Canola Market Outlook: December 5, 2022

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – Weekly US export sales of soybeans were mid-range of trade guesses at 694,000 MT, for a season total of 1,370 million bu, unchanged on last year.

The corn-soybean ratio improved to 2.23, mainly due to the weakness in corn.

This week saw soybean oil fundamentals change significantly (lower than expected EPA three-year targets for renewable fuel volumes), which may impact crush margins, product spreads and flat price for soybeans.

Canola – Year-to-date canola disappearance into week 17 of the crop year is slightly above last year’s usage (+4%) and amounted to 5.8 million MT compared to 5.6 million MT last year.

The canola crush margin is now lower due to the break in soybean oil futures, but with rapeseed oil at a premium to soybean oil in China, the demand for seed remains excellent. Crushers have dropped their prices as their storage is full, and exporters are now showing the best bids.

There is no need to sell additional tonnage at this stage; we would definitely ignore crusher bids.

Oilseed Market Backdrop

Soybeans

Current market situation:

A hugely volatile week left CBOT soybeans slightly higher, while the oilseed products saw major moves. Early trade revolved around hopes that China was starting to open up, along with rumours about production cuts by OPEC+. However, it was the EPA's midweek move on lower-than-expected renewable mandates, which sent soybean oil into a tailspin, and lifted meal on product spreading and fears of a reduced crush.

South American weather was generally favourable in Brazil, where planting is about 90% complete. But Argentina was mostly hot and dry – seeding at 29% complete remains well below the 50% average. The renewed Argentine 'Soy Peso' came into effect, but farmer selling was less than expected.

Market outlook:

The corn-soybean ratio improved to 2.23, mainly due to the weakness in corn. We still think that the ratio has further to go, but we need to remember that at this time we have very strong crush margins which will limit the future ratio. The three-year chart below does reflect a strong soybean price, so we can expect some volatility in futures. Funds have sold some of their corn long and quietly taken a strong position in soybean futures. They are now long 103,000 contracts.

China is set to auction off 500,000 MT of imported soybeans on December 9. Company StoneX expects the Brazilian soybean crop to be 737,000 tonnes higher than previous estimates. However, there still are a lot of weather days to go before this crop is made. Argentina is still too dry.

Canola Market

Canola usage:

The Canadian Grain Commission reported that during week 17 of the crop year, growers delivered 448 thousand MT of canola into primary elevators, exports were at 267 thousand MT, while the domestic disappearance amounted to a steady 162 thousand MT.

Year-to-date canola disappearance into week 17 of the crop year is slightly above last year’s usage (+4%) and amounted to 5.8 million MT compared to 5.6 million MT last year.

Visible stocks stayed at 1.3 million MT, with 798 thousand MT in primary elevators, 209 thousand MT in process elevators, 138 thousand MT in Vancouver/ Prince Rupert, and 175 thousand MT in eastern ports.

Current market situation:

Statistics Canada published their last production estimate of the 2022 crop. Their estimate for this year’s canola crop was at 18.173 million MT based on an average yield of 32.2 bu/acre. This is another 925,000 MT lower than their September estimate and is way too low in our view. We are using close to 20 million MT, and the trade was estimating the crop at 19.2 million MT (range of 18.6 to 20.5 million MT). StatsCan has a history of being incorrect and its numbers are being used by companies as a market factor for futures, rather than a real estimate that companies use in their operations. However, it is a low number and Canada would not be able to sustain the current export pace if it were accurate.

We have added an estimate for exports and crush to our supply and demand based on the latest StatsCan estimates. Using StatsCan’s crop estimate of 18.17 million MT, exports could only reach about 7.5 million MT. The StatsCan canola production estimate is supportive to the canola market.

In other news, the Biden Administration recently approved the use of canola oil in the production of renewable diesel and other biofuels. US federal standards and regulations have been changed to make this possible. This is also supportive of canola futures.

