Canola Market Outlook: October 10, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans – The soybean complex had all its components down on the week.

Export inspections are up 8%, but sales are down 32%.

Soybean oil continues to weaken and represents less of the crush value.

Canola: Vegetable oils in Asia were weak, which reflects negatively on canola.

Export demand for canola is down as there is less need for vegetable oils this year compared to last year.

Still, we would hold additional sales for the present to see what the USDA report brings and how the markets react to the new Middle East crisis.

Oilseed Market Backdrop

Soybeans

Current market situation

The soybean complex had all its components down on the week. Export inspections are up 8%, but sales are down 32%. The US soybean harvest is 23% harvested, a little ahead of normal.

In the US, RIN values (RIN = Renewable Identification Number; it is a credit that is generated each time a gallon of renewable fuel (ethanol, biodiesel, etc.) is produced)continue to lead that market lower, so there is debate over the relevance of RINS to US soybean oil prices. While they are not exactly an indicator of demand to biodiesel, they do reflect the current US biodiesel demand picture to some degree. Soybean oil is now down 2.47c/lb ($55/mt) for the month.

China returned from their weeklong holiday as sellers with Dalian soybean meal and soybean oil both showing 3-month lows. Malaysian palm oil reacted negatively, and it too fell to 3-month lows overnight, with the added bearish backdrop of a 9.6% increase in Malaysia’s September stocks.

Market outlook

The WASDE report comes out on Thursday and the average trade guess looks for yields to drop just below 50 bu/acre (vs. 50.1 bu/acre in the Sept. report). This may improve futures in the short term. But it is primarily the very poor export sales performance that is damaging sentiment and pushing funds to neutralize their soybean position, though they are still long the products. Soybean oil continues to weaken and represents less of the crush value.

