Canola Market Outlook: January 2, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: CBOT soybeans closed the calendar year with double-digit losses, with March closing below $13/bu for the first time since October.

Soybean meal closed with a weekly loss of $5.10 for the March contract, but soybean oil closed the trading day 19-35 points higher. Board crush margins continue to slide lower.

Weekly US Export Sales came in at 984k MT of soybeans, which was at the low end of estimates and at a 12-week low.

The trade will carefully watch precipitation levels in Brazil this week, ahead of the WASDE and Dec 1st stocks report Dec. 12.

Canola: YTD total canola disappearance into week 20 of the crop year amounts to 6.6 million MT compared to 7.2 million MT last year and is down 8% on last year.

Currently supportive weather in S America has put pressure on oilseed markets, but new purchases by China could revert this trend quickly. Crush should remain good, as Cdn. crush margins are still close to $148/MT.

Assuming growers have sold 80 percent as we advised, we would hold additional new sales for now.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans closed the calendar year with double-digit losses, with March closing below $13/bu for the first time since October. Mch soybeans lost 8 ¼ c/bu for the week and 64c/bu for the month. The trading range of the March ‘23 contract was a huge $2.83/bu, from $11.45 to $14.28. Soybean meal closed $4.50 to $7 weaker, with a weekly loss of $5.10 for the March contract. However, soybean oil closed the trading day 19-35 points higher, but did loose 69 pints during the year, and 4.4 c for the month. Board crush margins continue to slide lower with March falling to just 91c/bu, a new low for March.

Spec traders added 5.3k contracts to their shorts in soybeans to 9.4k contracts. CFTC reported soybean meal spec traders 15.6k contracts less net long at 59,233 contracts. Managed money traders were 17.7k contracts more net short in soybean oil due to new spec selling during the week.

Weekly US Export Sales came in at 984k MT of soybeans, which was at the low end of estimates and at a 12-week low.

ANEC in Brazil had Dec soybean shipments at 3.5 million MT, a 20k MT reduction from a preliminary forecast. The strengthening Real is an impediment to Brazilian export competitiveness, and at 4.8 it is at its highest since July. There is improved model agreement that last week’s heat and dryness in N Brazil will turn wetter this week with much needed rainfall of 1-3” during the week.

Meanwhile, Argentina is dry in the North and wetter in the South. At around 80% complete, Argentine plantings should be nearing their conclusion. They are a little behind normal, although ahead of last year. Crops should maintain their very high overall rating, but increasing dryness will be watched.

Market outlook

The trade will carefully watch precipitation levels in Brazil this week, ahead of the WASDE and Dec 1st stocks report Dec. 12. So, the overall leitmotif remains the same: How does a recovery in Argentine production affect soybean products (meal and oil), and how is the Brazilian export outlook developing?

The decline in crush margins will likely follow a recovery in Argentine crush. And with deferred crush margins testing historical lows, it becomes a question of at what point crushers stall expansion plans? The market for the increased soybean oil supply is directed towards the largely inelastic and politically influenced biodiesel markets, leaving meal vulnerable as it attempts to find a home in a more free-market environment.

Canola Market

Canola usage

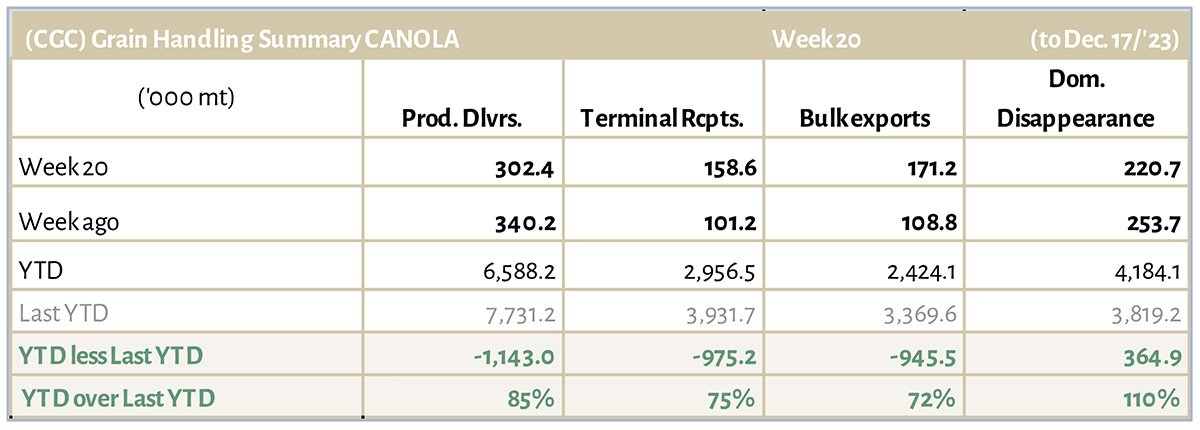

The Canadian Grain Commission only shows handling data up to Dec. 17/’23 (week 20). During week 20 of the crop year, growers delivered 302 thousand MT of canola into primary elevators, exports were at an improved 171 thousand MT, while the domestic disappearance showed 221 thousand MT.

YTD canola disappearance into week 20 of the crop year amounts to 6.6 million MT compared to 7.2 million MT last year and is down 8% on last year.

Visible stocks were shown at 1.09 million MT, with 529 thousand MT in primary elevators, 225 thousand MT in process elevators, 145 thousand MT in Vancouver/ Prince Rupert, and 191 thousand MT in eastern ports.

Current market situation

There was little action in canola trade over the holidays, but background markets have not been supportive. March soybeans are down over $1.14/bu compared to this time last year, Mch. meal is down over $24/MT and soybean oil down 11.5c/lb. Importantly in this background picture, the US soybean market never did live up to the demand expectation fuelled by the biodiesel market. So, while the US crush is running at record levels, margins are much weaker than this time last year and soybean exports are below expectations as well. This is having a profound effect on oil-driven canola. So, on its first trading day in the New year, canola was under pressure following weakness in vegetable oil markets (soybean oil, palm oil, Matif rapeseed).

Improved conditions and higher expectations for the Argentine crop are set to potentially affect the products markets (meal and oil) further. The Argentine crop is currently called 40% excellent vs. 10% this time last year.

In Europe, rapeseed is some €112/MT (C$163/MT) cheaper today than this time last year, and this follows increasing competition with oilseeds from the Black Sea region.

Not helping either, the Cdn.$ was down half of a US cent compared to Friday’s close.

Market outlook

Currently supportive weather in S America has put pressure on oilseed markets, but new purchases by China could revert this trend quickly. Crush should remain good, as Cdn. crush margins are still close to $148/MT.

Action

Assuming growers have sold 80 percent as we advised, we would hold additional new sales for now.

Canola – Topics of Interest

Statistics Canada: Monthly Cdn. canola crush:

According to StatsCan just before Christmas, Canada crushed 908k MT of canola during the month of November ’23, for a year-to-date total of 3.6 million MT. This is 14% higher (+445k MT) than what we crushed last crop year to date.

Annualizing the YTD crush to the full crop year would give a total of 10.9 mlm MT, which would exceed last year’s crush by 9.4% (+941k MT).