Canola Market Outlook: October 16, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – It was a mixed week for the soybean complex: Soybean futures were up 14 ¼ cents from the previous week; meal was sharply higher, and soybean oil was weaker.

The USDA report resulted in a significant move higher on Thursday mainly due to the lower US yield, but there was a failure on Friday when there was no follow-through buying.

The current premium to corn is justified when there is business, but overtime we still think soybeans are overpriced to corn.

Canola: Fresh export sales of canola remain tepid, and companies are putting more emphasis on crushing canola.

We will need to see a big increase in weekly exports, or the market will turn very bearish.

Crushers, meanwhile, have very good margins at present and are the best buyers.

We would consider getting up to 80% sold canola at $16.40/bu.

Oilseed Market Backdrop

Soybeans

Current market situation

It was a mixed week for the soybean complex: Soybean futures opened this past week at $12.67/bu. and closed at $12.80 ¼ /bu., up 14 ¼ cents from the previous week. Meal was sharply higher and soybean oil was weaker.

The USDA report brought an unchanged US carryout, as the lower yield was offset by a higher carry-in and lower exports. The soybean crush was lowered in old crop and raised in new crop. The US soybean oil balance tightened further with an increasing share of use for biodiesel.

In the WASDE report, China’s crush was increased by 1 million MT in old crop crush, which was taken from stocks. Similarly, this season’s stocks were lowered to facilitate a further increase in their crush. There were no changes to the S American balance sheets.

The CFTC Commitment of Traders report indicated that as of October 10th, funds were net short 3,185 contracts, selling a net 5,572 contracts. Commercials were net short 104,025 contracts.

Market outlook

The USDA report resulted in a significant move higher on Thursday mainly due to the lower US yield, but there was a failure on Friday when there was no follow-through buying.

We saw some good soybean purchases during the week to China and elsewhere. We think the USDA is currently under estimating protein demand.

The current premium to corn is justified when there is business, but overtime we still think soybeans are overpriced to corn.

