Canola Market Outlook: September 18, 2023

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans - Soybeans finished the week lower, down 22c/bu despite the USDA lowering US soybean ending stocks to 220 million bu for new crop.

Black Sea/EU protein supplies remain quite robust.

In our view, there is sufficient vegetable oil available this season and soybeans do not justify their current premium to feed grains.

Canola: YTD canola disappearance into week 6 of the crop year amounted to 1.55 million MT compared to 1.2 million MT last year and is up 38% on last year.

We are concerned about the depth of export demand in the ‘23/24 crop year. Without solid buying by China, the canola balance sheet will not become tight despite a decent crush program. With lower export numbers, ending stocks start moving back up to around 2.5 million MT, and the balance sheet no longer looks tight.

Given the weak canola export markets, we think growers would be well advised to be sold 75 percent of their expected crop at current prices.

Oilseed Market Backdrop

Soybeans

Current market situation

Soybeans finished the week lower, down 22c/bu despite the USDA lowering US soybean ending stocks to 220 million bu for new crop. Meal lost over $9/MT, but soybean oil gained 1.9 ($42/MT).

In the WASDE report last week, US soybean yields were lowered (as had been expected) to 50.1 bu/acre with a partial offset of an increased area, to take production down by 59 million bu to 4.15 bln bu. However, global production remains up by ~16 million MT on last year. On the consumption side, both US crush and exports were lowered by a combined 45 million bu, with most coming out of exports. Chinese domestic usage was raised 1million MT each for old and new crop, and Chinese imports were raised by 2 million MT for old crop to 102 million MT and by 1 million MT to 100 million MT for new crop. - The initial market reaction was negative in the absence of a clear bullish surprise. New crop has become less tight. And for the European market, Ukrainian oilseed production and crushing exerts a huge regional pressure on vegoils.

Market outlook

In our view, there is sufficient vegetable oil available this season and soybeans do not justify their current premium to feed grains.

Logistics hinder old crop execution from Brazil, but the market is looking ready to buy new crop.

To locals, USA oil share seems like it can find support, but crude oil has yet to really prove supportive while the world veg oils are heavy. Black Sea/EU protein supplies remain robust.

Canola Market

Canola usage

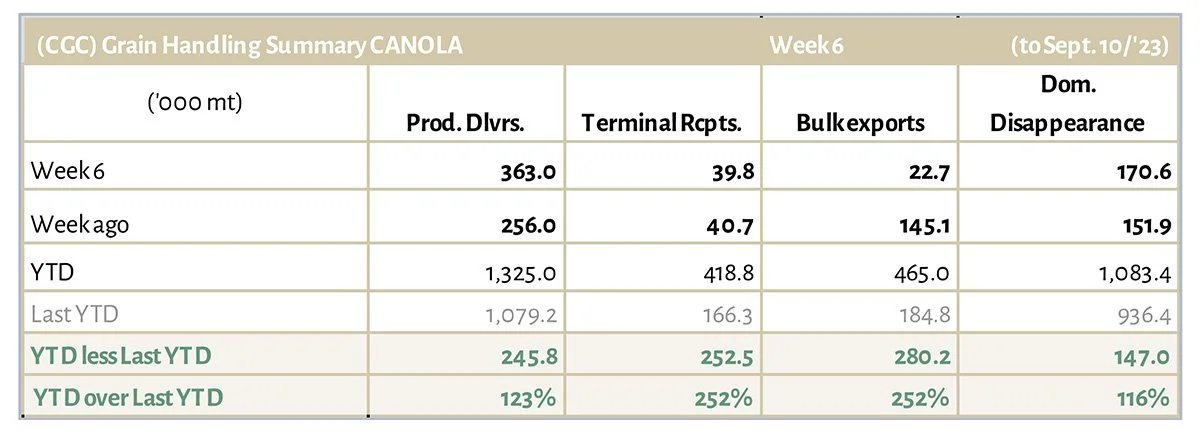

The Canadian Grain Commission reported that during week 6 of the new crop year, growers delivered 363 thousand MT of canola into primary elevators, exports were at 23 thousand MT, while the domestic disappearance amounted to 171 thousand MT.

YTD canola disappearance into week 6 of the crop year amounted to 1.55 million MT compared to 1.2 million MT last year and is up 38% on last year.

Visible stocks were at 764 thousand MT, with 462 thousand MT in primary elevators, 150 thousand MT in process elevators, 95 thousand MT in Vancouver/ Prince Rupert, and 57 thousand MT in eastern ports.

Current market situation

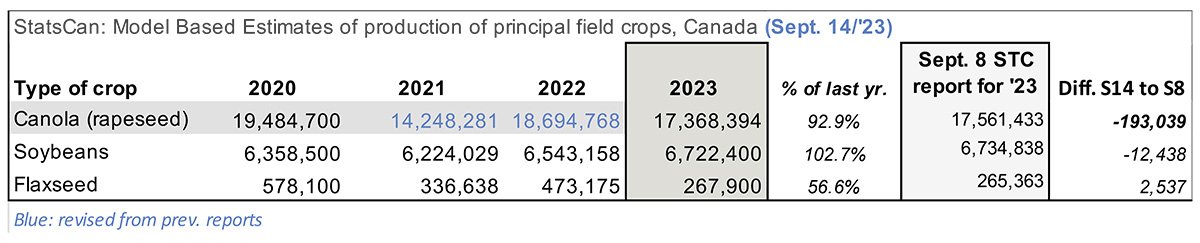

The StatsCan Model based Production report last week pegged the Cdn. ’23 canola production at 17.4 million MT, 193k MT smaller than the previous estimate two weeks ago.

Meanwhile, in the USDA-WASDE report, the Canadian canola crop was lowered by 800k MT to 18.2 million MT, just slightly below last year’s. The WASDE report also showed Ukrainians rapeseed plus sunflower seed production up 17% on last year to 18.3 million MT (up 700k MT on last month).

However, here is how Mercantile sees this year’s canola balance sheet: We have taken the week 5 deliveries as representing old crop canola, added the week 52 visible, and assumed/ deduced that the ’22/23 crop carry-out was 1.94 million tonnes. On the demand side for the coming year, we have assumed basically zero sales to the EU and less volume demand from China.

Our export projections are based on current prices relative to other commodities, so the export number is low and adds to only 6.3 million MT. We will need lower prices to attract more exports. We have assumed acres to be up 1.5 percent, but yields are lower due to the dry conditions.

Given the lower export numbers, ending stocks start moving back up to around 2.5 million MT, and the balance sheet no longer looks tight.

Basically, the world vegetable oil market is focused on the Black Sea supplies and on palm oil, the meal market is watching Argentina and its improved crop forecast, while soybeans are a function of US yields.

Market outlook

Crude oil has yet to really prove itself supportive and world vegetable oils are heavy. Black Sea/EU protein supplies remain quite robust.

Action

Given the weak export markets, we think growers would be well advised to be sold 75 percent of their expected crop at current prices.

Canola – Topics of Interest

Australian Canola Exports for July ’23

According to ABARES, Australia exported 424,369 MT of canola during July ’23, up 31% from the 323,384 MT shipped in June, but below the 503,745 MT shipped in May.

Japan at 153,289 MT was the largest market for July-shipped canola, followed by Pakistan with 89,330 MT and Belgium on 59,046 MT. The Japanese market used to buy primarily from Canada in previous years but has taken ~692k MT from Australia over the past three months (M/J/J).

Other destinations where Canadian canola competes with Australian canola are Bangladesh, Pakistan, the UAE, France, Belgium, Mexico.