Canola Market Outlook: August 21, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans The November soybean contract was the week’s top performer in the grain complex. November soybeans were up 45-6 for the week, settling at 1353-2 – above the psychologically significant 1350 level.

Demand has improved and the focus in the US soybean market is on next week's crop tour because of yield concerns resulting from the ongoing heat and dryness.

Canola: YTD canola disappearance into week 2 of the crop year amounted to 629k MT compared to 390k MT last year and is up 61% on last year.

November ICE canola closed at 800.50/mt, up $5.30 on Friday, and up 38.60/mt on the week (+ 5.07%). It closed up another $8.90/mt up this Monday at $809.40/mt.

Prices have moved up substantially over the past two weeks supported by a stronger soybean complex and by worries about yields in Canada. If the lower end of estimates proves correct, then an element of demand rationing might be necessary.

Crushers remain the best buyers at this time, but we would avoid additional sales while yields are in question.

Oilseed Market Backdrop

Soybeans

Current market situation

The November soybean contract was the week’s top performer in the grain complex. November soybeans were up 45-6 for the week, settling at 1353-2 – above the psychologically significant 1350 level.

On the one hand, the trade is looking ahead to the Pro Farmer tour this week. The tendency is for soybean futures to weaken on average by 25c/bu during the course of the tour and the tendency for the Pro Farmer tour is to under-state yields compared to final results by around 2-3 bu/acre. On the other hand, the heatwave has potentially larger implications for soybeans than for corn. Soybean acreage is substantially lower than last year’s (-3 million acres), so any downward adjustments to yields may have a more significant impact on the contract’s price, and demand for soybeans has improved over the past 4 weeks.

The NOPA July crush was a record for the month and also supportive. Dalian soymeal in China hit contract highs for the 7th straight week, up $190 from the June lows, and Asian vegetable oil markets are also firm.

Market outlook

The focus in the US soybean market is on next week's crop tour because of yield concerns resulting from the ongoing heat and dryness. There also is a Chinese delegation in Chicago in the context of very limited new crop purchases so far.

Canola Market

Canola usage

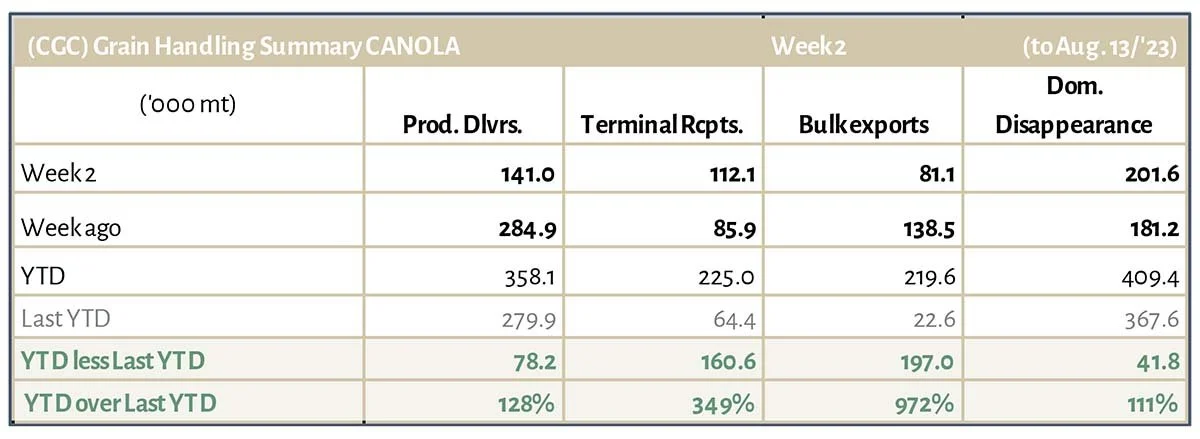

The Canadian Grain Commission reported that during the 2nd week of the new crop year (wk. 2), growers delivered 141 thousand MT of canola into primary elevators, exports were at a 81 thousand MT, while the domestic disappearance amounted to 202 thousand MT.

