Canola Market Outlook: January 8, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: The CBOT soybean complex ended lower, with soybeans falling over 40 cents per bushel, as export sales were at a season low of 7 million bushels.

Soybean meal fell by over $16/ton, also weighed down by weak export sales. The soybean oil share upheld its slow ascent and closed back above 39%.

We remain of the opinion that soybeans are overpriced to corn. The spread has continued to narrow, but we think soybeans need to fall further, as it is hard to see longs having the resilience to wait out another month.

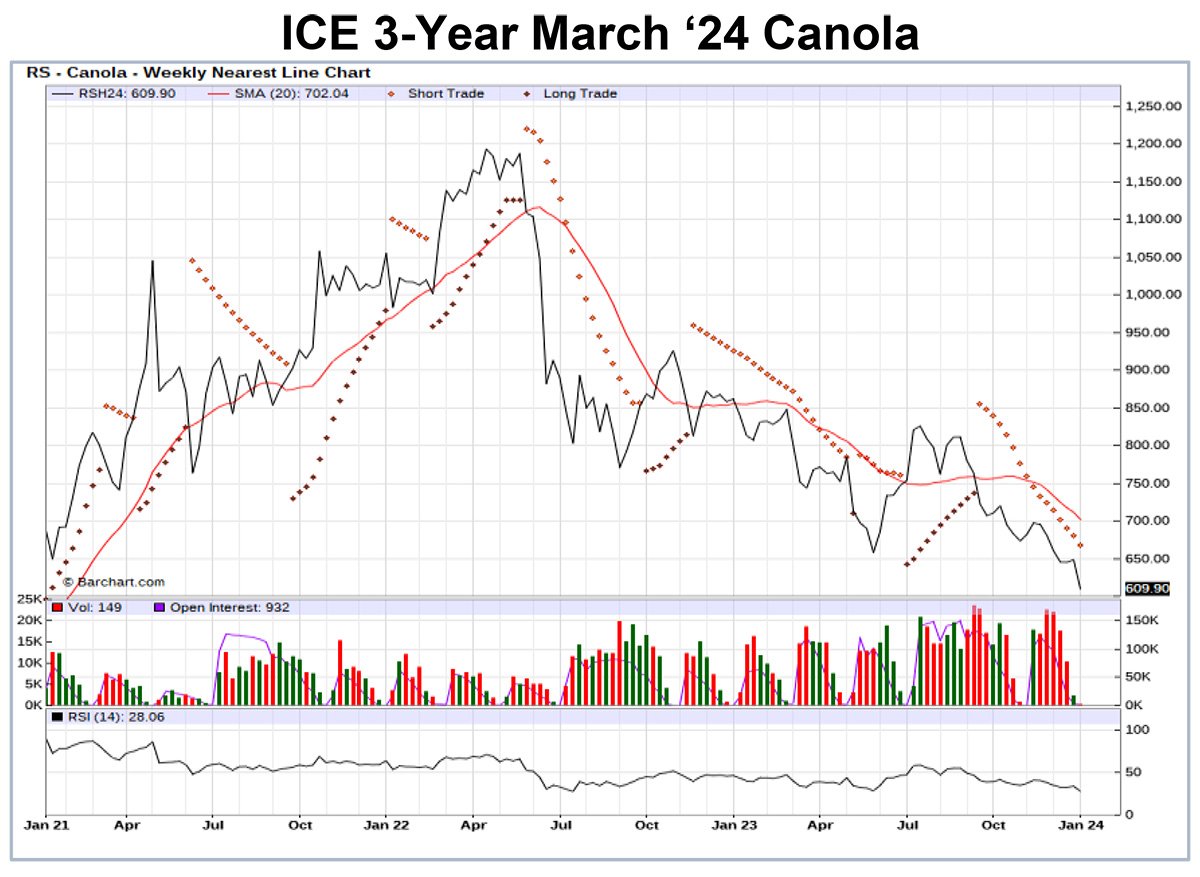

Canola: YTD total canola disappearance into week 20 of the crop year amounts to 7.1 million MT compared to 7.7 million MT last year and is down 9% on last year.

We do not see weekly exports reviving much, which is why we had reduced our export estimate to 7.5 million MT. (AAFC is using 7.7 million MT of exports). Crush margins are still good, and the crush pace is quite decent.

Brazil has been getting rain and more is forecast for this week, which is not supportive to soybeans. We also don't expect to see much new in this week's USDA-WASDE reports.

Assuming growers have sold 80 percent as we advised, we would hold additional new sales for now. If you are not well sold (80% (+), we would add to sales to that level.

