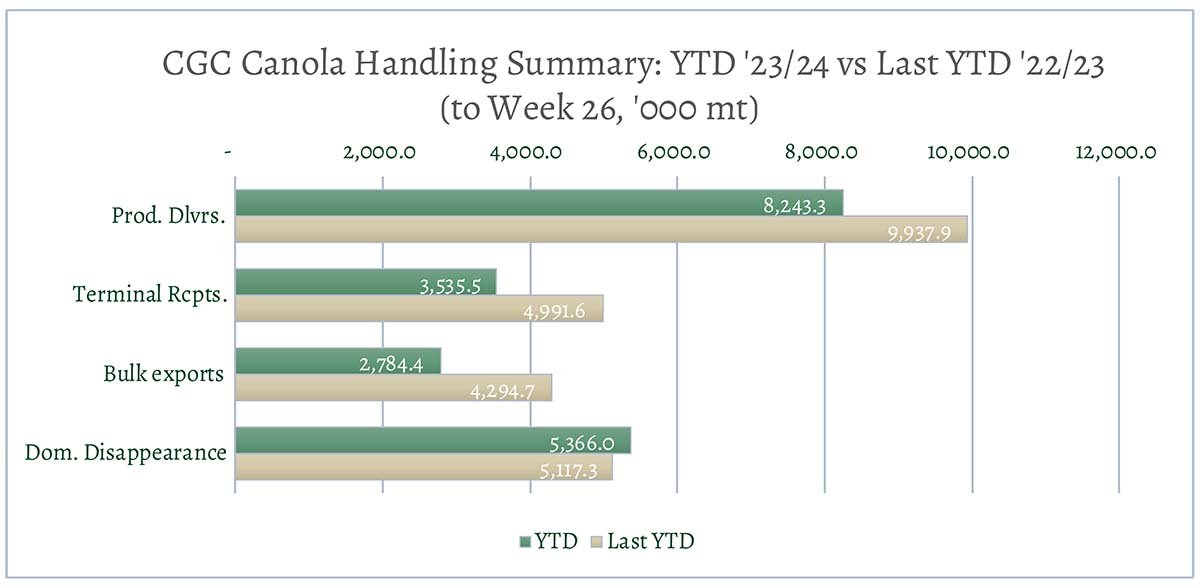

During week 26 of the crop year, growers delivered 443 thousand MT of canola into primary elevators, exports were again at a small 61 thousand MT, while the domestic disappearance amounted to 174 thousand MT.

YTD total canola disappearance into week 25 of the crop year amounts to 8.2 million MT compared to 9.4 million MT last year and is down 13% on last year.

Visible stocks were shown at 1 million MT, with 510 thousand MT in primary elevators, 192 thousand MT in process elevators, 152 thousand MT in Vancouver/ Prince Rupert, and 152 thousand MT in eastern ports.

Current market situation

We again expect poor exports for week 27 and start to doubt if we will even achieve our revised export estimate of 7 million MT for ‘23/24.

On the domestic crush side, the margins of the large crush plants are not too bad, but they are getting tight for the smaller plants. Canola values continue to be pressured by weak vegoil’s and the crush demand is driven by the value of meal, not oil. Due to the higher protein in soybeans, canola has lost value to soybeans. (Canola meal has around 75-80% of the total protein that soybean meal offers.)

Subdued economic data from China and questions about long term demand by China are pressuring protein and vegoil markets. Meanwhile in Europe, while oilseed crushing is running at strong levels, oilseed imports are lagging last years by 18% and veg oil imports are down by 3%. This is curbing regional rapeseed oil and sunflower oil values.

The weakness in global protein markets and pressure from vegetable oils pushed Matif rapeseed to new 7-monhts lows. Similarly, Canadian canola at it fell more than C$20/MT to new 3-year lows.

Market outlook

China’s weakening economic situation has demand consequences and oilseed imports seem to be building a long-term plateau. Meanwhile, the US market has expanding capacity for biodiesel/renewable diesel but so far, shows no sign of expanding production. Crushers must be wondering where the demand growth for meal and oil will come from to absorb the growth in capacity.

On Feb 8th, StatsCan will report Grain Stocks for December. The average trade guess is to see 13 million MT of canola versus 12.7 million MT last year. The full range of estimates is from 200k MT tighter to 1.2 million MT bigger than in Dec ’22.

We will also have a new USDA-WASDE report next week, which may help provide new market direction.

Action

We would like to be 100% sold old crop seed and would sell ~15% October at around $13.75/bu.

Canola – Topics of Interest

UFOP: 2023/24 Record Year of Oilseed Production

According to current USDA estimates, global production of oilseeds in the crop year 2023/24 is set to hit a peak of around 661.0 million MT, which would be up around 4 per cent year-on-year.

According to the most recent USDA outlook, global processing of oilseeds is also set to rise to a record high of 542.5 million MT, up around 19.1 million MT compared to 2022/23.

Global ending stocks are expected to amount to 131.7 million MT, which would exceed the previous year's level by 11.5 MT. Nevertheless, ending stocks are seen to be clearly below the high in 2018/19 of 134.0 million MT.

World trade in oilseeds is expected to drop 5 million MT to 196.8 million MT.