Canola Market

Canola usage

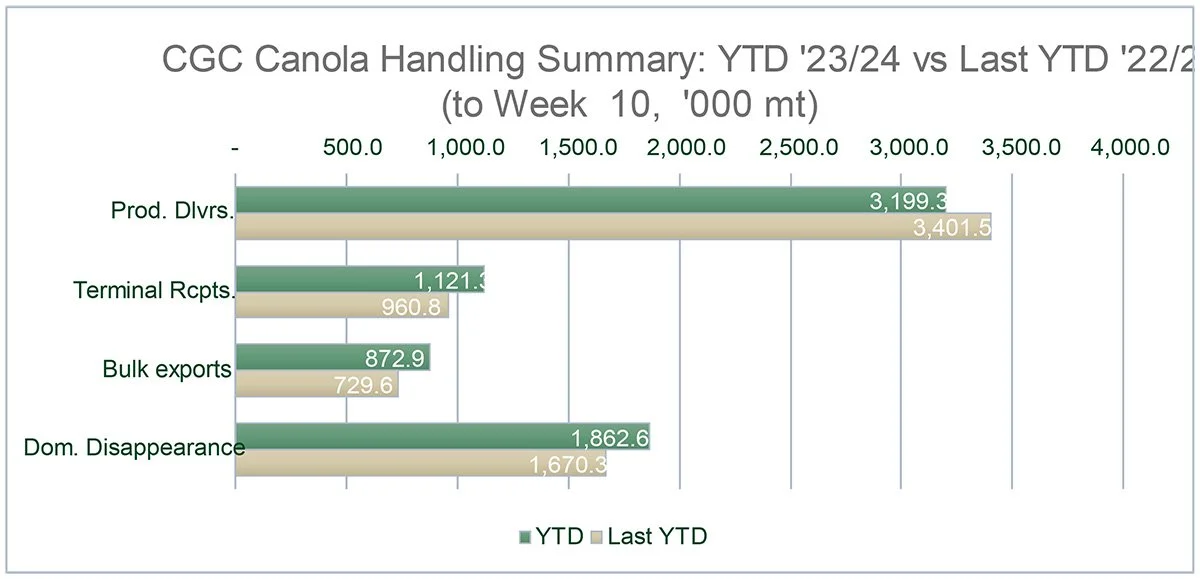

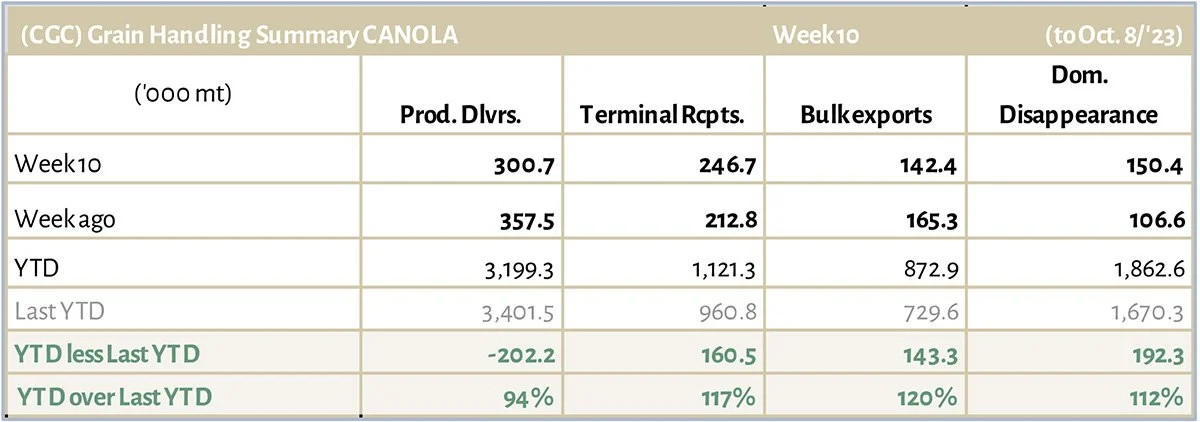

The Canadian Grain Commission reported that during week 10 of the new crop year, growers delivered 301 thousand MT of canola into primary elevators, exports were at 142 thousand MT, while the domestic disappearance amounted to 150 thousand MT.

