Canola Market Outlook: January 29, 2024

Weekly canola market outlook provided by Marlene Boersch of Mercantile Consulting Venture Inc.

Key Points for the Week

Soybeans: CBOT soybeans futures were down by another 10 to 14 cents across the front months last Friday, which left the weekly chart down for the sixth consecutive week, and with a net loss of ~$1.50/bu.

In S America, the early harvest in Brazil is showing erratic yield results but based on the ongoing collapse in FOB premiums in Paranagua, the bigger issue seems to be the lack of demand.

We expect US futures to weaken further as more S American seed comes to market.

Canola: YTD total canola disappearance into week 25 of the crop year amounts to 7.9 million MT compared to 9.1 million MT last year and is down 13% on last year.

Crush margins have weakened and some of the smaller crush plants are now making very small margins. Currently the biggest value in the crush is for high protein meal, which is why canola seed has lost value to soybeans.

Having sold 80 percent old crop seed and some August new crop, we would leave canola seed alone for now.

Oilseed Market Backdrop

Soybeans

Current market situation

CBOT soybeans futures were down by another 10 to 14 cents across the front months last Friday. This which left the weekly chart down for the sixth consecutive week, and with a net loss of ~$1.50/bu. Soybean meal also closed with 2% losses on Friday, but soybean oil futures closed firmer with 32 to 40 point gains for the front months.

In S America, the early harvest in Brazil is showing erratic yield results but based on the ongoing collapse in FOB premiums in Paranagua, the bigger issue seems to be the lack of demand. The 12-hour work stoppage by Argentina’s largest worker’s Union CGT will have no impact on crushing but could signal the start of more strikes amidst the ongoing peso devaluation. The most recent occurrence of major strikes in Argentina was in December 2021, and reduced the monthly crush down to 850k MT. The BA Grain Exchange estimated that 98% of the Argentine soybean crop is planted. Condition was rated at 44% Good/Exc., a sharp drop from the previous week.

Market outlook

We remain of the opinion soybeans are overpriced to corn, so retain our long March corn against soybeans. The lack of demand, expanding harvest and improving yields all conspired to create the price drop. For now, South America is leading the protein complex lower.

We expect USA futures to weaken as more South American seed comes to market.

Canola Market

Canola usage

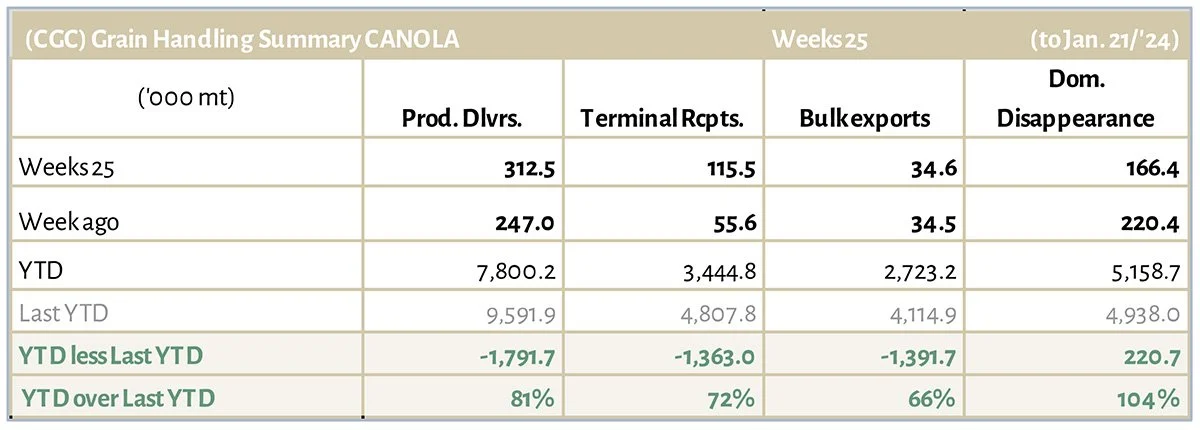

During week 25 of the crop year, growers delivered 313 thousand MT of canola into primary elevators, exports were again at a very small 35 thousand MT, while the domestic disappearance slipped to 166 thousand MT.

YTD total canola disappearance into week 25 of the crop year amounts to 7.9 million MT compared to 9.1 million MT last year and is down 13% on last year.

Visible stocks were shown at 970k MT, with 468 thousand MT in primary elevators, 180 thousand MT in process elevators, 160 thousand MT in Vancouver/ Prince Rupert, and 162 thousand MT in eastern ports.

Current market situation

Crush margins have weakened and some of the smaller crush plants are now making very small margins. Currently the biggest value in the crush is for high protein meal, which is why canola seed has lost value to soybeans.

Exports through week 25 continue to be poor for canola seed. YTD exports would annualize to only 5.7 million MT, so we have reduced our export forecast to 7.0 million tonnes. As more Southern Hemisphere oilseeds hit the market, we expect canola seed to weaken further.

AAFC came out with their January balance sheets last week. For the ‘23/24 crop year, AAFC left canola exports at 7.7 million MT, which we have little to no chance of reaching. (We are now using 7 million MT for exports and 10.3 million MT for crush). AAFC is using 10.5 million MT for domestic crush. ‘23/24 ending stocks were left at 1.45 million MT. However, we think that AAFC overestimates canola production. For the 2024/25 crop year, AAFC projects that 21.7 million acres will be seeded to canola, a 1.5% drop from last year. We think acres could drop more to 21.4 million acres (-3%). For ‘24/25, AAFC is again assuming 7.7 million MT exports and 10.5 million MT crush, which would leave ending stocks at 1.4 million MT. – Seeded acreage for 2024, as well as export potential and crush margins will have to be monitored.

In Europe, after early gains and a retest of the 100-day moving average, Matif closed at €432 last Friday, up €2.55, but this Monday is back down to €426/MT. Vegetable oil prices are under pressure with the fob-Dutch mill market marked at ~€855, and the sunflower oil also fractionally weaker. The lower Rhine meal market seems locked in at around €280 for the past 2 weeks, which has pushed crush margins below last seasons for the first time since last October.

Market outlook

As more Southern Hemisphere oilseeds hit the market, we expect canola seed to weaken further. We think the AAFC overestimates canola production.

Action

Having sold 80 percent old crop seed and some August new crop, we would leave canola seed alone for now.

Canola – Topics of Interest

Statistics Canada (STC) – Monthly Crush data:

According to STC, the domestic crush for December ’23 bounced back to 943k MT from 908k MT the month prior. YTD crush (Aug. to Dec. ’23) adds to 4.6 million MT, which is 14% higher than last years. Annualizing the YTD crush would give us close to 11 million MT, but slowing crush margins and the traditional summer maintenance schedules will likely result in 10.3 to 10.5 million MT for the crop year. We are currently using 10.3 million MT for the annual crush.