Canola Market Outlook: April 29, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: Nearby CBOT May soybeans were up 9 cents for the week. Soybean meal dropped $3.90 in the nearby May contract, finishing at $340. Soybean oil eked out modest gains of 11 to 30 points for the day.

US soybean export sales were just 211k mt for the week, a 3-week low and below the trade estimates.

Weather remains questionable and is keeping growers from selling. Stronger crude oil is helping soybean oil used for fuel.

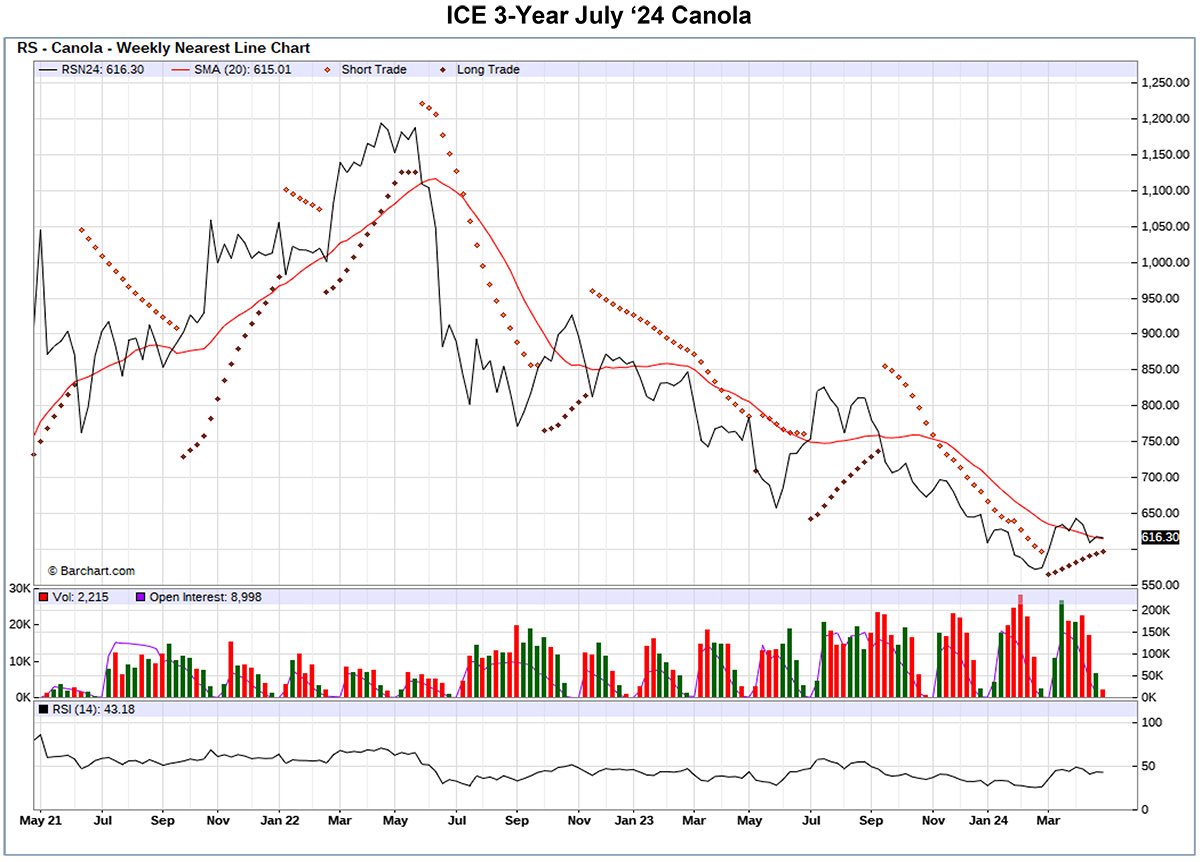

Canola: YTD total canola disappearance into week 38 of the crop year amounts to 12.7 million MT compared to 14.02 million MT last year and is down 11% on last year.