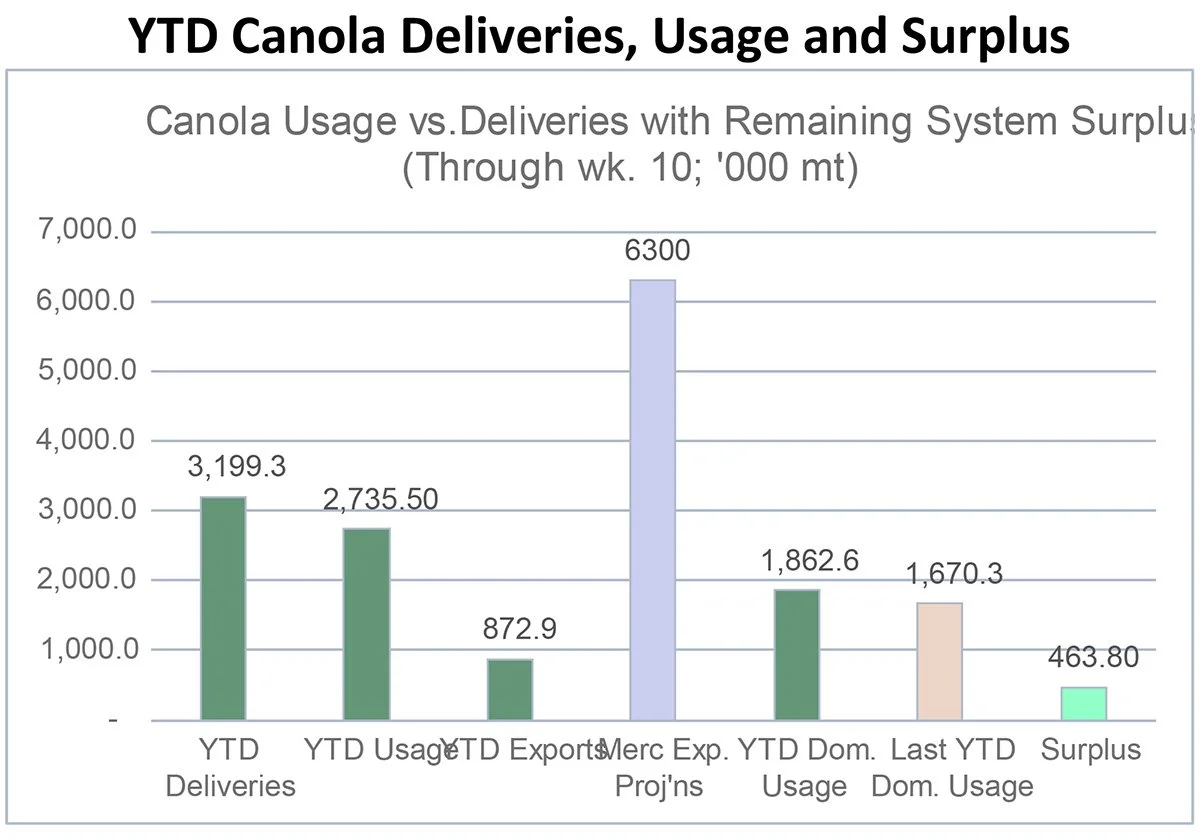

YTD canola disappearance into week 10 of the crop year amounts to 2.7 million MT compared to 2.4 million MT last year and is up 14% on last year.

Visible stocks dropped to 1.24 million MT, with 766 thousand MT in primary elevators, 205 thousand MT in process elevators, 170 thousand MT in Vancouver/ Prince Rupert, and 126 thousand MT in eastern ports.

Current market situation

Fresh export sales of canola remain tepid, and companies are putting more emphasis on crushing canola. We will need to see a big increase in weekly exports, or the market will turn very bearish. Crushers, meanwhile, have very good margins at present and are the best buyers.

The USDA in their monthly report lowered the Canadian canola crop to 17.8 million MT, which actually is higher than the most recent (Sept.) AAFC canola production number of 17.4 million MT. Global rapeseed crush was lowered by USDA by 450k MT to 17.01 million MT. And the USDA also raised the global sunflower seed crush by 895k MT to 52.33 million MT thanks to increases for Argentina, Ukraine and Russia.

Market outlook

Chicago soybean oil and Malaysian palm oil were both higher this Monday, but Matif rapeseed in Europe was lower. Crude oil also was down while the market awaits a ground offensive by Israeli forces into the Gaza Strip. Still, the new instability in the Middle East might lend support to crude oil prices.

Action

We would consider getting up to 80% sold canola at $16.40/bu.