YTD canola disappearance into week 2 of the crop year amounted to 629k MT compared to 390k MT last year and is up 61% on last year.

Visible stocks were at 704 thousand MT, with 314 thousand MT in primary elevators, 200 thousand MT in process elevators, 159 thousand MT in Vancouver/ Prince Rupert, and 31 thousand MT in eastern ports.

Current market situation

November ICE canola closed at 800.50/mt, up $5.30 on Friday, and up 38.60/mt on the week (+ 5.07%). It closed up another $8.90/mt up this Monday at $809.40/mt.

Matif rapeseed in Europe was also stronger during the week for 3 straight sessions before finding some resistance at €470/mt. ICE canola was also firm, and as long as soybean oil remains strong, canola will follow with the chain reaction working through to Australian canola and finally Matif. - EU biodiesel markets were up $40-50/ mt.

Apart from the demand side, it still is difficult to judge the overall production at this stage. Some rainfall last weekend in SK and AB and cooler temperatures should still prove helpful to canola crop conditions. We are using a yield of 36.5 bushels for the average crop. But open questions about the size of the 2023 canola crop are keeping traders on alert. Trade guesses about the size of the crop seem to range from 16.5 mln mt to 19.5 mln mt, with AAFC weighing in at 18.8 mln mt on August 18th. We are at the higher end of the range, and Statistics Canada will add their assessment on Aug. 29th (survey-based estimates) and again on Sept. 12th (model-based estimates).

Prices have moved up substantially over the past two weeks, indicating that buyers are worried about yields. If the lower end of estimates proves correct, then an element of demand rationing will be necessary. While crush margins are still very good, this would come from the export side (where there are questions about the depth of Chinese demand). - Crushers remain the best buyers at this time.

Outside vegoil markets have been supportive, with Asian vegetable oil markets firm and with EU biodiesel back up.

Market outlook

We will need to watch what happens with the soybean markets in the wake of the Pro Farmer crop tour as well as early yield developments in Canada. Depending on yields, harvest pressure might keep a lid on futures later in September.

Action

We would avoid additional sales while yields remain in question.

Canola – Topics of Interest

Ukraine – Oilseed Exports 2021/22 to F2023/24

Exports of oilseeds from the Ukraine increased despite the war that has been going on since February 2022 and the associated restrictions.

Sunflower Seeds: Ukraine maintained its global position as main producer of sunflower seed in the 2022/23 season. Although the 12.2 mln mt harvest was 5.3 mln mt smaller than that of the previous season, Ukraine remained the world's second most important producer after Russia and ahead of the EU. Despite the challenging conditions, around 2 million tonnes of sunflower seed were still exported, slightly more than in the previous season.

Soybeans: APK-Inform in Ukraine estimated that soybean exports in 2022/23 amounted to around 3 million tonnes, which compares to 1.4 million tonnes the previous marketing year. Mostly exports to the EU and Turkey increased.

Rapeseed: Ukrainian rapeseed exports in the 2022/23 marketing year are seen to have reached 3.4 to 3.6 million tonnes. This would be both a significant increase on the previous year's level of 2.7 million tonnes and a record volume. The most important destination was the EU, receiving just less than 3 million tonnes, with rapeseed imports from Ukraine accounting for just under 41 per cent of total imports. APK-Inform has projected exports for the coming marketing year 2023/24 at the level of the past marketing year.

Biodiesel Consumption in Germany

Consumption of B7 diesel fuel for the first four months of 2023 amounted to just over 9.6 million tonnes, which was down just under 7 per cent on the previous year's volume.

However, the March 2023 volume outstripped the previous sales volumes in the calendar year. April 2023 biodiesel consumption declined just less than 5 per cent to 209,300 tonnes on the same month the previous year.