We think that in their latest ‘24/25 canola balance sheet, the AAFC’s carry-in is too low, exports are optimistic, and yields are too pessimistic for that year. All this distorts the outlook for canola/ is not sufficiently realistic.

We would sell remaining old crop canola for August delivery to capture the carry charge. We would leave new crop alone for now.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans settled 3 ¼ lower to 3 cents higher on Friday, with delivery months through January 2025 in negative territory and the rest of the 2025 contracts ending higher. Nearby May soybeans were up 9 cents for the week. Soybean meal dropped $3.90 in the nearby May contract, finishing at $340. Soybean oil eked out modest gains of 11 to 30 points for the day.

US soybean export sales were just 211k mt for the week, a 3-week low and below the trade estimates, with China the top buyer (168k mt). New crop sales were on the low side of the trade range at 120k mt, less than half of the previous week’s total.

US bean planting will likely be slowed for a few days with the rains into the weekend for the Midwest. The trade doesn’t seem concerned as seeding is well ahead of average pace.

According to the Buenos Aires Grain Exchange (BAGE), soybean conditions in Argentina were steady this week at 30% Gd/Exc. Poor ratings were up 1% this week to 24%. The crop is 26% harvested. BAGE left the Argentine crop production unchanged at 51 mln mt, but flagged poor early yields in the north. This could result in a reduction to the crop. Overall, the harvest is slow - slightly behind last year, but well behind the 50% average.

In Brazil, the Real was weaker, which prompted farmer selling of 600-700k mt of soybeans. April loadings to date are at 11.3 mln mt, with another 9 mln mt in the line-up.

Market outlook

We remain of the opinion that soybeans are overpriced to corn. At 211,000 mt, US exports were below trade estimates and YTD total exports are running below USDA estimate for the year.

Weather still remains questionable and is keeping growers from selling. Stronger crude oil is helping soybean oil used for fuel.

Canola Market

Canola usage

During week 38 of the crop year, growers delivered 317 thousand MT of canola into primary elevators, exports were at 181 thousand MT, while the domestic disappearance amounted to 222 thousand MT.

YTD total canola disappearance into week 38 of the crop year amounts to 12.7 million MT compared to 14.02 million MT last year and is down 11% on last year.

Visible stocks were at 1.37 million MT, with 919 thousand MT in primary elevators, 214 thousand MT in process elevators,165 thousand MT in Vancouver/ Prince Rupert, and 76 thousand MT in eastern ports.

Current market situation

Extrapolating year-to-date exports through to week 52 suggests that canola exports this crop year will amount to about 6.2 mln mt, well below last year’s 7.95 mln mt. Meanwhile, crush should be good; it currently extrapolates to 11.1 mln mt for the year. Domestic crush margins remain good, as the crushers keep prices firm to improve their margins. Bear in mind that the smaller canola seed exports translate into better crush margins. Consider that the seed crushers are the same companies as the seed exporters, and it is not hard to guess why exports take second place.

Canadian Balance sheet: In the latest AAFC canola balance sheet for 2024/25, we consider that AAFC is using a low carry-in, optimistic exports, and low yields for that year. The balance sheet below illustrates the cumulative effects of using a higher carry-in and lower exports.

In Europe, Matif rapeseed made 8-month highs mid-week on concern over freezing temperatures across much of Europe during peak flowering, before easing into the close. The extent of freeze damage to EU rapeseed crops will not be known for some time, but could have a significant impact on trade flows, and the Funds still hold a major net short position.

Market outlook

Oilseed markets remain volatile for now. The Argentine harvest pace, the actual Brazilian crop size, and fund short covering will the drive markets in the near term, with Chinese demand and EU rapeseed damage hovering in the background.

Action

We would sell remaining old crop canola for August delivery to capture the carry charge. We would leave new crop alone for now.

Canola – Topics of Interest

StatsCan: Monthly Canadian crush numbers:

Statistics Canada published the March ‘24 crush number at 961k mt, for an August ‘23 through March ’24 total of 7.73 mln mt.

This was the second highest monthly crush this crop year, and the third highest monthly crush recorded.

The YTD crush is running 11% ahead of last year’s crush.