Canola – Topics of Interest

Canada – AAFC September Canola Balance Sheet

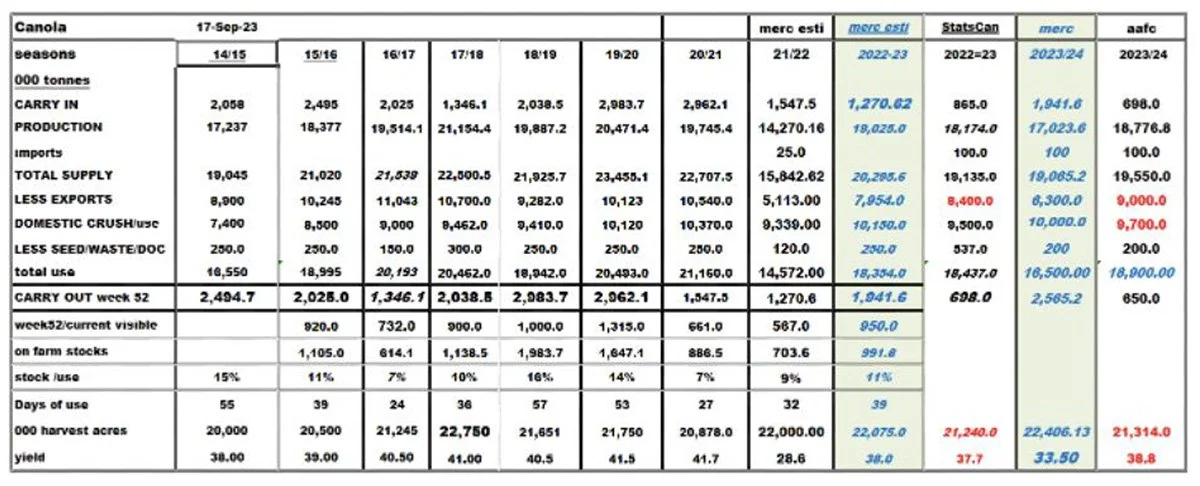

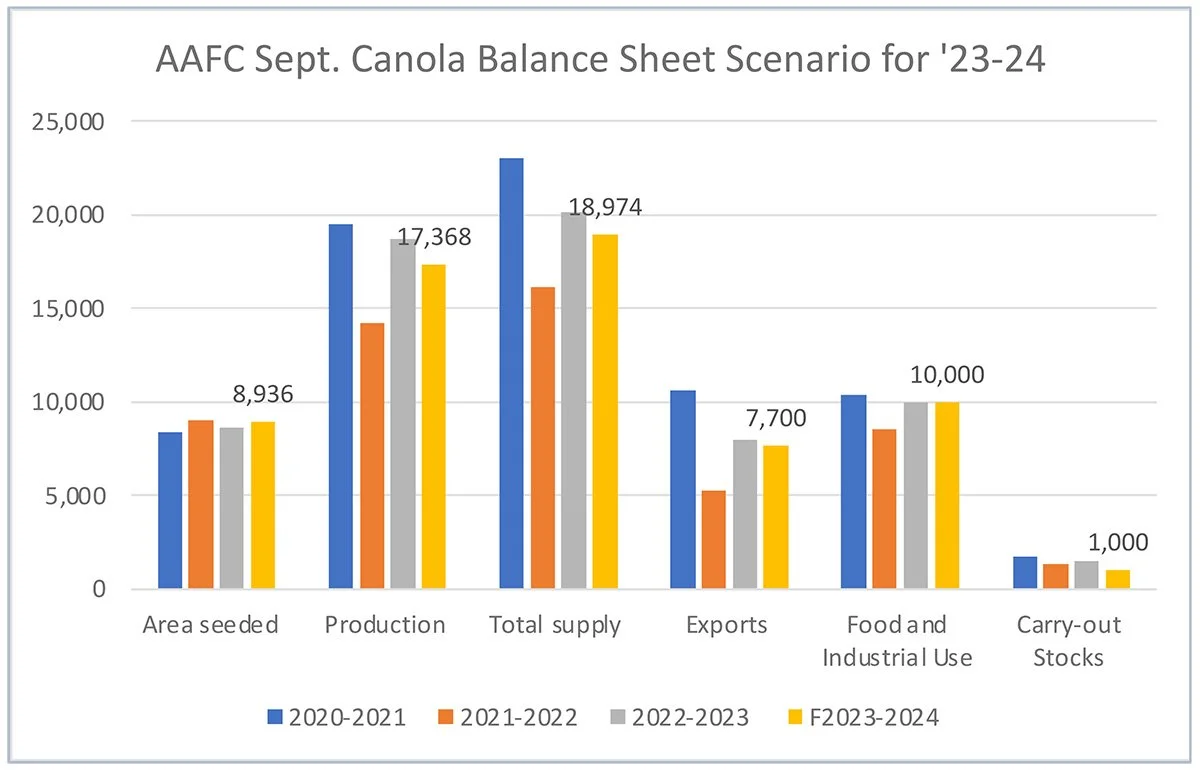

The AAFC September balance sheet showed some significant changes from their previous numbers, both for old crop and for new crop. The size of the changes for the previous crop year (and beyond) are not particularly confidence inspiring.

To start with the ‘22/23 crop numbers, the 2022 canola production was increased by 521k MT to 18.7 million MT. Supply was raised even more (by 1 million MT) to 20.14 million MT due to changes to the previous carry-out. On the demand side, exports were lowered (-252k MT) to 7.95 million MT, while domestic crush was increased (+161k MT) to 10 million MT. The adjusted ‘22/23 ending stocks were shown at 1.5 million MT, down from 1.75 million MT shown in August.

2023/23 numbers: The 2023 canola production was lowered by 806k MT to 17.4 million MT due to lower yields (1.96 MT/ha). Supply dropped by 1.7 million MT to 18.97 million MT due to the lower carry-in and lower production. On the demand side, AAFC lowered canola exports to 7.7 million MT (9 million MT shown previously). Given the pace of recent export sales, we think this number still is too high. AAFCV increased industrial use/ crush by 300k MT to 10 million MT, which we also think is at the high side. AAFC ‘23/24 ending stocks fell by 700k MT from their previous number to 1 million MT. – We expect ‘23/24 ending stocks to end up higher due to a tepid canola export campaign.