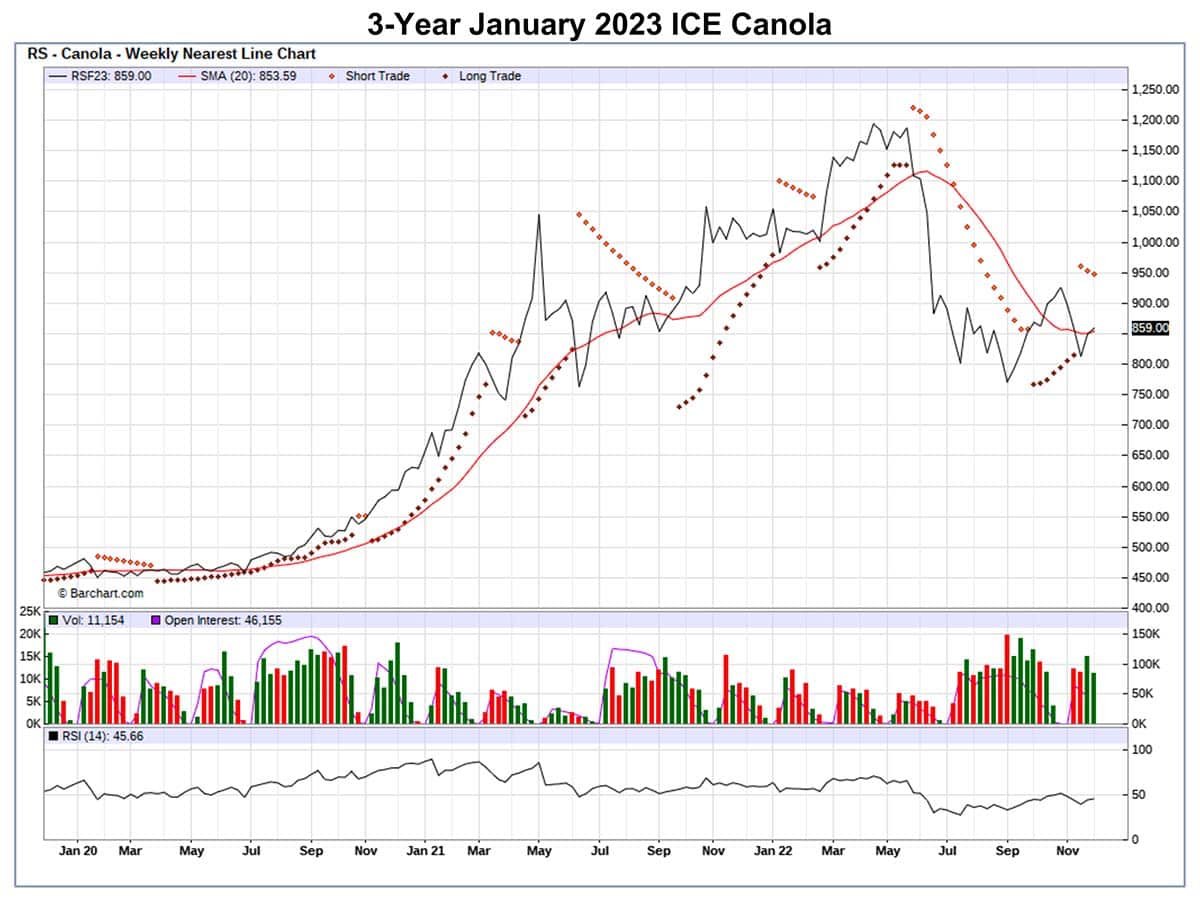

So, while Matif rapeseed fell to its lowest close of 2022, Canadian canola bounced C$35/MT last Friday on spreading against soybean oil and following the significant drop in Statistics Canada's crop estimate.

Market outlook:

Canola exports are good, and we hear that export companies are paying even better premiums as they are having trouble buying enough stocks to fill railcars. The canola crush margin is now lower due to the break in soybean oil futures, but with rapeseed oil at a premium to soybean oil in China, the demand for seed remains excellent. Crushers have dropped their prices as their storage is full, and exporters are now showing the best bids.

Action:

There is no need to sell additional tonnage at this stage; we would definitely ignore crusher bids.

Canola – Topics of Interest

US Biofuel Program:

The US Environmental Protection Agency (EPA) details last week showed lower-than-expected renewable mandates, sending soybean oil into a tailspin on fears of a reduced crush. The Biden Administration also endeavoured to expand the use of canola oil. The EPA is proposing a new approval for canola oil intended to add new pathways for fuels to participate in the Renewable Fuel Standard (RFS) program to provide renewable diesel, jet fuel and other fuels. This action is to demonstrate the EPA’s commitment to approving new petitions for renewable fuels that can provide greenhouse gas benefits, as well as reduce reliance on petroleum fuels.

Basically, the EPA determined that renewable diesel, jet fuel, heating oil, naphtha and liquefied petroleum gas produced from canola and rapeseed all reduce greenhouse gas emissions by at least 50% compared to petroleum-based fuels. The 50% figure is what is required by the RFS for advanced biofuels and biomass-based diesel. Part of the canola advantage is its high proportion of oil to meal. And because of production practices, including minimum- and no-till, Canadian canola production sequesters more carbon than some other producers. It is thought that the RFS final rule could spark expanded canola crush capacity in Canada and potentially in the US.