Oilseed Market Backdrop

Soybeans

Current market situation

The CBOT soybean complex ended lower, with soybeans falling over 40 cents per bushel, as export sales were at a season low of 7 million bushels. Soybean meal fell by over $16/ton, also weighed down by weak export sales. The soybean oil share upheld its slow ascent and closed back above 39%.

The CoT report had managed money spec traders with an 12k contract net short as of Jan. 2nd. That was their 2nd net short since March of 2020, and came via net new selling for the week. Commercial soybean traders were 78k contracts net short on Jan. 2nd after a week of 13k new long contracts added.

In S America, rain in Brazil has reduced crop concerns, but private estimates are below CONAB's current 160.2 million MT. (CONAB will update their numbers on Wednesday). To recap, Brazil now is by far the world’s largest producer and exporter of soybeans, having surpassed the USA in recent years. In 2023/’24, Brazil is forecast to double the USA’s export total (99 million MT, compared to 47 million MT), with most of the exports expected to go to the world’s biggest importer, China.

In Argentina, BAGE estimated Argentine plantings are 86% complete (compared to 94% last year, and a 90% average). Gd/ Exc. ratings rose 2% from 40% to 42% (vs. 7% last year) and the crop forecast was unchanged at 50 million MT to keep South America still on course for a bigger crop than last year.

Market outlook

We maintain our long March corn against short March soybeans, as we remain of the opinion that soybeans are overpriced to corn. The spread has continued to narrow. - We think soybeans need to fall further, as it is hard to see longs having the resilience to wait out another month.

The markets will concentrate on the Brazilian crop updates and on the January USDA-WASDE reports on Friday

Canola Market

Canola usage

During weeks 21 & 22 of the crop year, growers delivered 345 thousand MT of canola into primary elevators, exports were at a poor 83 thousand MT, while the domestic disappearance showed 283 thousand MT.

YTD total canola disappearance into week 20 of the crop year amounts to 7.1 million MT compared to 7.7 million MT last year and is down 9% on last year.

Visible stocks were shown at 921k MT, with 472 thousand MT in primary elevators, 189 thousand MT in process elevators, 102 thousand MT in Vancouver/ Prince Rupert, and 158 thousand MT in eastern ports.

Current market situation

Canola exports are progressing very slowly and with oil being much weaker and fighting against heavy competition by other oils. We do not see weekly exports reviving much, which is why we had reduced our export estimate to 7.5 million MT. (AAFC is using 7.7 million MT of exports). Crush margins are still good, and the crush pace is quite decent.

We think that canola production is lower than StatsCan/AAFC estimate (18.3 million MT), but if we are wrong, the carryover could be burdensome.

We have also made a provisional estimate for the 2024 canola production, using a reduction of canola acres of 5 percent lower.

In Europe, Matif rapeseed was mixed but mostly trendless as the complex prefers to push down Canadian canola instead. Canola it lost C$34 last and has now shed its entire premium over Matif. However, Australian exports to Europe/ timing of exports under are question with the Red Sea uncertainty, although we think that the press is overstating the costs of the detours. Winterkill potential in N Germany and the Baltics is on traders’ radars, ut there has been no damage so far. Asian markets all ended lower last week and never recovered from the negative economic tone in President Xi’s New Year’s speech.

Market outlook

Brazil has been getting rain and more is forecast for this week, which is not supportive to soybeans. We also don't expect to see much new in this week's USDA-WASDE reports.

Meanwhile, the corn-soybean spread has continued to narrow, but we think soybeans are still overpriced. We think soybeans need to fall further, as it is hard to see longs having the resilience to wait out another month.

Closer to home, canola is still lacking export volume, though is priced a bit better vis-a-vis soybeans of late. We do not expect much change from this week.

Action

Assuming growers have sold 80 percent as we advised, we would hold additional new sales for now. If you are not well sold (80% (+), we would add to sales to that level.

Canola – Topics of Interest

EU Rapeseed Imports

EU rapeseed imports are down from last year’s pace; they are at an annualized pace of 4.8 million MT compared to last MY imports of 6.8 million MT. This would signify a 29% reduction in imports. On top of that, Canada’s market share of EU rapeseed imports has shrunk from 3.8% last year to 2.7% currently, while the Ukraine, Serbia and Moldova have been able to increase their market shares.

So far this year, Canadian exporters have shipped one 42k MT cargo to Belgium. Last crop year, our main destination in the EU was France, which has not bought anything from Canada this year. We doubt that there will be any more Canadian rapeseed shipments to the EU this crop year.