Canola Market

Canola usage

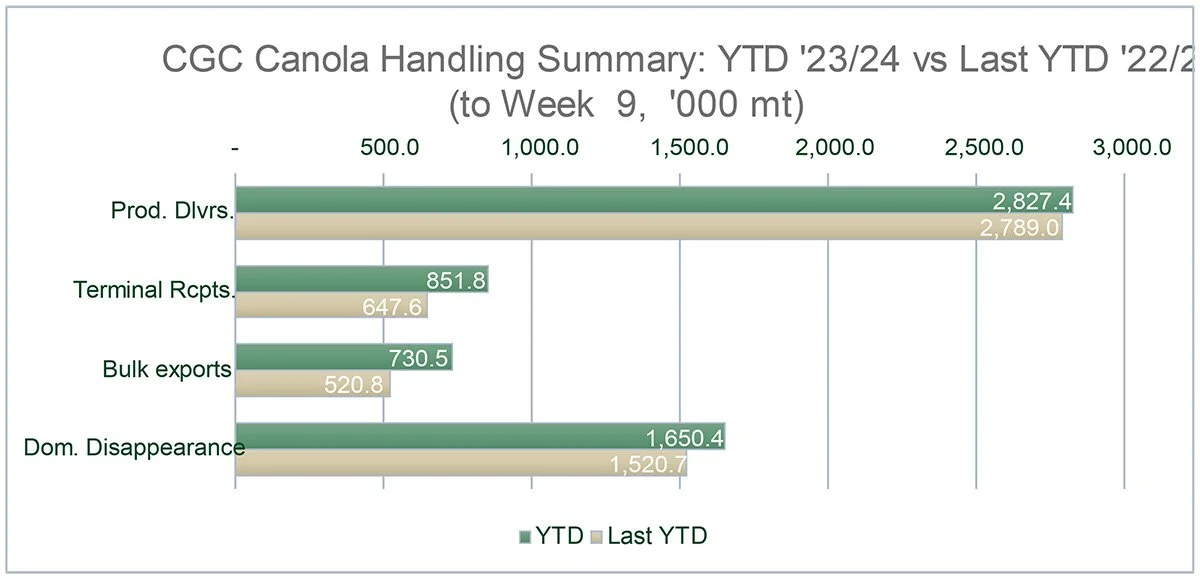

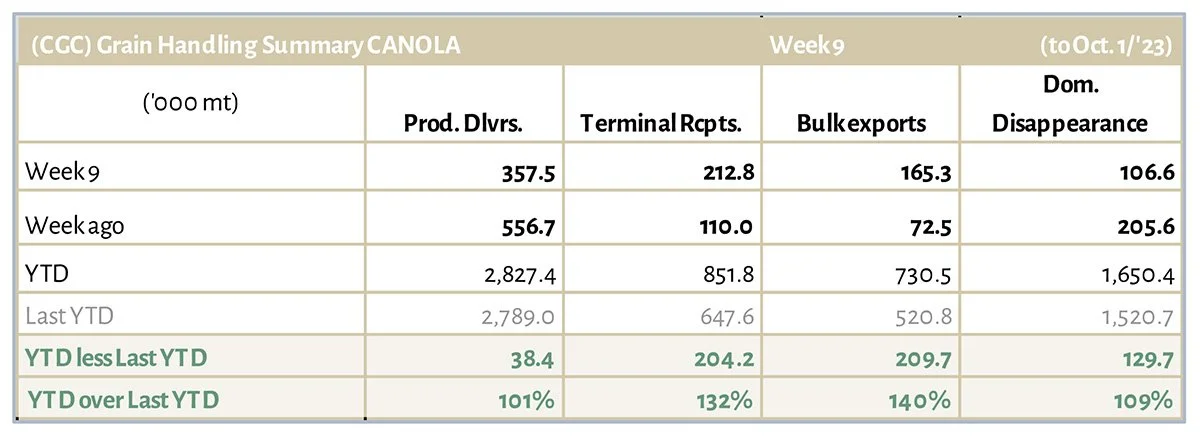

The Canadian Grain Commission reported that during week 9 of the new crop year, growers delivered 358 thousand MT of canola into primary elevators, exports were at 165 thousand MT, while the domestic disappearance amounted to 107 thousand MT.

YTD canola disappearance into week 9 of the crop year amounts to 2.4 million MT compared to 2 million MT last year and is up 17% on last year.

Visible stocks increased to 1.33 million MT, with 856 thousand MT in primary elevators, 208 thousand MT in process elevators, 138 thousand MT in Vancouver/ Prince Rupert, and 133 thousand MT in eastern ports.

Current market situation

Export demand for canola is down as there is less need for vegetable oils this year compared to last year. Meanwhile, the crushers have not dropped their bottled canola prices and are making great margins as the price of seed is lower.

In Europe, rapeseed closed down sharply last week at 4-month lows with slow biodiesel demand and cheap Black Sea exports hitting their markets. Canola is back in retreat as well.

The USDA might reduce their soybean yield in their October USDA-WASDE report, which would help canola move a little higher.

Market outlook

The demand for vegetable oils is down this year, and so the export pull for canola has lessened. With soybeans facing a potential sell-off and canola export sales very slow, we do not see sustained strength developing for canola.

However, the new instability in the Middle East might lend support to crude oil prices.

Action

We would hold additional sales for the present to see what the USDA report brings and how the markets react to the new Middle East crisis.

Canola – Topics of Interest

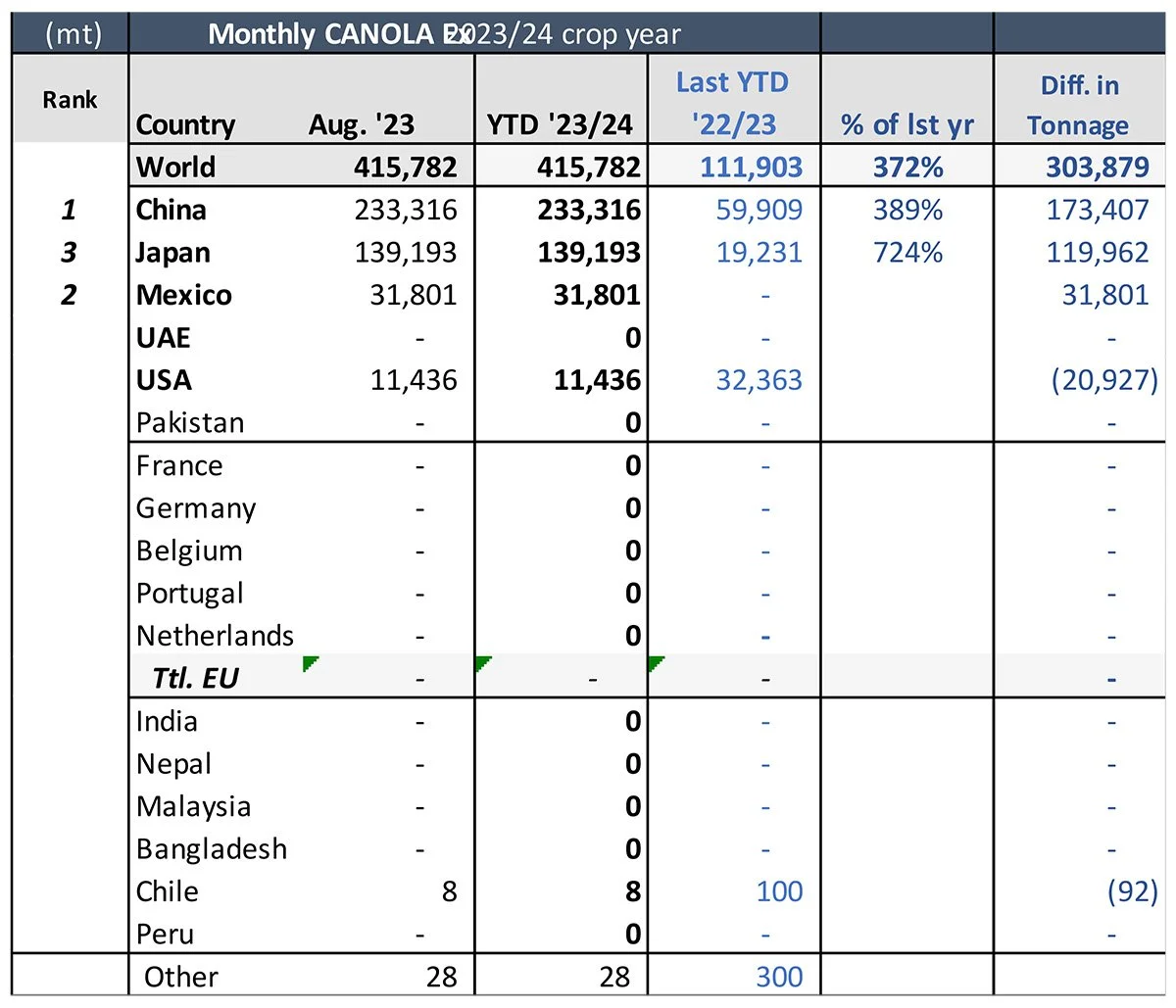

Canada – StatsCan August Exports by Destination

Canada exported 415k mt of canola during August 2023. These were sales made over the summer months. 56% of the August exports went to China. The USA and Japan were the only other buyers.

USDA: Total Vegetable Oil Production Outlook for 2023/24

According to the previous (Sept.) global USDA estimates, the production of vegetable oils is set to grow for the third consecutive year and to reach new record highs.

USDA estimates that global output of vegetable oils will reach 222.8 mln mt in 2023/24, which would be a 6.5 mln mt rise compared to 2022/23. If correct, production will more than adequately cover the estimated demand of 217.5 mln mt. Global ending stocks of vegetable oils will likely increase to 30.6 mln mt.

Global palm oil production will likely grow for the third consecutive year, reaching 79.5 mln mt, a 1.9 mln mt increase over 2022/23. Palm oil accounts for 35.7% of total global vegetable oil production.

Soybean oil production is expected to grow 2.9% to 61.6 mln mt in the coming crop year and could hit a new record.

Sunflower oil production is also projected to grow, based on larger availability due to expansions in area planted. Global output is seen to reach 21.7 mln mt, 600k mt more than in 2022/23.

Rapeseed oil is set to exceed the previous year's volume by an estimated 400k mt in 2023/24, reaching 33 mln mt.